NFT Strategy Tokens Live on OpenSea – New Era of Trading

NFT strategy tokens on OpenSea are revolutionizing digital trading, bringing smarter investing and seamless NFT strategies to the marketplace.

Non-fungible tokens (NFTs) have been evolving at a rapid pace, transforming from simple digital collectibles into complex financial instruments with real-world value. From digital art and gaming assets to music and virtual real estate, NFTs have become more than just digital property—they represent ownership, utility, and access within the growing Web3 ecosystem. Now, the introduction of NFT strategy tokens on OpenSea marks a groundbreaking development that could redefine how investors, collectors, and creators engage in NFT trading.

OpenSea, the largest NFT marketplace in the world, has long been the go-to platform for buying, selling, and discovering NFTs. With the launch of NFT strategy tokens, OpenSea is not just expanding its services but also pioneering a new way of interacting with digital assets. This innovation allows traders to leverage strategic, tokenized bundles or investment approaches instead of buying and selling NFTs individually. The result is a more dynamic, accessible, and potentially profitable method of trading NFTs, one that could draw parallels with traditional stock market strategies.

In this article, we will dive deep into the concept of NFT strategy tokens, their significance in revolutionizing NFT trading, the role of OpenSea in their adoption, and what this means for the broader digital economy.

NFT Strategy Tokens: New Era of Trading

What Are NFT Strategy Tokens?

NFT strategy tokens are specialized digital assets designed to represent investment strategies within the NFT market. Unlike traditional NFTs that usually stand alone as unique items—such as digital artwork, gaming avatars, or collectible cards—strategy tokens are structured to provide exposure to bundled NFT strategies. These strategies can be based on trends, specific collections, or even automated investment algorithms.

Essentially, holding a strategy token allows investors to participate in NFT market performance without needing to manually manage multiple assets. Much like an exchange-traded fund (ETF) in traditional finance, NFT strategy tokens bundle together multiple NFTs or strategic approaches to reduce risks and enhance accessibility.

Why Are They Important?

NFT trading has often been criticized for being highly speculative, volatile, and confusing to newcomers. Many investors find it overwhelming to analyze hundreds of projects and decide which NFTs might appreciate. NFT strategy tokens simplify this process by offering predefined strategies that traders can invest in directly. This makes it easier for both beginners and advanced traders to participate in the market while diversifying their exposure.

By tokenizing strategies instead of individual assets, OpenSea has effectively lowered the barrier to entry for NFT investing, opening the doors for broader adoption.

OpenSea’s Role in Revolutionizing NFT Trading

Why OpenSea Is the Ideal Platform

OpenSea has established itself as the largest NFT marketplace, with millions of users and billions of dollars in trading volume. Its dominance and credibility make it the perfect launchpad for NFT strategy tokens. Unlike niche NFT platforms, OpenSea provides instant exposure to a massive audience, ensuring liquidity and accessibility for these tokens.

The platform already supports a wide range of NFT types, from Ethereum-based ERC-721 assets to Polygon NFTs, making it flexible enough to host innovative formats like strategy tokens. Furthermore, OpenSea’s seamless user interface and strong reputation build trust among investors who may be hesitant to explore new products.

How NFT Strategy Tokens Work on OpenSea

When an investor purchases an NFT strategy token on OpenSea, they are essentially buying into a smart contract-driven strategy. This contract can include multiple NFTs, dynamic allocation, or even algorithmic trading models. For example, a strategy token might represent a “Top 10 NFT Collections” approach, where the underlying portfolio adjusts to track the performance of the most valuable projects on the market.

These tokens can then be traded on OpenSea like any other NFT, giving users both ownership and liquidity. The marketplace thus becomes more than just a place to collect art; it transforms into a financial hub for innovative trading strategies.

The Evolution of NFT Trading

From Collectibles to Financial Instruments

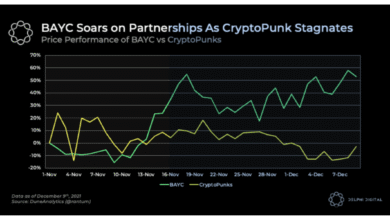

Initially, NFTs were largely driven by hype around digital collectibles such as CryptoPunks and Bored Ape Yacht Club. These projects drew attention to NFTs as symbols of digital culture, but their value was often speculative. Over time, the NFT market began to evolve, introducing utility-based NFTs for gaming, memberships, and metaverse applications.

With the arrival of NFT strategy tokens, the market is taking a significant step forward, moving from individual ownership to portfolio-based trading. This mirrors the evolution of traditional finance, where markets moved from individual stock ownership to mutual funds and ETFs for broader accessibility.

Bridging Traditional Finance and Web3

NFT strategy tokens act as a bridge between the world of decentralized finance (DeFi) and NFTs. By applying financial models such as diversification, hedging, and algorithmic trading to NFTs, they provide a familiar entry point for traditional investors. Institutions that were previously hesitant about NFTs due to their volatility may now see strategy tokens as a more structured way to enter the market.

This blending of traditional financial concepts with blockchain innovation signals a maturing NFT ecosystem that appeals not just to collectors but also to serious investors.

Also, More: NFT Platform Wars: Which Marketplace Will Dominate 2025?

Benefits of NFT Strategy Tokens for Traders

Simplified Investment Choices

One of the biggest challenges in NFT trading is information overload. With thousands of projects, collections, and tokens to choose from, even experienced investors struggle to pick the right assets. Strategy tokens solve this issue by packaging NFTs into simplified, strategic bundles.

Risk Diversification

By distributing exposure across multiple assets or strategies, NFT strategy tokens reduce the risk associated with holding a single NFT. Just as investors in traditional finance prefer diversified portfolios, NFT traders can now minimize their risks through these tokenized strategies.

Accessibility for Beginners

For newcomers, navigating the NFT market has always been intimidating. With strategy tokens, beginners no longer need to understand every detail of the ecosystem—they can simply invest in a predefined strategy that aligns with their goals.

Liquidity and Flexibility

Unlike static NFT collections, strategy tokens are dynamic. NFT strategy tokens. They can be bought, sold, or traded easily on OpenSea, providing liquidity that individual NFTs sometimes lack. This flexibility makes them highly attractive for both short-term traders and long-term investors.

Potential Challenges and Risks

Market Volatility

Although strategy tokens provide diversification, they are still exposed to the overall volatility of the NFT market. A downturn in demand for NFTs could impact their value significantly.

Smart Contract Risks

Since strategy tokens rely on smart contracts, any vulnerability or coding error could expose investors to risks. Security audits and strong development practices will be crucial for ensuring safety.

Regulatory Uncertainty

As with many innovations in the blockchain world, regulatory frameworks for NFT strategy tokens remain unclear. Governments may impose rules that affect how these tokens are issued, traded, or taxed.

The Future of NFT Strategy Tokens

Institutional Adoption

The structured nature of NFT strategy tokens makes them appealing to institutional investors who demand more than speculative assets. As more financial institutions explore Web3, these tokens could become a gateway for mainstream adoption.

Integration with DeFi

NFT strategy tokens could also integrate with decentralized finance platforms, enabling users to stake, lend, or collateralize their tokens. This would further expand their utility and embed them deeper into the broader crypto economy.

Expanding Use Cases

Beyond trading, strategy tokens could be used for NFT-based index funds, fractional ownership models, and even metaverse economies. The possibilities are vast, and OpenSea’s role as the leading marketplace ensures it will be at the center of this evolution.

Conclusion

The launch of NFT strategy tokens on OpenSea represents a turning point in the evolution of digital asset trading. By combining the creativity of NFTs with the structured strategies of traditional finance, these tokens make the NFT market more accessible, diversified, and innovative. OpenSea’s role as the leading marketplace ensures that this innovation reaches a global audience, bridging the gap between collectors, investors, and institutions.

While challenges such as volatility, smart contract risks, and regulatory uncertainty remain, the potential of strategy tokens to revolutionize NFT trading cannot be ignored. As adoption grows, they may become the standard way of investing in the digital economy, transforming how we view ownership, value, and financial strategies in the Web3 era.

FAQs

1. What are NFT strategy tokens on OpenSea?

NFT strategy tokens are tokenized investment strategies that allow users to gain exposure to bundles of NFTs or automated trading approaches instead of individual assets.

2. How do NFT strategy tokens benefit investors?

They simplify decision-making, diversify risks, and provide easier access to the NFT market, making trading more structured and less speculative.

3. Can beginners invest in NFT strategy tokens?

Yes, they are particularly beginner-friendly since investors can choose predefined strategies without needing deep knowledge of individual NFT projects.

4. Are NFT strategy tokens safe?

While they reduce some risks through diversification, they still carry market volatility, smart contract vulnerabilities, and regulatory uncertainties.

5. What is the future of NFT strategy tokens?

They are expected to gain institutional adoption, integrate with DeFi, and expand into broader use cases such as index funds, staking, and metaverse applications.