Ethereum Staking Rewards Earn Passive Income While You Sleep in 2025

How Ethereum staking rewards can generate passive income in 2025. Learn staking rates, best platforms, risks, and step-by-step guides...

The cryptocurrency landscape has evolved dramatically since Ethereum transitioned to Proof-of-Stake in September 2022, and 2025 presents unprecedented opportunities for investors seeking passive income through Ethereum staking rewards. With institutional adoption at an all-time high and regulatory clarity improving globally, staking ETH has become one of the most reliable ways to generate consistent returns in the digital asset space.

Whether you’re a seasoned crypto investor or someone looking to diversify your income streams, understanding how to leverage Ethereum’s staking mechanism could be the key to building wealth while you sleep. This comprehensive guide will walk you through everything you need to know about maximizing your Ethereum staking rewards in 2025, from choosing the right platforms to understanding the risks and implementing winning strategies.

What Are Ethereum Staking Rewards?

Ethereum staking rewards represent the incentives paid to validators who secure the Ethereum network by locking up their ETH tokens. When Ethereum transitioned from Proof-of-Work to Proof-of-Stake through “The Merge,” it fundamentally changed how new ETH is created and distributed.

How Ethereum Staking Works

The Ethereum network operates on a consensus mechanism where validators:

- Propose new blocks containing transactions

- Attest to the validity of other blocks

- Participate in network governance through their stakeholder

- Earn rewards proportional to their staked amount

Unlike traditional mining, staking doesn’t require expensive hardware or massive energy consumption. Ethereum Staking Rewards: Instead, validators “stake” their ETH as collateral, essentially putting their tokens on the line to guarantee honest behavior.

Types of Staking Rewards

Ethereum validators earn rewards through multiple mechanisms:

- Block Proposal Rewards: Earned when a validator successfully proposes a new block

- Attestation Rewards: Received for validating other validators’ proposed blocks

- Sync Committee Rewards: Additional compensation for participating in light client synchronization

- MEV (Maximal Extractable Value): Profits from transaction ordering and inclusion

Current Ethereum Staking Rates in 2025

Real-Time Staking Yields

As of 2025, Ethereum staking rewards have stabilized around attractive levels that make them competitive with traditional investment vehicles:

| Staking Method | Annual Percentage Rate (APR) | Minimum ETH Required | Lock-up Period |

|---|---|---|---|

| Solo Staking | 4.2% – 5.8% | 32 ETH | Variable |

| Liquid Staking | 3.8% – 5.2% | 0.01 ETH | None |

| Centralized Exchanges | 3.5% – 4.8% | 0.1 ETH | 7-90 days |

| Staking Pools | 4.0% – 5.5% | 0.1 ETH | Variable |

Factors Affecting Staking Rewards

Several key factors influence your Ethereum staking rewards:

- Total Amount Staked: A Higher total network stake generally means lower individual rewards

- Network Activity: More transactions increase MEV opportunities

- Validator Performance: Uptime and accuracy directly impact earnings

- Slashing Events: Network penalties can reduce overall reward pools

Best Ethereum Staking Platforms in 2025

Top-Tier Staking Providers

Choosing the right platform is crucial for maximizing your Ethereum staking rewards. Here are the leading options in 2025:

1. Lido Finance

- APR: 4.8% – 5.2%

- Minimum Stake: 0.01 ETH

- Liquidity: Instant through stETH tokens

- Fees: 10% of rewards

Pros:

- Market-leading liquid staking solution

- Strong institutional backing

- Excellent DeFi integration

- No minimum lock-up period

Cons:

- Centralization concerns

- Smart contract risks

- Fee structure

2. Rocket Pool

- APR: 4.5% – 5.1%

- Minimum Stake: 0.01 ETH

- Liquidity: Through rETH tokens

- Fees: Variable commission to node operators

Pros:

- Decentralized protocol

- Strong community governance

- Competitive rewards

- Open-source transparency

Cons:

- More complex user experience

- Lower liquidity than Lido

- Technical learning curve

3. Coinbase Staking

- APR: 3.8% – 4.5%

- Minimum Stake: 0.1 ETH

- Liquidity: Limited

- Fees: 25% of rewards

Pros:

- User-friendly interface

- Regulatory compliance

- Insurance coverage

- Established reputation

Cons:

- Higher fees

- Centralized custody

- Limited flexibility

- Lower yields

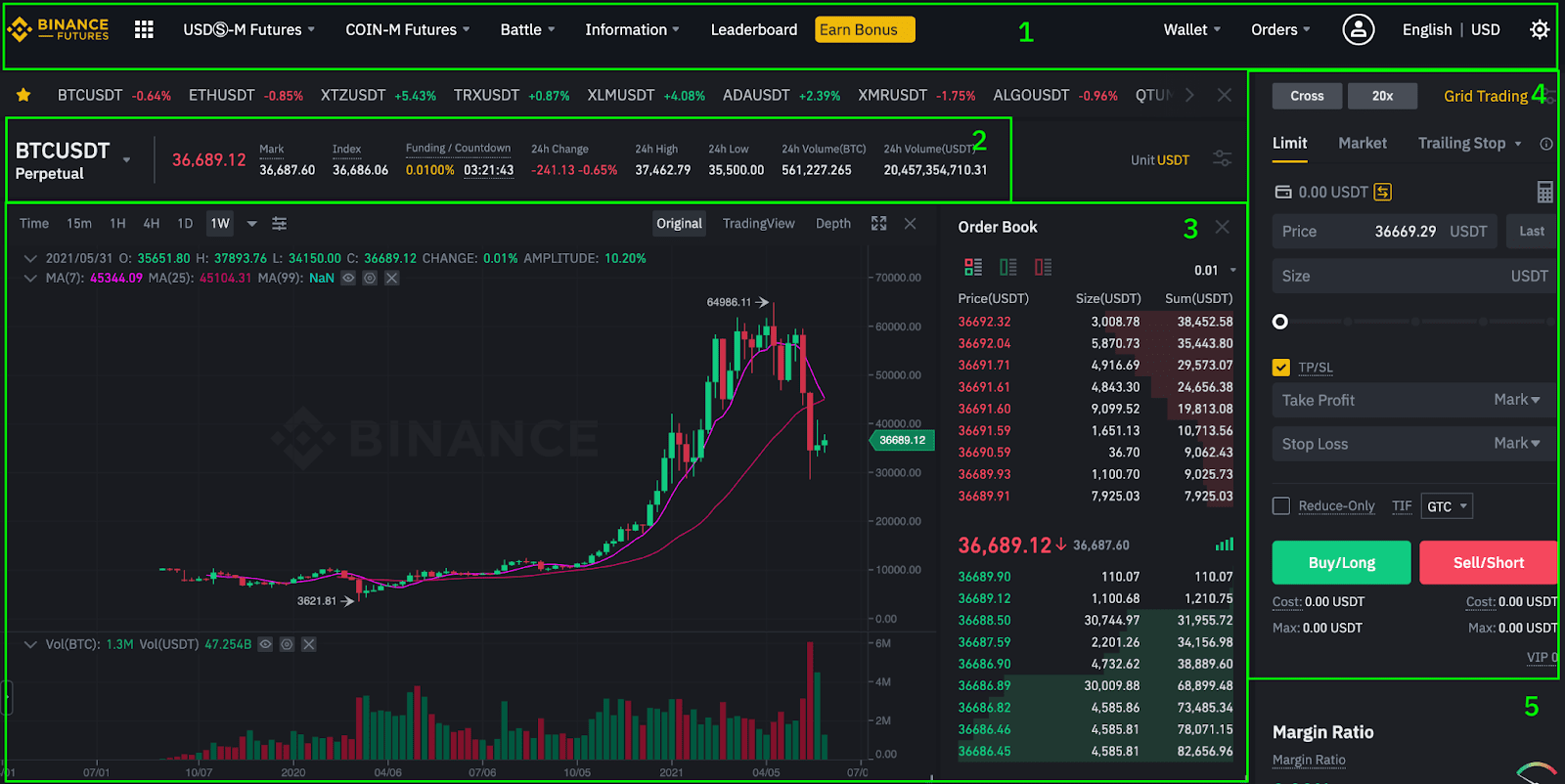

Staking Platform Comparison Interface

Emerging Platforms to Watch

Several new platforms are gaining traction in 2025:

- StakeWise V3: Offering personalized staking vaults

- Frax Ether: Providing competitive liquid staking yields

- Swell Network: Focusing on restaking and additional yields

Step-by-Step Guide to Start Earning Ethereum Staking Rewards

Method 1: Liquid Staking (Recommended for Beginners)

Step 1: Choose Your Platform Research and select a liquid staking provider based on:

- Yield rates

- Fee structures

- Security track record

- Liquidity options

Step 2: Set Up Your Wallet

- Install a compatible wallet (MetaMask, Ledger, etc.)

- Ensure you have ETH for staking plus gas fees

- Verify wallet security settings

Step 3: Connect and Stake

- Visit your chosen platform’s website

- Connect your wallet securely

- Enter the amount of ETH to stake

- Confirm the transaction and pay gas fees

Step 4: Receive Liquid Staking Tokens

- Receive tokens representing your staked ETH (stETH, rETH, etc.)

- These tokens can be used in DeFi protocols

- Monitor your rewards accumulation

Method 2: Solo Staking (For Advanced Users)

Requirements:

- 32 ETH minimum

- Dedicated hardware or VPS

- Technical knowledge of validator setup

- 24/7 internet connection

Step 1: Hardware Setup

- Configure a dedicated staking machine

- Install Ethereum execution and consensus clients

- Ensure reliable internet and power

Step 2: Generate Validator Keys

- Use official Ethereum tools to create validator keys

- Securely store your mnemonic phrase

- Generate a deposit data file

Step 3: Make a Deposit

- Visit the official Ethereum launchpad

- Upload your deposit data

- Send 32 ETH to the deposit contract

Step 4: Monitor Performance

- Track validator status and rewards

- Maintain high uptime for maximum rewards

- Stay updated on network upgrades

Maximizing Your Ethereum Staking Rewards in 2025

Advanced Strategies

1. Restaking Protocols

Emerging restaking platforms like EigenLayer allow you to earn additional rewards by securing other protocols with your staked ETH:

- Additional APR: 2% – 8% on top of base staking rewards

- Risks: Increased slashing conditions

- Complexity: Higher technical requirements

2. MEV Optimization

Maximize MEV rewards through:

- MEV-Boost: Connecting to block builders for higher yields

- Timing Strategies: Optimizing proposal timing

- Pool Selection: Choosing MEV-optimized staking pools

3. Liquid Staking Token Strategies

Leverage your liquid staking tokens:

DeFi Integration:

- Provide liquidity on DEXs (Uniswap, Curve)

- Use as collateral in lending protocols (Aave, Compound)

- Participate in yield farming opportunities

Tax Optimization:

- Consider holding periods for tax advantages

- Track basis for accurate reporting

- Utilize tax-loss harvesting strategies

Also, More: Premium Ethereum Smart Contract Development Top 10 Firms

Risk Management

Understanding Staking Risks

Slashing Risk:

- Penalties for validator misbehavior

- Can result in partial or total stake loss

- Mitigation: Choose reputable validators

Smart Contract Risk:

- Bugs in staking protocols

- Potential loss of funds

- Mitigation: Use audited, established platforms

Regulatory Risk:

- Changing government policies

- Potential staking restrictions

- Mitigation: Stay informed, diversify jurisdictions

Market Risk:

- ETH price volatility affects the USD value

- Opportunity cost considerations

- Mitigation: Dollar-cost averaging, diversification

Tax Implications of Ethereum Staking Rewards

2025 Tax Landscape

Understanding the tax implications of Ethereum staking rewards is crucial for compliance and optimization:

United States

- Income Recognition: Staking rewards taxed as ordinary income

- Fair Market Value: Based on price when received

- Capital Gains: Apply when selling staked ETH

- Reporting Requirements: Form 8949 and Schedule D

European Union

- Varied Approaches: Different rules across member states

- Income vs. Capital: Depends on classification and holding period

- DTA Agreements: Double taxation treaties may apply

Emerging Jurisdictions

Several countries are creating crypto-friendly tax frameworks:

- Portugal: Potential tax-free staking for individuals

- Singapore: Favorable treatment for long-term holders

- UAE: No capital gains tax on cryptocurrencies

Record-Keeping Best Practices

Maintain detailed records, including:

- Staking start dates and amounts

- Daily reward calculations

- Platform fees and expenses

- Token conversion transactions

- Market values at receipt

Future of Ethereum Staking Rewards

2025 and Beyond Predictions

Protocol Upgrades

Several Ethereum Improvement Proposals (EIPs) will impact staking:

EIP-4844 (Proto-Danksharding):

- Reduced transaction costs

- Increased network activity

- Higher MEV opportunities

Validator Set Expansion:

- Lower minimum stake requirements under consideration

- Increased decentralization

- More accessible staking

Market Dynamics

Institutional Adoption:

- Major corporations are adding ETH staking to their treasury strategies

- Investment funds launching staking products

- Traditional banks offering staking services

Regulatory Clarity:

- Clearer guidelines from major jurisdictions

- Potential approval of staking ETFs

- Enhanced consumer protections

Technological Innovations

Layer 2 Integration

- Optimistic rollup staking mechanisms

- Cross-layer yield optimization

- Reduced gas costs for staking operations

Artificial Intelligence

- AI-powered validator optimization

- Automated MEV capture strategies

- Predictive yield forecasting

Future Ethereum Ecosystem Diagram

Beginner Pitfalls

- Choosing Platforms Based Solely on Yield

- Higher yields often come with higher risks

- Consider security, liquidity, and reputation

- Ignoring Fee Structures

- Hidden fees can significantly impact returns

- Compare the total cost of ownership

- Poor Security Practices

- Using unsecured wallets

- Sharing private keys or seed phrases

- Falling for phishing attacks

- Lack of Diversification

- Putting all ETH in one staking platform

- Not considering other crypto assets

- Ignoring traditional investments

Advanced User Mistakes

- Solo Staking Without Proper Infrastructure

- Inadequate hardware or internet connection

- Insufficient technical knowledge

- Poor monitoring and maintenance

- Overleveraging Liquid Staking Tokens

- Using excessive leverage in DeFi

- Ignoring liquidation risks

- Complex yield farming without understanding

- Tax Planning Oversights

- Not tracking rewards properly

- Missing deduction opportunities

- Inadequate record keeping

Conclusion

Ethereum staking rewards in 2025 represent one of the most compelling opportunities in the cryptocurrency space, offering the potential for sustainable passive income generation. Ethereum Staking Rewards: With yields ranging from 3.5% to 8% depending on your strategy, staking provides an attractive alternative to traditional savings accounts and bonds while supporting the security and decentralization of the Ethereum network. The key to success lies in choosing the right approach for your situation. Beginners should consider liquid staking platforms like Lido or Rocket Pool for their ease of use and flexibility, while advanced users with substantial holdings might explore solo staking for maximum rewards and control.

Ethereum Staking Rewards: As we move through 2025, the staking landscape will continue evolving with new protocols, improved yields, and enhanced user experiences. By staying informed, managing risks appropriately, and maintaining a long-term perspective, you can harness the power of Ethereum staking rewards to build wealth while you sleep. Ethereum Staking Rewards: Remember that successful staking requires ongoing attention to market conditions, platform updates, and regulatory changes. Start with small amounts to gain experience, gradually increase your stake as you become more comfortable, and always prioritize security over yield optimization.

FAQs

Q: What are Ethereum staking rewards, and how are they generated?

Ethereum staking rewards are the earnings validators receive for securing the Ethereum network under its Proof-of-Stake (PoS) system. Validators lock up their ETH to propose and validate new blocks. In return, they earn rewards from transaction fees, block proposals, attestations, and MEV (Maximal Extractable Value). The more efficiently a validator performs, the higher the potential yield.

Q: How much can I earn from Ethereum staking in 2025?

In 2025, Ethereum staking yields generally range between 3.5% and 5.8% APR, depending on the staking method and platform you choose. Solo staking offers the highest potential returns (4.2%–5.8%) since you operate your own validator and keep all rewards, though it requires 32 ETH and technical expertise.

Q: What’s the safest way to start staking Ethereum as a beginner?

Beginners should start with liquid staking platforms like Lido Finance or Rocket Pool. These allow you to stake small amounts (as little as 0.01 ETH) and retain liquidity through tokens like stETH or rETH. Always choose audited, reputable providers and secure your wallet before connecting to any platform.

Q: Are Ethereum staking rewards taxable in 2025?

Yes. In most jurisdictions, staking rewards are treated as taxable income when received, based on their fair market value. If you later sell your staked ETH or liquid staking tokens, capital gains tax may apply. Keep detailed records of staking dates, amounts, and values to simplify reporting and compliance.