Crypto Punks & BAYC Lead November 2025 NFT Sales

Crypto Punks & BAYC Lead 2025 NFT sales with record-breaking transactions. Discover the top collections and market trends shaping digital art.

CryptoPunks and Bored Ape Yacht Club (BAYC) are reclaiming their positions as the undisputed leaders of digital collectibles. As blockchain technology continues to mature and institutional investors return to the space, these iconic collections have demonstrated their staying power in an increasingly competitive landscape. The month witnessed extraordinary transaction volumes, high-profile sales, and renewed enthusiasm from collectors worldwide, signaling a potential new chapter in the evolution of digital ownership.

November’s performance marks a significant shift from the volatility experienced throughout 2024 and early 2025. While newer projects have emerged with innovative utility and community features, the established blue-chip NFT collections have proven that scarcity, Crypto Punks & BAYC Lead: cultural significance, and historical value remain paramount in the digital art marketplace. This comprehensive analysis explores the factors behind this dominance, examines the specific sales that captured headlines, and provides insights into what these trends mean for the broader NFT ecosystem.

The Return of Blue-Chip NFT Collections: Crypto Punks & BAYC Lead

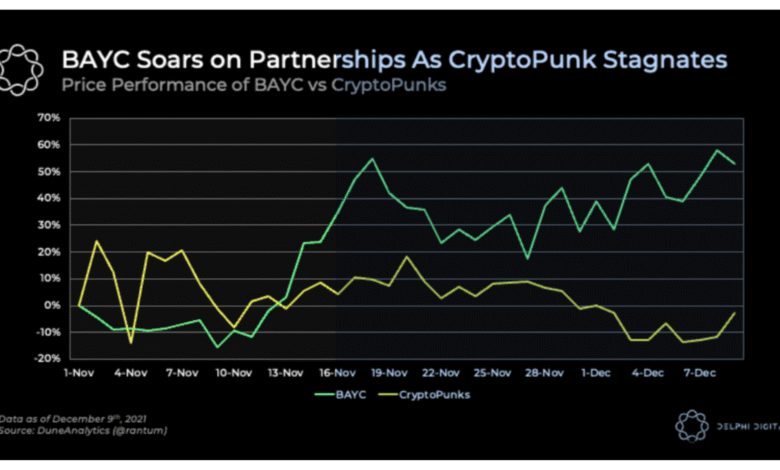

The concept of blue-chip NFTs has evolved considerably since the initial boom of 2021. CryptoPunks and BAYC have consistently maintained their status as the most coveted digital assets, comparable to traditional art world masterpieces. November 2025 saw these collections experience a resurgence that many analysts attribute to several converging factors, including improved market sentiment, regulatory clarity, and a flight to quality among collectors.

CryptoPunks, the pioneering pixel art collection created by Larva Labs and now owned by Yuga Labs, consists of 10,000 unique characters that have become synonymous with the NFT movement itself. The collection’s historical significance as one of the first NFT projects on the Ethereum blockchain has cemented its position as a cultural artifact. Throughout November, multiple CryptoPunks changed hands for amounts exceeding one million dollars, with rare attributes such as alien and ape types commanding premium valuations.

The Bored Ape Yacht Club, launched in April 2021, has similarly transcended its origins as a digital collectible to become a lifestyle brand and status symbol. The collection’s emphasis on commercial rights and exclusive community benefits has created a robust ecosystem that extends far beyond simple ownership. In November 2025, BAYC demonstrated remarkable resilience with sales figures that rivaled and in some cases exceeded those from the market’s previous peak periods.

Record-Breaking CryptoPunks Transactions

November witnessed several extraordinary CryptoPunks sales that captivated the attention of both crypto enthusiasts and mainstream media outlets. One particularly notable transaction involved CryptoPunk #3100, one of the nine alien punks in existence, which reportedly sold for a staggering sum that placed it among the most expensive NFT transactions of all time. The sale underscored the enduring appeal of rare attributes within established collections.

The scarcity factor plays a crucial role in CryptoPunks valuations. With only nine aliens, twenty-four apes, and eighty-eight zombies among the 10,000 total punks, these rare types consistently command astronomical prices. November’s sales data revealed that collectors are willing to pay significant premiums for punks with multiple rare attributes or those with particular cultural relevance within the community.

Mid-tier CryptoPunks also experienced substantial activity during the month. Punks featuring desirable combinations of accessories such as beanies, mohawks, and 3D glasses saw increased trading velocity. This suggests that the market has matured beyond exclusively focusing on the rarest pieces, with collectors recognizing value across the entire spectrum of the collection. The floor price for CryptoPunks rose consistently throughout November, indicating broad-based demand rather than isolated high-value transactions.

BAYC Maintains Market Dominance

The Bored Ape Yacht Club demonstrated exceptional performance throughout November 2025, with transaction volumes and floor prices both trending upward. The collection’s utility-driven approach has created multiple value streams for holders, from exclusive merchandise and events to intellectual property rights that enable commercial exploitation of owned apes. This multifaceted value proposition has proven particularly attractive during periods of market uncertainty.

Several high-profile BAYC sales dominated headlines in November. Rare golden fur apes and those with unique expression combinations attracted considerable attention from institutional collectors and celebrity buyers. The social proof element of BAYC ownership, where holding an ape grants access to exclusive digital and physical experiences, has created a self-reinforcing cycle of demand. As more prominent individuals acquire bored apes, the perceived value and desirability of the collection increases correspondingly.

Yuga Labs’ strategic expansion of the BAYC ecosystem has also contributed to sustained interest. The interconnected nature of their various collections, including Mutant Ape Yacht Club, Bored Ape Kennel Club, and the Otherside metaverse, has created a comprehensive digital world where BAYC serves as the foundational asset. November saw increased activity across all these related collections, with BAYC holders leveraging their positions within the broader ecosystem.

Market Analysis and Trading Volumes

The overall NFT market trends in November 2025 revealed a marked improvement in liquidity and trading activity compared to the preceding months. Total transaction volume across major marketplace,s including OpenSea, Blur, and LooksRare, exceeded levels not seen since early 2023. CryptoPunks and BAYC accounted for a significant portion of this volume, with their combined market share representing nearly thirty percent of all high-value NFT transactions.

Institutional participation has notably increased, with several crypto investment funds and family offices establishing or expanding their NFT portfolios. This institutional interest has predominantly focused on established collections with proven track records, further reinforcing the dominance of CryptoPunks and BAYC. The entrance of traditional finance players has also contributed to improved price discovery mechanisms and reduced volatility within these blue-chip collections.

Secondary market dynamics have shifted considerably as well. The average holding period for CryptoPunks and BAYC has extended, suggesting that current buyers view these assets as long-term holds rather than short-term speculative plays. This behavioral shift indicates growing confidence in the enduring value of premium digital collectibles and mirrors patterns observed in traditional art markets where masterworks change hands infrequently.

Cultural Impact and Celebrity Endorsements

The cultural cachet associated with owning premium NFTs like CryptoPunks and BAYC has expanded significantly. November 2025 witnessed numerous high-profile individuals publicly acquiring pieces from these collections, generating substantial media coverage and social media engagement. Celebrity endorsements have historically driven mainstream adoption of emerging technologies, and the NFT space has proven no exception to this pattern.

Entertainment industry figures, professional athletes, and business leaders have increasingly incorporated their NFT holdings into their public personas. For BAYC holders specifically, the ability to use their ape’s likeness commercially has led to creative integrations across music, fashion, and digital content. Several major brands announced collaborations with BAYC holders during November, demonstrating the collection’s viability as an intellectual property foundation for commercial ventures.

The social signaling aspect of NFT ownership has become more sophisticated. Rather than merely displaying profile pictures on social media platforms, collectors are now participating in exclusive virtual events, contributing to decentralized autonomous organizations, and accessing members-only experiences in both digital and physical spaces. This evolution has transformed NFTs from simple collectibles into multifunctional assets that confer status, utility, and community membership simultaneously.

Technological Developments and Market Infrastructure

Improvements in blockchain infrastructure have significantly enhanced the NFT trading experience throughout 2025. Ethereum’s continued evolution, including more efficient transaction processing and reduced gas fees, has made trading high-value NFTs more accessible and cost-effective. November benefited from these technological advancements, with collectors able to execute transactions more quickly and economically than in previous years.

Layer-2 scaling solutions have also played a crucial role in expanding market accessibility. While CryptoPunks and BAYC remain primarily traded on Ethereum’s main network, the broader NFT ecosystem has embraced various scaling approaches that have helped normalize digital collectibles among wider audiences. This technological maturation has contributed to the overall market growth that has lifted blue-chip collections.

Advanced analytics tools and market intelligence platforms have emerged as essential resources for serious NFT collectors. November saw increased reliance on data-driven decision making, with collectors utilizing historical sales data, rarity rankings, and on-chain metrics to inform their acquisition strategies. This professionalization of the market has favored established collections with extensive historical data, providing another advantage to CryptoPunks and BAYC over newer entrants.

Comparison with Other NFT Projects

While CryptoPunks and BAYC dominated November’s headlines, the broader digital collectibles market includes numerous other projects competing for collector attention. Collections such as Azuki, Doodles, and CloneX maintained active communities and respectable trading volumes, yet none approached the transaction values or cultural impact of the two market leaders. This disparity highlights the winner-take-most dynamics that have emerged within the NFT space.

Newer projects launching in November attempted to differentiate themselves through innovative mechanics, enhanced utility, or novel artistic approaches. However, most struggled to capture sustained attention in an environment where collectors increasingly prioritize proven value retention and historical significance. The flight to quality phenomenon has concentrated liquidity and interest within a small number of elite collections.

Art-focused NFT platforms featuring one-of-one pieces from established digital artists represented an alternative segment of the market. While these platforms attracted dedicated collectors and achieved notable individual sales, their cumulative impact paled in comparison to the systematic dominance exhibited by profile picture collections like CryptoPunks and BAYC. The distinction between art NFTs and collectible NFTs has become increasingly pronounced, with different collector bases and valuation methodologies applying to each category.

Future Outlook for Premium NFT Collections

The performance of CryptoPunks and BAYC in November 2025 has prompted considerable speculation about the future trajectory of the NFT market. Many analysts interpret the month’s results as confirmation that digital collectibles have transitioned from a speculative frenzy to a mature asset class with established valuation frameworks. The consistent demand for blue-chip collections suggests that NFTs have secured a permanent position within the broader digital economy.

Regulatory developments will likely play a significant role in shaping the market’s evolution. As governments worldwide continue refining their approaches to digital assets, clear frameworks for NFT ownership, taxation, and trading could either facilitate or impede market growth. November’s strong performance occurred against a backdrop of increasing regulatory clarity in several major jurisdictions, suggesting that well-defined rules may actually benefit established collections by reducing uncertainty.

The integration of NFTs with emerging technologies such as artificial intelligence, virtual reality, and augmented reality presents additional growth opportunities. As the metaverse concept continues developing, premium NFT collections like BAYC that have already established digital worlds and communities are well-positioned to capitalize on increasing virtual engagement. The convergence of these technologies could create entirely new dimensions of value and utility for digital collectibles.

Conclusion

November 2025 will be remembered as a pivotal month in the evolution of non-fungible tokens, with CryptoPunks and BAYC definitively reasserting their dominance over the digital collectibles landscape. The combination of record-breaking sales, increased institutional participation, and sustained community engagement has demonstrated that these pioneering collections have transcended their origins to become enduring cultural and financial assets. The month’s performance suggests that the NFT market has matured beyond speculative excess into a more stable ecosystem where quality, scarcity, and historical significance command premium valuations.

The success of these blue-chip collections in November reflects broader trends within digital asset markets, including the flight to quality during uncertain times and the growing recognition of blockchain-based ownership as a legitimate form of value storage. As the technology continues advancing and regulatory frameworks solidify, premium NFT collections appear positioned to remain relevant and valuable components of diversified digital portfolios. For collectors, investors, and observers alike, the events of November 2025 provide compelling evidence that carefully selected digital assets can deliver both cultural relevance and financial performance.

FAQs

Q: What makes CryptoPunks and BAYC more valuable than other NFT collections?

CryptoPunks and BAYC possess several distinguishing characteristics that support their premium valuations. CryptoPunks holds historical significance as one of the first NFT projects on Ethereum, creating irreplaceable cultural value. BAYC offers extensive commercial rights and utility through its ecosystem, including exclusive events, metaverse integration, and brand partnerships.

Q: How have NFT marketplaces contributed to the success of these collections in November 2025?

NFT marketplaces have significantly improved their infrastructure, user experience, and security features throughout 2025, making high-value transactions more accessible and trustworthy. Platforms like OpenSea, Blur, and LooksRare have implemented advanced analytics, improved liquidity through aggregation, and reduced transaction friction.

Q: Are CryptoPunks and BAYC good long-term investments?

While past performance has been strong, NFTs remain speculative assets with inherent risks. CryptoPunks and BAYC have demonstrated resilience through multiple market cycles, suggesting some degree of value stability compared to newer projects. Their cultural significance, brand recognition, and limited supply provide foundational support for long-term value retention.

Q: How do rarity traits affect the value of individual NFTs within these collections?

Rarity plays a crucial role in determining individual NFT valuations within both CryptoPunks and BAYC collections. For CryptoPunks, type rarity is paramount, with aliens and apes commanding substantial premiums over more common human punks. Attribute combinations, including accessories, facial expressions, and unique characteristics, further differentiate value.

Q: What role does community play in maintaining the value of these NFT collections?

Community engagement serves as a critical value driver for both CryptoPunks and BAYC, extending far beyond simple collective ownership. BAYC particularly emphasizes community through exclusive events, collaborative decision-making via governance mechanisms, and shared experiences in virtual environments. Strong communities create network effects where each new member increases the value proposition for existing holders.