Bitcoin Whales Dump $3.37B December’s Massive Selloff

Bitcoin Whales Dump $3.37B, triggering market volatility. Discover the impact on crypto prices and what it means for investors.

Bitcoin whales initiated one of the most substantial distribution phases of the year. Large-scale holders controlling between 10,000 and 100,000 Bitcoin collectively offloaded approximately 36,500 BTC, representing a staggering $3.37 billion in value. Bitcoin Whales Dump $3.37B: This massive divestment occurred during a period of heightened market uncertainty, with Bitcoin trading in a volatile range between $85,000 and $94,000 throughout the month.

The cryptocurrency market has long been influenced by the actions of large Bitcoin holders, commonly known as whales. These influential entities possess the financial firepower to move markets, and their December activities sent ripples throughout the digital asset ecosystem. Understanding the motivations behind this substantial selloff and its implications for both institutional and retail investors has become paramount for anyone navigating the turbulent waters of cryptocurrency investment.

This whale distribution represents more than just numbers on a blockchain. It signifies a critical shift in market sentiment among the most sophisticated participants in the Bitcoin ecosystem. As on-chain data revealed a 130% increase in selling pressure from this specific cohort during the first half of December alone, market observers began questioning whether this signaled the end of Bitcoin’s rally toward new all-time highs or merely a temporary pause in its upward trajectory.

Bitcoin Whale Behavior and Market Dynamics

Bitcoin whale activity serves as one of the most reliable indicators of market direction, often providing early signals before significant price movements occur. In the cryptocurrency ecosystem, whales are typically defined as entities holding between 1,000 and 10,000 BTC, while mega whales control even larger amounts exceeding 10,000 coins. These large holders wield considerable influence over market liquidity and price discovery mechanisms.

The December selloff wasn’t an isolated incident but rather part of a broader pattern of whale distribution that intensified as Bitcoin approached psychological resistance levels. On-chain analytics firms tracking these movements observed that the selling pressure emanated primarily from the 10,000 to 100,000 BTC cohort, suggesting institutional-level participants rather than individual retail investors were behind the transactions.

What makes this particular distribution phase noteworthy is its methodical nature. Unlike panic selling often observed during market crashes, this divestment appeared calculated and strategic. Large holders executed their sales through fragmented transactions spread across multiple exchanges, minimizing immediate price impact while systematically reducing their exposure. This sophisticated approach indicates that professional trading desks and institutional investors were orchestrating the selloff rather than emotional retail traders.

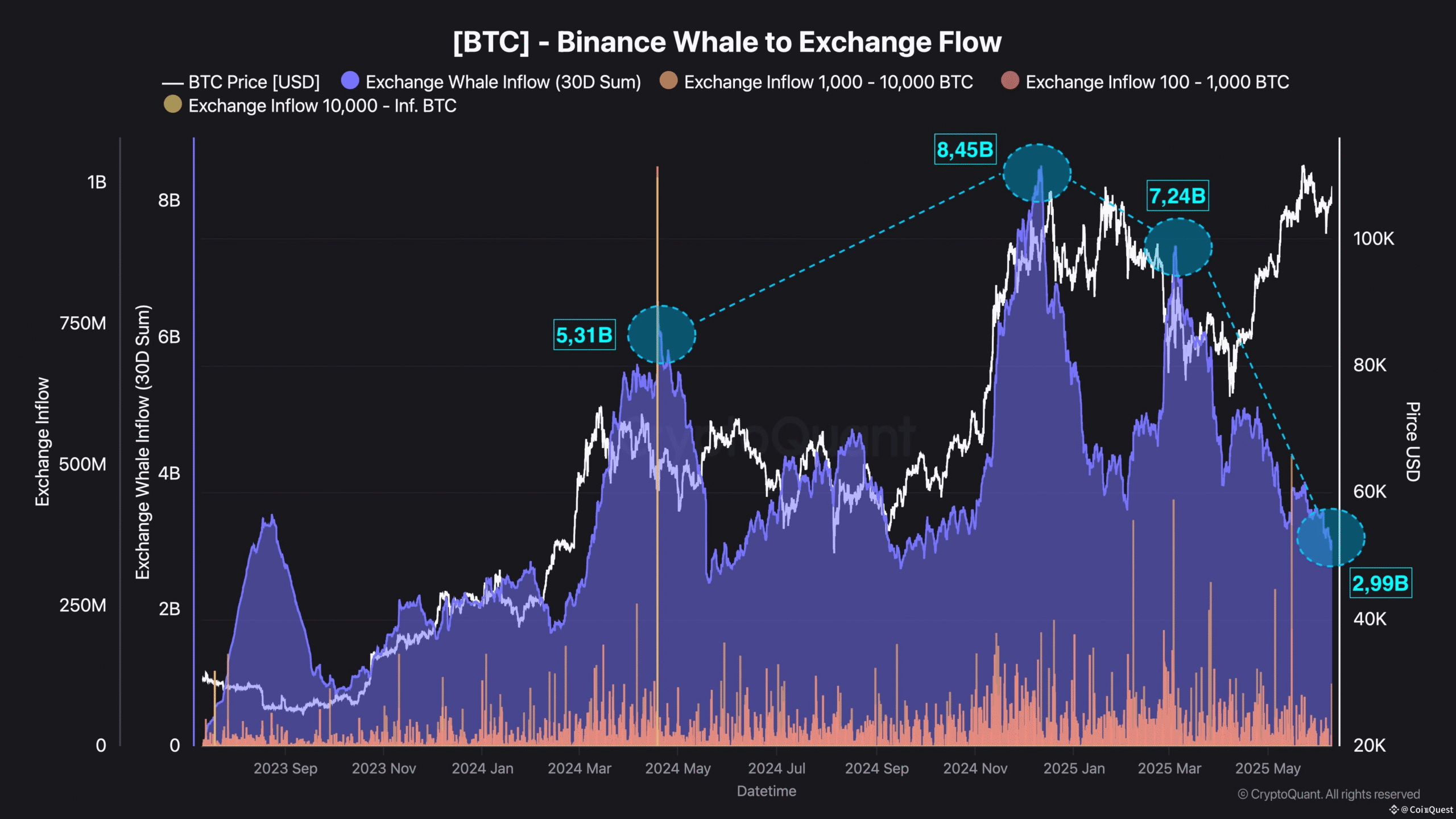

The timing of these whale movements coincided with Bitcoin’s struggle to maintain levels above $100,000 following its December peak. Despite positive catalysts such as renewed spot Bitcoin ETF inflows and growing institutional adoption, the persistent selling pressure from whales created a formidable ceiling preventing sustained upward momentum. Market participants closely monitored exchange inflow data to distinguish between coins being sold on the open market versus those merely being moved for internal wallet management or over-the-counter transactions.

The $3.37 Billion Question: Bitcoin Whales Dump $3.37B

Several factors contributed to the massive Bitcoin whale selloff observed throughout December 2024. Understanding these motivations provides crucial context for interpreting current market conditions and anticipating future price movements.

Profit-taking emerged as the primary driver behind the distribution. Many whale addresses accumulated substantial Bitcoin holdings during previous market cycles, including the 2022 bear market when prices plummeted to $15,500. With Bitcoin reaching $108,000 in mid-December, these long-term holders found themselves sitting on unrealized profits exceeding 500% in some cases. The temptation to lock in such substantial gains proved irresistible for many institutional participants.

Macro economic conditions also played a significant role in shaping whale behavior. The Federal Reserve’s monetary policy decisions, particularly regarding interest rates, created uncertainty across all risk assets including cryptocurrencies. When the Fed announced its rate decision in mid-December, markets reacted with volatility, prompting some large holders to reduce their exposure to digital asset markets. The correlation between traditional financial markets and cryptocurrency prices meant that whales needed to consider broader economic headwinds when managing their portfolios.

Portfolio rebalancing represented another motivation for whale distribution. Institutional investors and family offices managing diversified portfolios regularly adjust their allocations based on market conditions and risk parameters. As Bitcoin’s price appreciation significantly increased its weighting within these portfolios, managers felt compelled to trim positions to maintain their target asset allocation ratios. This mechanical selling, while not reflecting negative sentiment toward Bitcoin’s long-term prospects, still created substantial selling pressure.

Additionally, the approach of year-end tax considerations likely influenced some whale decisions. Large holders seeking to realize losses for tax purposes or strategically timing capital gains recognition may have accelerated their selling activities to align with fiscal year deadlines. This seasonal pattern of tax-loss harvesting and strategic realization commonly affects cryptocurrency markets during the final weeks of December.

Market Impact: Price Volatility and Trading Desk Reactions

The immediate impact of whale selling manifested through increased Bitcoin price volatility and downward pressure on spot prices. As the 36,500 BTC flowed toward exchanges throughout December, Bitcoin’s price trajectory shifted from its previous upward momentum to a choppy consolidation pattern. The cryptocurrency oscillated within a $10,000 range, unable to reclaim the psychological $100,000 level that had briefly been achieved earlier in the month.

Trading desks and market makers found themselves navigating challenging conditions as whale distribution altered the supply-demand equilibrium. The sudden influx of coins created temporary liquidity imbalances, with bid-ask spreads widening during periods of heavy selling. Professional traders monitoring order books observed large sell walls appearing at key resistance levels, creating technical barriers that prevented sustained rallies.

Exchange inflow data became a focal point for market analysis during this period. A spike in inflows to major cryptocurrency exchanges typically signals preparatory activity before open market selling. Analysts tracking these movements noted that while significant Bitcoin quantities moved to exchanges, not all coins were immediately sold, suggesting some whales positioned themselves for opportunistic selling at favorable price levels rather than executing immediate market orders.

The cryptocurrency market correction triggered by whale selling had cascading effects across the broader digital asset ecosystem. As Bitcoin declined, alternative cryptocurrencies experienced even more pronounced selloffs, with many altcoins posting double-digit percentage losses. This correlation highlighted Bitcoin’s continued dominance and its role as a market leader whose price movements influence investor sentiment across all cryptocurrency sectors.

Leveraged positions added fuel to the volatility fire. As Bitcoin’s price declined, margin calls forced leveraged long positions to liquidate, creating additional selling pressure that amplified the initial whale-driven correction. Over $271 million in leveraged positions were liquidated during the most volatile trading sessions, demonstrating how whale actions can trigger chain reactions affecting smaller market participants who employ leverage in their trading strategies.

Contrasting Trends: Smaller Holders Accumulate While Whales Distribute

While the 10,000 to 100,000 BTC whale cohort engaged in distribution, on-chain data revealed an interesting countertrend among smaller holders. The so-called “shark” category, comprising wallets holding between 100 and 1,000 BTC, demonstrated persistent accumulation throughout December’s volatility. This divergence between whale behavior and mid-sized holder activity painted a nuanced picture of market sentiment.

Retail and smaller institutional investors viewed the December price weakness as an attractive buying opportunity. As whales took profits near multi-year highs, these smaller participants accumulated coins at lower price points, effectively transferring Bitcoin from potentially weak hands into stronger ones. This classic pattern of distribution from old holders to new participants represents a healthy market dynamic that often precedes the next phase of appreciation.

The accumulation by sharks added approximately 34,000 BTC to their collective holdings in the weeks following the initial whale selloff. This buying activity helped establish a price floor around $85,000, preventing Bitcoin from experiencing a deeper correction despite continued selling pressure from larger holders. The resilience demonstrated by mid-sized holders suggested confidence in Bitcoin’s longer-term value proposition remained intact.

Institutional adoption continued apace even as whales distributed holdings. Spot Bitcoin ETFs, which had revolutionized access to cryptocurrency exposure for traditional investors, experienced renewed inflows after initial outflows early in December. These vehicles attracted capital from investors seeking regulated exposure to Bitcoin without the complexities of direct ownership. The $458 million in initial ETF outflows reversed as prices stabilized, with institutional buyers recognizing attractive entry points.

This transfer of Bitcoin from concentrated whale wallets to a more distributed holder base potentially reduces future market manipulation risks. A more decentralized distribution of Bitcoin ownership theoretically creates greater price stability, as no single entity or small group of entities can exert outsized influence on market movements. However, the transition period during which this redistribution occurs often generates the exact volatility observed throughout December.

Technical Analysis: Support Levels and Future Price Trajectories

From a technical perspective, the December whale selloff established critical support and resistance zones that continue shaping Bitcoin’s price action. The $85,000 to $88,000 range emerged as a significant support area, representing a zone where buying interest consistently emerged to absorb selling pressure. This level coincided with multiple technical indicators suggesting oversold conditions, attracting value-oriented buyers.

Resistance proved more formidable, with the $94,000 to $95,000 range acting as a ceiling that Bitcoin struggled to penetrate. This resistance zone represented the approximate price level where whale distribution intensified, creating a supply overhang that prevented sustained breakouts. Technical analysts noted that reclaiming this level with conviction would likely signal the end of the distribution phase and potentially trigger a new leg higher.

On-chain metrics provided additional context for price analysis. The Network Value to Transactions (NVT) ratio, which measures Bitcoin’s network value relative to transaction volume, remained below historical overvaluation levels, suggesting the asset wasn’t experiencing bubble-like conditions despite its year-to-date appreciation. The Market Value to Realized Value (MVRV) Z-score similarly indicated Bitcoin traded within a “belief” zone where the market neither appeared extremely overbought nor oversold.

Trading volume patterns revealed decreased participation from retail investors during December’s volatility. Lower volumes often accompany distribution phases, as excited buyers from earlier rally stages become exhausted while patient sellers methodically exit positions. This volume contraction suggested that a resolution to the sideways consolidation pattern would eventually occur, though the direction remained uncertain without additional catalysts.

Chart patterns developing during the December selloff presented both bullish and bearish scenarios. Optimistic analysts pointed to a potential bull flag formation, where the consolidation represented a healthy pause before continuation of the uptrend. Pessimistic observers noted the development of a potential head and shoulders topping pattern, which if confirmed through a break below key support, could signal a deeper correction toward the $75,000 to $80,000 region.

Institutional Perspective: What Professional Traders Are Watching

Professional trading operations and institutional investors maintained heightened vigilance throughout December’s whale distribution phase. These sophisticated market participants employed advanced analytics and proprietary indicators to navigate the volatile conditions and position themselves advantageously for whatever market phase emerged next.

One key area of focus involved monitoring the Exchange Whale Ratio, a metric comparing the largest exchange inflows against total exchange activity. When this ratio spikes, it indicates that whale transactions represent a disproportionate share of exchange volume, often presaging significant price movements. December’s elevated Exchange Whale Ratio reinforced that large holders were actively repositioning, making careful position management essential for institutional desks.

Funding rates in the derivatives markets provided additional signals about trader positioning and sentiment. Negative funding rates, where short position holders pay longs, typically indicate bearish sentiment, while positive rates suggest optimism. Throughout December’s selloff, funding rates oscillated between slightly positive and neutral, indicating that the derivatives market wasn’t experiencing extreme positioning in either direction despite the spot market volatility.

Options market data revealed sophisticated investors employing complex strategies to navigate uncertainty. Put option volumes increased as investors sought downside protection, while call spreads at higher strikes suggested some market participants anticipated eventual breakouts above current resistance levels. This mixed positioning reflected the genuine uncertainty about near-term direction while maintaining longer-term constructive views.

Institutional capital flows from cryptocurrency funds and investment vehicles painted a picture of cautious optimism. While some funds experienced redemptions during volatile periods, others reported net inflows as investors viewed weakness as opportunity. This divergence in investor behavior highlighted the maturation of cryptocurrency markets, where diverse participant types with varying time horizons and risk tolerances now coexist.

Implications for Bitcoin’s 2025 Outlook

The December whale distribution carries significant implications for Bitcoin’s trajectory throughout 2025. Understanding how this redistribution phase might affect future price action helps investors formulate appropriate strategies and maintain realistic expectations about potential outcomes.

One potentially bullish interpretation suggests that the whale selling removed a significant supply overhang that had been restraining price appreciation. With large holders having reduced positions substantially, less selling pressure might exist at higher price levels, potentially allowing Bitcoin to breakout more easily when positive catalysts emerge. This supply absorption by more committed holders could lay groundwork for sustained appreciation.

Conversely, the distribution might signal that sophisticated investors perceive limited upside in the near term. If whales possessing superior information and analytical capabilities chose to reduce exposure, their actions might reflect concerns about macroeconomic headwinds, regulatory uncertainties, or technical factors suggesting consolidation or correction lies ahead. Respecting the “smart money” positions warrants consideration when forming market views.

Cryptocurrency market trends extending beyond Bitcoin also merit attention. Ethereum and other major alternative cryptocurrencies experienced varying degrees of whale activity, with some showing accumulation while others faced distribution similar to Bitcoin. The relative performance of different digital assets might offer clues about where investment flows are heading and which sectors of the cryptocurrency ecosystem appear most attractive to sophisticated capital.

Regulatory developments will undoubtedly influence how quickly markets can recover from the December selloff and establish new uptrends. Government policies regarding cryptocurrency taxation, exchange regulation, and institutional custody continue evolving globally. Positive regulatory clarity could unlock substantial capital that currently remains sidelined, while restrictive policies might extend the consolidation phase.

The broader macroeconomic environment, particularly Federal Reserve policy and traditional market performance, maintains its correlation with cryptocurrency prices. If risk assets generally perform well throughout 2025, Bitcoin will likely benefit from positive spillover effects. However, if economic conditions deteriorate or interest rates remain elevated longer than anticipated, cryptocurrencies might struggle to establish sustained momentum regardless of whale distribution patterns.

Strategic Considerations for Investors Navigating Whale Activity

Individual investors observing whale distribution must calibrate their strategies appropriately based on personal circumstances, risk tolerance, and investment horizons. Several key principles can guide decision-making during periods characterized by large holder selling.

First, distinguishing between short-term noise and long-term signal remains crucial. Whale distribution creates temporary volatility and price weakness, but doesn’t necessarily invalidate Bitcoin’s fundamental value proposition or long-term appreciation potential. Investors with conviction in cryptocurrency’s role in the future financial system might view whale selling as opportunity rather than threat, using weakness to accumulate positions at favorable prices.

Dollar-cost averaging provides a sensible approach during uncertain periods. Rather than attempting to time the perfect entry point amid whale-driven volatility, systematic purchases at regular intervals allow investors to build positions gradually without excessive exposure to any single price level. This strategy removes emotion from investment decisions and ensures participation in eventual upside while managing downside risk.

Risk management assumes paramount importance when whales are actively repositioning. Setting appropriate stop-loss levels, maintaining diversified portfolios, and avoiding excessive leverage help protect capital during volatile periods. The $271 million in liquidations experienced during December’s selloff serves as a cautionary tale about the dangers of over-leveraging in markets subject to whale influence.

Staying informed about on-chain developments empowers investors to make educated decisions. Numerous platforms provide real-time data about whale movements, exchange flows, and other blockchain metrics. While interpreting this data requires some expertise, even basic awareness of large holder activity helps investors understand the forces shaping price action and adjust expectations accordingly.

Finally, maintaining perspective about Bitcoin’s historical price action provides comfort during turbulent periods. The cryptocurrency has experienced numerous corrections, distribution phases, and periods of whale selling throughout its existence. Each time, patient long-term holders who maintained conviction through volatility were ultimately rewarded as new bull phases emerged. While past performance never guarantees future results, Bitcoin’s track record suggests resilience in the face of temporary headwinds.

Conclusion

The December 2024 Bitcoin whale distribution of 36,500 BTC worth $3.37 billion represents a significant market event that reshuffled holdings from large players to smaller participants. This methodical selloff triggered increased volatility, established new technical support and resistance levels, and tested the resolve of cryptocurrency investors across all categories.

While the immediate impact manifested through price weakness and trading range consolidation, the longer-term implications remain subject to interpretation. Optimistic observers view the distribution as a healthy transfer of coins from profit-takers to committed new holders, potentially setting the stage for future appreciation once the supply overhang clears. Pessimistic analysts worry that sophisticated whale selling signals concerns about near-term prospects that might take time to resolve.

Understanding whale behavior provides valuable context for navigating cryptocurrency markets, but shouldn’t dictate investment decisions in isolation. Multiple factors including macroeconomic conditions, regulatory developments, technological advancements, and institutional adoption trends collectively determine Bitcoin’s trajectory. The December selloff represents one data point within a complex, evolving ecosystem.

As markets continue processing the whale distribution and establishing new equilibriums, investors must remain adaptable and informed. The cryptocurrency landscape constantly evolves, presenting both opportunities and challenges for participants willing to engage thoughtfully with this transformative asset class. Whether December’s whale selling proves a temporary headwind or harbinger of extended consolidation will only become clear with time and perspective.

FAQs

Q: What exactly is a Bitcoin whale and how much do they typically hold?

A Bitcoin whale is an individual or entity holding substantial amounts of Bitcoin, typically defined as wallets containing 1,000 BTC or more. In cryptocurrency markets, whales are further categorized by holding size: those with 1,000-10,000 BTC are considered standard whales, while mega whales control over 10,000 BTC. These large holders can significantly influence market dynamics through their trading activities because their transactions involve volumes large enough to impact prices, especially during periods of lower liquidity. Notable examples include early Bitcoin adopters, institutional investment firms, and even cryptocurrency exchanges managing customer assets.

Q: How does whale selling specifically impact Bitcoin’s price?

Whale selling impacts Bitcoin prices through several mechanisms. When large holders offload significant quantities of BTC, they increase the available supply in the market, potentially overwhelming existing demand and pushing prices downward. The psychological effect on other market participants also matters—observing whale distribution can trigger fear and uncertainty, prompting smaller investors to sell as well, creating cascading price declines. Additionally, whale transactions often trigger liquidations of leveraged positions, as margin calls force over-extended traders to exit, amplifying the initial price movement. However, the impact varies based on whether whales sell gradually through fragmented transactions or dump coins rapidly through market orders.

Q: Should retail investors be concerned when whales sell large amounts of Bitcoin?

Retail investors should view whale selling with informed perspective rather than panic. While large holder distribution creates short-term volatility and potential price weakness, it doesn’t necessarily indicate fundamental problems with Bitcoin itself. Often, whale selling represents profit-taking after substantial appreciation or portfolio rebalancing rather than loss of confidence in cryptocurrency’s future. Historically, periods of whale distribution have transferred coins to new holders at lower prices, redistributing ownership more broadly and potentially reducing future manipulation risks. Retail investors with long-term conviction might actually view whale-driven price weakness as opportunity to accumulate at favorable levels, though appropriate risk management remains essential.

Q: How can investors track whale activity in real-time?

Several on-chain analytics platforms enable investors to monitor whale activity in real-time. Services like Whale Alert provide immediate notifications of large Bitcoin transactions, while comprehensive analytics firms such as Glassnode, CryptoQuant, and Santiment offer detailed metrics about wallet distributions, exchange flows, and holder behavior patterns. These platforms track indicators like the Exchange Whale Ratio, accumulation trends across different wallet sizes, and long-term holder supply changes. Many services offer free basic features with premium subscriptions for advanced analytics. Social media platforms, particularly Twitter/X, also feature accounts dedicated to reporting significant whale movements, though investors should verify information through multiple sources before making investment decisions.

Q: What happened after the December 2024 whale selloff—did Bitcoin recover?

Following the initial December whale distribution, Bitcoin entered a consolidation phase with mixed signals. While the immediate aftermath saw prices oscillate in the $85,000-$94,000 range, on-chain data revealed that mid-sized holders (sharks) began accumulating the coins distributed by whales, suggesting confidence remained among a broad base of investors. Some analysts reported that whales accumulated approximately 34,000 BTC in the weeks following the initial December selloff, indicating that even large holders viewed the weakness as opportunity. The ultimate price trajectory depends on numerous factors including macroeconomic conditions, institutional adoption trends, and regulatory developments, with both bullish and bearish scenarios remaining plausible as markets digest the redistribution and establish new trading patterns.