Bitcoin & Ethereum Drop Crypto’s Next Move Revealed

Bitcoin price falls as Ethereum slips lower. Bitcoin & Ethereum Drop Crypto's , market analysis, and expert insights on what's driving...

The cryptocurrency market has once again demonstrated its characteristic volatility, with Bitcoin and Ethereum experiencing notable price declines that have left investors and traders questioning what comes next. As digital assets continue to mature and integrate into the broader financial ecosystem, understanding the factors driving these price movements becomes increasingly crucial for anyone involved in the crypto space. The recent downturn in Bitcoin price and Ethereum’s Bitcoin & Ethereum Drop Crypto’s: declining value has sparked intense debate among market analysts, institutional investors, and retail traders alike about whether this represents a temporary correction or signals a more prolonged bearish trend.

The cryptocurrency landscape has evolved significantly since Bitcoin’s inception, transforming from a niche digital experiment into a trillion-dollar asset class that commands attention from Wall Street, regulatory bodies, and governments worldwide. Today’s market dynamics are influenced by a complex interplay of macroeconomic factors, regulatory developments, technological innovations, Bitcoin & Ethereum Drop Crypto’s: and investor sentiment. Bitcoin & Ethereum Drop Crypto’s: As we examine the current state of Bitcoin and Ethereum, Bitcoin & Ethereum Drop Crypto’s: it’s essential to consider not just the immediate price action but also the underlying fundamentals, market structure, and emerging trends that will shape the future trajectory of these leading digital assets.

Recent Price Decline in Bitcoin and Ethereum

The recent Bitcoin price decline and Ethereum slip have caught many market participants off guard, particularly those who had anticipated a sustained rally following previous consolidation periods. Bitcoin, often referred to as digital gold and the bellwether of the cryptocurrency market, has experienced selling pressure that pushed its value below key psychological support levels. Similarly, Ethereum, the second-largest cryptocurrency by market capitalization and the backbone of decentralized finance (DeFi) and non-fungible tokens (NFTs), has faced its own challenges as network activity and gas fees fluctuate.

Several interconnected factors contribute to these price movements. Market sentiment has been particularly sensitive to macroeconomic indicators, including inflation data, interest rate decisions by central banks, and traditional equity market performance. Bitcoin & Ethereum Drop Crypto’s: When institutional investors adjust their portfolios in response to changing economic conditions, cryptocurrencies often experience correlated movements with risk-on assets like technology stocks. Bitcoin & Ethereum Drop Crypto’s: This correlation, which has strengthened over recent years, means that broader market trends significantly impact crypto prices regardless of blockchain-specific developments.

The selling pressure observed in recent trading sessions appears to stem from a combination of profit-taking by short-term traders, concerns about regulatory crackdowns in major markets, and uncertainty surrounding the approval and performance of cryptocurrency-related investment products. Additionally, on-chain metrics reveal that large holders, commonly known as whales, Bitcoin & Ethereum Drop Crypto’s: have been moving significant amounts of Bitcoin and Ethereum to exchanges, typically a precursor to selling activity that can amplify downward price momentum.

Key Technical Indicators Signaling: Bitcoin & Ethereum Drop Crypto’s

Technical analysis provides valuable insights into potential price movements by examining historical patterns, trading volumes, and mathematical indicators. Bitcoin & Ethereum Drop Crypto’s: For Bitcoin, several critical support levels have come under pressure, with traders closely monitoring whether the cryptocurrency can maintain stability above these thresholds. The 50-day and 200-day moving averages, widely followed technical indicators, are approaching a potential crossover that could signal either a continuation of the bearish trend or a reversal depending on how price action develops in the coming weeks.

The Relative Strength Index (RSI), which measures the speed and magnitude of price changes, currently indicates that both Bitcoin and Ethereum may be approaching oversold territory. Historically, such conditions have presented buying opportunities for long-term investors who view temporary price weaknesses as chances to accumulate assets at more favorable valuations. However, oversold conditions can persist for extended periods during strong downtrends, making timing crucial for those looking to enter positions.

Trading volume patterns also offer important clues about market conviction. Higher volumes during price declines suggest strong selling interest and genuine distribution, while declining volumes might indicate that the sell-off is losing momentum. Recent data shows mixed signals, with some sessions experiencing elevated volumes that confirm bearish sentiment, while others display lower participation that could suggest exhaustion among sellers.

Chart patterns such as descending triangles, head and shoulders formations, and support-resistance zones are being actively monitored by technical traders. These patterns, when confirmed with volume and other indicators, can provide probabilistic insights into where prices might head next. The break below certain support levels often triggers automatic sell orders and stop-losses, creating cascading effects that accelerate price movements in the direction of the break.

Fundamental Factors Influencing Cryptocurrency Valuations

Beyond technical analysis, fundamental factors play an equally important role in determining the long-term value proposition of Bitcoin and Ethereum. Bitcoin’s value proposition as a store of value and hedge against inflation continues to attract attention from both individual and institutional investors seeking alternatives to traditional fiat currencies. The fixed supply of 21 million Bitcoin ensures scarcity, a fundamental economic principle that supports the digital asset’s long-term value thesis despite short-term price volatility.

The Bitcoin halving cycle, which reduces mining rewards approximately every four years, historically influences price trends by decreasing the rate of new supply entering the market. While the next halving event has already occurred, its effects typically unfold gradually over extended periods as the supply-demand dynamics adjust to the new issuance rate. Understanding these cyclical patterns helps investors contextualize current price movements within broader market cycles that have repeated throughout Bitcoin’s history.

For Ethereum, fundamental value derives from its utility as the leading smart contract platform powering thousands of decentralized applications. Network activity, measured through transaction counts, total value locked in DeFi protocols, and daily active addresses, provides insights into real-world usage and demand for Ethereum’s native token, ETH. Recent data showing fluctuations in these metrics suggests that user adoption and application development may be entering a consolidation phase as the ecosystem matures and adapts to evolving market conditions.

The transition to Ethereum 2.0 and the proof-of-stake consensus mechanism has fundamentally altered Ethereum’s economic model. The introduction of staking, where users lock up ETH to secure the network and earn rewards, has removed significant amounts of supply from circulation. Additionally, the EIP-1559 upgrade implemented a burn mechanism that destroys a portion of transaction fees, creating deflationary pressure that could support long-term price appreciation if demand remains constant or increases.

Regulatory Landscape and Its Impact on Crypto Markets

The evolving regulatory environment represents one of the most significant factors influencing cryptocurrency prices and market sentiment. Governments and financial regulators worldwide are grappling with how to classify, regulate, and integrate digital assets into existing financial frameworks. Recent developments in major markets, including the United States, the European Union, and Asian economies, have created both opportunities and challenges for the cryptocurrency industry.

In the United States, the Securities and Exchange Commission (SEC) continues to scrutinize various aspects of the crypto ecosystem, from token classifications to exchange operations and investment products. The approval or rejection of Bitcoin exchange-traded funds (ETFs) and similar investment vehicles has historically triggered significant price movements as these products potentially open cryptocurrency exposure to millions of retail investors through traditional brokerage accounts. The ongoing dialogue between industry participants and regulators creates uncertainty that manifests in price volatility as markets attempt to price in potential outcomes.

Tax policies affecting cryptocurrency transactions also influence investor behavior and market dynamics. Clear guidance on tax treatment helps legitimize digital assets and encourages broader participation, while ambiguous or punitive tax structures can deter investment and drive activity to more favorable jurisdictions. Recent efforts to establish comprehensive taxation frameworks demonstrate that governments increasingly view cryptocurrencies as permanent fixtures of the financial landscape rather than temporary phenomena.

International regulatory coordination, or lack thereof, creates additional complexity for global cryptocurrency markets. Different approaches across jurisdictions can lead to regulatory arbitrage, where businesses and investors migrate to regions with more favorable policies. This fragmentation affects market liquidity, price discovery, and the ability of institutional investors to participate at scale, all of which impact Bitcoin and Ethereum valuations.

Institutional Adoption and Market Maturation

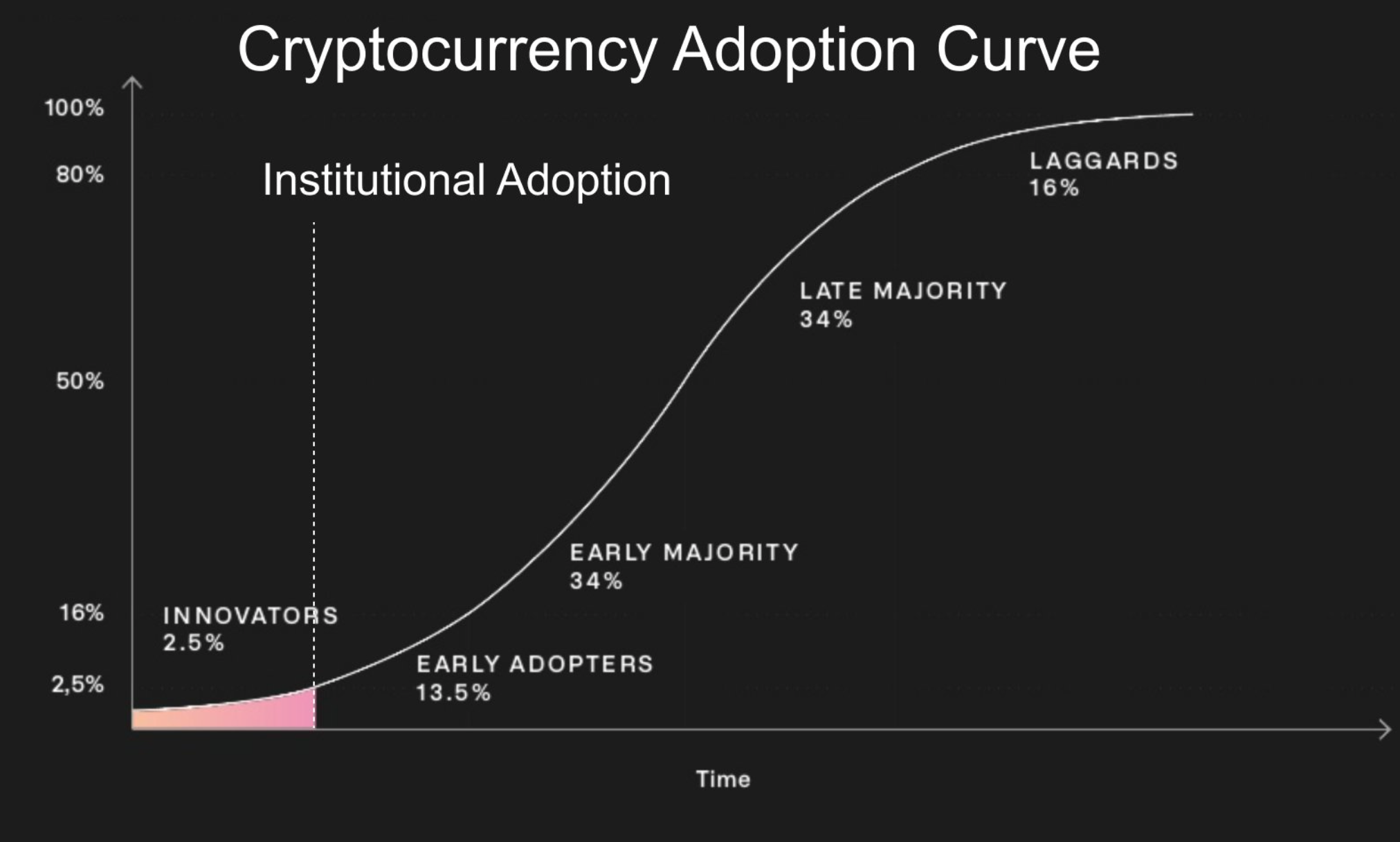

The entrance of institutional investors into cryptocurrency markets has profoundly changed market structure, liquidity, and price behavior. Major financial institutions, hedge funds, pension funds, and corporate treasuries have allocated portions of their portfolios to Bitcoin and Ethereum, bringing significant capital and legitimacy to the asset class. However, institutional participation also introduces new dynamics, including correlation with traditional markets and sensitivity to macroeconomic factors that previously had minimal impact on crypto prices.

Corporate adoption of Bitcoin as a treasury reserve asset, pioneered by companies seeking to preserve capital against fiat currency devaluation, demonstrated that cryptocurrencies could serve practical business purposes beyond speculation. While some corporations have since adjusted their positions based on market conditions and risk management considerations, the precedent of corporate Bitcoin holdings remains significant for long-term adoption narratives.

The development of cryptocurrency derivatives markets, including futures, options, and perpetual swaps, has created sophisticated tools for price discovery, hedging, and speculation. These instruments, now offered by both crypto-native platforms and traditional financial institutions, allow market participants to express complex views on price direction and volatility. The growing open interest in these markets reflects increasing sophistication and deeper liquidity, though it also introduces leverage that can amplify price movements in both directions.

Custody solutions and infrastructure improvements have addressed previous barriers to institutional participation, such as security concerns and operational challenges. The emergence of regulated custodians, prime brokerage services, and institutional-grade trading platforms has made it feasible for large organizations to securely hold and trade significant cryptocurrency positions, removing friction that previously limited institutional engagement.

What to Watch: Key Indicators for Crypto’s Next Move

Investors and traders monitoring the cryptocurrency market should pay attention to several key indicators that may signal the direction of Bitcoin and Ethereum’s next significant move. On-chain metrics, which analyze blockchain data directly, provide unique insights unavailable in traditional financial markets. Metrics such as exchange inflows and outflows, miner behavior, whale activity, and network hash rate offer real-time glimpses into supply and demand dynamics that precede price movements.

The fear and greed index, which aggregates various sentiment indicators into a single measure, helps contextualize current market psychology. Bitcoin & Ethereum Drop Crypto’s: Extreme fear often corresponds with price bottoms as capitulation selling exhausts itself, while extreme greed can signal overheated conditions vulnerable to corrections. Current readings suggest markets are navigating cautious territory, Bitcoin & Ethereum Drop Crypto’s: neither fully capitulated nor excessively optimistic, indicating that the next major catalyst could determine direction.

Macroeconomic data releases, particularly inflation reports, employment figures, and central bank announcements, warrant close attention given the increasing correlation between cryptocurrency and traditional risk assets. Federal Reserve policy decisions regarding interest rates directly impact the opportunity cost of holding non-yielding assets like Bitcoin, while broader economic conditions affect risk appetite among investors allocating to cryptocurrencies.

Developments in the DeFi ecosystem, including total value locked, protocol revenues, and new application launches, provide insights into Ethereum’s fundamental demand drivers. Similarly, Bitcoin’s Lightning Network adoption and layer-2 scaling solutions indicate progress toward addressing scalability challenges that could unlock new use cases and drive adoption. Monitoring these technological advances helps investors assess whether underlying fundamentals support current valuations or suggest adjustments are warranted.

Conclusion

The recent decline in Bitcoin price and Ethereum’s slip represent another chapter in the ongoing evolution of cryptocurrency markets. While short-term volatility can test investor resolve, understanding the multifaceted factors driving price movements—from technical indicators and fundamental developments to regulatory changes and institutional adoption—provides essential context for navigating these markets successfully. The cryptocurrency ecosystem continues maturing, Bitcoin & Ethereum Drop Crypto’s: with improving infrastructure, clearer regulatory frameworks, and growing real-world utility supporting long-term value propositions despite near-term turbulence.

Investors should maintain balanced perspectives that account for both risks and opportunities inherent in this emerging asset class. Bitcoin & Ethereum Drop Crypto’s: The next significant move in cryptocurrency markets will likely emerge from the convergence of technical breakouts or breakdowns, fundamental catalysts such as regulatory clarity or adoption milestones, and macroeconomic conditions that shape broader risk sentiment. Bitcoin & Ethereum Drop Crypto’s: By monitoring key indicators across these dimensions and maintaining disciplined risk management practices, market participants can position themselves to respond effectively, whether the next move brings renewed bullish momentum or continued consolidation. Bitcoin & Ethereum Drop Crypto’s: The cryptocurrency journey remains dynamic and unpredictable, but informed analysis and patient strategy continue to serve long-term participants well in this transformative financial landscape.

FAQs

Q: Why are Bitcoin and Ethereum prices falling right now?

Bitcoin and Ethereum prices are experiencing declines due to a combination of factors, Bitcoin & Ethereum Drop Crypto’s: including profit-taking after previous rallies, concerns about regulatory developments in major markets, macroeconomic uncertainty affecting risk assets, Bitcoin & Ethereum Drop Crypto’s: and technical selling pressure as key support levels break. Additionally, whale activity showing large holders moving assets to exchanges suggests potential selling pressure that weighs on prices.

Q: Is this a good time to buy Bitcoin and Ethereum during the price dip?

Whether current price levels represent a buying opportunity depends on individual investment goals, risk tolerance, and time horizon. Bitcoin & Ethereum Drop Crypto’s: Many long-term investors view significant price declines as accumulation opportunities, especially when fundamental factors remain intact. Bitcoin & Ethereum Drop Crypto’s: However, catching falling knives can be risky, and it’s essential to conduct thorough research, consider dollar-cost averaging strategies, and never invest more than you can afford to lose.

Q: How do regulatory changes affect cryptocurrency prices?

Regulatory developments significantly impact cryptocurrency prices by influencing investor confidence, market accessibility, and institutional participation. Positive regulatory clarity, such as approval of investment products or clear legal frameworks, Bitcoin & Ethereum Drop Crypto’s: typically supports prices by encouraging broader adoption. Conversely, crackdowns, restrictive policies, or regulatory uncertainty can trigger selling pressure as investors reassess risk.

Q: What technical indicators should I watch to predict Bitcoin’s next move?

Key technical indicators include moving averages (50-day and 200-day), Relative Strength Index (RSI) for overbought or oversold conditions, support and resistance levels, Bitcoin & Ethereum Drop Crypto’s: trading volume patterns, and chart formations such as triangles or head and shoulders patterns. Bitcoin & Ethereum Drop Crypto’s: Additionally, monitoring on-chain metrics like exchange inflows/outflows, whale activity, and miner behavior provides blockchain-specific insights that complement traditional technical analysis.

Q: How is Ethereum different from Bitcoin in terms of investment potential?

Ethereum and Bitcoin serve different purposes and have distinct value propositions. Bitcoin functions primarily as a store of value and digital alternative to gold, with a fixed supply and established position as the leading cryptocurrency. Ethereum, Bitcoin & Ethereum Drop Crypto’s: Bitcoin & Ethereum Drop Crypto’s: however, derives value from its utility as a smart contract platform powering decentralized applications, DeFi protocols, and NFTs.