NFT Winter Deepens Sales Plunge to 2024 Low

NFT Winter Deepens in 2024 as market sentiment weakens. Discover what's driving the downturn and what it means for digital collectors.

The non-fungible token market has experienced a dramatic downturn, with monthly sales volumes reaching their lowest point throughout 2024. What was once celebrated as a revolutionary technology that would transform digital ownership and creative economies has now entered what industry insiders are calling an extended NFT winter. This significant decline in trading activity reflects broader challenges facing the digital collectables space, from waning consumer interest to regulatory uncertainties and evolving market dynamics.

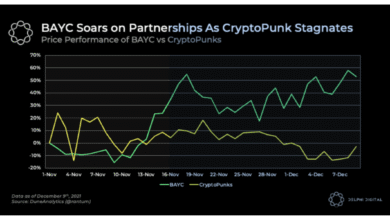

The current state of the NFT ecosystem paints a sobering picture for collectors, creators, and investors who rode the wave of enthusiasm during the market’s peak years. NFT Winter Deepens : Monthly transaction volumes have plummeted dramatically compared to the billion-dollar months witnessed during the height of the NFT boom in 2021 and early 2022. This downturn represents more than just a temporary correction; it signals a fundamental shift in how the market operates and what participants value in digital assets. Understanding the factors contributing to this decline and examining the broader implications for the blockchain technology sector provides crucial insights into where the market may be heading next.

The Magnitude of the Decline: NFT Winter Deepens

The depth of the current NFT winter becomes starkly apparent when examining the raw numbers behind monthly sales figures. Recent data indicate that transaction volumes have contracted to levels not seen since the earliest days of mainstream NFT adoption. Major marketplaces like OpenSea, Blur, and Magic Eden have all reported significant decreases in both the number of transactions and the total dollar value exchanged on their platforms.

This contraction affects virtually every segment of the digital collectables market. Blue-chip NFT collections that once commanded premium prices have seen floor prices decline substantially. Projects that were household names during the bull market now struggle to maintain relevance and trading volume. Even historically resilient collections have not been immune to the broader market malaise, with many experiencing 70% to 90% declines from their peak valuations.

The impact extends beyond simple price depreciation. Trading velocity, which measures how frequently NFTs change hands, has slowed dramatically. This reduced liquidity makes it increasingly difficult for holders to exit positions, creating a feedback loop that further discourages new market participants. The combination of falling prices and reduced liquidity has fundamentally altered the risk-reward calculus that previously attracted speculators and collectors to the space.

Factors Driving the Extended Downturn

Multiple converging factors have contributed to the unprecedented decline in NFT sales volumes. The macroeconomic environment has played a significant role, with rising interest rates and inflation concerns causing investors to retreat from speculative assets across all categories. When traditional markets face headwinds, riskier asset classes like digital collectables typically experience amplified selling pressure as capital flows toward safer havens.

Beyond macroeconomic conditions, the NFT market faces challenges unique to its ecosystem. The initial wave of speculation that drove prices to unsustainable levels has given way to a more discriminating market environment. Many collectors who purchased NFTs during the height of the frenzy have realised that their digital assets lack the utility and long-term value proposition they initially anticipated. This disillusionment has led to widespread selling pressure as participants attempt to recover whatever value remains in their portfolios.

The proliferation of low-quality projects has also damaged market sentiment. During the boom period, thousands of new NFT collections launched weekly, with many offering little more than derivative artwork and empty promises of future utility. This oversaturation diluted the market and made it increasingly difficult for genuinely innovative projects to stand out. The subsequent collapse of numerous high-profile collections has eroded trust and made potential buyers significantly more cautious about entering the market.

The Impact on Creators and Artists

The declining NFT marketplace conditions have profound implications for digital artists and creators who initially embraced the technology as a means of monetising their work. During the peak market period, numerous artists reported life-changing sales that provided financial security and validation for their creative efforts. The promise of ongoing royalties from secondary sales offered an appealing model that traditional art markets could not match.

However, the current market reality presents stark challenges for creators attempting to sustain themselves through NFT sales. With drastically reduced buyer interest and lower price points, many artists find it nearly impossible to generate meaningful revenue from new releases. The competitive landscape has become increasingly difficult, with even established creators struggling to attract attention in an oversaturated market filled with declining enthusiasm.

The royalty model that once seemed so promising has also come under pressure. Several major marketplaces have made creator royalties optional or eliminated them entirely in efforts to attract more trading volume by reducing transaction costs. This shift undermines one of the fundamental value propositions that attracted artists to NFTs in the first place, forcing many to reconsider whether the technology truly serves their long-term interests better than traditional channels.

Market Consolidation and Platform Struggles

The prolonged downturn has triggered significant consolidation within the NFT trading platform ecosystem. Smaller marketplaces that gained traction during the bull market have seen traffic and volume evaporate, forcing many to shut down operations or seek acquisition by larger competitors. Even well-funded platforms with significant backing have announced layoffs and pivots as they struggle to maintain operations amid declining revenue.

OpenSea, once the undisputed leader in NFT trading, has faced increasing competition and declining market share. The platform has implemented various initiatives to stem the tide, including fee reductions and new features designed to attract users. However, these efforts have produced mixed results as traders become increasingly price-sensitive and willing to fragment their activity across multiple platforms in search of the best execution.

The competitive dynamics have shifted dramatically from the growth-at-all-costs mentality of the bull market to a focus on sustainability and differentiation. Platforms now emphasise features like gas fee optimisation, advanced trading tools, and curation to attract and retain users. Some marketplaces have pivoted toward serving specific niches such as gaming assets or digital fashion, recognising that broad-based approaches may no longer be viable in the contracted market environment.

Institutional Participation and Future Outlook

Despite the challenging conditions, institutional interest in NFTs has not disappeared entirely, though it has evolved considerably from the speculative fervour of previous years. Major brands and corporations that experimented with NFT launches during the boom are now taking more measured approaches, focusing on genuine utility and community building rather than pure speculation.

Several institutions view the current downturn as an opportunity to build sustainable infrastructure for the long term. Development continues on custody solutions, compliance frameworks, and integration tools designed to make NFTs more accessible to traditional businesses and collectors. These behind-the-scenes efforts may not generate immediate trading volume but could lay the groundwork for future growth when market conditions improve.

The regulatory landscape also continues to evolve, with authorities worldwide grappling with how to classify and oversee NFT transactions. Greater regulatory clarity, while potentially introducing new compliance burdens, could ultimately benefit the market by providing the certainty that institutional participants require. The path forward likely involves a maturation process where the market sheds its speculative excesses and develops more practical applications that deliver genuine value to users.

Technological Innovation Amid Market Turmoil

Paradoxically, the blockchain technology underlying NFTs continues to advance even as market sentiment remains depressed. Developers are building more efficient protocols, exploring new use cases, and addressing the scalability and environmental concerns that plagued earlier implementations. Layer 2 solutions and alternative blockchains are making NFT transactions faster and cheaper, removing some of the barriers that limited mainstream adoption.

Innovation in NFT utility extends beyond simple digital art collecting. Sectors like gaming, music, ticketing, and digital identity are exploring how non-fungible tokens can solve real-world problems and create value beyond speculation. These application-focused approaches may ultimately prove more sustainable than the collectable-centric model that dominated the initial boom, even if they generate less immediate hype and trading volume.

The integration of NFTs with artificial intelligence and virtual reality technologies also presents intriguing possibilities for the future. As the metaverse concept continues to develop, digital assets and provable ownership may play increasingly important roles in virtual economies and social interactions. These long-term trends could provide fundamental support for NFT valuations that has little connection to the speculative dynamics that characterised earlier market cycles.

Conclusion

The NFT winter that has brought monthly sales to their lowest point of 2024 represents a significant inflexion point for the digital collectables market. What began as a revolutionary technology promising to transform digital ownership and creative monetisation has encountered the harsh realities of market cycles, speculation, and the challenge of building sustainable value. The dramatic decline in trading volumes and valuations has shaken confidence and forced all participants to reassess their assumptions about the technology’s potential.

However, viewing this downturn purely through the lens of failure overlooks the important lessons being learned and the foundation being built for whatever comes next. Markets that experience spectacular booms inevitably face corrections that separate genuine innovations from unsustainable hype. The current environment, while challenging for those caught in the downturn, may ultimately prove healthy for the long-term development of practical NFT applications that serve real needs rather than pure speculation.

The future of NFTs likely lies not in replicating the frenzy of 2021 but in developing use cases that integrate seamlessly into digital experiences and solve genuine problems for users. As the market continues to mature, finding this sustainable path forward will determine whether non-fungible tokens become a lasting innovation or a cautionary tale about the dangers of speculative excess. For now, the extended winter continues, testing the resilience and commitment of everyone involved in the ecosystem.

FAQs

Q: What caused NFT sales to drop to their lowest point in 2024?

The decline in NFT sales results from multiple factors, including broader macroeconomic pressures, reduced speculative interest, market oversaturation with low-quality projects, and disillusionment among collectors who realised many NFTs lacked sustainable value. The combination of these elements created a perfect storm that drove trading volumes to yearly lows.

Q: Are NFTs completely dead, or is this just a temporary downturn?

While the current market conditions are challenging, calling NFTs “dead” oversimplifies the situation. The technology continues to evolve, and developers are exploring practical applications beyond speculation. Previous cryptocurrency and technology cycles suggest that markets can recover from severe downturns, though the recovery timeline and ultimate form remain uncertain.

Q: How are NFT creators surviving the current market conditions?

Many creators have diversified their income streams beyond NFT sales, returning to traditional commissions, licensing, and other revenue sources. Some have built loyal communities willing to support their work regardless of market conditions, while others have reduced their focus on NFTs entirely until market sentiment improves.

Q: What happens to the value of the NFTs I purchased during the boom?

Most NFTs purchased during peak market periods have experienced significant value depreciation, with many collections down 70-90% from their highs. However, value depends on the specific collection, its community strength, and any ongoing utility. Some blue-chip collections maintain relative stability while countless others have become essentially worthless.

Q: When might the NFT market recover to previous levels?

Predicting market recoveries is inherently uncertain, but history suggests that technology cycles often take years to work through downturns before finding sustainable growth paths. Any recovery will likely look different from the speculation-driven boom, potentially focusing more on utility and practical applications rather than pure collectable value. Patience and realistic expectations are essential for anyone hoping to see market conditions improve.