The digital revolution has transformed how we perceive ownership, creativity, and investment opportunities. At the forefront of this transformation lies the NFT Mastery Blueprint – a comprehensive strategy that separates successful traders from casual observers. Whether you’re a complete beginner or an experienced investor looking to refine your approach, this NFT Mastery Blueprint provides actionable insights that generate real results.

Non-Fungible Tokens have evolved from experimental digital curiosities to legitimate investment vehicles worth billions. NFT Mastery Blueprint: However, navigating this complex landscape requires more than luck – it demands a systematic approach. Our NFT Mastery Blueprint combines time-tested principles with cutting-edge strategies, ensuring you make informed decisions that protect your capital while maximizing profit potential.

The difference between profitable NFT traders and those who lose money isn’t intelligence or capital – it’s having a proven system. This comprehensive guide reveals 12 battle-tested methods that consistently deliver quick wins, regardless of market conditions.

The Foundation of NFT Success

What Makes NFT Trading Different from Traditional Investments

NFT trading operates on fundamentally different principles than traditional asset classes. Unlike stocks or bonds, NFTs derive value from scarcity, cultural significance, and community engagement rather than corporate performance metrics. This unique value proposition creates opportunities for savvy traders who understand the underlying dynamics.

The blockchain technology powering NFTs ensures authentic ownership and provenance, eliminating counterfeiting concerns that plague traditional collectibles. However, this technological advantage comes with increased complexity, requiring traders to understand smart contracts, gas fees, and various NFT marketplace mechanics.

Successful digital asset investment in the NFT space demands a blend of artistic appreciation, technological understanding, and market psychology. Traditional fundamental analysis proves insufficient when evaluating tokenized assets whose value stems from community sentiment and cultural relevance.

The Psychology Behind NFT Value Creation

Market psychology plays a crucial role in NFT investment success. Unlike traditional assets with intrinsic value, NFTs represent pure speculation based on perceived future demand. Understanding crowd psychology, social media influence, and cultural trends becomes essential for predicting price movements.

The fear of missing out (FOMO) drives many NFT purchases, creating volatile price swings that experienced traders exploit. Conversely, fear, uncertainty, and doubt (FUD) can trigger massive sell-offs, presenting buying opportunities for those following a disciplined NFT Mastery Blueprint.

Community-driven value creation distinguishes successful NFT projects from failures. Projects with engaged communities, clear roadmaps, and utility beyond mere speculation tend to maintain value during market downturns, making them excellent candidates for long-term investment strategies.

The 12 Proven Methods for NFT Success

Method 1: Research-Driven Project Selection

Thorough research forms the cornerstone of any successful NFT trading strategy. Before investing in any project, analyze the team’s background, previous successes, and technical capabilities. Established artists or developers with proven track records significantly reduce investment risk.

Examine the project’s utility beyond speculation. NFTs offering gaming integration, membership benefits, or real-world applications demonstrate stronger value propositions than purely aesthetic pieces. This utility creates sustained demand even during market corrections.

Community engagement metrics provide valuable insights into project longevity. Active Discord servers, Twitter engagement, and holder loyalty indicate strong fundamentals that support price stability and growth potential.

Method 2: Timing Your Market Entry

Market timing significantly impacts NFT investment returns. Monitor broader cryptocurrency market trends, as NFT prices often correlate with major cryptocurrencies like Ethereum. Bull markets in crypto typically drive increased NFT activity and higher prices.

Identify optimal entry points by analyzing trading volume patterns and price action. Low-volume periods often precede significant price movements, creating opportunities for strategic positioning before major announcements or community events.

Seasonal patterns affect NFT markets differently from traditional assets. Holiday periods, major conferences, and cultural events can trigger increased activity in specific categories, allowing prepared traders to capitalize on predictable demand cycles.

Method 3: Portfolio Diversification Strategies

Diversification protects against the extreme volatility inherent in digital art trading. Spread investments across different categories, including profile picture projects, utility tokens, gaming assets, and digital art to minimize risk exposure.

Price point diversification ensures portfolio stability during market fluctuations. Combine high-value blue-chip NFTs with promising mid-tier and emerging projects to balance potential returns with risk management.

Marketplace diversification reduces platform-specific risks. While OpenSea dominates trading volume, emerging platforms like Magic Eden, Foundation, and Rarible offer unique opportunities and reduced competition for quality assets.

Method 4: Community Integration and Networking

Active participation in NFT communities provides invaluable market intelligence and early access to promising projects. Join Discord servers, follow Twitter influencers, and participate in community discussions to stay ahead of market trends.

Building relationships with other collectors, artists, and traders creates opportunities for private sales, collaboration, and insider knowledge. The NFT space rewards active community members with exclusive access and valuable connections.

Contribute value to communities through helpful content, market analysis, or technical expertise. Valuable community members often receive priority access to new projects, whitelist spots, and collaborative opportunities that enhance investment returns.

Method 5: Technical Analysis for NFT Markets

Apply traditional technical analysis principles to NFT marketplace data with modifications for unique market characteristics. Floor price movements, volume patterns, and holder distribution provide insights similar to stock chart analysis.

Support and resistance levels apply to NFT collections just as they do to traditional securities. Identify key price levels where buying or selling interest historically concentrates to optimize entry and exit points.

Volume analysis reveals market sentiment and potential price movements. Increasing volume during price declines often signals capitulation and potential reversal, while decreasing volume during rallies may indicate weakening momentum.

Also, More: PUBG Announces NFT Integration Through This Collaboration

Method 6: Utility-Based Investment Approach

Focus on NFTs offering tangible utility beyond speculation. Gaming assets, membership tokens, and access passes provide ongoing value that supports price floors during market downturns.

Evaluate the long-term viability of proposed utilities. Projects promising future gaming integration or real-world benefits should demonstrate clear development progress and realistic timelines to justify current valuations.

Utility-driven projects often develop secondary markets and revenue streams that benefit holders. Successful gaming NFTs generate ongoing income through gameplay, while membership tokens provide exclusive access to valuable resources and opportunities.

Advanced NFT Mastery Techniques

Method 7: Arbitrage Opportunities

NFT marketplace inefficiencies create profitable arbitrage opportunities for alert traders. Price discrepancies between platforms, delayed market reactions to news, and information asymmetries generate consistent profit potential.

Cross-platform arbitrage involves buying undervalued assets on one marketplace and selling them at higher prices on another. This strategy requires quick execution and understanding of each platform’s fee structures and transfer times.

Temporal arbitrage capitalizes on delayed market reactions to fundamental changes. News announcements, partnership reveals, and technical developments often take time to impact prices across all platforms, creating windows for profitable trading.

Method 8: Minting Strategy Optimization

Strategic minting participation can generate significant returns when executed properly. Research upcoming projects thoroughly, analyzing team credentials, artistic quality, and community-building efforts before mint day.

Whitelist acquisition provides priority access and often reduces minting costs. Contribute to project communities, follow social media requirements, and participate in promotional activities to secure valuable whitelist positions.

Gas fee optimization during minting events requires careful timing and transaction management. Monitor network congestion, set appropriate gas prices, and use tools like Flashbots to improve transaction success rates during high-demand mints.

Method 9: Floor Price Analysis and Prediction

Understanding floor price dynamics enables better buying and selling decisions. Floor prices represent the minimum market value and often serve as support levels during price declines.

Analyze holder distribution to predict floor price stability. Projects with diverse holder bases and strong diamond hands (long-term holders) typically maintain floor prices better than those with concentrated ownership or weak community commitment.

Track floor price movements relative to trading volume and market sentiment. Sustained volume increases during floor price rises often indicate genuine demand growth, while low-volume pumps may signal manipulation or unsustainable momentum.

Method 10: Social Media and Influencer Analysis

Social media sentiment significantly impacts NFT trading outcomes. Monitor Twitter trends, Discord activity, and influencer opinions to gauge market sentiment and identify emerging opportunities before they reach mainstream attention.

Influencer endorsements can dramatically impact NFT prices, but distinguishing genuine enthusiasm from paid promotion requires careful analysis. Investigate influencer investment history, engagement quality, and previous recommendation outcomes.

Develop systems for tracking social media metrics across multiple platforms. Tools for sentiment analysis, mention tracking, and engagement monitoring provide quantitative data to support trading decisions.

Method 11: Long-term Holding Strategies

Diamond hand strategies focus on acquiring and holding high-quality NFTs through market cycles. This approach requires exceptional project selection but can generate superior returns compared to active trading.

Identify projects with strong fundamentals, active development, and growing communities for long-term holds. These characteristics typically indicate sustained value growth and reduced volatility compared to speculative assets.

Develop criteria for holding versus selling decisions. Clear exit strategies prevent emotional decision-making during market euphoria or panic, ensuring disciplined execution of long-term investment plans.

Method 12: Risk Management and Capital Protection

Position sizing prevents catastrophic losses during market downturns. Never invest more than you can afford to lose in individual NFTs, and maintain diversified portfolios to spread risk across multiple assets and categories.

Implement stop-loss strategies adapted for NFT markets. While traditional stop-losses don’t apply directly, establish clear criteria for exiting positions when fundamental factors change or price targets are reached.

Insurance and protection strategies for high-value NFTs include secure wallet management, multi-signature solutions, and comprehensive security practices to prevent theft or loss of valuable digital assets.

Advanced Market Analysis Techniques

Market Cycles and Seasonality: NFT Mastery Blueprint

NFT markets exhibit cyclical behavior influenced by broader cryptocurrency trends, cultural events, and seasonal factors. Bull markets in Bitcoin and Ethereum typically correlate with increased NFT activity and higher valuations across all categories.

Seasonal patterns emerge during holiday periods, back-to-school seasons, and major industry conferences. Understanding these cycles allows strategic positioning ahead of predictable demand increases or decreases.

Market maturity phases affect trading strategies. Early-stage markets reward aggressive speculation, while mature markets favor fundamental analysis and utility-focused investments.

Regulatory Impact Assessment

Evolving regulatory frameworks significantly impact NFT markets. Stay informed about government policies, tax implications, and legal developments that could affect trading profitability and market structure.

Jurisdictional differences create opportunities and risks for international traders. Understanding legal requirements, tax obligations, and compliance issues in different regions enables more informed decision-making.

Regulatory clarity often reduces market volatility and increases institutional participation. Monitor regulatory developments as positive indicators for long-term market growth and stability.

Building Your NFT Investment Portfolio

Asset Allocation Strategies

Effective NFT portfolio construction balances growth potential with risk management. Allocate capital across different risk categories: blue-chip established projects, emerging opportunities, and speculative plays.

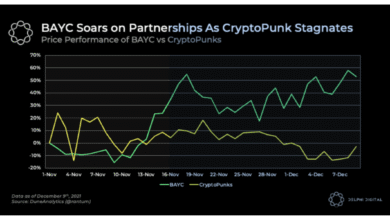

Blue-chip NFTs like CryptoPunks and Bored Ape Yacht Club provide portfolio stability and liquidity. NFT Mastery Blueprint: These established projects often weather market downturns better than newer, unproven collections.

Emerging projects offer higher growth potential but require careful evaluation. NFT Mastery Blueprint: Focus on projects with strong teams, clear utility, and engaged communities to maximize success probability.

Liquidity Management

Maintain adequate liquidity for opportunistic purchases during market downturns. NFT Mastery Blueprint: Cash reserves enable quick action when exceptional opportunities arise during panic selling or forced liquidations.

Stagger selling strategies to optimize exit pricing. NFT Mastery Blueprint : Rather than selling entire positions at once, gradual liquidation during favorable market conditions often achieves better overall returns.

Platform liquidity varies significantly between NFT marketplaces. NFT Mastery Blueprint: Understand each platform’s typical trading volumes and buyer demographics to optimize listing strategies for quick sales when needed.

Conclusion and Next Steps

The NFT Mastery Blueprint provides a comprehensive framework for achieving consistent success in digital asset trading. These 12 proven methods transform random speculation into systematic investment strategies that deliver measurable results.

Success in NFT trading requires dedication, continuous learning, and disciplined execution. The methods outlined in this blueprint have generated profits for countless traders, but their effectiveness depends on consistent application and adaptation to changing market conditions.

Your journey toward NFT investment mastery begins with implementing these proven strategies systematically. NFT Mastery Blueprint: Start with thorough research, build your knowledge base, NFT Mastery Blueprint: and gradually expand your portfolio as your expertise develops.

Ready to transform your NFT trading results? Begin implementing this NFT Mastery Blueprint today by selecting your first research targets and joining relevant communities. NFT Mastery Blueprint: The difference between profitable NFT Mastery Blueprint: NFT traders and unsuccessful ones lies in taking action with proven methods rather than hoping for lucky breaks.