NFTs Evolve Beyond Price Utility & Culture in 2025

NFTs Evolve Beyond Price, moving beyond speculation toward real utility, cultural impact, and community-driven value creation.

The on-fungible token (NFT) landscape underwent a dramatic transformation in 2025, marking a pivotal shift away from speculative price-driven trading toward meaningful applications rooted in utility and cultural significance. After the euphoric highs of 2021 and the subsequent market correction that continued through 2024, the NFT ecosystem matured into something far more substantial than digital collectibles changing hands for eye-watering sums. NFTs Evolve Beyond Price: This evolution represents not a death of the technology, but rather its rebirth as a practical tool for creators, communities, and businesses seeking genuine value creation.

The year 2025 witnessed a fundamental recalibration of what digital assets could represent in our increasingly connected world. While mainstream media narratives often focused on plummeting floor prices and diminished trading volumes, a quieter revolution was taking place beneath the surface. Artists, developers, and entrepreneurs were discovering innovative ways to leverage blockchain technology for access control, community building, intellectual property management, and cultural preservation. This transition from financial speculation to functional implementation signaled the industry’s maturation from its Wild West origins into a more sustainable and purposeful ecosystem.

Understanding this transformation requires examining how various sectors adapted NFT technology to solve real-world problems, how cultural movements embraced digital ownership as a form of identity and belonging, and why this utility-first approach may ultimately prove more valuable than the speculative frenzy that first brought NFTs into public consciousness. The story of NFTs in 2025 is one of resilience, adaptation, and the persistent human desire to create, connect, and claim ownership over the things that matter most to us.

The Decline of Speculation and Market Correction

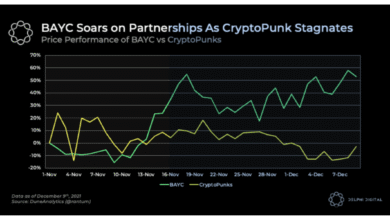

The NFT market experienced a significant contraction throughout 2024 and into 2025, with trading volumes on major marketplaces declining by substantial margins compared to peak periods. High-profile collections that once commanded millions of dollars saw their floor prices stabilize at fractions of previous valuations. This market correction eliminated much of the speculative excess that had characterized the earlier boom years, forcing both creators and collectors to reassess their relationship with digital collectibles.

However, this price decline proved to be a necessary purge rather than a terminal diagnosis. The exodus of short-term speculators and flippers created space for genuine enthusiasts and builders who understood that lasting value would come from functionality rather than hype. Projects that had relied solely on artificial scarcity and celebrity endorsements struggled to maintain relevance, while those offering tangible benefits to holders demonstrated remarkable resilience even as prices softened.

The market’s maturation also brought increased scrutiny to project roadmaps and team credentials. Collectors became more discerning, asking difficult questions about long-term sustainability, actual utility delivery, and the genuine value proposition beyond potential price appreciation. This shift in buyer psychology fundamentally altered how projects positioned themselves, with marketing messages evolving from “investment opportunity” to “community membership” and “access platform.”

Financial institutions and traditional investors also recalibrated their approach to blockchain-based assets during this period. While many withdrew from pure speculation, others recognized the underlying technology’s potential for revolutionizing digital rights management, ticketing systems, and credential verification. This institutional pivot toward utility-focused applications provided validation for the sector’s evolution beyond speculative trading.

Utility Takes Center Stage: NFTs Evolve Beyond Price

As price frenzy subsided, 2025 became the year when utility-driven NFTs finally delivered on long-promised applications. The concept of NFTs as access passes gained significant traction across multiple industries, with event organizers, exclusive clubs, and educational institutions implementing token-gated systems that provided holders with verifiable entry rights and membership benefits.

The music industry emerged as a particularly innovative adopter of NFT utility. Artists began issuing tokens that granted holders access to exclusive listening parties, meet-and-greet opportunities, and even revenue sharing from streaming royalties. These music NFTs transformed the artist-fan relationship by creating direct connections that bypassed traditional intermediaries while providing musicians with new revenue streams and fans with unprecedented access to their favorite creators.

Gaming continued its integration of NFT technology, though with a more sophisticated approach than earlier play-to-earn models that had often devolved into unsustainable Ponzi-like structures. Developers focused instead on creating genuine gaming experiences where digital assets enhanced gameplay rather than serving as primary motivators. In-game items, character customization options, and cross-platform asset portability became realistic features rather than empty promises, demonstrating how blockchain could enhance rather than exploit gaming communities.

The real estate sector experimented with tokenized property fractional ownership, allowing investors to hold verifiable stakes in physical assets through digital tokens. While regulatory frameworks remained complex, these applications showcased blockchain’s potential for democratizing access to traditionally illiquid assets. Similarly, educational credentials and professional certifications began migrating to NFT formats, providing tamper-proof verification systems that simplified background checks and credential validation.

Cultural Significance and Community Building

Beyond functional applications, 2025 witnessed NFTs becoming important vehicles for cultural expression and community formation. Digital art communities that had initially formed around collection ownership evolved into sophisticated cultural movements with shared values, collaborative projects, and genuine social bonds extending far beyond token ownership.

Profile picture collections that had dominated the 2021 boom found new purpose as identity signifiers within digital spaces. Rather than status symbols primarily denoting wealth, these digital identities became markers of community membership and shared interests. Holders of particular collections could access exclusive Discord servers, attend real-world events, and participate in collaborative decision-making about collection development and community initiatives.

Cultural preservation emerged as an unexpected but meaningful application of NFT technology. Indigenous communities, historians, and cultural organizations began using blockchain to create immutable records of traditional knowledge, historical artifacts, and cultural practices. These initiatives transformed NFTs from speculative assets into tools for safeguarding cultural heritage against loss and appropriation, with smart contracts ensuring that creators and communities retained control over how their cultural expressions were used and shared.

The intersection of NFTs and social impact gained momentum as charitable organizations discovered blockchain’s potential for transparent fundraising and donor engagement. Tokens representing contributions to specific causes provided donors with verifiable proof of their support while creating communities united around shared philanthropic goals. This application demonstrated how digital ownership could foster collective action rather than individual accumulation.

Artists Reclaim Control Through Direct Distribution

The artist community experienced perhaps the most meaningful transformation in their relationship with NFT technology during 2025. As speculative collectors retreated, creators found opportunities to establish direct relationships with genuine supporters who valued their work beyond potential resale value. This shift enabled digital artists to build sustainable practices based on patron models rather than lottery-like marketplace flips.

Many artists pivoted from open editions and generative drops toward more curated releases with built-in utility for collectors. These might include access to future works, participation in creative decisions, or exclusive content unavailable elsewhere. By emphasizing the relationship between creator and collector rather than treating NFTs as tradable commodities, artists cultivated dedicated supporter bases willing to engage with their work over extended periods.

The development of more sophisticated smart contract functionality allowed artists to embed complex rights management into their tokens. Collectors could receive specific usage rights—perhaps for commercial applications or reproduction—while artists retained other aspects of copyright. This granular control over intellectual property proved particularly valuable for photographers, illustrators, and designers whose work had commercial applications beyond pure collection.

Traditional art institutions also began acknowledging NFTs as legitimate artistic expressions worthy of museum exhibition and critical analysis. Major galleries held exhibitions featuring digital works, while art schools incorporated blockchain technology into their curricula. This institutional recognition helped legitimize digital creation as an artistic medium while providing emerging artists with new pathways for professional development and recognition.

Brand Integration and Corporate Adoption

Corporate adoption of NFT technology matured significantly in 2025 as brands moved beyond experimental launches toward integrated strategies that connected digital tokens with customer loyalty programs, product authentication, and experiential marketing. Rather than treating NFTs as standalone marketing stunts, forward-thinking companies embedded them into broader customer engagement strategies.

Luxury brands implemented NFTs as certificates of authenticity for high-value goods, creating immutable provenance records that helped combat counterfeiting while providing buyers with transferable proof of ownership. These authentication systems added tangible value to purchases while familiarizing mainstream consumers with blockchain technology through practical applications they could immediately understand and appreciate.

Retail loyalty programs began incorporating tokenized rewards that customers could accumulate, trade, or redeem for exclusive products and experiences. Unlike traditional points systems locked within proprietary platforms, these blockchain-based programs offered portability and transparency that enhanced their perceived value. Customers appreciated the flexibility of managing their rewards across wallets and platforms, while brands benefited from increased engagement and data about customer preferences.

Entertainment franchises discovered NFTs provided compelling ways to deepen fan engagement through limited digital merchandise, virtual experiences, and interactive storytelling elements. Rather than replacing physical collectibles, digital tokens complemented traditional merchandise by offering additional layers of engagement and community participation. Fans could demonstrate their dedication through collection building while accessing exclusive content and experiences unavailable to casual audiences.

Technical Infrastructure Improvements

The blockchain infrastructure supporting NFTs underwent significant improvements during 2025, addressing many of the scalability, environmental, and usability concerns that had hindered broader adoption. Layer-two solutions and more energy-efficient consensus mechanisms became standard, dramatically reducing transaction costs and carbon footprints associated with minting and trading digital assets.

User experience improvements made interacting with NFTs more accessible to non-technical audiences. Wallet interfaces simplified, onboarding processes streamlined, and custodial solutions provided options for users uncomfortable managing private keys. These developments removed significant friction points that had previously limited NFT adoption to crypto-native audiences comfortable with technical complexity.

Interoperability standards gained traction, enabling digital assets to move more freely between platforms and ecosystems. Collections minted on one blockchain could be bridged to others, while metadata standards ensured consistent representation across different marketplaces and applications. This increased fluidity enhanced utility by preventing assets from becoming trapped within isolated ecosystems.

Security enhancements addressed many of the scams and exploits that had plagued earlier NFT markets. Improved wallet security, better marketplace verification systems, and enhanced smart contract auditing practices helped protect users from malicious actors. While risks remained, the overall security posture of the NFT ecosystem improved substantially, building trust among both individual collectors and institutional participants.

The Evolution of Digital Ownership Philosophy

Perhaps most significantly, 2025 marked a philosophical evolution in how participants understood digital ownership. The initial framing of NFTs as investments or speculative assets gave way to more nuanced perspectives recognizing multiple forms of value beyond monetary price. Collectors increasingly spoke about emotional connections to works, community belonging, and supporting creators they admired as primary motivations for acquisition.

This shift reflected broader cultural conversations about the role of ownership in digital spaces. As more of our lives migrated online, the desire for meaningful digital possessions that reflected our identities and values intensified. NFTs provided a mechanism for expressing these desires, even as the specific implementations continued evolving toward greater utility and sustainability.

The concept of digital scarcity itself underwent reconsideration. Rather than artificial limitations designed to drive up prices, thoughtful creators implemented scarcity in service of community management and meaningful collector experiences. Limited editions became tools for ensuring intimate community sizes rather than pure value drivers, with the focus shifting toward what ownership enabled rather than what it cost.

Educational efforts around blockchain technology improved dramatically, helping broader audiences understand both the capabilities and limitations of NFT systems. This increased literacy reduced susceptibility to scams while enabling more informed decision-making about which projects offered genuine value versus hollow promises. As understanding deepened, expectations became more realistic and aligned with what technology could practically deliver.

Conclusion

The transformation of NFTs from speculative assets to utility-driven tools and cultural artifacts represents a natural maturation process for emerging technology. While 2025’s price declines disappointed those hoping for continued financial appreciation, they enabled the development of more sustainable models based on actual value creation rather than greater fool theory. The projects and creators that survived this transition emerged stronger, with clearer value propositions and more engaged communities.

This evolution demonstrates that meaningful technology adoption rarely follows straight trajectories. The path from initial hype through disillusionment toward productive implementation characterizes most transformative innovations. For NFTs, this journey led away from auction houses and speculative trading toward practical applications in access control, digital rights management, community formation, and cultural preservation.

Looking forward, the utility-first approach established in 2025 provides a foundation for continued growth and innovation. As technical infrastructure improves, use cases multiply, and understanding deepens, NFT technology will likely become increasingly invisible—embedded within systems we use daily rather than standalone phenomena requiring specialized knowledge. The true success of this technology will be measured not by trading volumes or floor prices, but by how effectively it enables creators to connect with audiences, communities to organize around shared interests, and individuals to express their digital identities in meaningful ways.

FAQs

Q: What caused NFT prices to decline in 2025?

NFT prices declined primarily due to market correction following unsustainable speculation in previous years. As short-term investors exited the market and broader cryptocurrency valuations decreased, NFT trading volumes and floor prices contracted significantly. This correction eliminated projects lacking fundamental value while allowing utility-focused applications to develop more sustainable models based on actual user demand rather than speculative investment.

Q: How do utility NFTs differ from traditional collectible NFTs?

Utility NFTs provide tangible benefits beyond digital ownership, such as access to exclusive events, membership in communities, voting rights in governance decisions, or discounts on products and services. Traditional collectible NFTs primarily offered aesthetic value and potential resale opportunities. The shift toward utility emphasizes ongoing benefits from holding tokens rather than one-time acquisition and speculation on price appreciation.

Q: Are NFTs still a good investment in 2025?

Approaching NFTs primarily as financial investments remains highly speculative and risky. However, acquiring NFTs for their utility, community access, or personal enjoyment can provide value independent of price appreciation. Collectors should focus on projects offering tangible benefits they actually want to use rather than hoping for resale profits. As with any emerging technology, only invest amounts you can afford to lose entirely.

Q: How are artists benefiting from NFTs despite lower prices?

Artists benefit from direct relationships with collectors, ongoing royalties from secondary sales, and reduced dependence on traditional intermediaries like galleries and publishers. Lower prices actually help some creators by making their work more accessible to genuine fans rather than wealthy speculators. Many artists have built sustainable practices around dedicated supporter communities willing to purchase work because they value the creative output rather than potential investment returns.

Q: What industries are successfully implementing NFT technology?

Music, gaming, event ticketing, luxury goods authentication, education credential verification, and digital art communities have all implemented successful NFT applications. These industries benefit from blockchain’s ability to verify ownership, manage access rights, and create transparent transaction records. Success comes from focusing on solving real problems rather than simply adding blockchain because it’s trendy, with the technology serving genuine user needs.