The Non-Fungible Token (NFT) market has exploded into a multi-billion dollar ecosystem, attracting millions of investors NFT Mistakes That Obliterate: worldwide seeking lucrative opportunities in digital assets. However, NFT Mistakes That Obliterate: beneath the surface of astronomical sales figures and celebrity endorsements lies a treacherous landscape filled with pitfalls that can devastate even the most promising NFT portfolios.

Since the NFT boom began in 2021, countless investors have watched their digital collections plummet in value, often losing 90% or more of their initial investments. NFT Mistakes That Obliterate: NFT Mistakes That Obliterate: The harsh reality is that for every success story of someone making millions from NFT trading, there are thousands of cautionary tales of investors who made critical errors that obliterated their portfolio value.

These NFT investment mistakes are crucial for anyone serious about building a sustainable and profitable digital asset portfolio. NFT Mistakes That Obliterate: The difference between success and failure in the NFT marketplace often comes down to avoiding fundamental errors that experienced collectors have learned through expensive trial and error.

This comprehensive guide reveals the eight most devastating NFT mistakes that insider traders and seasoned collectors have identified as portfolio killers. NFT Mistakes That Obliterate: By understanding these critical errors and implementing the protective strategies outlined in this article, you can safeguard your investments and position yourself for long-term success in the volatile world of digital collectibles.

NFT Mistakes That Obliterate: Whether you’re a newcomer to the NFT space or an experienced trader looking to refine your strategy, NFT Mistakes That Obliterate: this insider knowledge will help you navigate the complex landscape of blockchain-based assets while avoiding the costly pitfalls that have claimed countless portfolios before yours.

1. FOMO-Driven Purchasing Without Proper Research

The Rush to Buy: When Emotions Override Logic

Fear of Missing Out (FOMO) represents one of the most destructive forces in NFT investing. When collectors see rapid price increases or celebrity endorsements, the psychological pressure to act quickly often overrides rational decision-making processes. This emotional trading behavior has led to more portfolio destruction than any other single factor in the NFT market.

The mechanics of FOMO-driven purchases typically follow a predictable pattern. Investors notice a particular NFT collection gaining traction on social media platforms, NFT Mistakes That Obliterate: see influencers promoting specific projects, NFT Mistakes That Obliterate: or observe sudden price spikes in secondary markets. NFT Mistakes That Obliterate: The fear that prices will continue rising indefinitely creates an urgency that bypasses thorough research and due diligence.

Research Fundamentals That Prevent Costly Mistakes

Successful NFT collectors understand that proper research forms the foundation of profitable investments. Before purchasing any digital asset, investors should examine the project’s roadmap, team credentials, community engagement, and long-term utility prospects. Smart contract audits, partnership announcements, and tokenomics structures provide crucial insights into a project’s sustainability.

The most valuable NFT projects typically demonstrate clear utility beyond speculative trading. Whether through gaming integration, membership benefits, or intellectual property rights, sustainable collections offer holders tangible value propositions that extend beyond market speculation. Projects lacking these fundamental characteristics often experience dramatic value collapses when initial hype subsides.

Building Systematic Evaluation Processes

Professional NFT traders employ systematic evaluation frameworks that remove emotional decision-making from their investment process. These frameworks include technical analysis of trading volumes, holder distribution patterns, and historical price movements. Additionally, fundamental analysis examines team backgrounds, development progress, and competitive positioning within specific NFT categories.

2. Ignoring Market Cycles and Timing

NFT Market Dynamics

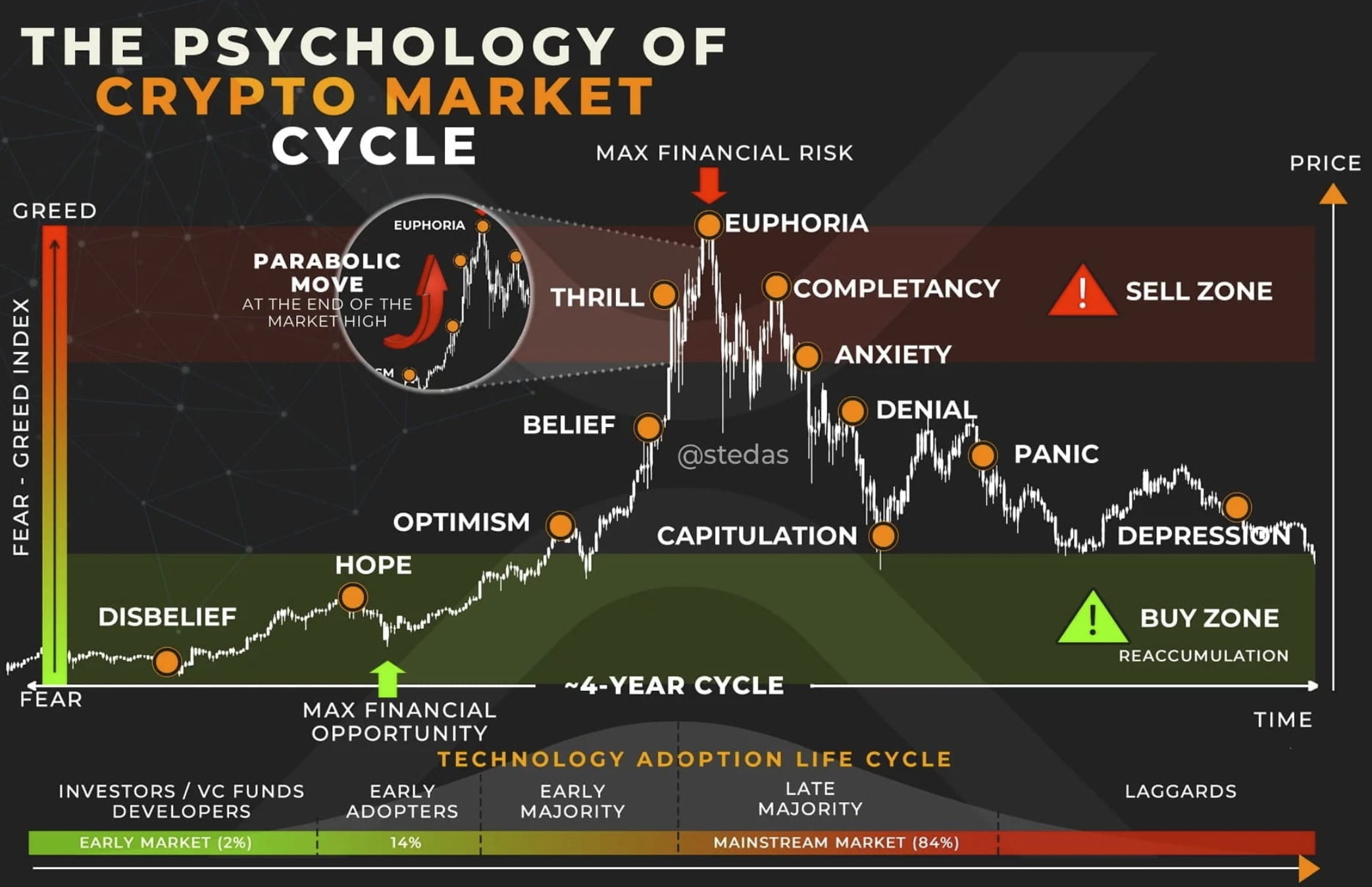

The NFT marketplace operates within distinct cycles that mirror broader cryptocurrency market patterns while maintaining unique characteristics specific to digital collectibles. These cycles typically include accumulation phases, NFT Mistakes That Obliterate: where smart money quietly builds positions, followed by expansion periods characterized by increased mainstream attention and price appreciation.

Market timing in the NFT space requires understanding both macroeconomic factors and sector-specific trends. Successful investors recognize that NFT prices often correlate with cryptocurrency market performance, particularly Ethereum prices, since most NFT transactions occur on the Ethereum blockchain. However, the NFT market also responds to unique catalysts, NFT Mistakes That Obliterate: including celebrity involvement, mainstream media coverage, and technological developments.

Seasonal Patterns and Cyclical Trends

Historical data reveals distinct seasonal patterns within NFT markets. Holiday periods often see increased activity as collectors seek unique gifts, while summer months typically experience reduced trading volumes. NFT Mistakes That Obliterate: Understanding these patterns helps investors optimize entry and exit timing for maximum portfolio value preservation.

The most destructive NFT mistakes often occur during peak market euphoria when prices reach unsustainable levels. Investors who purchase blue-chip NFTs or emerging collections at cycle tops frequently experience significant portfolio value destruction as markets inevitably correct. NFT Mistakes That Obliterate: Conversely, disciplined buyers who accumulate during market downturns often achieve superior long-term returns.

Strategic Entry and Exit Planning

Professional NFT investors develop predetermined entry and exit criteria that remove emotional decision-making from their trading strategy. These plans include specific price targets, portfolio allocation limits, and risk management protocols that prevent any single investment from causing catastrophic portfolio damage.

3. Neglecting to Diversify Across Collections and Categories

The Concentration Risk Trap

Portfolio diversification represents a fundamental principle of investment management that applies equally to traditional assets and NFT collections. NFT Mistakes That Obliterate: However, many investors concentrate their holdings in single projects or narrow categories, creating unnecessary concentration risk that can obliterate portfolio value when specific sectors decline.

The NFT ecosystem encompasses numerous categories, including profile picture (PFP) projects, gaming assets, virtual real estate, digital art, and utility tokens. Each category responds differently to market conditions, technological developments, and cultural trends. Investors who diversify across multiple categories reduce their exposure to sector-specific risks while maintaining upside potential across the broader NFT landscape.

Strategic Category Allocation

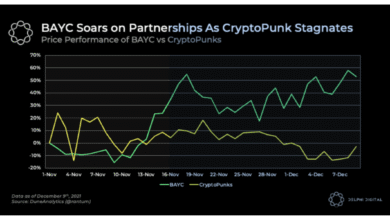

Sophisticated NFT portfolios typically allocate holdings across established categories while maintaining exposure to emerging sectors. Blue-chip collections like CryptoPunks and Bored Ape Yacht Club provide stability and liquidity, while newer projects offer growth potential at higher risk levels. Gaming NFTs and metaverse assets represent rapidly evolving sectors with significant long-term potential despite current volatility.

The most successful NFT collectors maintain dynamic allocation strategies that adapt to changing market conditions and emerging opportunities. This approach requires continuous monitoring of sector performance, technological developments, and cultural shifts that influence digital collectible demand patterns.

Geographic and Platform Diversification

Advanced NFT investment strategies extend beyond category diversification to include geographic and platform considerations. Different regions exhibit varying preferences for NFT styles and categories, while multiple blockchain platforms host distinct ecosystems with unique characteristics and user bases.

Ethereum-based NFTs dominate current market capitalization, but emerging platforms like Solana, Polygon, and Cardano host growing ecosystems with lower transaction costs and innovative features. Diversifying across platforms reduces dependence on any single blockchain while providing exposure to emerging technological developments.

4. Falling for Pump and Dump Schemes

Recognizing Artificial Price Manipulation

Pump and dump schemes represent one of the most insidious threats to NFT portfolio value, particularly affecting inexperienced collectors who lack the knowledge to identify artificial price manipulation. These schemes typically involve coordinated efforts to artificially inflate NFT prices through false social media promotion, fake trading volume, and misleading influencer endorsements.

The anatomy of NFT pump and dump schemes follows predictable patterns that informed investors can recognize and avoid. Initial phases involve creating artificial scarcity through limited minting or exclusive access claims. Promoters then generate artificial excitement through coordinated social media campaigns, often featuring paid influencers and fake testimonials from supposed early investors.

Also, More: 10 Ultimate Ethereum Mistakes Costing Investors Millions

Warning Signs of Fraudulent Projects

Professional NFT traders identify potential scams by examining several key indicators that distinguish legitimate projects from fraudulent schemes. Anonymous teams with no verifiable credentials represent major red flags, particularly when combined with unrealistic promises about future returns or utility. Legitimate projects typically feature transparent team information, clear development roadmaps, and realistic value propositions.

Social media manipulation represents another common characteristic of pump and dump schemes. Organic community growth typically occurs gradually over time, while artificial promotion creates sudden spikes in follower counts, engagement rates, and social media mentions. Sophisticated investors examine engagement quality, account authenticity, and historical activity patterns to identify genuine community interest.

Protecting Against Manipulation Tactics

The most effective defense against pump and dump schemes involves developing systematic due diligence processes that examine all aspects of NFT projects before investment. This includes technical analysis of smart contracts, fundamental analysis of team credentials and project viability, and social analysis of community authenticity and engagement patterns.

Risk management protocols should include position sizing limits that prevent any single investment from causing catastrophic portfolio damage. Even experienced investors occasionally encounter sophisticated scams that initially appear legitimate, making proper risk management essential for long-term portfolio preservation.

5. Overpaying for Hyped Projects Without Utility

The Hype Cycle Phenomenon

NFT hype cycles create dangerous investment environments where prices become completely disconnected from underlying value or utility. During peak hype phases, digital collectibles often trade at multiples of their reasonable valuation based purely on social media buzz, celebrity endorsements, or speculative momentum rather than fundamental value propositions.

The psychology behind hype-driven investing stems from social proof mechanisms and the fear of missing exceptional returns. When investors observe others apparently profiting from NFT investments, the desire to participate often overrides rational analysis of project fundamentals, long-term viability, and sustainable value creation mechanisms.

Evaluating True Utility and Long-term Value

Sustainable NFT projects demonstrate clear utility propositions that extend beyond speculative trading activity. Gaming NFTs provide in-game functionality, membership tokens offer access to exclusive communities or services, and intellectual property NFTs grant licensing or revenue-sharing rights. Projects lacking these fundamental utility characteristics typically experience dramatic value collapses when initial speculation subsides.

The most valuable NFT collections create ongoing value for holders through continuous development, community building, and utility expansion. Roadmap execution, partnership development, and holder benefits provide measurable indicators of project quality that transcend temporary market sentiment or social media promotion.

Fundamental Analysis Frameworks

Professional NFT investors employ systematic analysis frameworks that evaluate projects based on quantifiable metrics rather than subjective hype indicators. These frameworks examine team experience and credentials, technological innovation and implementation quality, community engagement and retention rates, and competitive positioning within relevant market segments.

Financial analysis of NFT projects includes examining revenue models, token economics, and sustainability mechanisms that support long-term value creation. Projects with clear monetization strategies and sustainable economic models typically outperform those relying purely on speculative trading activity for value creation.

6. Inadequate Security Measures and Wallet Management

The Critical Importance of Digital Asset Security

NFT security represents a fundamental aspect of portfolio preservation that many investors overlook until they experience costly security breaches. The irreversible nature of blockchain transactions means that stolen or compromised NFTs cannot be recovered through traditional dispute resolution mechanisms, making preventive security measures essential for serious collectors.

The most common NFT security vulnerabilities involve inadequate wallet management practices, including using exchange-hosted wallets for long-term storage, failing to implement multi-signature security, and connecting wallets to malicious smart contracts. These vulnerabilities expose investors to various attack vectors, including phishing attempts, malicious contract interactions, and social engineering schemes.

Hardware Wallet Implementation

Hardware wallets represent the gold standard for NFT security, providing offline storage that isolates private keys from internet-connected devices. Leading hardware wallet manufacturers offer NFT-compatible solutions that support major blockchain platforms while maintaining the highest security standards for digital asset protection.

The implementation of proper wallet security extends beyond hardware selection to include backup procedures, recovery phrase management, and operational security practices. Professional collectors typically employ multi-wallet strategies that separate trading activities from long-term holdings, reducing exposure to daily transaction risks while maintaining operational flexibility.

Smart Contract Interaction Safety: NFT Mistakes That Obliterate

Smart contract interactions represent significant risk vectors in NFT trading and collecting activities. Malicious contracts can drain wallets, steal valuable assets, or compromise future transactions through various attack mechanisms. Sophisticated investors implement systematic contract verification procedures before approving any blockchain interactions.

Security protocols should include using reputable platforms for NFT trading, verifying contract addresses before transactions, and implementing transaction approval limits that prevent catastrophic losses from single interactions. Regular security audits of wallet connections and approved contracts help maintain ongoing protection against evolving threats.

7. Emotional Trading and Panic Selling During Downturns

The Psychology of Market Downturns

Emotional trading destroys more NFT portfolios than any technical analysis error or fundamental miscalculation. When markets decline sharply, the psychological pressure to cut losses often overrides rational decision-making processes, leading investors to sell valuable assets at significant discounts to their long-term fair value.

The mechanics of panic selling typically follow predictable patterns during NFT market downturns. Initial price declines create anxiety about further losses, leading to increased selling pressure that accelerates price declines. This creates negative feedback loops where falling prices trigger more selling activity, ultimately causing temporary price collapses that provide exceptional buying opportunities for disciplined investors.

Building Emotional Discipline

Successful NFT collectors develop emotional discipline through systematic approaches that remove subjective decision-making from portfolio management activities. This includes predetermined exit criteria based on objective metrics rather than emotional responses, regular portfolio reviews that focus on long-term objectives, and risk management protocols that prevent catastrophic losses.

Market downturns often provide the best accumulation opportunities for high-quality NFT collections, as temporary selling pressure creates pricing inefficiencies that disciplined buyers can exploit. The most successful investors develop contrarian approaches that involve increasing allocation to quality assets during periods of maximum pessimism.

Systematic Decision-Making Frameworks

Professional NFT traders employ systematic frameworks that evaluate investment decisions based on objective criteria rather than emotional responses to market volatility. These frameworks include technical analysis tools, fundamental evaluation metrics, and risk-adjusted return calculations that provide rational bases for portfolio decisions.

Portfolio management systems should include automatic rebalancing mechanisms that maintain target allocations regardless of market conditions, dollar-cost averaging strategies that reduce timing risk, and cash flow management that ensures sufficient liquidity for strategic opportunities during market downturns.

8. Neglecting Tax Implications and Record Keeping

NFT Tax Obligations

NFT taxation represents a complex and evolving area of law that many collectors neglect until facing significant compliance issues or audit inquiries. The tax implications of NFT trading activities vary considerably based on jurisdiction, transaction types, and holding periods, making proper record-keeping and professional guidance essential for serious investors.

Capital gains treatment applies to most NFT transactions, with short-term and long-term rates depending on holding periods. However, NFT Mistakes That Obliterate: active traders may face ordinary income treatment on their activities, while creators selling original works encounter different tax implications entirely. NFT Mistakes That Obliterate: The complexity of these rules necessitates careful planning and documentation throughout all NFT investment activities.

Comprehensive Record-Keeping Systems

Professional NFT collectors maintain detailed records of all transactions, including purchase dates, sale prices, transaction fees, and market values at various points in time. This documentation proves essential for accurate tax reporting, portfolio performance analysis, and potential audit defense.

Blockchain transaction records provide immutable documentation of NFT activities, but translating this technical information into tax-compliant formats requires specialized knowledge and tools. NFT Mistakes That Obliterate: Many investors employ cryptocurrency tax software or professional services to ensure accurate reporting and compliance with evolving regulatory requirements.

Strategic Tax Planning

Advanced NFT tax strategies include timing transaction recognition to optimize tax efficiency, utilizing tax-loss harvesting to offset gains with losses, and structuring holdings to qualify for favorable long-term capital gains treatment. NFT Mistakes That Obliterate: These strategies require careful planning and professional guidance, but can significantly impact after-tax portfolio returns.

International tax considerations affect investors operating across multiple jurisdictions or investing in NFTs on foreign platforms. NFT Mistakes That Obliterate: The complexity of cross-border digital asset taxation makes professional guidance particularly valuable for serious collectors with significant holdings or active trading strategies.

Conclusion

The NFT marketplace continues evolving at breakneck speed, presenting both extraordinary opportunities and significant risks for digital asset collectors. Understanding and avoiding these eight critical NFT mistakes provides the foundation for building resilient portfolios that can weather market volatility while capturing long-term value creation opportunities.

NFT Mistakes That Obliterate: Success in NFT investing requires combining emotional discipline with systematic analysis, diversification strategies with selective focus, and risk management with growth-oriented thinking. NFT Mistakes That Obliterate: The investors who master these balance points while avoiding common pitfalls position themselves for NFT Mistakes That Obliterate sustainable success in this revolutionary new asset class.

NFT Mistakes That Obliterate future of digital collectibles remains bright for those who approach the market with proper knowledge, systematic processes, and disciplined execution. NFT Mistakes That Obliterate:By learning from the costly mistakes of others and implementing the protective strategies outlined in this guide, you can build an NFT portfolio NFT Mistakes That Obliterate: that thrives regardless of market conditions while avoiding the devastating errors that obliterate value for unprepared investors.