Crypto traders should read these 7 recommendations and blunders.

If you try to swim against the current, you might get swept away. It is best to learn from other people’s mistakes if you want to get better at trading and understand the market better. The next article was written by someone with a lot of experience in the crypto field and who has traded thousands of cryptos over the past few years. Mistakes were made along the way, of course. Should we start?

The order book: How to give proper orders

Let’s talk about how to use the order book right. The value of a coin is determined by the last transaction that took place, where buyers and sellers meet, or by the forces of supply and demand. These orders for supply and demand are written in a table that is called the order book. Everything in crypto is about how volatile it is.

So, when you enter a position, you should set the sell level to take profits. This is in line with the other tips we’ve given in our article about crypto trading. Or, you could set a stop loss to limit losses while trying to make it at the same time. But how will we know where these commands need to go? First, we look at the graph at its most basic level to find both areas of resistance and areas of support. An article for beginners on technical analysis will help with this task.

We figure out where we want to make money (resistance levels) and where we want to buy (support levels) at the same time. By looking at the order book, we can figure out the best levels at which to place these orders. Keep in mind that if support levels break, it’s time to get out of the trade.

To figure out where to sell to make a profit, we use the order book to find the areas of resistance we’ve already looked at. It’s likely that, since these spots are resistant, there is a lot of supply (a “wall” of sell orders) around them. The trick is to put our sell orders in exactly one step ahead of time, at a slightly lower price, so that if demand starts to eat away at the supply wall, our order has already been put in and sold, making us money.

Read More: How to Invest in Bitcoin?

Finding stop loss levels to limit losses: In the order book, we mark the points of support that we have already looked at and analysed. It’s likely that there is a “wall” of buyers around those spots, as there is a lot of demand for them. This is the best place to put the stop loss command, though it should be a little lower than the high demand zone. They will only get to our command if the sellers are able to lower the price and the “wall” of buyers breaks. The “wall” of buyers protects our command in a way.

Is it possible to put in both a “take profit” and a “stop loss” order at the same time? As of the time this was written, most trading exchanges, with the exception of leveraged trading exchanges like BitMEX, do not allow you to place both commands at the same time.

In a perfect world, we could have set both a stop loss for trades and levels for taking profits. This would have made it less likely that we would lose a lot of money. We will have to make do with what we have until that happens. I usually set a take profit level for part of the position and a stop loss level for the rest.

Graph analysis: Bitcoin, altcoins, and the dollar

The most USD is traded in exchange for major altcoins. So, the best way to look at the graphs of these Altcoins is to compare them to the graphs of Bitcoin and the dollar value. We make sure to do that for our weekly market reports on CryptoPotato. If we only looked at the Bitcoin price chart, we would miss the time when Ethereum grew by about $300 (remember how $300 worth of Bitcoin grew in 2015?). At the time of writing, one Ether is worth more than $1000, which is a month after it was first bought.

I’m aiming for your emotions

Rule number one in trading is that you should never let your feelings get in the way. This is a basic rule for anyone who trades, no matter how long they do it for. It is especially important for short-term traders. Suppose you bought Bitcoin using the DCA strategy: Let’s say that in three days, the price of Bitcoin fell by 40%. What’s next? DCA says that it’s clear that it’s time to buy a second piece of the coin and average the initial trading entry price. But almost everyone I know got “cold feet” at the “terrifying” moment when the price went down and didn’t buy the second share. Why does it keep happening? One word: feeling. Fear of loss, in this case, is an emotion that affects us and throws off our plans. If you are one of the majority of people who won’t buy the second share in the example above, you should think about your future as a trader, especially a crypto trader. It’s also important to get over your feelings after a bad trade or when you sell a coin that goes up in value right after you sell it (FOMO). To sum up, don’t feel bad about the money you lost or the trades you didn’t win. Set a plan of action and goals for yourselves, and then act as if you were a computer that had already been programmed. People are not logical creatures.

Recommendation for such a plan: close out half of your position after putting in target sell commands and if the coin has reached its first goal. In the meantime, raise the stop loss to the level where you started, so you won’t lose anything. At the second target level, you should close out an extra quarter of the position. Now, it’s likely that you’ll stay in the position with a quarter of the money, or just the profits, once you’ve brought the money from the fund “home.” At this point, the game of making money can go on forever. There are a lot of coins in the crypto world that go up by 2,000% in two weeks. When you only play your winnings, you’re on the safe side and it’s much easier.

What goes down does not always go back up.

Another common mistake is to look for crashed coins based on their value compared to the Bitcoin in the hopes that they will go back to their glory prices. So, here’s a news flash: some coins are light years away from their high points. Take Aurora as an example. In March 2014, 0.14 Bitcoin was the most ever paid for one Aurora. At the time this was written, Aurora was trading at a discount of 99.9%, or 0.00014 Bitcoins. Could the (damned) Aurora go up by 1000 times? You won’t find out. You can’t just assume that a coin’s price being lower than its high point is an opportunity. There are also coins that went missing and slowly stopped being traded. This is definitely a situation to think about (especially with the low-cap and volume altcoins).

Time is money

In terms of events and things that happen, a week on the crypto market is like three months on a traditional stock exchange. If you want to dive right into crypto trading, you have to keep up with it not just every day, but every hour. This game can’t be played by everyone. Still, you should think about how much time the process will take. Sometimes it’s better to invest for the long term than to trade every day. Also, just because you are a daily trader doesn’t mean you have to buy, sell, and trade every single day. The destination of a trade can be reached in minutes or in months. Think about how much time you are willing to spend studying the market and keeping an eye on it. Don’t forget that your time has a marginal cost, or, in other words, a price tag. If you want to trade every day, it’s best to start with small amounts and see how they do before putting in more money. This is another benefit of crypto: the ability to trade on small amounts of money. On the stock market, if you were interested in Apple stock, you would have to buy a minimum share worth a few thousand dollars. In crypto, you can make transactions for as little as a few cents.

Read More:The FBI advises DeFi investors to do this.

First mistake: I bought Ripple because its price is low compared to that of Ethereum.

Beginners often make the mistake of looking at the price of the coin instead of the market cap. Altcoins are judged by their market capitalization, which is found by multiplying the number of shares by the price of a single share. This is the same way that companies are judged. The price of a coin times the number of coins in circulation. For a low-priced coin like Ripple, the only thing that makes people buy it is how it makes them feel. It doesn’t matter if one Ripple is worth one dollar and there are a billion of them or if one Ripple is worth a thousand dollars and there are a million of them. So, from now on, when you’re looking at coins to invest in on CoinMarketCap, pay more attention to the market cap and less to the price of a single coin.

Don’t put all your eggs in one basket, which is the second mistake:

Crypto is very hard to predict. The section still stands and will continue to get dozens of billions of dollars wiped out, even though it is making profits of hundreds of percent. Altcoins usually go through the same thing when Bitcoin loses value against the US dollar. Simple math shows that holding some of the portfolio in Altcoins like Ethereum and Litecoin is usually not enough to keep a Bitcoin dump from wiping out a big chunk of the USD value of the portfolio.

In 2015 and the beginning of 2016, when Bitcoin was as stable as Bitcoin can be, moving around $300 per BTC, the game was to trade Altcoins to get more Bitcoin. People thought that Bitcoin would go up in value in the future (the Pygmalion effect). Having a base asset like Bitcoin that changes a lot in value makes it more important to compare our portfolio’s performance in terms of both its Bitcoin value and its dollar value. In the past year, many traders have cut back on the amount of Bitcoin they hold (hey, it wasn’t hard when Ethereum dropped 70% from its Bitcoin all-time high…), even though it had a good dollar yield. The crypto market made a lot of money from Bitcoin’s growth. Its total market cap went up 30 times in the last year. As a trader, it’s important to keep Bitcoin as your main asset, but it’s also important not to forget how much a dollar is worth and to sometimes take a profit. You should always look at the bigger picture. Cryptocurrency is just one of many ways you can invest your money. You can also invest in the stock market, real estate, bonds, and many other things. It’s important to spread the risks across your crypto portfolio and your whole family.

Third mistake: Bitcoin has gone up a lot, so I’ll buy Litecoin.

As was already said, there are two ways to look at investing in Altcoins: in comparison to Bitcoin and in comparison to the US dollar. This is a common mistake made by people who missed the Bitcoin train and now want to make money with other cryptocurrencies. Those investors have to look at the investment in terms of dollars, since they trade US dollars or other fiat currencies for crypto (instead of buying with the Bitcoins they already have).

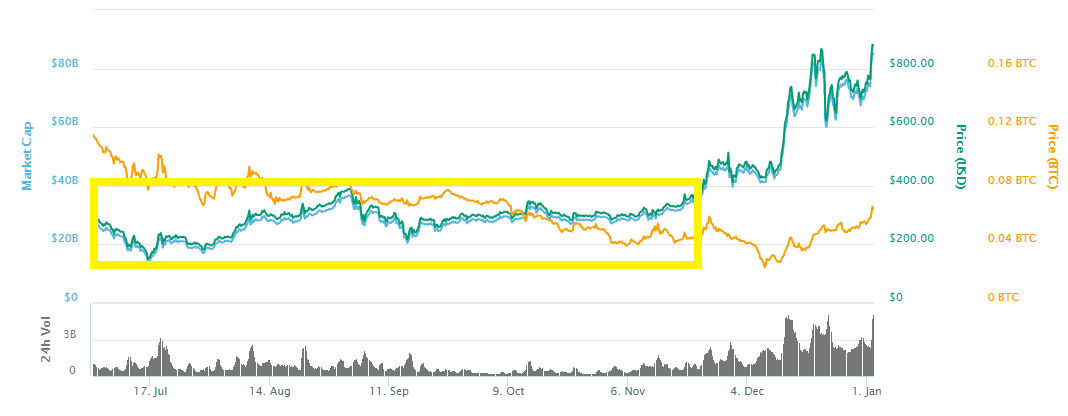

So, what’s the catch? Check out this Litecoin chart, which shows how it did from March to December 2017:

The yellow line shows the price of Litecoin in terms of the value of Bitcoin. The green line shows the price of Litecoin in US dollars, and the blue line shows the total market cap of LTC in USD.

In terms of Bitcoin, the first assumption that the value of Altcoins goes down when the value of Bitcoin goes up is correct. A side note: This isn’t always true. When China made it illegal to trade cryptocurrencies, money flew out of all of them. Bitcoin dropped, and altcoins dropped even more.

As you can see, the price of Litecoin has gone up along with that of Bitcoin (but less). A reminder that most people who say, “Bitcoin has gone up a lot, I’ll buy Litecoin,” should buy Litecoin with fiat currency (or by converting to Bitcoin, then to Litecoin right after – which is the same). So, based on the graph and assuming the same behaviour, when Bitcoin’s value drops, the USD value of Altcoins will also drop (although as a percentage it will probably be less, but it will still go down)

As a result:

Good traders know they make mistakes, but what’s more important is that they look at them and learn from them. This helps them understand the market better.

One Comment