Blockchain Institutional Adoption What’s Missing Now?

Blockchain Institutional Adoption what else enterprise adoption requires—security, regulation, interoperability, and scalability solutions.

Blockchain technology has evolved dramatically over the past decade. What once seemed like a speculative experiment confined to cryptocurrency enthusiasts has transformed into a legitimate infrastructure consideration for major financial institutions, multinational corporations, and government entities. The narrative that blockchain networks are too slow for enterprise-level operations has been thoroughly challenged by recent technological advancements. Modern blockchain platforms now process thousands of transactions per second, rivaling and sometimes exceeding traditional payment networks. Yet, despite achieving the speed benchmarks that skeptics claimed were impossible, widespread institutional adoption remains frustratingly elusive.

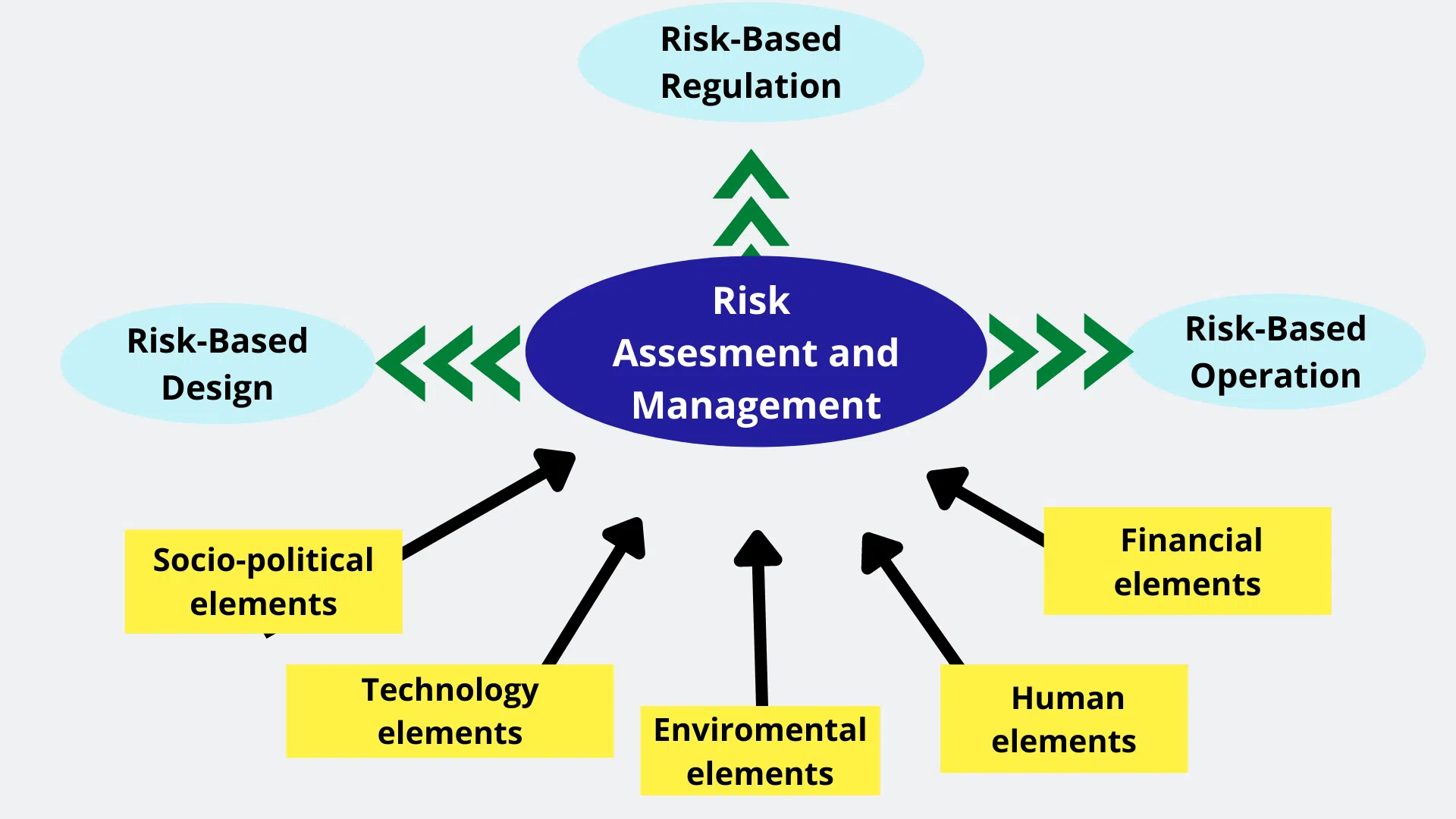

The question is no longer whether blockchain can match the performance requirements of traditional systems. The technology has proven its capability to handle institutional transaction volumes with remarkable efficiency. Instead, we must examine the other critical factors preventing organizations from fully embracing distributed ledger technology in their core operations. Blockchain Institutional Adoption: Speed was merely one piece of a complex puzzle that includes regulatory frameworks, security protocols, integration capabilities, operational costs, and cultural resistance to change. Understanding these remaining barriers is essential for anyone tracking the evolution of enterprise blockchain solutions or considering how this technology will reshape financial infrastructure in the coming years.

The Speed Barrier Has Been Overcome

Traditional blockchain networks like Bitcoin and early Ethereum faced legitimate criticism regarding their transaction throughput limitations. Bitcoin processes approximately seven transactions per second, while Ethereum’s original architecture handled around fifteen. These numbers pale in comparison to Visa’s claimed capacity of 65,000 transactions per second. For institutions processing millions of daily transactions, such limitations represented a fundamental incompatibility with operational requirements.

However, the blockchain ecosystem has responded with innovative solutions that dramatically enhance processing capabilities. Layer-two scaling solutions, including Lightning Network for Bitcoin and various rollup technologies for Ethereum, have exponentially increased transaction throughput while maintaining security guarantees. Newer blockchain architectures built specifically for enterprise applications, such as Solana, Avalanche, and Algorand, regularly process thousands of transactions per second with finality times measured in seconds rather than minutes or hours.

Enterprise-focused blockchain platforms like Hyperledger Fabric and R3 Corda were designed from inception to meet institutional performance requirements. These permissioned networks eliminate the computational overhead associated with public blockchain consensus mechanisms, achieving transaction speeds comparable to traditional databases. The technology has matured to where speed is no longer a meaningful objection for most use cases. Financial settlements, supply chain tracking, identity verification, and asset tokenization can all occur at speeds that meet or exceed conventional systems.

Regulatory Clarity Remains the Primary Obstacle

While blockchain technology has conquered technical performance challenges, the regulatory landscape remains fragmented and uncertain. Financial institutions operate within strict compliance frameworks that govern everything from customer identification to transaction reporting and capital requirements. The absence of comprehensive regulatory guidance specific to blockchain implementations creates enormous liability risks that conservative institutional decision-makers cannot accept.

Different jurisdictions have adopted wildly inconsistent approaches to blockchain regulation. Some countries have embraced the technology with clear legal frameworks that provide certainty for innovators. Switzerland, Singapore, and the United Arab Emirates have established themselves as blockchain-friendly jurisdictions with defined regulatory pathways. Conversely, other major economies maintain ambiguous positions that leave institutions uncertain about compliance obligations. The United States, despite being home to significant blockchain innovation, has struggled to provide unified regulatory clarity, with different agencies sometimes offering contradictory guidance.

The challenge extends beyond cryptocurrency regulation to encompass smart contracts, tokenized securities, decentralized finance protocols, and digital identity systems. Institutions need definitive answers about custody requirements, fiduciary responsibilities, tax treatment, and cross-border transaction rules before committing to blockchain infrastructure. Without regulatory certainty, legal departments within major organizations routinely veto blockchain initiatives regardless of their technical merit. The technology might be ready for institutions, but the legal framework governing its use remains frustratingly incomplete.

Interoperability Challenges Persist Across Networks

The blockchain landscape currently resembles the early internet era when incompatible networks struggled to communicate with one another. Dozens of blockchain platforms exist, each with unique protocols, consensus mechanisms, and smart contract languages. For institutions that must interact with multiple partners, suppliers, and customers across various blockchain networks, this fragmentation creates significant operational complexity.

True institutional adoption requires seamless interoperability solutions that allow different blockchain networks to exchange information and value without manual intervention or trusted intermediaries. An enterprise using Ethereum-based supply chain tracking must be able to interact effortlessly with partners using Hyperledger Fabric or Corda. Financial institutions need to settle transactions across multiple blockchain networks without converting assets back to traditional systems as an intermediary step.

Several projects are working to address these interoperability challenges. Cross-chain communication protocols like Polkadot, Cosmos, and Chainlink’s Cross-Chain Interoperability Protocol aim to create standardized methods for blockchain networks to exchange data and assets. Industry consortia are developing common standards that would allow different blockchain implementations to work together more effectively. However, achieving truly frictionless interoperability across the entire blockchain ecosystem remains a work in progress. Until institutions can confidently build on any platform while maintaining connectivity with all relevant networks, adoption will remain limited to isolated pilot projects rather than core infrastructure deployments.

Security Concerns Extend Beyond the Technology Itself

Blockchain security is often touted as one of the technology’s primary advantages, with distributed consensus mechanisms making networks highly resistant to tampering and fraud. While the underlying blockchain protocols have proven remarkably secure, the broader security picture for institutional implementations is far more complex. Organizations must consider security across the entire technology stack, including wallet management, private key custody, smart contract vulnerabilities, and integration points with legacy systems.

The irreversible nature of blockchain transactions creates unique security challenges for institutions accustomed to error correction and fraud reversal mechanisms. Traditional financial systems include safeguards that allow transactions to be disputed, reversed, or corrected when mistakes occur. Once a blockchain transaction is confirmed, recovering assets requires cooperation from the recipient rather than administrative action by the institution. This finality demands perfect execution and robust security measures that many organizations struggle to implement reliably.

Smart contract vulnerabilities represent another significant security concern that has resulted in hundreds of millions of dollars in losses. Despite rigorous auditing practices, complex smart contracts frequently contain exploitable bugs that attackers discover and leverage. Institutions considering blockchain deployment must develop comprehensive security protocols covering code auditing, vulnerability testing, incident response procedures, and insurance mechanisms to protect against inevitable breaches. The technology itself might be secure, but building secure applications on top of blockchain platforms requires expertise that remains scarce and expensive.

Integration with Legacy Systems Creates Technical Debt

Most large institutions operate on technology infrastructure built over decades, with complex interdependencies between countless systems, databases, and applications. Introducing blockchain technology into this environment is not simply a matter of deploying new software. It requires careful integration with existing systems, data migration strategies, and often fundamental reimagining of business processes built around centralized databases and trusted intermediaries.

The challenge of enterprise blockchain integration extends beyond technical compatibility to encompass organizational change management. Blockchain’s distributed nature fundamentally conflicts with the centralized control models that characterize traditional institutional technology architecture. Decision-making authority, data ownership, access control, and system administration all function differently in blockchain environments compared to conventional databases. Institutions must navigate these differences while maintaining operational continuity and regulatory compliance throughout the transition period.

Many organizations have discovered that blockchain implementations require significant investment in middleware, custom APIs, and integration platforms that translate between blockchain protocols and legacy systems. This integration layer adds complexity, maintenance requirements, and potential points of failure that diminish some of blockchain’s theoretical advantages. Until standardized integration frameworks emerge or institutions complete wholesale technology stack replacements, the practical difficulty of blockchain integration will continue limiting adoption regardless of the underlying technology’s capabilities.

Remains Unclear for Many Use Cases: Blockchain Institutional Adoption

Implementing blockchain solutions requires substantial upfront investment in infrastructure, personnel training, security measures, and ongoing maintenance. Institutions evaluating blockchain adoption must justify these costs against clearly defined benefits that exceed what existing systems provide. While blockchain offers theoretical advantages in transparency, immutability, and disintermediation, translating these features into concrete financial benefits often proves challenging.

For certain use cases, the value proposition is relatively clear. Cross-border payments using blockchain can reduce settlement times from days to minutes while eliminating multiple intermediary fees. Supply chain tracking on distributed ledgers provides unprecedented visibility and authenticity verification that reduces fraud and counterfeiting. However, many proposed blockchain applications offer marginal improvements over existing solutions that don’t justify the implementation costs and operational risks.

The total cost of ownership for blockchain systems extends beyond initial deployment to include transaction fees, network maintenance, security audits, regulatory compliance, and personnel with specialized blockchain expertise commanding premium salaries. Organizations must also consider opportunity costs—resources devoted to blockchain implementation cannot simultaneously address other technology priorities. Until the return on investment becomes more predictable and compelling across a broader range of use cases, many institutions will rationally choose to wait for the technology to mature further rather than becoming early adopters bearing disproportionate costs and risks.

Talent Shortage Hampers Implementation Efforts

The rapid evolution of blockchain technology has created a significant gap between the supply of qualified professionals and the demand for their expertise. Institutions looking to implement blockchain solutions face intense competition for developers, architects, security specialists, and consultants with proven blockchain experience. This talent shortage drives up implementation costs, extends project timelines, and increases the risk of failed deployments due to inexperienced teams making preventable mistakes.

The blockchain developer skillset extends beyond general software engineering to encompass specialized knowledge of cryptography, distributed systems, consensus algorithms, and specific blockchain platforms and smart contract languages. Finding professionals who combine this technical expertise with an understanding of institutional operations, regulatory requirements, and enterprise architecture is exceptionally difficult. Many organizations have resorted to training existing staff, hiring expensive consultants, or partnering with blockchain-focused vendors who may lack deep institutional experience.

This talent constraint creates a chicken-and-egg problem for institutional adoption. Organizations hesitate to commit to blockchain implementations partly because qualified personnel are scarce and expensive. Meanwhile, technology professionals avoid investing time in blockchain expertise because institutional adoption remains limited, making relevant career opportunities uncertain. Breaking this cycle requires either significantly expanded blockchain education initiatives, maturation of development tools that lower the expertise barrier, or enough institutional adoption momentum to justify workforce development investments.

Cultural Resistance and Risk Aversion in Traditional Institutions

Perhaps the most underestimated barrier to blockchain adoption is the conservative institutional culture that prioritizes stability, predictability, and risk minimization over innovation. Large financial institutions, government agencies, and established corporations have survived for decades or centuries by avoiding unnecessary risks and adopting new technologies only after they become thoroughly proven and standardized. Blockchain technology, despite its maturation, still represents a significant departure from established practices that triggers institutional risk-aversion instincts.

Decision-makers within traditional organizations face asymmetric incentives regarding blockchain adoption. Successfully implementing innovative blockchain solutions might generate modest recognition, while failed implementations can derail careers. This risk calculation naturally biases executives toward conservative choices, favoring incremental improvements to existing systems over transformative but uncertain blockchain deployments. Changing this institutional culture requires either external competitive pressure that makes blockchain adoption necessary for survival or internal champions with sufficient authority to overcome organizational inertia.

The decentralized philosophy underlying blockchain technology also conflicts fundamentally with the hierarchical control structures that characterize most large institutions. Blockchain’s promise of disintermediation threatens the relevance of various intermediary roles that currently exist within institutional operations. Employees whose positions depend on centralized control or intermediation naturally resist technologies that could make their functions obsolete. Overcoming this resistance requires careful change management, stakeholder engagement, and often structural reorganization that many institutions prefer to avoid.

Conclusion

The journey toward widespread institutional adoption of blockchain technology has overcome significant technical hurdles, particularly regarding transaction speed and throughput capabilities. Modern blockchain platforms now comfortably meet the performance requirements that once seemed insurmountable. However, speed was never the only barrier, and perhaps not even the most significant one. The path forward requires addressing regulatory uncertainty, interoperability challenges, security concerns beyond the blockchain protocol itself, integration difficulties with legacy systems, unclear cost-benefit ratios, talent shortages, and deeply ingrained institutional culture resistant to transformative change.

The technology itself is ready for institutional deployment across numerous use cases. What remains needed is a comprehensive ecosystem that includes clear regulatory frameworks, standardized interoperability protocols, robust security best practices, simplified integration tools, compelling economic incentives, expanded professional talent pools, and cultural shifts within traditional organizations toward innovation acceptance. Progress is occurring across all these dimensions, but at different speeds in different jurisdictions and industry sectors. The institutions that successfully navigate these challenges and adopt blockchain technology strategically will gain competitive advantages in efficiency, transparency, and capability that late adopters will struggle to match.

FAQs

Q: What blockchain platforms are most suitable for institutional adoption?

The most suitable platforms depend heavily on specific use case requirements and whether the institution needs a public, private, or hybrid blockchain solution. For permissioned enterprise applications, Hyperledger Fabric and R3 Corda are specifically designed for institutional requirements with strong privacy controls and regulatory compliance features. For public blockchain applications.

Q: How does blockchain improve upon traditional database systems for institutions?

Blockchain technology provides several advantages over conventional databases, primarily in scenarios involving multiple parties who need shared access to information without relying on a single trusted authority. The immutability of blockchain records creates reliable audit trails that reduce fraud and disputes.

Q: What regulatory changes would most accelerate institutional blockchain adoption?

The most impactful regulatory development would be comprehensive, internationally coordinated frameworks that provide legal certainty for blockchain applications across borders. Specifically, institutions need clarity on the legal status of tokenized assets, the enforceability of smart contracts, and custody requirements for digital assets.

Q: Can blockchain coexist with existing financial infrastructure, or does it require complete replacement?

Blockchain implementation does not require the complete replacement of existing financial infrastructure. The most practical adoption path involves gradual integration where blockchain enhances specific functions while interoperating with legacy systems through standardized APIs and middleware.

Q: What timeline should institutions expect for widespread blockchain adoption?

Widespread institutional blockchain adoption will likely unfold over the next five to ten years in phases rather than as a sudden transformation. Early adoption is already occurring in specific use cases where value propositions are clearest, including cross-border payments, trade finance, and supply chain tracking.