XRP faces another 10% dip—when will bulls step in?

XRP hovers under $3 after a sharp sell-off. Will bulls defend key support or is a deeper drop ahead? Latest price levels, catalysts, and timing.

XRP is back under pressure. Following an aggressive, market-wide deleveraging in late September, the token slipped beneath the psychological $3 handle and is now wrestling with broken support that has turned into resistance. Broader crypto weakness—sparked by billions in liquidations—has added fuel to the move, while traders weigh how much of Ripple’s hard-won legal clarity is already priced in. In short: sentiment is fragile, liquidity is thinner than it was at the summer highs, and bears are probing for stops.

Over the last week, major outlets reported the most significant crypto washout of 2025, with $1.5–$1.7 billion in positions wiped out, and leading coins such as Bitcoin, Ethereum, Solana, and XRP faces another all-time low, taking a hit. That set the stage for the current pullback and the question on every trader’s mind: Does XRP face another 10% dip, or will bulls step in at the next cluster of support?

In this deep dive, we map XRP’s near-term risk and upside, align technicals with macro and on-chain context, and identify the price zones where dip buyers typically re-emerge. We’ll also unpack how Ripple’s 2025 legal resolution with the U.S. Securities and Exchange Commission (SEC) changes the medium-term setup, and why Bitcoin dominance, funding, and liquidity conditions still matter more than many XRP-only narratives admit.

The state of play: Price, Context, and Catalysts

A market still digesting a major reset

The September slump wasn’t just another bad day; it was a broad deleveraging that flushed out overcrowded longs across majors and altcoins. XRP joined the down-draft as Bitcoin slid toward critical trend levels and derivatives liquidations cascaded. This type of event often leaves a “vacuum” in order books, as prices can drift when liquidity providers widen spreads and retail traders pivot from FOMO to risk management. Barron’s and Business Insider framed the episode as the most enormous selloff/liquidation wave in months, underscoring how sensitive crypto remains to leverage buildups.

Legal overhang eased—but “how much is priced in?”

On the structural side, 2025 brought a pivotal moment: the SEC and Ripple reached a settlement framework, with Reuters reporting a reduced penalty of around $50 million and the SEC dropping its appeal tied to the 2023 “programmatic sales” ruling—clarity that many in the market had long sought. Some industry outlets emphasise the reduced penalty and returned funds from a previously proposed $125 million figure; others note injunction-style limits around certain institutional sales.

The upshot for traders is regulatory visibility: retail exchange trading of XRP isn’t treated as a securities transaction under the 2023 ruling, and the multi-year uncertainty premium has faded. But price is about future cash flows and flows of capital—clarity alone doesn’t guarantee immediate upside, especially when macro liquidity tightens.

Supply mechanics: the escrow that everyone watches

Ripple still releases up to 1 billion XRP each month from escrow, a mechanism established in 2017 that is well-documented on Ripple’s site. The company commonly relocks a large portion, but traders closely watch these cycles for any signs of incremental sell pressure. As of August 2025, third-party trackers estimated that roughly 35.6 billion XRP remained in escrow—evidence that the supply unlock narrative remains a variable in flux. While releases do not necessarily equal market dumps, the schedule can influence sentiment when technicals are weak.

Technical setup: where a further 10% could land

Structure under $3: broken support, new resistance

Spot action beneath $3 signals a failed hold of a significant psychological level. Independent technical reads this week flagged a bearish pattern with potential downside targets near the low-$2s if momentum fails to repair quickly. In particular, a move toward the $2.40–$2.50 band would equate to roughly another 10% drawdown from the current spot of approximately $2.75–$2.80, and aligns with typical measured-move projections after failed retests. Some analysts project a worst-case “liquidity sweep” toward approximately $2.07 if market stress re-accelerates.

Momentum gauges: RSI, MACD, and why “oversold” isn’t a buy signal.l

Following the September liquidation, RSI readings in majors compressed; however, the “oversold” condition requires context: in downtrends, RSI may remain weak while the price continues to grind lower. MACD bear crosses on daily frames often precede multi-week chop before any durable reversal. This month’s Binance Research notes hinted at fragility in market breadth, with Bitcoin dominance hovering in the high 50s earlier and rotation risk still alive. In such backdrops, altcoin rallies can stall unless BTC stabilises first. For XRP, momentum stabilisation above prior range highs is the cleaner bull signal than simply tagging an oversold oscillator.

Liquidity pockets: where buyers typically step in

Prices rarely move in straight lines; they chase liquidity. For XRP, the first meaningful pocket sits just below recent swing lows—a region where late shorts place stops and sidelined longs wait to fade panic. If that pocket gives way, the next magnet often clusters around prior breakout bases in the $2.30–$2.50 zone, which conveniently lines up with the “another 10%” scenario. Think of these as potential support and resistance “bands,” not single ticks.

Macro matters: Bitcoin, funding, and flows

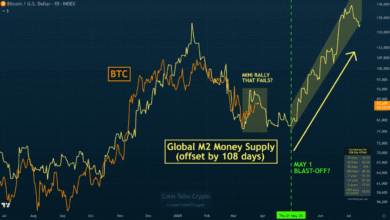

Bitcoin sets the tone

Regardless of the XRP narrative, Bitcoin still sets the tone. If BTC loses its key short-term holder cost basis (analysts have recently highlighted the approximately $111k pocket), alts typically underperform as traders de-risk. Conversely, firming above near-term moving averages unlocks room for “beta plays” like XRP to rebound. Late-September coverage stressed that the selloff was leverage-led—not thesis-shattering. That nuance helps: unwind events often set up ranges that resolve higher after consolidation, provided macro doesn’t deteriorate further.

Funding and positioning

After liquidations, perp funding can flip negative, a clear indication of mean reversion if spot demand reappears. Traders should still respect lower-highs structures. The healthiest rebounds start with spot-led demand, followed by cautious leverage—not the other way around. In other words, watch for quieter bid absorption before chasing green candles.

When will the bulls step in?

The price-action answer

Bulls typically step in when three things happen in quick succession: (1) wicks into high-liquidity demand zones, (2) momentum flattening (RSI divergence, MACD curl), and (3) reclaimed levels holding on retests. For XRP, a flush toward $2.40–$2.50, a fast reclaim above $2.60–$2.70, and acceptance back over $2.80–$2.90 would fit the playbook. If BTC cooperates, the ceiling at $3.00–$3.10 can serve as a springboard.

The catalyst answer

On the catalyst front, the SEC–Ripple saga’s end reduces headline tail risk. Reuters reported in spring and early summer that the SEC dropped its appeal and that Ripple’s penalty was cut—milestones that, in prior cycles, might have unleashed a sustained uptrend. This time, the market appears more macro-driven, with rate-cut signalling, liquidity, and ETF inflows dominating the flow of funds. If BTC stabilises, that legal clarity can finally be expressed as relative strength for XRP in Q4 rotations.

The time-horizon answer

In the short term (days to weeks), another ~10% dip is entirely plausible, potentially into the $2.40s, if sellers press their advantage and BTC wobbles. Medium-term (1–3 months), the case for bulls improves if we see range-building above mid-$2s, with the legal overhang cleared and escrow behaviour well-telegraphed. Long-term, XRP’s path still depends on enterprise adoption, payment rails traction, and whether alt liquidity broadens beyond the BTC-led core.

Risk checklist for XRP traders and investors

Regulatory follow-through

While 2025 brought a settlement framework and de-escalation, with the SEC appeal being dropped and a reduced penalty being discussed, investors should still monitor any injunction conditions related to constitutional sales and the pace of global compliance efforts. Some coverage earlier in the summer highlighted judicial back-and-forth on the fine amount; by late September, multiple outlets framed the dispute as effectively concluded with a reduced penalty, while others referenced differing figures. The pragmatic takeaway: the existential U.S. question mark has narrowed, but execution and jurisdictional nuances still matter.

Supply optics and escrow

Ripple’s monthly escrow cadence remains a recurring topic of discussion. Historically, vast portions are relocked, but traders often respond to optics in stressed environments. Keeping tabs on net circulating increases and exchange balances can help separate signal from noise. Ripple’s original escrow explainer and recent third-party tallies give you a baseline for expectations.

Correlation risk

XRP rarely decouples for long. If macro wobbles (rate path surprises or risk-off) or if Bitcoin dominance rises during stress, altcoins can underperform. Binance Research’s September take noted shifting dominance and seasonal shakiness—consistent with what we’re seeing in this pullback.

Strategy notes (educational, not financial advice)

For momentum traders

Momentum traders typically avoid fighting clean downtrends. Many will wait for a daily close back above reclaimed levels—think $2.80–$2.90—and a higher low before risking capital. Bearish breakdowns are often retested; if those retests fail, a continuation of the lower trend is common. Use invalidation: above where your breakdown thesis dies.

For swing reversion seekers

Mean-reversion traders look for panic wicks into the $2.40–$2.50 support zone, coupled with RSI/MACD divergences. They prefer spot entries, tight risk, and partial profit-taking into the first level of resistance. This style works best when broader crypto isn’t in a cascading selloff.

For longer-term allocators

Allocators focused on utility, payment rails, and enterprise adoption may scale over time, utilising deep drawdowns to enhance their basis. Legal clarity (per Reuters reports) and a predictable supply mechanism can underpin a multi-quarter thesis—but price will still follow liquidity cycles.

Will XRP really drop another 10%?

The honest answer: it might, and the market has already laid the kindling. The September deleveraging flushed longs, structure sits below $3, and liquidity bands beckon in the mid-$2s. That said, swift liquidation events sometimes mark local extremes. If Bitcoin steadies, funding normalises, and XRP reclaims $2.80–$2.90, the next leg may be sideways to up rather than straight down. In the near term, respect the $2.40–$2.50 range for the magnet. Medium-term, watch to see if buyers can build a higher low above that shelf.

Conclusion

XRP’s latest slide is less about a collapsing thesis and more about leverage, liquidity, and timing. The legal cloud has thinned—Reuters and industry coverage alike point to a 2025 settlement framework with a reduced penalty and the SEC abandoning its appeal regarding programmatic sales—yet price action remains dependent on macro drivers and crypto’s internal plumbing. Another ~10% dip into the mid-$2s is a real risk if bears control the tape, especially while BTC wavers. But those same drawdowns create the demand zones where bulls often step in.

For traders, look for price confirmation: seek reclaimed levels and momentum stabilisation before adjusting the bias. For investors, focus on the bigger arc: legal clarity, predictable escrow mechanics, and adoption catalysts, tempered by a clear view of market cycles. In volatile weeks like this, patience is a virtue.

FAQs

Q: Did the SEC–Ripple case finally end in 2025, and what changed for XRP?

Yes—2025 brought a settlement framework that reduced Ripple’s penalty and saw the SEC drop its appeal tied to the 2023 ruling on programmatic sales. This narrowed regulatory uncertainty for XRP’s retail trading in the U.S., although certain institutional sale restrictions and compliance obligations remain factors to watch.

Q: Why does everyone track Ripple’s XRP escrow each month?

Because supply optics influence sentiment. Ripple’s 2017 escrow releases up to 1B XRP monthly, with substantial amounts typically relocked. As of August 2025, approximately 35.6 billion XRP remained in escrow. The process is transparent, but traders still closely monitor net circulation shifts during fragile market conditions.

Q: What price levels matter most right now?

Under $3, the market is treating $2.80–$2.90 as a key reclaim zone. Lose the recent lows decisively, and the price can magnetise to $2.40–$2.50—about another 10% down—where bulls may try to defend. Some technicians see a deeper worst-case sweep near ~$2.07 if stress returns.

Q: How much of XRP’s move is just macro?

A lot. The late-September drawdown was driven by leverage across the cryptocurrency market. Bitcoin dominance, liquidity, and ETF-driven flows continue to dictate the performance of altcoins. When BTC stabilises, altcoins—including XRP—tend to find their footing more easily.

Q: Could bulls step in without another dip?

It’s possible. If BTC firms and XRP quickly reclaim the $2.80–$2.90 range, momentum could shift without reaching the mid-$2s. Watch for spot-led buying, stabilising RSI/MACD, and clean retests that hold—classic tells that buyers are back in control.

Show All: Crypto Market Wipes Out September Gains as Bitcoin Barely Holds