Ignoring Bitcoin at $400 Young Aussies’ Big Regret

Why many young Australians regret ignoring Bitcoin at $400—and what this lesson means for smarter investing today.

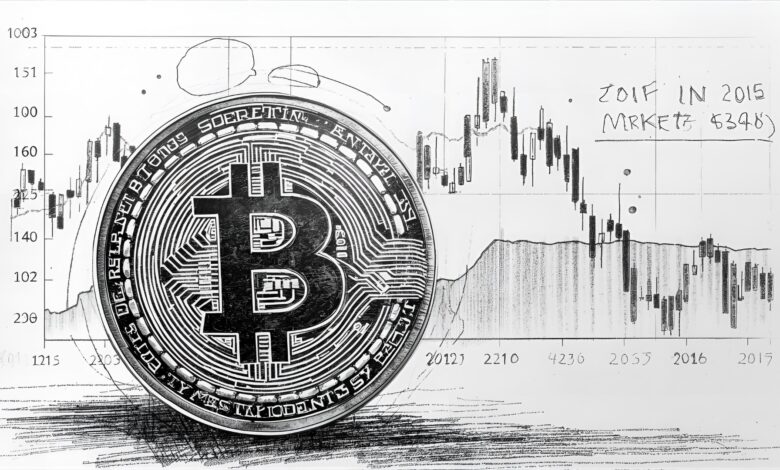

The $400 moment a snapshot in time that shaped a generation

Yet, the $400 level also symbolised the classic early-stage inflection point of a new technology. The internet had its dial-up days; smartphones had small screens and fewer apps; streaming felt inferior to DVDs—until suddenly it didn’t. Bitcoin at $400 wasn’t merely a price; it was a litmus test of whether we recognise emergent value before it’s obvious. The fact that so many passed on that test is not a condemnation of those individuals. It’s an invitation to study the conditions that kept them on the sidelines: uncertainty, social proof, and the absence of a simple, resilient plan.

The difference between price and conviction

Price alone rarely persuades. People do not buy assets because they are cheap; they buy because they have conviction. Conviction comes from education, time in the market, and exposure to credible voices. In 2015 and 2016, most Australians didn’t have a trusted friend or adviser explaining Bitcoin, cryptography, decentralisation, and the value of verifiable digital scarcity. Without that narrative, $400 wasn’t “cheap”; it was just “unknown.” The regret many feel now isn’t only about missing gains—it’s about missing the chance to build conviction earlier.

Regret, FOMO, and the psychology of missed opportunities

Humans are wired to avoid regret more than to seek gains. Loss aversion and status quo bias make inaction feel safer than action, especially with something new. When Bitcoin was $400, the fear was, “What if it goes to zero?” Today, the fear sounds like, “What if I’m late?”—classic FOMO. The irony is that both fears can paralyse us. Understanding this psychology is essential to constructing a durable strategy.

The cost of inaction vs. the cost of being wrong

We often overestimate the cost of being wrong and underestimate the cost of doing nothing. Let’s say you put a modest amount—money you could afford to risk—into an experiment. The worst case: it goes to zero, and you’ve paid tuition to the school of risk management. The best case: you’re early to a trend that compounds for years. The middle case: your small position teaches you how the asset behaves, helping you decide whether to add or move on. In each case, action generates data. Inaction produces only stories—and those stories harden into regret.

Australia’s unique context: wages, inflation, and the AUD lens

To understand why ignoring Bitcoin at $400 stings, we also need the Australian lens. Wage growth has been uneven, the Australian dollar (AUD) cycles with commodities, and inflation has gnawed at purchasing power. For young workers, parking cash in a savings account felt safe but often lagged real-world price rises. Meanwhile, superannuation—vital for retirement—can feel distant when rent is due next week. In that setting, an asset that is global, scarce, and independent of local policy might offer hedging benefits, even if only as a small allocation.

Diversification beyond the usual suspects

Traditional wisdom advises a mix of equities, bonds, and cash. That remains sensible. But a small slice of alternative assets, like Bitcoin and Ethereum, can diversify sources of risk because they do not always correlate with local factors. This is not a claim that crypto is “safe”; it’s an argument that appropriate sizing, combined with time, can improve a portfolio’s resilience. The regret over missing Bitcoin at $400 is, in part, a regret over missing diversification.

From hindsight to foresight: building a process you can trust

Hindsight is a loud teacher. The way to mute its sting is to build a system that captures upside without gambling on perfect timing. Three pillars matter most: education, structure, and safeguards.

Education: from jargon to understanding

Replace headlines with frameworks. What is blockchain? Why does digital scarcity matter? How does a decentralised network secure value without a central bank? What are the trade-offs between speed, security, and decentralisation? Which assets have durable use cases, and which are purely speculative? As your working knowledge deepens, you will find it easier to allocate small amounts without drama. Education turns volatility into context.

Structure: dollar-cost averaging as a habit

A simple way to avoid the “should I buy now?” spiral is dollar-cost averaging (DCA)—investing a fixed amount on a regular schedule regardless of price. Whether Bitcoin is dipping or ripping, you contribute the same figure weekly or monthly. Over time, you buy more when price is low and less when price is high, reducing the impact of market timing. The beauty of DCA is not that it beats every strategy; it’s that it helps real people act consistently. Many young Australians who regret ignoring Bitcoin at $400 could have sidestepped that pain with a tiny, repeatable DCA plan.

Safeguards: position sizing and risk management

Risk management is the difference between speculation and strategy. Cap your allocation to a level that would not derail your life if it drops sharply. Set guidelines: perhaps 1%–5% for high-volatility assets, reviewed quarterly. Use reputable Australian exchanges that comply with KYC/AML standards. Store long-term holdings in secure wallets. Document rules in plain English so you can follow them during stress. Investing is not a test of courage; it’s a test of discipline.

Why Bitcoin specifically captured the narrative

There are countless missed opportunities—tech stocks, property cycles, startups—but Bitcoin occupies a special place in the cultural imagination. It challenged how we think about money itself. It also offered a once-in-a-generation financial experiment that anyone in Australia with a smartphone and $50 could join. That accessibility made the miss feel personal. Ignoring early-stage biotech might be rational if you’re not a scientist; ignoring a universally accessible digital asset feels like a choice you could have made differently.

Scarcity, network effects, and Lindy

Bitcoin’s thesis rests on three ideas. First, programmatic scarcity: a known supply schedule with a fixed cap. Second, network effects: as more participants join, the value of the network increases. Third, Lindy effect: the longer the system survives, the longer it is expected to survive. None of these guaranteed success at $400. But they explained why serious people kept studying it. The regret now felt by many young Australians stems from underestimating those dynamics.

What “ignoring Bitcoin at $400” really teaches

When you strip away the price charts and headlines, this episode teaches five durable lessons.

Lesson 1: Curiosity compounds like capital

Small curiosity, consistently applied, becomes insight. And insight, consistently applied, becomes conviction. Make curiosity a routine: subscribe to one sober newsletter, read one whitepaper summary, follow one credible analyst. You’ll not only make better choices; you’ll feel better about them.

Lesson 2: Process beats prediction

No one accurately predicts every trend. But a process—education, dollar-cost averaging, and position sizing—can capture a share of many trends without risking ruin on any single bet. If you had applied a fixed DCA to Bitcoin from $400 onward, you would’ve built exposure without the stress of timing.

Lesson 3: Volatility is the fee, not the fine

Volatility in emerging assets is not a penalty for being wrong; it’s the fee for accessing potential growth. Once you frame fluctuations as fees you willingly pay in small amounts, the fear subsides. You accept drawdowns and move on, guided by rules.

Lesson 4: Diversification is a humility hack

Diversification admits we don’t know the future. A portfolio that includes a measured slice of cryptocurrency, alongside equities, cash, and perhaps gold, is a portfolio built for imperfect knowledge.

Lesson 5: Write your rules before the storm

Rules written during calm keep you from improvising during chaos. Decide beforehand: what percentage will you allocate to digital assets? Under what conditions will you rebalance? What are your security practices? Put it in writing and revisit quarterly.

The role of regulation, security, and trust in Australia

Australian investors operate within a specific regulatory environment. Exchanges adapt to ASIC expectations; banks evaluate on-ramps; tax rules evolve. For many, the absence of clarity years ago made action feel risky. Today, while the landscape continues to mature, best practices are more accessible: use compliant platforms, verify custody options, enable two-factor authentication, and understand your tax obligations on capital gains. Regret thrives in environments of confusion; trust grows where standards are clear.

Custody choices and security hygiene

Long-term holders often prefer hardware wallets or reputable custodians with transparent audits. Short-term traders may keep a portion on exchange for liquidity. Either way, treat security like seatbelts—boring until the day they save you. Back up seed phrases offline, avoid phishing, and verify addresses. This is not paranoia; it’s prudence.

What if you still feel “late”?

Many young Australians ask: “If I missed $400, is it too late now?” That question hides a trap. It assumes the only valid win is buying at the absolute bottom. But investing is not a trophy for perfect entries; it’s a practice of intelligent participation. The relevant questions are: Does this asset still have a thesis you understand? Does it fit your risk tolerance? Can you build exposure slowly, via DCA, with clear rules? If yes, then “late” is a story you can retire.

Reframing “late” as “prepared”

Preparation changes everything. A small, structured approach means you can take action without theatrics. If you’re wrong, your downside is capped. If you’re right, time and network effects do the heavy lifting. Either outcome is better than paralysis.

How to avoid the next $400 moment

There will be new frontiers: real-world asset tokenisation, decentralised finance (DeFi) applications with clearer utility, AI-crypto intersections, improvements to Bitcoin’s scaling layers, and perhaps innovations we cannot name yet. You don’t need to predict the champion. You need a framework that lets you participate responsibly.

Build a “curiosity budget” and a “conviction budget”

Consider two buckets. The curiosity budget funds small experiments: $20 to test a wallet, $50 to interact with a protocol, a few dollars to try a layer-2 network. The conviction budget supports assets you understand and plan to hold through cycles, funded via dollar-cost averaging. This split avoids the extremes of reckless gambling and total avoidance.

Audit your influences

In the era of hot takes, be deliberate about who you listen to. Prioritise sources that explain risk, highlight uncertainty, and show their work. Avoid anyone who promises certainty. Long-term investing is quiet; hype is loud.

Measuring success beyond price

Price is a lagging indicator of collective belief. It matters, but it is not the only measure of success. Financial peace, reduced anxiety, and sensible habits also matter. If you sleep better because your portfolio follows rules you trust, that’s a win. If you can talk about Bitcoin and cryptocurrency without defensiveness or tribalism, that’s progress. If you can explain your strategy to a friend in two minutes, you’ve done the hard work.

The quiet compounding of good behaviour

Good behaviour—automatic contributions, regular learning, periodic rebalancing—compounds. In five years, you’ll thank yourself not only for the assets you own but for the calm you’ve built. The missed Bitcoin at $400 can be the story you tell about how you changed, not the wound you keep scratching.

A note on humility and luck

Finally, a little humility. Some people did buy at $400 by luck, not foresight. Others sold too early. Some never bought and still built wealth through property, business, or index funds. There are many paths. The point is not to idolise a single asset but to recognise patterns: early skepticism, noisy narratives, and the eventual rewards for those who combine curiosity with discipline. If you transform that pattern into a habit, you won’t need luck as much.

Conclusion

“Young Australians’ biggest financial regret: Ignoring Bitcoin at $400” is more than a headline. It’s a chapter in a broader playbook for modern investing. You can’t change the past, but you can change your process. Prioritise education. Embrace dollar-cost averaging. Respect risk management. Diversify with humility. Use secure custody. And most of all, act—small, steady, and soon. The next $400 moment won’t announce itself. But with a structure you trust, you won’t need it to.

FAQs

Q: Is it still worth buying Bitcoin if I missed the early years?

It can be—if you have a clear thesis, a long time horizon, and strict position sizing. Rather than chasing price, consider a small DCA plan that fits your budget and risk tolerance. Your goal isn’t perfect timing; it’s consistent participation.

Q: How much of my portfolio should be in cryptocurrency?

There’s no universal number. Many conservative frameworks suggest 1%–5% for high-volatility digital assets, depending on your income stability, savings rate, and psychological comfort with drawdowns. The key is that losses at that allocation should not threaten your day-to-day life.

Q: What if I’m worried about security and scams?

Use reputable Australian platforms that meet compliance standards, enable two-factor authentication, and learn basic wallet hygiene. For longer-term holdings, consider hardware wallets and keep your seed phrase offline. Treat security setup as a one-time project that protects you for years.

Q: Should I buy only Bitcoin or diversify across other cryptocurrencies?

Bitcoin has the strongest store-of-value narrative and the most established network effects. Some investors add a small allocation to other assets like Ethereum for smart-contract exposure. If you diversify, do so thoughtfully and avoid chasing headlines. Quality over quantity.

Q: How do I avoid FOMO during big price moves?

Codify your rules before emotions spike. Automate your dollar-cost averaging, schedule periodic portfolio reviews, and rebalance to target allocations. When the plan is written and automatic, FOMO has less room to drive decisions.

See More: Bitcoin vs Ethereum Which Is the Better Investment