Fusaka Upgrade Ethereum’s Value Accrual Revolution

Ethereum's Value Accrual Revolution upgrade marks a strategic shift toward value accrual and economic sustainability for ETH holders in 2025.

Fusaka upgrade represents far more than a routine technical enhancement to the world’s leading smart contract platform. According to a comprehensive analysis by Fidelity Digital Assets, this transformative network update signals a fundamental shift in how Ethereum approaches value creation, economic sustainability, and stakeholder alignment. As the digital asset ecosystem matures, understanding the implications of this upgrade becomes essential for investors, developers, and anyone interested in the future direction of decentralised technology.

The Ethereum Fusaka upgrade emerges during a critical period of evolution for blockchain networks. While previous updates focused primarily on technical improvements and functionality expansions, Fusaka represents something fundamentally different. Ethereum’s Value Accrual Revolution: It embodies a more cohesive, economically-driven roadmap that directly addresses how value flows through the network and ultimately accrues to ether holders. Fidelity Digital Assets analyst Max Wadington characterises this moment as a maturation in Ethereum’s governance structure, moving from loosely coordinated technical upgrades to a strategic vision guided by clearer economic intent.

This comprehensive analysis explores the multifaceted implications of the Fusaka upgrade, examining its technical innovations, economic philosophy, and potential impact on the broader cryptocurrency ecosystem. From enhanced layer-1 scaling capabilities to reformed layer-2 economics, we’ll unpack how this upgrade positions Ethereum for its next phase of growth and what it means for the diverse stakeholders invested in the platform’s success.

Ethereum Fusaka Upgrade Framework

The Fusaka upgrade, derived from combining the names Fulu and Osaka, represents a simultaneous enhancement to both Ethereum’s consensus and execution layers. Scheduled for implementation in December 2025, this bundled upgrade comprises twelve Ethereum Improvement Proposals that collectively reshape how the network handles data, processes transactions, and distributes economic incentives. Unlike previous upgrades that addressed isolated concerns, Fusaka takes a holistic approach to network optimisation.

At its technical core, the upgrade introduces PeerDAS (Peer Data Availability Sampling), a revolutionary data verification system that fundamentally changes how validators confirm information integrity. Rather than requiring every validator to download and verify complete data packages known as blobs, PeerDAS enables validators to sample small cross-sections of data distributed across different network participants. This innovation dramatically reduces bandwidth and storage requirements while maintaining the network’s robust security guarantees. The result is a more scalable infrastructure capable of supporting significantly increased transaction throughput without compromising decentralisation.

The upgrade also implements substantial changes to the Ethereum Virtual Machine, including modifications to transaction size limits and the introduction of new operational codes that enhance smart contract efficiency. Perhaps most significantly, Fusaka increases the block gas limit from 45 million to 150 million, effectively tripling the network’s capacity to process transactions and smart contract operations. These technical enhancements work synergistically to address Ethereum’s most persistent challenges around network congestion and transaction costs.

What distinguishes Fusaka from its predecessors is the strategic coherence underlying these technical improvements. Rather than pursuing scalability, security, and decentralisation as competing priorities, the upgrade demonstrates how thoughtful protocol design can advance all three simultaneously. This alignment reflects a maturing understanding of blockchain economics and represents a significant evolution in how Ethereum’s development community approaches network upgrades.

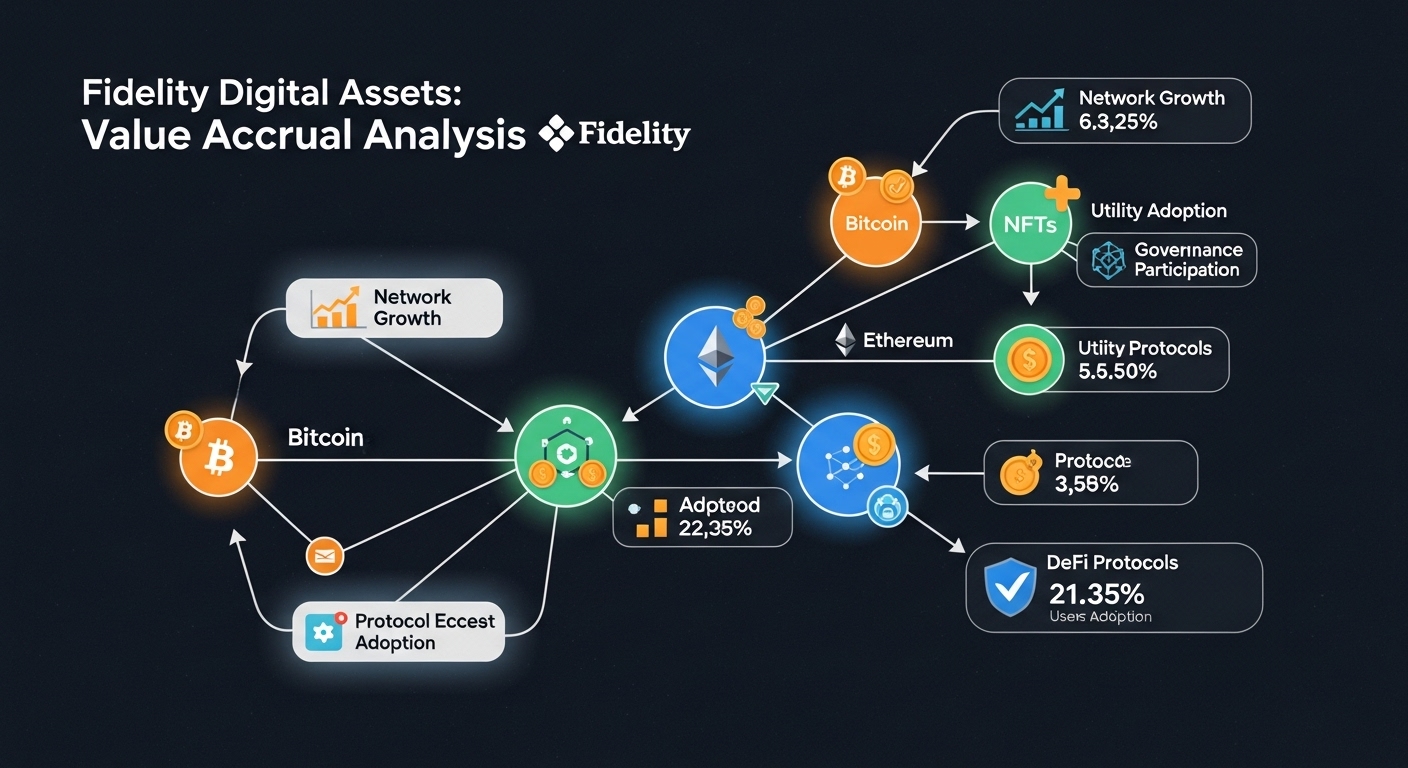

Fidelity Digital Assets’ Value Accrual Analysis

Fidelity Digital Assets’ Thursday report positions the Fusaka upgrade as a watershed moment in Ethereum’s economic evolution. The investment firm’s analysis highlights how this update reflects Ethereum’s most cohesive and value-driven roadmap to date, marking a decisive break from the platform’s historical pattern of accommodating diverse and sometimes conflicting stakeholder priorities. According to analyst Max Wadington, the upgrade consolidates development efforts around a narrower set of goals that more directly reinforce scalability, usability, and critically, value accrual to Ether itself.

The report emphasises that while value accrual isn’t explicitly named as a core upgrade objective, it has emerged as the shared incentive uniting developers, users, and investors across the Ethereum ecosystem. This alignment manifests in protocol-level decisions that strengthen Ethereum’s pricing power and expand its revenue-generating potential. The renewed emphasis on layer-1 scaling particularly stands out as a strategic choice with significant economic implications. By enhancing the base layer’s capabilities rather than exclusively relying on layer-2 solutions, Ethereum positions itself to capture more value directly at the protocol level.

Fidelity’s analysis suggests this dynamic could substantially reinforce Ether’s position as a cash-flowing asset. The upgrade’s economic architecture creates clearer pathways for network activity to translate into tangible value for token holders. As transaction demand increases and the network demonstrates improved efficiency, the resulting fee dynamics and staking rewards create compelling investment fundamentals. This transformation aligns with broader institutional interest in digital assets that demonstrate quantifiable economic utility beyond speculative appeal.

However, the report carefully notes that these strategic moves come with inherent trade-offs. The challenge lies in aggressively prioritising monetisation and pricing power without inadvertently dampening broader adoption. If transaction costs rise too dramatically or if the network becomes perceived as optimising for profit extraction over accessibility, it could undermine the very adoption that drives long-term value creation. Fidelity’s analysis encourages investors to monitor how Ethereum balances these competing pressures as the upgrade rolls out and its economic effects become measurable.

Layer-1 Scaling and Layer-2: Ethereum’s Value Accrual Revolution

The Fusaka upgrade’s approach to layer-1 scaling represents a strategic recalibration in Ethereum’s multi-layered architecture philosophy. For several years, the dominant narrative positioned layer-2 solutions as the primary avenue for achieving blockchain scalability. Networks like Arbitrum, Optimism, and various zkRollups emerged to handle transaction volume while the base layer focused on security and settlement. Fusaka doesn’t abandon this vision but rather rebalances it by significantly strengthening the foundational layer’s capabilities.

By dramatically increasing the block gas limit and implementing PeerDAS to enhance data throughput, the upgrade enables the base layer to handle substantially more activity directly. This creates interesting economic dynamics for the entire Ethereum ecosystem. When the layer-1 network can process more transactions efficiently, it potentially captures value that might otherwise flow to layer-2 networks. The increased target for blob data from 6 to potentially 48 (with a maximum of 72) represents an eightfold increase in data availability, fundamentally altering the economics of posting transaction data to the main chain.

These changes could reshape layer-2 economics in several ways. On one hand, improved layer-1 data availability and throughput make layer-2 solutions more efficient and cost-effective, as they rely on the base layer for data availability and security guarantees. Lower costs for posting data to layer-1 translate directly into reduced fees for layer-2 users, potentially accelerating adoption of these scaling solutions. This synergistic relationship demonstrates how strengthening the base layer can benefit the entire scaling ecosystem.

On the other hand, a more capable layer-1 may alter the competitive dynamics between different scaling approaches. If Ethereum’s base layer can handle significantly more activity while maintaining reasonable costs, some use cases that migrated to layer-2 solutions purely for scalability reasons might reconsider their architecture. The optimal balance between layer-1 and layer-2 usage becomes a more nuanced calculation involving technical requirements, economic considerations, and user experience factors. This recalibration represents exactly the kind of strategic flexibility that Fidelity’s analysis highlights as characteristic of Ethereum’s maturing roadmap.

Governance Evolution and Stakeholder Alignment

The Fusaka upgrade exemplifies a significant evolution in Ethereum’s governance philosophy and decision-making processes. Historically, Ethereum’s development path reflected input from a wide array of stakeholders with varying priorities and sometimes competing visions for the network’s future. Core developers, application builders, miners (now validators), users, and investors all sought to influence the platform’s direction based on their particular interests and perspectives. This democratic but often unwieldy approach sometimes resulted in compromises that satisfied multiple constituencies without fully optimizing for any specific outcome.

Wadington’s analysis frames Fusaka as a departure from this pattern, representing a maturation toward governance guided by clearer economic intent and strategic coherence. The upgrade demonstrates increased alignment around shared objectives that benefit the ecosystem broadly rather than accommodating every potential stakeholder request. This doesn’t mean abandoning Ethereum’s community-driven ethos, but rather achieving greater focus and intentionality in prioritising improvements that strengthen the network’s fundamental value proposition.

The emerging alignment around value accrual as a unifying principle offers particular insight into this governance evolution. Developers benefit from a more economically sustainable network that can fund ongoing innovation. Users gain from improved efficiency and potentially lower transaction costs. Investors appreciate clearer mechanisms through which network growth translates into token value appreciation. Validators see enhanced rewards tied to increased network activity. When these diverse stakeholder interests converge around complementary objectives, protocol development can proceed with greater strategic clarity.

This governance maturation also reflects Ethereum’s transition from experimental technology to critical infrastructure. As institutions allocate capital to ETH and developers build increasingly sophisticated applications on the platform, the stakes of governance decisions rise accordingly. The community’s ability to coordinate around economically coherent upgrades like Fusaka demonstrates a level of sophistication necessary for Ethereum to fulfil its ambitions as foundational infrastructure for the decentralised web. The upgrade thus serves as both a technical enhancement and a proof point for Ethereum’s organisational capacity.

Monetisation Strategy and Pricing Power

A crucial aspect of Fidelity’s Fusaka analysis centres on Ethereum’s evolving approach to monetisation and the assertion of pricing power. These concepts might seem counterintuitive in the context of an open-source, decentralised network, yet they’re fundamental to understanding the upgrade’s economic implications. Pricing power in this context refers to the network’s ability to maintain or increase transaction fees as adoption grows, creating sustainable revenue that flows to validators and ultimately supports token value.

The strategic emphasis on layer-1 scaling directly relates to this monetisation framework. By enhancing the base layer’s capabilities and capacity, Ethereum positions itself to capture more economic value from network activity rather than seeing that value migrate entirely to layer-2 solutions or alternative blockchains. This doesn’t mean Ethereum seeks to maximise fees at the expense of usability, but rather to establish a sustainable economic model where increased utility generates proportional value for the network and its stakeholders.

The Fusaka upgrade implements several mechanisms that support this monetisation strategy. The increased block gas limit expands revenue potential by enabling more transactions per block. Enhanced data availability through PeerDAS makes the network more attractive for data-intensive applications, potentially expanding the range of use cases that generate fees. Improvements to smart contract efficiency through new operational codes create additional utility that justifies network usage even as competitors emerge.

However, as Fidelity’s report cautions, aggressively pursuing monetisation carries risks. If fees rise beyond what users consider acceptable, they may seek alternatives, whether other blockchain platforms or entirely different technological solutions. The challenge lies in asserting sufficient pricing power to create compelling economics for token holders while maintaining the accessibility that drives adoption. Fusaka’s design attempts to thread this needle by increasing capacity and efficiency simultaneously, allowing for both higher throughput and manageable costs. The coming months will reveal whether this balance can be sustained as network usage evolves.

Technical Innovations PeerDAS and Beyond

Among the Fusaka upgrade’s technical innovations, PeerDAS (Peer Data Availability Sampling) stands out as particularly transformative for Ethereum’s scalability roadmap. This mechanism fundamentally reimagines how the network confirms data availability, moving from a model requiring comprehensive verification by all participants to one based on probabilistic sampling and distributed responsibility. Understanding PeerDAS requires grasping both its technical elegance and its practical implications for network performance.

Under the previous data availability model, validators needed to download complete data blobs to verify their integrity and availability. As blob sizes increased to accommodate more transaction data, this requirement created significant bandwidth and storage burdens, particularly for smaller validators running home staking setups. This dynamic threatened to centralize validation by making participation economically viable only for well-resourced operators with high-end infrastructure. PeerDAS elegantly addresses this challenge by distributing verification responsibilities across the network.

The system works by breaking each data blob into many small pieces and distributing these pieces across different validators. Each validator then samples random subsets of data from multiple blobs, verifying that their assigned pieces are correctly formed and available. Through clever probability mathematics, if a sufficient number of validators successfully verify their samples, the network can conclude with high confidence that the entire blob is available and intact. This approach dramatically reduces the data burden on individual validators while maintaining robust security guarantees through redundancy and random sampling.

Beyond PeerDAS, Fusaka introduces several complementary technical enhancements. The implementation of Verkle Trees promises more efficient data organisation and verification, compressing proof sizes and reducing the computational overhead associated with state access. Modifications to the EVM introduce new operational codes that enable more efficient smart contract execution. Adjustments to the ModExp precompile contract alter gas pricing for certain cryptographic operations, better aligning costs with actual computational requirements. Together, these improvements create a comprehensive technical foundation for Ethereum’s next phase of development and scaling.

Impact on Institutional Investment Thesis

The Fusaka upgrade carries significant implications for the institutional investment thesis surrounding Ethereum and ether as an asset class. Fidelity Digital Assets’ prominent analysis of the upgrade reflects growing institutional interest in understanding not just blockchain technology’s potential, but the specific economic mechanisms that translate network utility into investment returns. As traditional finance increasingly allocates capital to digital assets, upgrades that clarify value accrual pathways become critical decision factors for institutional allocators.

Institutional investors typically evaluate assets through frameworks emphasizing cash flows, growth potential, risk management, and competitive positioning. Fusaka addresses each of these considerations in meaningful ways. The upgrade’s emphasis on creating clearer pathways from network activity to value accrual helps institutions model potential returns more confidently. Enhanced scalability suggests capacity for growth without proportional cost increases. The technical robustness of implementations like PeerDAS addresses operational risk concerns. Strategic positioning through layer-1 improvements strengthens Ethereum’s competitive moat against alternative platforms.

The concept of ether as a cash-flowing asset, highlighted in Fidelity’s analysis, particularly resonates with institutional frameworks. Post-Merge Ethereum already demonstrated how network activity generates yields for staked ether through transaction fees and maximal extractable value (MEV). Fusaka potentially amplifies these dynamics by increasing transaction capacity and optimising economic incentives. For institutions accustomed to evaluating assets based on income generation capacity, this evolution makes ether more comprehensible and analyzable through traditional investment lenses.

However, institutional adoption also requires addressing concerns around volatility, regulatory clarity, and operational infrastructure. While Fusaka primarily focuses on technical and economic improvements, its success in creating more stable, predictable network economics could indirectly support institutional adoption. As Ethereum demonstrates the capacity to execute complex upgrades successfully while maintaining network stability, institutional confidence in the platform’s long-term viability strengthens. This reputational dimension complements the direct economic benefits of improved network performance and clearer value accrual mechanisms.

Preparing for Implementation and Network Transition

The Fusaka upgrade’s path to mainnet activation involves careful orchestration across multiple testing phases designed to identify and resolve potential issues before they affect the live network. This methodical approach reflects lessons learned from previous major upgrades and the high stakes involved in modifying critical infrastructure securing hundreds of billions of dollars in value. Understanding the implementation timeline and preparation requirements helps stakeholders navigate the transition successfully.

The upgrade rollout follows a structured testnet sequence beginning with Holesky, progressing through Sepolia and Hoodi, before eventual mainnet deployment. Each testnet activation provides opportunities for validators, node operators, application developers, and infrastructure providers to test their systems against the new protocol rules. This phased approach allows the community to identify compatibility issues, performance bottlenecks, or unexpected behaviours in controlled environments where corrections can be implemented without risking actual assets or network stability.

For validators and node operators, preparation involves updating client software, potentially adjusting hardware configurations to accommodate increased data handling requirements, and testing operational procedures against testnet deployments. While PeerDAS reduces individual validator resource requirements in many respects, the overall increase in network capacity means operators should verify their infrastructure can handle anticipated load increases. Clear communication from client development teams and coordination through community channels helps ensure smooth transitions across diverse operational environments.

Application developers face their own preparation requirements. While Fusaka maintains backward compatibility with existing smart contracts, applications should undergo testing to ensure they perform as expected under the new protocol rules. Changes to gas pricing for certain operations, modifications to transaction size limits, and the introduction of new EVM features all create potential touchpoints requiring validation. Proactive testing during the testnet phases allows developers to identify and address issues before mainnet activation, ensuring uninterrupted service for users.

Long-Term Strategic Implications for Ethereum

Looking beyond immediate technical improvements, the Fusaka upgrade carries profound implications for Ethereum’s long-term strategic positioning within the broader blockchain ecosystem. Fidelity’s characterisation of the upgrade as signalling Ethereum’s next phase reflects recognition that this update represents more than incremental progress along an established trajectory. Instead, it marks an inflection point in how Ethereum conceptualises its role, prioritises development efforts, and positions itself competitively.

The strategic recalibration toward economically sustainable network operation addresses one of the most fundamental questions facing blockchain platforms: how to fund ongoing development, security, and innovation without centralised corporate backing or inflationary token emissions. By creating clearer mechanisms for value accrual from network usage, Ethereum establishes a self-sustaining economic model where increased adoption directly supports the resources needed for continued improvement. This virtuous cycle resembles successful technology platforms that achieve profitability, enabling reinvestment in product development.

Competitionally, Fusaka positions Ethereum to maintain leadership against emerging challenges from alternative layer-1 blockchains and evolving technological paradigms. Platforms like Solana, Avalanche, and others have gained traction partly by offering higher throughput than Ethereum’s base layer. By substantially increasing capacity while maintaining decentralisation and security guarantees, Ethereum addresses these competitive pressures without compromising its core values. The upgrade demonstrates that technical innovation remains central to Ethereum’s strategy even as the network matures.

Perhaps most significantly, Fusaka exemplifies Ethereum’s capacity for coordinated, meaningful evolution. In technology markets, the ability to adapt to changing requirements and user needs while maintaining backward compatibility and community consensus represents a critical competitive advantage. The successful conception, development, and implementation of an upgrade as complex as Fusaka demonstrates organisational capabilities that rival those of centralised technology companies, but within a decentralised governance framework. This combination of adaptability and decentralisation may prove to be Ethereum’s most durable competitive moat.

Conclusion

The Ethereum Fusaka upgrade represents far more than a technical milestone in blockchain development. As Fidelity Digital Assets’ comprehensive analysis articulates, this transformative network enhancement signals a fundamental shift in how Ethereum approaches value creation, economic sustainability, and stakeholder alignment. By consolidating development efforts around a more cohesive, economically-driven roadmap, Ethereum demonstrates the organisational maturity and strategic clarity necessary for its evolution from experimental technology to critical global infrastructure.

The upgrade’s multifaceted improvements spanning technical innovation, economic optimization, and governance evolution work synergistically to position Ethereum for its next growth phase. Enhanced layer-1 scaling through mechanisms like PeerDAS and increased block capacity address longstanding scalability challenges while creating clearer pathways for value accrual to benefit ether holders. The strategic emphasis on strengthening the base layer while supporting the layer-2 ecosystem demonstrates a sophisticated understanding of how different scaling approaches complement rather than compete with each other.

For investors, developers, validators, and users, Fusaka offers compelling reasons for optimism about Ethereum’s trajectory. The upgrade’s success would validate the platform’s capacity to execute complex technical transformations while maintaining security and stability. Its economic architecture suggests more predictable relationships between network growth and token value, supporting both institutional allocation and individual investment theses. The governance alignment it represents indicates Ethereum’s community can coordinate effectively around shared objectives even as the ecosystem grows more diverse and complex.

As December 2025 approaches and Fusaka transitions from concept to reality, the blockchain industry watches with keen interest. This upgrade will either confirm Ethereum’s ability to adapt and lead in an increasingly competitive landscape or reveal limitations in its approach to scaling and value creation. Based on the comprehensive preparation, technical soundness, and strategic coherence that Fidelity’s analysis highlights, Ethereum appears well-positioned to deliver on Fusaka’s promise and enter a new era of sustainable growth and value accrual for all ecosystem participants.

FAQs

Q: What exactly is the Ethereum Fusaka upgrade, and when will it happen?

The Fusaka upgrade is a comprehensive network enhancement combining improvements to both Ethereum’s consensus and execution layers, scheduled for implementation in December 2025. Named by merging “Fulu” and “Osaka,” the upgrade includes twelve Ethereum Improvement Proposals focused.

Q: How will Fusaka benefit ether holders specifically?

According to Fidelity Digital Assets’ analysis, Fusaka creates clearer mechanisms for value accrual by strengthening layer-1 capabilities and optimising economic incentives throughout the network. The upgrade enhances Ethereum’s pricing power and revenue-generating potential.

Q: What is PeerDAS, and why is it important for Ethereum’s scalability?

PeerDAS (Peer Data Availability Sampling) is an innovative verification mechanism that allows validators to confirm data integrity by sampling small pieces rather than downloading entire data blobs. This approach dramatically reduces bandwidth and storage requirements for individual validators while maintaining.

Q: How does Fusaka affect Ethereum’s layer-2 solutions?

Rather than competing with layer-2 networks, Fusaka enhances their effectiveness by improving the base layer infrastructure they depend upon. Increased data availability and lower costs for posting transaction data to Layer 1 make Layer 2 solutions more efficient and economical for users.

Q: What should investors watch for as Fusaka rolls out?

Investors should monitor several key indicators, including transaction throughput improvements, fee dynamics across both layer-1 and layer-2 networks, validator participation rates, and application developer adoption of new features. Fidelity’s report specifically notes the importance of watching trade.