Drawdown limiter tools have emerged as essential weapons in every serious prop trader’s arsenal, providing the critical safety net that separates professionals from gamblers. These sophisticated risk management systems can mean the difference between a thriving trading career and a catastrophic account blow-up.

The proprietary trading landscape has evolved dramatically over the past decade, with institutional-grade drawdown limiter tools becoming increasingly accessible to both individual traders and prop firms. These powerful systems automatically monitor your trading performance, enforce predetermined risk parameters, and execute protective measures before emotions can cloud judgment. Whether you’re managing a six-figure prop account or building your track record with a smaller allocation, understanding and implementing effective drawdown protection strategies is no longer optional—it’s absolutely essential for long-term success.

Modern drawdown limiter tools go far beyond simple stop-loss orders, incorporating advanced algorithms that analyze market volatility, position correlation, and portfolio heat in real-time. They serve as your trading guardian, ensuring that no single trade, trading day, or market event can derail your entire career. As we dive deeper into this comprehensive guide, you’ll discover how these tools work, why they’re crucial for prop trading success, and most importantly, how to implement them effectively in your own trading strategy.

Drawdown Limiter Tools in Prop Trading

Drawdown limiter tools represent a sophisticated category of risk management software designed specifically to protect trading Capital from excessive losses. Unlike traditional stop-loss mechanisms that operate on individual positions, these advanced systems monitor your entire portfolio’s performance and implement protective measures at the account level. They function as an automated risk manager that never sleeps, never gets emotional, and never makes impulsive decisions that could jeopardize your trading Capital.

The core principle behind drawdown limiter tools lies in their ability to define and enforce maximum acceptable loss thresholds. These tools continuously calculate your account’s peak-to-trough performance, monitoring both daily drawdown limits and maximum overall drawdown percentages. When predetermined risk parameters are approached, the system can automatically reduce position sizes, close existing trades, or temporarily halt trading activities until market conditions improve or risk levels normalize.

Key Components of Effective Drawdown Protection Systems

Professional-grade drawdown limiter tools incorporate multiple layers of protection to create a comprehensive risk management framework. The first layer typically involves real-time portfolio monitoring, where the system tracks the profit and loss impact of every open position on the overall account balance. This continuous surveillance allows for immediate response to rapidly deteriorating market conditions or unexpected volatility spikes that could threaten account stability.

The second critical component involves intelligent position sizing algorithms that automatically adjust trade sizes based on current drawdown levels and market volatility. As your account approaches predefined risk thresholds, these drawdown limiter tools progressively reduce position sizes, ensuring that subsequent trades pose minimal additional risk to your Capital base. This dynamic scaling approach helps maintain trading opportunities while strictly controlling downside exposure.

Advanced drawdown limiter tools also incorporate correlation analysis to prevent over-concentration in related market sectors or trading strategies. By analyzing the relationships between different positions, these systems can identify when seemingly diverse trades might all move against you simultaneously during market stress events. This correlation-aware protection helps prevent the kind of concentrated losses that have historically destroyed many otherwise successful trading careers.

The Critical Importance of Risk Management in Proprietary Trading

Proprietary trading presents unique challenges that make drawdown limiter tools absolutely essential for sustainable success. Unlike traditional investment approaches, where time can heal most wounds, prop traders operate under strict performance constraints and Capital allocation requirements that leave little room for significant drawdowns. Prop firms typically enforce monthly or quarterly performance standards, and exceeding maximum drawdown limits often results in immediate account termination and loss of trading privileges.

The psychological pressure inherent in prop trading can lead to devastating decision-making errors when accounts begin experiencing losses. Drawdown limiter tools remove emotional decision-making from the equation, ensuring that protective measures are implemented consistently regardless of market conditions or trader psychology. This automation proves particularly valuable during high-stress periods when manual risk management decisions are most likely to be compromised by fear, greed, or overconfidence.

Statistical Reality of Trading Losses

Professional trading statistics reveal sobering truths about the inevitability of drawdown periods in any successful trading career. Even the most successful hedge fund managers and prop traders experience significant losing streaks, with average maximum drawdowns ranging from 10% to 25% annually. Drawdown limiter tools help traders navigate these inevitable rough patches by ensuring that temporary setbacks don’t become career-ending disasters.

Historical analysis of failed trading careers reveals that catastrophic losses often stem from the absence of effective risk controls, rather than poor market analysis or timing. The most common scenario involves successful traders who become overconfident after a winning streak and abandon their risk management discipline just as market conditions turn unfavorable. Drawdown limiter tools prevent this classic mistake by maintaining consistent protection regardless of recent trading performance or trader psychology.

The compounding effect of losses makes drawdown protection even more critical than most traders realize. A 50% account drawdown requires a 100% gain to return to breakeven, while a 75% loss demands a 300% recovery just to restore the original Capital level. Drawdown limiter tools prevent these mathematically challenging recovery scenarios by capping losses at manageable levels that don’t require superhuman performance to overcome.

Types of Drawdown Limiter Tools Available

The market for drawdown limiter tools has expanded significantly, offering solutions that range from simple automated stop-loss systems to sophisticated, artificial intelligence-powered risk management platforms. Basic drawdown protection tools typically focus on account-level stop losses, automatically closing all positions when total losses reach predetermined thresholds. While simple, these tools provide essential protection for traders who lack the discipline to manually enforce their own risk limits.

Intermediate-level drawdown limiter tools incorporate dynamic risk scaling features that adjust position sizes based on current account performance and market volatility conditions. These systems recognize that risk capacity changes with both account balance and market environment, automatically increasing position sizes during favorable conditions while reducing exposure during challenging periods. This adaptive approach helps optimize risk-adjusted returns while maintaining strict drawdown protection.

Advanced AI-Powered Risk Management Systems

Cutting-edge drawdown limiter tools leverage artificial intelligence and machine learning algorithms to provide predictive risk management capabilities. These systems analyze vast amounts of market data, trading patterns, and portfolio characteristics to identify potential risk scenarios before they fully materialize. By recognizing early warning signs of market stress or strategy deterioration, AI-powered tools can implement protective measures proactively rather than reactively.

Machine learning-enhanced drawdown limiter tools continuously evolve their risk assessment capabilities by learning from historical market events and trading outcomes. These systems can identify subtle patterns that human traders might miss, such as correlations between seemingly unrelated market sectors or early indicators of strategy performance degradation. This evolutionary learning process makes the risk management system increasingly sophisticated and effective over time.

Some advanced drawdown limiter tools incorporate natural language processing to analyze market sentiment and news flow as additional risk factors. By monitoring financial news, social media sentiment, and analyst reports, these systems can identify potential market-moving events that might impact portfolio performance. This comprehensive approach to risk assessment helps traders avoid being blindsided by unexpected market developments that could trigger significant drawdowns.

How Drawdown Limiter Tools Work

The operational mechanics of drawdown limiter tools vary significantly depending on their sophistication level, but all effective systems share common core functionalities. At the most basic level, these tools continuously monitor account equity and compare current values against historical peak performance to calculate real-time drawdown percentages. This constant surveillance ensures that risk thresholds are identified and addressed immediately as they develop.

Professional-grade drawdown limiter tools operate through direct integration with trading platforms and brokerage systems, enabling real-time position monitoring and automated execution of protective measures. This integration enables the system to track the impact of every trade on overall portfolio performance, while maintaining the ability to implement immediate protective actions as needed. The seamless connection between risk monitoring and trade execution eliminates the potential for delays that can be hazardous with manual intervention.

Real-Time Risk Calculation Algorithms

Modern drawdown limiter tools utilize sophisticated algorithms to calculate multiple risk metrics simultaneously, offering comprehensive protection that extends beyond simple drawdown percentages. These systems monitor daily loss limits, maximum position sizes, sector concentration limits, and correlation-adjusted risk exposure to create a multi-dimensional risk assessment framework. This comprehensive approach ensures that potential threats are identified from multiple angles before they can have a material impact on account performance.

The calculation engines within advanced drawdown limiter tools process thousands of data points per second, including real-time market prices, position Greeks, volatility measurements, and correlation coefficients. This intensive computational process enables the system to maintain accurate risk assessments even during rapidly changing market conditions when manual calculations would be impossible to maintain effectively.

Dynamic risk weighting represents another crucial functionality of sophisticated drawdown limiter tools. These systems recognize that not all positions carry equal risk potential and adjust their monitoring intensity accordingly. High-risk positions receive more frequent evaluation and tighter control parameters, while lower-risk trades are monitored with appropriate but less intensive oversight. This intelligent resource allocation ensures maximum protection where it’s needed most.

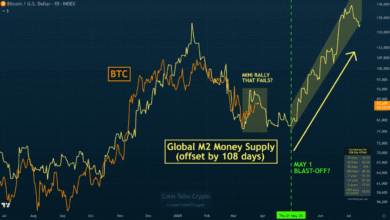

Also More: Crypto News Alert The $50 Billion Market Shift Nobody Saw Coming

Key Features to Look for in Drawdown Protection Software

Selecting the right drawdown limiter tools requires careful evaluation of features that directly impact their effectiveness in real trading environments. Platform compatibility stands as perhaps the most critical consideration, as your risk management system must integrate seamlessly with your existing trading infrastructure. Look for tools that support your specific trading platforms, data feeds, and brokerage systems to ensure reliable operation during all market conditions.

Customization capabilities represent another essential feature in professional-grade drawdown limiter tools. Different trading strategies, market environments, and risk tolerances require flexible parameter settings that can be adjusted to match your specific needs. The best systems offer granular control over risk thresholds, response mechanisms, and monitoring frequencies while maintaining user-friendly interfaces that don’t require programming expertise to operate effectively.

Alert and Notification Systems

Comprehensive alert functionality is crucial for maintaining situational awareness while your drawdown limiter tools operate in the background. Effective systems provide multiple notification methods, including email alerts, SMS messages, mobile app notifications, and desktop pop-ups, to ensure critical risk information reaches you regardless of your location or activity. These alerts should include detailed information about the specific risk condition that triggered the notification and any automated actions taken by the system.

Advanced drawdown limiter tools incorporate intelligent alert filtering to prevent notification fatigue while ensuring truly important warnings receive immediate attention. These systems learn your response patterns and risk preferences over time, adjusting their communication frequency and urgency levels accordingly. This smart filtering helps maintain alert effectiveness by avoiding the common problem of traders ignoring notifications due to excessive false alarms or minor threshold breaches.

Real-time reporting capabilities enable continuous monitoring of your risk management system’s performance and effectiveness. Quality drawdown limiter tools provide detailed analytics showing how often protective measures were triggered, their impact on overall performance, and recommendations for parameter adjustments. This analytical feedback helps optimize your risk management approach over time, providing valuable insights into the risk characteristics of your trading patterns.

Setting Up Your Drawdown Management System

Implementing drawdown limiter tools effectively requires careful planning and systematic configuration to match your specific trading approach and risk tolerance. Begin by conducting a thorough analysis of your historical trading performance to identify typical drawdown patterns, maximum loss periods, and recovery timeframes. This historical analysis provides the foundation for setting appropriate risk thresholds that protect your Capital without unnecessarily restricting profitable trading opportunities.

The initial configuration of drawdown limiter tools should reflect your prop firm’s specific requirements and your personal risk management philosophy. Most prop trading arrangements include strict maximum drawdown limits that could result in account termination if exceeded, making these hard limits the primary consideration for configuration. However, setting your internal limits significantly below these firm-imposed maximums provides an additional safety margin and helps prevent approaching dangerous territory.

Parameter Optimization Strategies

Effective parameter tuning for drawdown limiter tools involves striking a balance between protection and opportunity, ensuring that risk controls don’t eliminate profitable trading opportunities. Start with conservative settings that provide substantial safety margins, then gradually optimize based on actual trading experience and system performance data. This iterative approach allows you to find the optimal balance between protection and performance without risking significant Capital during the learning process.

Risk threshold cascading represents an advanced configuration strategy for drawdown limiter tools that implements multiple levels of protective response. Instead of a single maximum drawdown limit that triggers complete position closure, cascading systems implement progressively restrictive measures as losses mount. This might include reducing position sizes at 3% drawdown, eliminating new positions at 5% drawdown, and closing all trades at 7% maximum loss levels.

Dynamic parameter adjustment based on market volatility conditions can significantly enhance the effectiveness of your drawdown limiter tools. During periods of elevated market volatility, tighter risk controls may be appropriate to account for increased uncertainty and larger potential moves. Conversely, during stable market conditions, slightly more aggressive parameters might be justified to avoid over-restrictive trading constraints that limit profit potential.

Best Practices for Implementation

Successful implementation of drawdown limiter tools requires more than simply installing software and setting parameters. Develop comprehensive testing procedures using historical data and paper trading environments to validate your risk management system’s behavior under various market conditions. This testing phase helps identify potential configuration issues or unexpected system responses before risking real capital with the automated protection system.

Documentation of your drawdown limiter tools configuration and operational procedures is essential for consistent application and future optimization efforts. Maintain detailed records of parameter settings, trigger events, system responses, and performance outcomes to create a comprehensive knowledge base. This documentation becomes invaluable when adjusting parameters, troubleshooting issues, or explaining your risk management approach to prop firm managers or partners.

Integration with Trading Strategy

Effective drawdown limiter tools implementation requires careful coordination with your overall trading strategy and methodology. The risk management system should complement rather than conflict with your trading approach, ensuring that protective measures align with your strategy’s natural risk and reward characteristics. This integration prevents situations where the risk management system inadvertently undermines profitable trading opportunities or creates unnecessary restrictions.

Regular system maintenance and monitoring ensure that your drawdown limiter tools continue operating effectively as market conditions and trading approaches evolve. Schedule weekly reviews of system performance, alert accuracy, and parameter effectiveness to identify optimization opportunities or potential issues before they impact trading results. This proactive maintenance approach helps maintain maximum protection effectiveness over time.

Backup and redundancy planning for drawdown limiter tools provides essential protection against system failures during critical periods. Implement multiple communication channels for alerts, maintain backup power supplies for critical systems, and develop manual override procedures for emergency situations. This comprehensive backup planning ensures that your risk protection remains operational even in the event of unexpected technical difficulties or infrastructure problems.

Common Mistakes to Avoid

One of the most dangerous mistakes traders make with drawdown limiter tools is setting overly aggressive parameters that provide inadequate protection during genuine market stress events. The temptation to maximize profit potential by loosening risk controls often leads to catastrophic losses when unexpected market conditions exceed the trader’s risk tolerance. Conservative initial settings, with gradual optimization based on actual experience, provide a much safer implementation approach.

Over-reliance on automated systems without maintaining manual oversight represents another critical error in the implementation of drawdown limiter tools. While these systems provide excellent protection, they cannot anticipate every possible market scenario or account for unique circumstances that might require human intervention. Maintain active monitoring capabilities and decision-making authority to override automated systems when appropriate.

Configuration and Monitoring Pitfalls

Failing to regularly update and optimize drawdown limiter tools’ parameters as trading performance and market conditions evolve can significantly reduce their effectiveness over time. Static configurations that worked well during initial implementation may become inappropriate as your trading approach matures or market volatility patterns change. Schedule regular parameter reviews and optimization cycles to maintain optimal protection levels.

Inadequate testing and validation of drawdown limiter tools before live implementation have destroyed many otherwise promising trading careers. Always thoroughly test new risk management systems using historical data and simulated trading environments to identify potential issues or unexpected behaviors. This testing investment pays enormous dividends by preventing costly surprises during actual trading operations.

Ignoring the psychological impact of drawdown limiter tools on trading performance can lead to overconfidence and increased risk-taking behavior. Some traders mistakenly believe that having automated protection systems allows them to take larger risks or abandon other risk management practices. Remember that these tools serve as safety nets, not licenses for reckless trading behavior.

Advanced Strategies and Techniques

Sophisticated traders can enhance the effectiveness of their drawdown limiter tools by implementing multi-timeframe risk analysis that considers both short-term and long-term performance metrics. This approach might incorporate daily maximum loss limits, weekly drawdown thresholds, and monthly performance targets to create comprehensive protection across different time horizons. Multi-timeframe analysis helps prevent both day-to-day volatility and extended losing streaks from threatening account viability.

Portfolio diversification monitoring represents another advanced application of drawdown limiter tools that goes beyond simple position-size management. These systems can track correlation exposure across different markets, sectors, and trading strategies to prevent dangerous concentration that might not be apparent from individual position analysis. This correlation-aware protection helps avoid the devastating losses that occur when seemingly diverse positions all move against you simultaneously.

Adaptive Risk Management Techniques

Machine learning integration enables the most advanced drawdown limiter tools to continuously evolve their risk assessment capabilities in response to changing market conditions and trading performance patterns. These systems analyze thousands of variables to identify subtle relationships and patterns that human analysis might miss, providing increasingly sophisticated protection as the system gains experience with your trading approach and market behavior.

Volatility-adjusted position sizing represents a powerful technique for optimizing the performance of drawdown limiter tools across different market environments. Instead of using fixed position sizes or simple percentage-based calculations, these systems adjust trade sizes based on current market volatility levels, recent performance patterns, and risk capacity assessments. This dynamic approach helps maintain consistent risk exposure regardless of changing market conditions.

Predictive risk modeling enables the most sophisticated drawdown limiter tools to identify potential problem scenarios before they fully develop. By analyzing market conditions, portfolio characteristics, and historical patterns, these systems can implement preventive measures when risk probabilities exceed acceptable thresholds. This proactive approach offers superior protection compared to purely reactive systems, which only respond after losses have already occurred.

Technology and Platform Integration

Modern drawdown limiter tools require seamless integration with contemporary trading platforms to provide real-time protection and automated response capabilities. API connectivity stands as the foundation for effective integration, enabling direct communication between your risk management system and trading platform without manual intervention delays. Ensure that your chosen tools support robust API connections with your specific trading infrastructure.

Cloud-based drawdown limiter tools offer significant advantages in terms of reliability, accessibility, and computational power compared to locally installed alternatives. Cloud systems provide 24/7 monitoring capabilities, automatic backup and redundancy, and the ability to access your risk management system from any location. This accessibility proves particularly valuable for prop traders who may need to monitor positions across different time zones or during travel.

Mobile Access and Monitoring

Mobile compatibility has become essential for professional-grade drawdown limiter tools as trading becomes increasingly mobile and global in nature. Quality systems provide full-featured mobile applications that deliver real-time alerts, position monitoring, and emergency override capabilities from smartphones and tablets. This mobile access ensures that you can respond to critical risk situations regardless of your physical location.

Data security and privacy protection represent critical considerations when selecting drawdown limiter tools, particularly for prop traders handling institutional Capital or proprietary strategies. Look for systems that implement bank-level encryption, secure data transmission protocols, and comprehensive audit trails to protect sensitive trading information. These security features become increasingly important as cyber threats targeting financial professionals continue to evolve.

Latency optimization in drawdown limiter tools ensures that protective measures are implemented with minimal delay during rapidly moving market conditions. High-frequency data processing, optimized network connections, and efficient algorithmic execution combine to provide the fastest possible response times when emergency risk management actions are required. This speed advantage can mean the difference between manageable losses and catastrophic drawdowns.

Performance Monitoring and Analytics

Comprehensive performance analytics are essential for optimizing the effectiveness of drawdown limiter tools and validating their impact on overall trading results. Quality systems provide detailed reporting on protection trigger frequency, average response times, Capital preserved through automated interventions, and opportunity costs associated with risk management actions. This analytical feedback enables continuous optimization of risk management parameters and strategies.

Historical performance tracking allows you to quantify the value provided by your drawdown limiter tools implementation over extended periods. These systems should maintain detailed records of all protective actions taken, their impact on individual trades and overall account performance, and conduct counterfactual analysis to show potential losses avoided through automated intervention. This historical analysis proves invaluable for demonstrating risk management effectiveness to prop firm managers and optimizing future parameter settings.

Risk-Adjusted Return Analysis

Advanced drawdown limiter tools incorporate sophisticated risk-adjusted return calculations that help evaluate trading performance quality beyond simple profit and loss metrics. These systems calculate Sharpe ratios, Sortino ratios, maximum drawdown recovery times, and other advanced performance metrics to provide comprehensive insight into the risk-return characteristics of your trading approach. This analysis helps identify optimization opportunities and validates the effectiveness of your risk management implementation.

Real-time performance dashboard functionality enables continuous monitoring of both trading results and the effectiveness of the risk management system. Professional drawdown limiter tools offer customizable dashboards that display current drawdown levels, proximity to risk thresholds, recent system actions, and performance trends across multiple timeframes. This visual feedback helps maintain situational awareness and supports informed decision-making about parameter adjustments or manual overrides.

Benchmark comparison capabilities allow you to evaluate your risk-adjusted performance against relevant trading benchmarks or peer performance statistics. Advanced drawdown limiter tools can compare your results against market indices, strategy-specific benchmarks, or anonymized peer data to provide context for your risk management effectiveness. This comparative analysis helps identify areas for improvement and validates your risk management approach against industry standards.

Case Studies and Success Stories

Professional prop trading firms have documented substantial improvements in trader retention and account longevity following the implementation of comprehensive drawdown limiter tools. One prominent firm reported a 60% reduction in account terminations and a 40% improvement in average account lifespan after mandating automated risk management systems for all traders. These results demonstrate the concrete value that systematic drawdown protection provides in real-world trading environments.

Individual trader success stories highlight the career-saving potential of properly implemented drawdown limiter tools. Multiple documented cases describe experienced traders who were able to survive major market events, such as the 2020 COVID crash or 2022 inflation volatility, specifically because their automated risk systems prevented emotional decision-making during periods of extreme market stress. These traders credited their risk management tools with preserving their trading Capital and careers during conditions that destroyed many of their peers.

Quantitative Impact Analysis

Statistical analysis of trading performance before and after the implementation of drawdown limiter tools consistently shows improved risk-adjusted returns, even when absolute returns remain similar. Traders typically experience reduced volatility, shorter drawdown periods, and more consistent monthly performance following systematic risk management implementation. These improvements often translate to higher profit-sharing percentages and larger capital allocations from prop firms.

Comparative studies between traders using drawdown limiter tools versus those relying solely on manual risk management reveal significant performance advantages for the automated approach. Protected traders demonstrate superior performance consistency, longer career longevity, and better psychological stability during challenging market periods. These benefits compound over time, creating substantial advantages in long-term wealth accumulation and career progression.

Institutional analysis of drawdown limiter tools’ effectiveness across multiple trading strategies and market conditions validates their universal applicability. Risk management systems prove effective across day trading, swing trading, and position trading approaches, consistently delivering value regardless of the specific trading methodology or market focus. This broad applicability makes automated risk management essential for any serious prop trading operation.

Future Trends and Developments

Artificial intelligence integration represents the next frontier in the evolution of drawdown limiter tools, with machine learning algorithms becoming increasingly sophisticated at predicting and preventing risk scenarios. Future systems will likely incorporate natural language processing to analyze news sentiment, predictive modeling to anticipate market stress events, and deep learning algorithms to identify complex pattern relationships that human analysis cannot detect.

Blockchain technology may eventually enhance drawdown limiter tools through immutable audit trails, smart contract automation, and decentralized risk assessment validation. These technological advances could provide enhanced transparency, reduced operational costs, and improved trust between traders and prop firms regarding risk management compliance and effectiveness.

Regulatory Evolution Impact

Evolving financial regulations may increase the importance and requirements for drawdown limiter tools in prop trading operations. Regulatory authorities increasingly focus on risk management practices and may eventually mandate specific automated protection requirements for prop trading firms. Staying ahead of these regulatory trends by implementing robust risk management systems now provides a competitive advantage and prepares for regulatory compliance.

Integration with alternative data sources will likely expand the capabilities of drawdown limiter tools beyond traditional market data analysis. Future systems may incorporate satellite imagery, social media sentiment, weather data, and other non-traditional information sources to provide more comprehensive risk assessment and protection capabilities. This expanded data integration could significantly enhance predictive accuracy and risk management effectiveness.

Real-time collaboration features may transform drawdown limiter tools into comprehensive risk management platforms that facilitate communication between traders, risk managers, and firm management. These collaborative systems could provide shared risk monitoring, peer performance comparison, and collective learning capabilities that enhance individual risk management effectiveness through community knowledge sharing.

Conclusion

Drawdown limiter tools have evolved from optional accessories to absolutely essential components of any serious prop trading operation. The evidence overwhelmingly demonstrates that systematic, automated risk management provides substantial advantages in terms of Capital preservation, career longevity, and long-term performance consistency. Traders who embrace these tools position themselves for sustainable success in an increasingly competitive and volatile market environment.

The implementation of effective drawdown limiter tools requires careful planning, thorough testing, and ongoing optimization to achieve maximum benefit. However, the investment in proper risk management pays enormous dividends through reduced stress, improved performance consistency, and enhanced career stability. As markets become more volatile and prop trading competition intensifies, automated risk management becomes increasingly crucial for maintaining a competitive edge.

The future belongs to traders who combine skill, discipline, and technology to create comprehensive trading systems that can survive and thrive in any market environment. Drawdown limiter tools represent a crucial component of this technological evolution, providing the foundation for sustainable prop trading success. Whether you’re just starting your prop trading journey or looking to optimize an established career, implementing professional-grade risk management tools is no longer optional—it’s absolutely essential for long-term success.

Don’t wait for a catastrophic loss to teach you the importance of systematic risk management. Start researching and implementing drawdown limiter tools today to protect your trading Capital, preserve your career, and position yourself for sustained success in the competitive world of proprietary trading. Your future trading self will thank you for making this critical investment in risk management technology.