Ethereum Exchange Outflows Hit $978M Dip Buying Signal?

Ethereum Exchange Outflows to cold storage. Discover what this massive withdrawal means for price action and market sentiment.

The cryptocurrency market has witnessed a remarkable trend in recent days as Ethereum exchange outflows have surged to an impressive $978 million. Ethereum Exchange Outflows: sparking intense debate among traders and analysts about what this significant movement means for the second-largest cryptocurrency by market capitalisation. This substantial withdrawal of ETH from centralised exchanges represents one of the largest outflow events in recent months, prompting market participants to question whether sophisticated investors are accumulating Ethereum at current price levels in anticipation of a major rally.

Exchange outflows have long been considered a bullish indicator in cryptocurrency markets, as they suggest investors are moving their assets into cold storage or self-custody wallets rather than keeping them on exchanges where they might be readily available for selling. When large volumes of any cryptocurrency exit exchanges, it typically reduces the available supply for immediate trading, potentially creating upward pressure on prices if demand remains constant or increases. The recent $978 million outflow from Ethereum exchanges has captured the attention of market observers who are attempting to decipher whether this represents strategic accumulation by institutional investors, retail dip buyers seizing an opportunity, or perhaps a combination of both forces converging at a critical market juncture.

The timing of these outflows is particularly noteworthy given the broader market context. Ethereum has experienced significant volatility in recent trading sessions, with prices fluctuating in response to macroeconomic factors, regulatory developments, and shifting sentiment within the cryptocurrency ecosystem. Understanding whether this massive outflow signals the beginning of a new accumulation phase or simply represents routine wallet management requires a deeper examination of the underlying metrics, historical patterns, and market dynamics that influence investor behaviour in the digital asset space.

Exchange Outflows and Their Market Significance

Cryptocurrency exchange outflows represent the movement of digital assets from exchange wallets to external addresses, typically private wallets controlled by individual investors or institutional custody solutions. This metric serves as a critical indicator of market sentiment because it provides insight into whether holders are positioning for long-term storage or preparing to liquidate their positions. When investors withdraw substantial amounts from exchanges, they’re essentially removing liquidity from the immediate selling pressure pool, which can have profound implications for price discovery and market dynamics.

The mechanics behind why outflows matter are rooted in basic supply and demand economics. Exchanges function as the primary venues where buyers and sellers meet to execute trades, and the amount of cryptocurrency held on these platforms represents the readily available supply that can be sold at any moment. When significant volumes flow out of exchanges, the available supply for immediate trading contracts is potentially making it more difficult for buyers to find sellers at current price levels. This supply squeeze can lead to price appreciation if buying demand remains robust or increases, as purchasers must compete for a smaller pool of available tokens.

Historical analysis of exchange flow data reveals patterns that have preceded major price movements in Ethereum and other cryptocurrencies. Notable accumulation phases have often been characterised by sustained outflow periods where investors steadily remove tokens from exchanges over weeks or months. Conversely, periods of significant exchange inflows typically precede or accompany price declines, as investors move assets to exchanges in preparation for selling. The current $978 million outflow fits the profile of potential accumulation behaviour, though confirming this interpretation requires examining additional on-chain metrics and contextual factors.

The sophistication of modern blockchain analytics has made tracking these movements increasingly precise. Data providers can now distinguish between different types of wallet addresses, identifying exchanges, mining pools, institutional custodians, and various categories of retail wallets. This granular visibility allows analysts to paint a more detailed picture of who is moving Ethereum and potentially why. The recent outflows appear to involve transfers to addresses consistent with long-term holding patterns rather than immediate redistribution to other exchanges or DeFi protocols, strengthening the accumulation hypothesis.

Breaking Down the $978 Million Ethereum Exodus

The magnitude of the recent Ethereum outflow deserves careful examination to understand its potential implications fully. At $978 million, this represents a substantial portion of the typical daily trading volume across major exchanges, and the concentration of these withdrawals within a relatively short timeframe amplifies their significance. Market data indicates that these outflows occurred across multiple exchanges rather than being isolated to a single platform, suggesting widespread accumulation behaviour rather than exchange-specific factors like maintenance, upgrades, or security concerns.

Analysing the destination addresses for these withdrawn funds provides additional insight into investor intentions. A significant portion of the outflows moved to addresses that exhibit characteristics of cold storage wallets, which are typically used for long-term holding rather than active trading. These addresses often remain dormant for extended periods, with infrequent transaction activity that contrasts sharply with the constant movement seen in exchange hot wallets or active trading addresses. The prevalence of cold storage destinations in the current outflow pattern suggests conviction among holders that Ethereum prices will appreciate over time, justifying the decision to forgo immediate liquidity in favour of security and long-term positioning.

The timing of these outflows relative to Ethereum price action adds another layer of interpretation. The withdrawals accelerated during a period when ETH prices had retraced from recent highs, creating what many traders view as an attractive entry point. This pattern is consistent with “buying the dip” behaviour, where experienced investors view temporary price weakness as an opportunity to accumulate at discounted levels. The willingness to withdraw such large amounts during a correction rather than a rally suggests confidence that the current price represents value relative to future expectations.

Exchange-specific data reveals that the outflows weren’t uniformly distributed across all platforms. Certain exchanges experienced disproportionately large withdrawals, which could indicate varying levels of user confidence, different fee structures influencing withdrawal decisions, or concentrated accumulation by specific entities with preferred exchange relationships. Major platforms, including Binance, Coinbase, and Kraken all reported significant Ethereum withdrawals, though the exact distribution varies based on which analytics provider is consulted and how they categorise wallet addresses.

Historical Context: Comparing Previous Outflow Events

Placing the current $978 million outflow in historical context helps assess whether this represents an anomalous event or part of a recognisable pattern. Ethereum has experienced several major outflow events throughout its trading history, and examining how prices behaved following these episodes provides a valuable perspective on potential future trajectories. Historical exchange data shows that substantial outflows have preceded both bullish rallies and periods of consolidation, making it essential to consider additional factors beyond the raw outflow numbers.

One of the most notable historical precedents occurred in early 2023 when Ethereum exchange balances declined significantly following the successful completion of the Merge upgrade that transitioned the network to proof-of-stake consensus. That period saw sustained outflows as investors moved ETH into staking contracts and cold storage, confident in the network’s technological advancement and long-term prospects. Prices eventually rallied substantially from the lows observed during the outflow period, validating the accumulation thesis that many analysts had proposed based on the declining exchange balances.

Conversely, not all major outflow events have immediately preceded price increases. In some instances, large withdrawals have occurred during broader market uncertainty, with investors moving assets to self-custody as a precautionary measure rather than as an accumulation strategy. These defensive outflows, while reducing exchange supply, didn’t always translate to immediate price appreciation because they reflected risk aversion rather than bullish conviction. Distinguishing between accumulation-driven and fear-driven outflows requires examining concurrent indicators like derivatives market positioning, social sentiment metrics, and broader macroeconomic conditions.

The current outflow’s characteristics more closely resemble accumulation-driven patterns than defensive withdrawals. The steady, sustained nature of the outflows rather than a panicked exodus suggests calculated positioning by informed investors. Additionally, the lack of corresponding chaos in derivatives markets or extreme volatility in spot prices indicates these withdrawals represent strategic accumulation rather than emergency risk management. This interpretation gains support from on-chain metrics showing that many receiving addresses have histories consistent with long-term holding behavior rather than short-term speculation.

The Role of Institutional Investors in Recent Outflows

Institutional cryptocurrency adoption has transformed market dynamics significantly over the past several years, and institutional behaviour likely plays a substantial role in the recent Ethereum outflow activity. Large financial entities, hedge funds, and corporate treasuries operate under different constraints and motivations than retail traders, often taking positions measured in millions or tens of millions of dollars that require careful execution and secure custody solutions. The scale of the $978 million outflow suggests institutional involvement, as retail investors typically execute smaller individual transactions that would be less likely to create such concentrated flow patterns.

Institutional investors generally favour moving assets off exchanges and into specialised custody solutions that provide enhanced security, insurance coverage, and compliance with fiduciary standards. When institutions decide to allocate capital to Ethereum, the typical workflow involves purchasing on exchanges and then promptly withdrawing to qualified custodians like Coinbase Custody, Fidelity Digital Assets, or other institutional-grade solutions. This procedural requirement means that significant institutional buying naturally manifests as exchange outflows, making flow data a useful proxy for institutional accumulation activity.

The regulatory environment surrounding cryptocurrency custody has evolved considerably, with clearer guidelines emerging about how institutions should secure digital assets. This regulatory clarity has made institutional investors more comfortable accumulating substantial Ethereum positions, knowing they can maintain custody in compliance with their governance requirements. Recent developments in cryptocurrency regulation, including progress toward spot Ethereum ETF approvals and clearer guidance from financial regulators, may have encouraged institutional allocators to increase their Ethereum exposure, contributing to the observed outflows.

Analysing wallet addresses and transaction patterns provides circumstantial evidence of institutional involvement in recent outflows. Large, round-number transactions executed during specific time windows consistent with institutional trading desks, followed by transfers to addresses associated with known custody providers, all point toward institutional accumulation. Additionally, the absence of immediate redistribution or movement into DeFi protocols suggests these holders are taking passive positions rather than actively farming yields or providing liquidity, which aligns with typical institutional investment mandates that prioritise capital preservation alongside appreciation potential.

Retail Investors and Dip Buying Behaviour

While institutional participation likely accounts for a significant portion of recent outflows, retail investor behaviour also contributes meaningfully to the overall trend. Retail traders have become increasingly sophisticated in their approach to cryptocurrency markets, with many adopting strategies previously associated primarily with institutional players. The concept of “buying the dip” has become embedded in cryptocurrency culture, with retail investors actively seeking to accumulate during temporary price retracements that they believe offer attractive risk-reward profiles.

Social media sentiment and community discussions across platforms like Twitter, Reddit, and Discord reveal that many retail investors viewed recent Ethereum price levels as presenting accumulation opportunities. Discussions frequently reference fundamental factors supporting Ethereum’s long-term value proposition, including the network’s dominant position in decentralized finance, the growing NFT ecosystem, ongoing development of layer-2 scaling solutions, and the deflationary tokenomics introduced through EIP-1559. This fundamental conviction gives retail investors confidence to accumulate during periods of price weakness that less informed participants might interpret as bearish signals.

The democratisation of cryptocurrency custody has made it easier for retail investors to withdraw assets from exchanges and maintain self-custody. User-friendly hardware wallets, software wallet improvements, and educational resources about security best practices have lowered the barriers to self-custody, encouraging retail investors to adopt the same practices as institutions by removing assets from exchanges after purchase. This behavioural shift means that retail accumulation now manifests in exchange outflow data more prominently than in earlier cryptocurrency market cycles, when many retail participants simply left assets on exchanges indefinitely.

Retail participation in recent outflows also reflects growing awareness of the risks associated with keeping cryptocurrency on centralised exchanges. High-profile exchange failures, security breaches, and regulatory actions against certain platforms have heightened consciousness about counterparty risk. Many retail investors now view the period immediately after purchasing as the optimal time to withdraw to self-custody, both to eliminate exchange risk and to signal long-term holding intentions. This risk management behaviour, when aggregated across thousands of individual investors, contributes meaningfully to overall exchange outflow volumes.

Technical Analysis and Price Implications

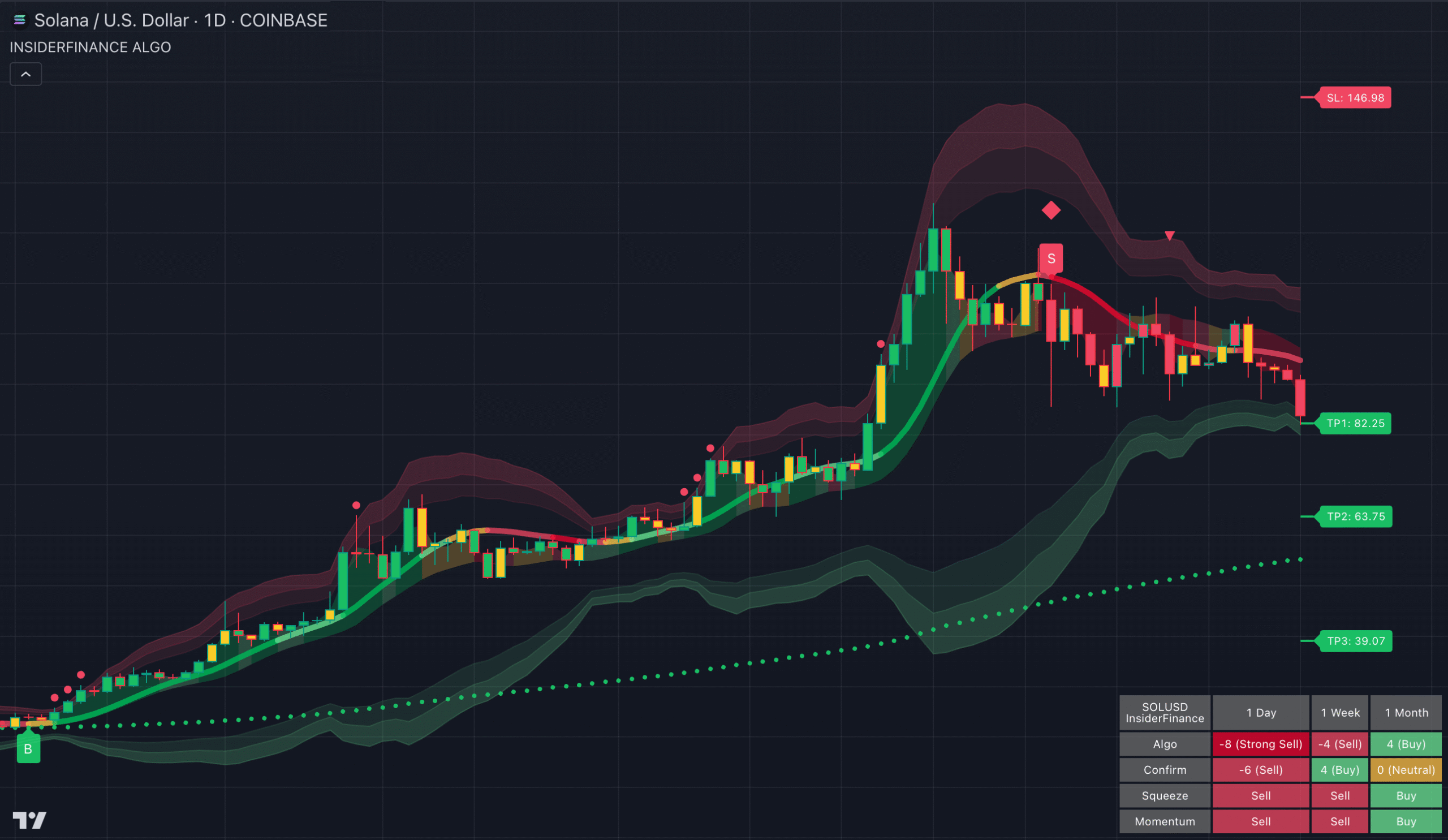

From a technical analysis perspective, the combination of substantial exchange outflows and current price levels presents an interesting setup for Ethereum. Chart patterns, support and resistance levels, and momentum indicators all factor into how traders interpret the significance of reduced exchange supply. Many technical analysts view declining exchange balances as a bullish divergence when they occur during price consolidation or retracement, suggesting accumulation at attractive levels that may precede a new upward trend.

Key support levels have held during the recent period of increased outflows, which technicians interpret as evidence that buyers are stepping in at these price points to establish positions. When support levels coincide with significant accumulation activity evidenced by exchange outflows, it reinforces the technical significance of those price levels and increases the probability that they will serve as launching points for future rallies. The current technical structure shows Ethereum maintaining key moving average support while exchange balances decline, a pattern that has historically preceded bullish price movements.

Volume analysis provides additional context for interpreting the outflows. While spot trading volumes have remained relatively stable or even increased during the outflow period, the fact that prices haven’t collapsed despite this activity suggests that selling pressure is being absorbed by determined buyers who then remove their purchases from exchanges. This dynamic creates a scenario where available supply continues to contract while demand remains robust, setting up potential for supply-demand imbalances that could drive prices higher if catalyst events trigger increased buying interest.

Derivatives market positioning offers further insight into how sophisticated traders view the market following these substantial outflows. Ethereum futures and options markets show positioning that generally supports a constructive outlook, with implied volatility levels suggesting expectations of significant price movement but without the extreme fear or complacency that often marks major turning points. Open interest in derivatives has remained healthy, indicating continued engagement from active traders, while spot market dynamics suggest long-term holders are accumulating.

Broader Market Context and Macroeconomic Factors

Understanding the recent Ethereum exchange outflows requires situating them within the broader macroeconomic environment that influences cryptocurrency markets. Digital assets don’t trade in isolation but respond to shifts in monetary policy, inflation expectations, risk appetite across traditional financial markets, and geopolitical developments. The current outflow activity occurs against a backdrop of evolving macroeconomic conditions that shape investor behaviour across all asset classes, including cryptocurrencies.

Central bank policies and interest rate trajectories significantly impact cryptocurrency valuations by influencing the opportunity cost of holding non-yielding assets and affecting overall liquidity conditions in financial markets. Recent signals from major central banks regarding their monetary policy stances have created an environment where some investors view the risk-reward profile of cryptocurrency exposure as increasingly attractive. If traditional safe-haven assets offer diminished real returns due to inflation exceeding nominal yields, alternative assets like Ethereum may attract capital from investors seeking to preserve purchasing power and capture potential appreciation.

The correlation between cryptocurrency markets and traditional risk assets like equities has fluctuated over time, and the current regime appears to show cryptocurrencies exhibiting some degree of independent behavior based on sector-specific catalysts. The technological development occurring within the Ethereum ecosystem, regulatory clarity improvements, and growing real-world utility for blockchain applications all provide fundamental support that may drive accumulation regardless of short-term movements in equity indices. Investors recognizing this potential decoupling may view current levels as attractive entry points independent of their views on traditional markets.

Geopolitical considerations also influence cryptocurrency demand, particularly in regions experiencing currency instability, capital controls, or banking system concerns. Ethereum’s role as a global, permissionless settlement layer makes it attractive for individuals and entities seeking to preserve wealth outside traditional financial infrastructure. While difficult to quantify precisely, the global nature of the recent outflows suggests that accumulation is occurring across multiple jurisdictions, potentially reflecting diverse motivations ranging from speculative positioning to genuine utility-driven demand for blockchain access and functionality.

Network Fundamentals Supporting Long-Term Value

Beyond short-term price speculation, the recent outflows may reflect growing appreciation for Ethereum’s network fundamentals and long-term value proposition. The Ethereum network continues to dominate key metrics that matter for blockchain platforms, including developer activity, total value locked in decentralised applications, transaction volumes, and the diversity of use cases being built on the platform. These fundamental strengths provide justification for long-term accumulation strategies independent of short-term price fluctuations.

The transition to proof-of-stake consensus through the Merge upgrade fundamentally altered Ethereum’s economic model, introducing deflationary token supply dynamics under certain network usage conditions. When transaction demand is sufficient, more ETH is burned through the fee mechanism than is issued to validators, creating net deflationary pressure on supply. This scarcity mechanism enhances the long-term value proposition for holders, as the total supply of ETH may actually decline over time rather than following the inflationary trajectory typical of most assets. Investors understanding these tokenomics may view current accumulation as positioning before scarcity effects become more pronounced.

Layer-2 scaling solutions built on Ethereum have matured significantly, addressing previous concerns about the network’s ability to handle mass adoption levels of transaction throughput. Projects like Arbitrum, Optimism, Base, and zkSync are processing millions of transactions at drastically reduced costs while inheriting Ethereum’s security guarantees. This scaling progress removes a major obstacle to adoption and expands the addressable market for Ethereum-based applications, strengthening the fundamental case for the network’s continued relevance and growth.

The upcoming Pectra upgrade and other planned improvements to the Ethereum protocol demonstrate continued innovation and development momentum. This ongoing evolution ensures that Ethereum remains at the forefront of blockchain technology rather than becoming obsolete as newer platforms emerge. Long-term investors considering these developmental trajectories may view current market conditions as offering accumulation opportunities before major technical upgrades potentially catalyse renewed attention and capital inflows to the ecosystem.

Conclusion

The substantial $978 million in Ethereum exchange outflows represents a significant market development that warrants careful interpretation by investors and market participants. While exchange outflows alone don’t guarantee future price appreciation, they provide valuable insight into accumulation behaviour and holder conviction that typically characterises market bottoms or consolidation phases preceding new uptrends. The combination of reduced exchange supply, strong network fundamentals, institutional adoption trends, and retail dip-buying behaviour creates a confluence of factors that support a constructive outlook for Ethereum.

However, investors should recognise that cryptocurrency markets remain volatile and subject to numerous factors beyond exchange flow data. Macroeconomic conditions, regulatory developments, technological challenges, and competitive dynamics within the blockchain space all influence Ethereum’s trajectory. The recent outflows suggest conviction among current holders and new entrants, but prudent risk management remains essential regardless of how compelling any single indicator appears.

As the cryptocurrency market continues to mature, exchange flow data has emerged as one of several valuable metrics for assessing market sentiment and potential future price movements. The current outflow pattern, when considered alongside technical factors, fundamental developments, and broader market context, presents a picture consistent with accumulation by informed investors who view current price levels as attractive relative to long-term expectations. Whether this accumulation proves prescient will become clearer as market conditions evolve and Ethereum’s adoption trajectory unfolds in the coming quarters.

FAQs

Q: What do Ethereum exchange outflows actually mean for investors?

Ethereum exchange outflows indicate that holders are moving their ETH from exchanges to private wallets or cold storage, typically suggesting long-term holding intentions rather than preparation for selling. When substantial volumes leave exchanges, the immediately available supply for trading decreases, potentially creating upward price pressure if buying demand remains constant or increases. For investors, large outflows often signal accumulation phases where sophisticated market participants are positioning for future appreciation, though outflows alone don’t guarantee price increases and should be considered alongside other market indicators.

Q: How do exchange outflows differ from exchange inflows in terms of market impact?

Exchange inflows represent cryptocurrency moving onto trading platforms, typically indicating preparation for selling or increased trading activity, which can create downward price pressure. Conversely, outflows suggest accumulation and long-term holding, reducing available supply and potentially supporting prices. Inflows during price rallies might indicate profit-taking, while outflows during corrections often suggest dip-buying behaviour. The direction and magnitude of these flows provide insight into holder sentiment and can help identify potential trend reversals or continuation patterns when analysed alongside price action and other metrics.

Q: Are exchange outflows always a bullish signal for Ethereum?

While exchange outflows generally carry bullish implications, they’re not universally predictive of immediate price increases. Context matters significantly—outflows during fear-driven market conditions might represent defensive positioning rather than confident accumulation. Additionally, large outflows to addresses that subsequently move funds to DeFi protocols or other exchanges don’t reduce available supply in the same way as movements to dormant cold storage wallets. Investors should examine outflow destinations, concurrent market conditions, derivatives positioning, and fundamental factors rather than relying solely on outflow data for investment decisions.

Q: How can retail investors track Ethereum exchange flows in real-time?

Several blockchain analytics platforms provide real-time or near-real-time tracking of exchange flows, including CryptoQuant, Glassnode, Santiment, and IntoTheBlock. These services offer dashboards showing exchange balances, net flows, and related metrics, with some providing free basic access and premium tiers for advanced features. Many analysts also share flow data insights through social media platforms like Twitter. Retail investors can combine these tools with their own on-chain analysis using blockchain explorers to verify major movements and understand the broader context of exchange flow trends.

Q: What other metrics should be considered alongside exchange outflows?

Comprehensive market analysis requires examining multiple metrics beyond exchange flows, including on-chain activity levels like active addresses and transaction volumes, derivatives market positioning such as futures open interest and options skew, staking participation rates, network fundamentals including total value locked in DeFi protocols, developer activity metrics, macroeconomic indicators affecting risk appetite, and technical price patterns with support and resistance levels. The convergence of multiple bullish indicators provides stronger conviction than any single metric alone, helping investors develop more robust views on potential market direction and timing.