Bitcoin Braces for a Critical Week Amid Tariff Jitters & Altcoin Catalysts

Bitcoin enters a pivotal week as tariff tensions roil risk assets and key altcoin events loom. Here’s what could drive BTC and majors next.

The cryptocurrency market is heading into a consequential stretch as Bitcoin Braces for a Critical tests resilience against resurgent tariff headlines while a cluster of altcoin ilestones approaches. Macro crosswinds have already rattled risk assets this month, with renewed U.S.–China trade friction seeping into crypto senti ent and price action. In parallel, structural crypto drivers—from ETF flows and regulatory decision windows to token unlock schedules—are converging to set up a volatile, opportunity-rich week for both BTC and large-cap altcoins.

Over the past several sessions, Bitcoin’s price has swung between sharp drawdowns and reflex rallies as global markets digest trade salvos, softer Chinese growth prints, and shifting expectations for TF product pipelines. Reports of a fresh chill in U.S.–China ties, including tougher tariff rhetoric and trade distortions, have tracked with BTC’s intraday whipsaws—most recently a selloff toward the lower $100Ks followed by a rebound back above the $110K handle, according to market coverage that tied the bou to ebbing jitters. Meanwhile, China’s latest data pointed to slower Q3 growth as tariffs and weak domestic demand bit into momentum—another macro signal traders are watching for crypto beta.

At the same time, the ETF narrative rem ns a powerful force. October opened with record crypto ETF inflows and new fund proposals even as regulators flagged concerns around leveraged products and a U.S. government shutdown s wed file processing. This unusual mix—robust demand but regulatory bottlenecks—has left markets hypersensitive to headlines, particularly around altcoin ETF prospects that could expand institutional access beyond BTC and ETH. In this deep dive, we map the macro, on-chain, and market-structure pressures that could define the week ahead for Bitcoin, then break down the key altcoin events that deserve a place on any trader’s watchlist.

Macro Crosswinds Put Bitcoin’s Risk Appetite to the Test

Tariff tensions reprice risk and revive correlation spikes.

Tariff stories tend to hit the same channels that influence crypto: global growth expectations, cross-asset risk appetite and the U.S. dollar. Fresh signs of trade strain include reports of disrupted U.S.–China commodity flows—for example, China importing no U.S. soybeans in September for the first time since 2018, a headline that underscored the extent f current frictions. While soybeans aren’t crypto, the signal is macro: persistent tariff frictions feed uncertainty, nudge safe-haven behavior, and can compress liquidity in speculative corners of the market where Bitcoin trades.

Those jitters have shown up in BTC’s intraday path, with selloffs toward ~$103–$104K followed by rebounds above $11 as the tone shifts. Coverage over the past week linked the price slump to tariff headlines and then to a relief bounce as tens ns appeared to cool. Add in China’s slower 4.8% Q3 growth as reported by the A,P and the macro mosaic looks fragile, a mix that historically increases Bitcoin Braces for a Critical volatility and can widen dispersion across altcoins as traders de-risk.

ETF flows, regulation tone, and the shutdown twist

Zooming out, crypto ETFs ar a central pillar othe f 2025 market structure. CoinShares tallied record weekly inflows of nearly $6B in early October as Bitcoin set a new all-time high above $126K, a signal of persistent i titutional demand even during macro oise. But the regulatory picture is mixed. The SEC recently signaled uncertainty around highly leveraged ETFs (3x–5x), noting potential conflicts with leverage rules—an overhang that could dampen the most aggressive product launches and modulate short-term speculative flows.

Complicating matters, a U.S. government shutdown h throttled the speed of regulatory review. Despite that, new crypto ETF filings have continued, including fresh staked-ETH and altcoin concepts—evidence that issuers still see substantial demand and are aring for a post-shutdown review sprint. For Bitcoin, the takeaway is twofold: net ETF demand remains a bullish anchor, but headline risk around product approvals can introduce abrupt swings.

Bitcoin’s Technical and Behavioral Setup Into the Week

Levels that matter after the October shakeout

After printing a new high above ~$126K earlier in the month, BTC retraced into the $100K–$110K zone before st b lizing above $110K on renewed dip demand. Commentary across outlets pegs $110K as a near-term battleground, with bulls eyeing a reclaim toward the $118K–$122K pocket and bears defendi g a break lower into the $105K–$108K shelf. The path from here likely hinges on news flow: harsher tariff rhetoric or weak global growth prints can pressure bids, whereas constructive ETF developments or softer dollar impulses could re-ignite upside momentum.

Positioning, liquidity pockets, and volatility clusters

Short-term volatility clu t rs tend to form around event-heavy weeks. With macro headlines live and several altcoin catalysts on deck, liquidity may fragment, producing sharper move n thinner order books outside U.S. hours. A practical implication for traders: expect faster travel between support/resistance zones and be mindful of slippage on stop-driven breakouts or breakdowns.

Altcoin Catalysts The Events That Could Steal the Spotlight

ETF watch decision windows, new filings, and expanding access

A marquee storyline is wheth r altcoin ETFs will inch closer to reality. Several outlets have pointed to an unusually compressed October decision window for XRP-related filings, produced by prior deadline extensions; though the government shutdown has clouded precise timing, the core idea remains: multiple altcoin products are stacking up for ev t l review once normal operations resume. More broadly, industry coverage tracks a growing roster of ETF proposals—spanning staked ETH to single-asset altcoins—that, once processed, could diversify institutional flows beyond Bitcoin and Ethereum.

Why this matters for the week ahead: Even in the absence of approvals, headlines about filings, comment periods, and iss er updates can move SOL, XRP, ADA, and LTC. Markets are forward-looking; credible signals of future access can pull returns forward, especially in coins with liquid derivatives markets.

Network upgrade aftermaths and ecosystem health checks

Some “events ahead” are less about a singl d te and more about post-upgrade adoption. Ethereum’s Pectra upgrade activated in May, and Dencun earlier in 2024 reset the economics for L2s and tooling; dev docs and roadmaps emphasize ongo ng user, validator, and developer benefits. That backdrop continues to shape ETH and L2 sentiment as projects showcase cost savings and throughput gains, themes likely to feature in team updates this week.

Similarly, Cardano’s Chang/Plomin hard fork, completed in January, inaugurated community governance and has kept ADA watchers focused on treasury proposals an g vernance tooling that roll out in waves. Any near-term governance milestones, treasury votes, or partner integrations can influence ADA flows into and through the week.applyy overhangs that markets can’t ignore

A less glamorous bu v ry real driver is token unlock schedules. Several dashboards track weekly unl ck across major L1s/L2s and DeFi protocols. These events can expanthe d circulating supply and nudge prices if liquidity is thin o i recipients redistribute into the market. Unlock calendars from reputable data aggregators (e.g., DeFiLlama and CryptoRank) are worth consulting as you plan exposures this week.

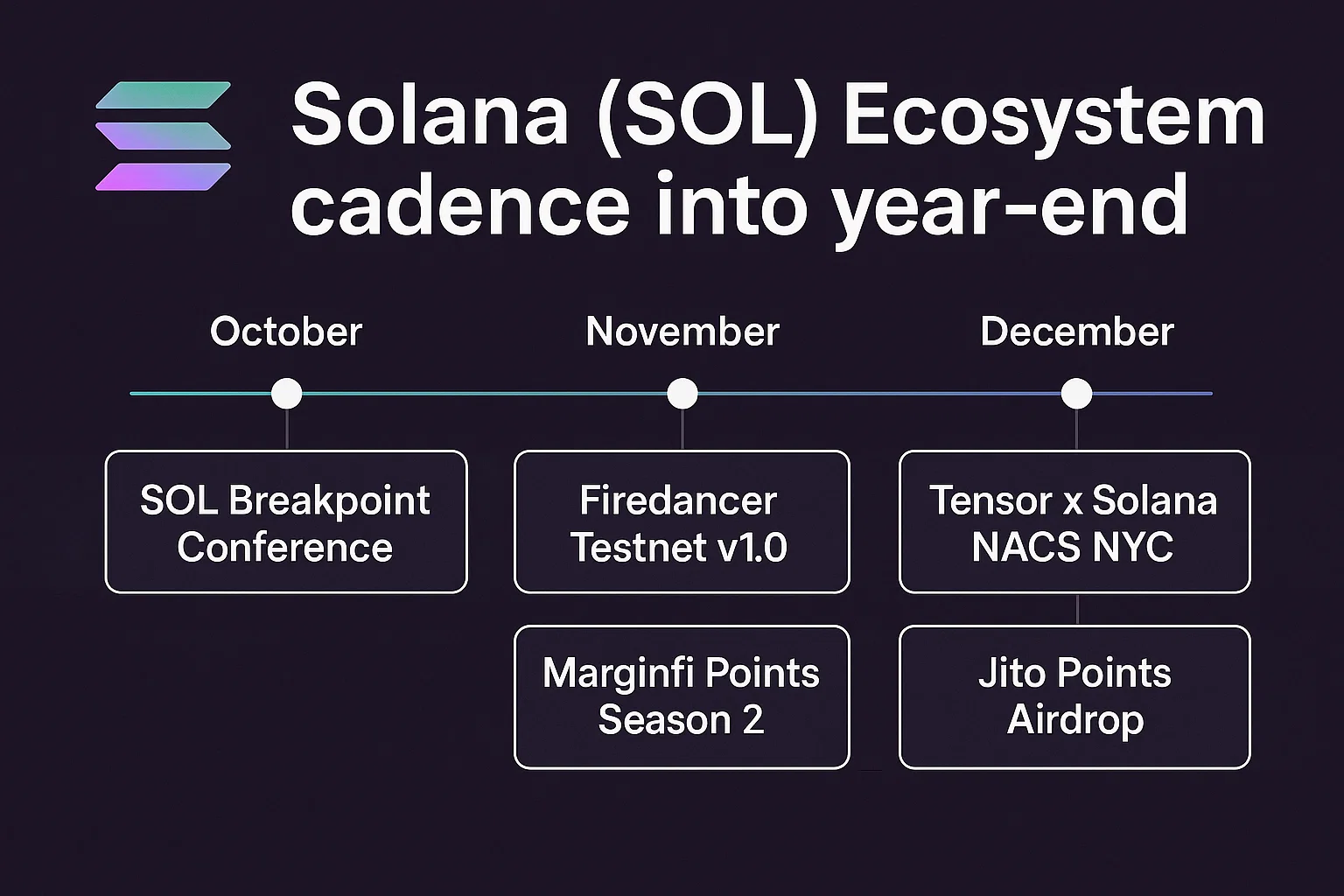

Conferences and announcements quieter calendar, targeted headlines

While flagship events like Solana Breakpoint are slated for December, project-level announc me ts and dev updates still drop year-round. Traders should keep an eye on ecosystem blogs, governance forums, and issuer press for product launches, roadmap tweaks, incentive programs, or bug-bounty outcomes (e.g., Ripple’s security “Attackathon” for XRPL’s new institutional lending protocol) that can create idiosyncratic moves in the majors.

What Tariff Tensions Mean for Crypto in Practice

Playbook for a trade-war headline tape

Tariffs ca i fluence crypto through multiple channels. First, they tend to strengthen the U.S. dollar in risk-off ph ses, which often inversely pressures BTC. Second, they can sap global growth, ed cing the appetite for speculative assets. Third, they amplify headline volatility, which increase l quidation risk on over-levered positions. The latest trade headlines—from commodity flow distortions to high-level tariff threats—are reminders that macro can trump micro for stretches, even in crypto.

Tactically, watch how Bitcoin trades versus traditional r sk proxies (equities, EM FX) on tariff days. A re-correlation spike—BTC dropping alo gs de equities—would signal macro dominance. Conversely, if BTC shrugs off trade shocks while ETF flows remain strong, it would reinforce the “digital gold + risk hybrid” thesis that helped power October’s early highs.

Regulation headline risk cuts both ways.

Regulatory noise often clusters: the same week you get record ETF inflows, you might also get ca tionary remarks about leveraged products. The SEC’s recent comments that approvals for 3x–5x leveraged ETFs are uncertain serve as a reminder that not all product innovation is green-lit, and that ris -a plifying structures face higher scrutiny. For altcoins, that means the first wave of ETFs—when the shutdown ends—will likely focus on spot exposure and conservative structures rather than aggressive leverage.

Deep Dive Coin-by-Coin Watchlist for the Week

Bitcoin (BTC) Range navigation with ETF undercurrents

The central question for Bitcoin is whether $110K c n ransform from a pivot into a springboard. If tariff news softens and ETF tone stays constructive, BTC has room to challenge the mid-$110Ks to low-$120Ks suppl z ne cultivated during the latest drawdown. Should trade fears escalate, watch for revisits toward the $10 K– 108K shelf where bids previously emerged. Market coverage this month captured BTC’s push to a new ATH and its fast retracements—conditions that reward disciplined risk frameworks and avoid late momentum chasing.

Ethereum (ETH) Post-Pectra digestion and L2 throughput

With Pectra live and Dencun already reshaping data costs, ETH is in a consolidation phase where adoption metrics—L2 activity, rollup economics, nd builder velocity—matter as much as price. Expect ecosystem updates rather than core-protocol headlines this week; still, any ETF-related signals for staked ETH or ETH-adjacent products can jolt the tape.

XRP Decision-watch and infra progress

Multiple reports and analyst notes have flagged October as a pivotal month for XRP ETF decisions due to prior deadline bunch ng even as the shutdown blurs exact timing. Markets will trade the headlines and hints: issuer updates, pro ed ral notices, or post-shutdown timetables. Separately, security initiatives around XRPL’s institutional lending protocol—like the Ripple-Immunefi “Attackathon”—reinforce ongoing infrastructure build-out.

Solana (SOL) Ecosystem cadence into year-end

No marquee conference this week, but Solana continues to benefit from strong developer engagement ahead of December’s Breakpoint in Abu Dhabi, where proje ts typically time releases and partnerships. Any pre-announcements, hackathon results, or program launches can keep SOL in focus even if macro dominates.

Cardano (ADA) Governance era follow-through

With Chang/Plomin activated in January, the narrative for ADA this week ce ters on governance and ecosystem funding. Watch for treasury-related proposals and tooling rollouts that signal how the new structure directs capital and incentives—key for medium-term adoption.

Polygon (POL) Transition milestones and liquidity migration

The ongoing Polygon 2.0 migration ro MATIC to POL remains a structural theme. Phase-by-phase updates matter for delegators, validators, and liquidity providers; any re h guidance or timelines can affect flows. Coverage in recent weeks has focused on how PIP-18, staking-layer changes, and sequencer architecture fit togethera —context that’s useful as markets price in progress markers.

Arbitrum (ARB) DAO programs and ecosystem funding

Ecosystem posts, such as the October OpCo update, help map gr nt , growth initiatives, and treasury usage. These don’t always move price intraday, but they set fundamental tothe ne for Total Value

Strategy Notes for Traders and Long-Term Investors

Respect the calendar—and the headlines

This week’s macro calendar is thin on bl ckbuster data but heavy on headline risk. Tariff soundbites can arrive a o d hours, igniting BTC and altcoin swings. Align entries around liquidity windows, avoid clustered stops in obvious zones, and size positions to survive overnight tape bombs.

Balance spot conviction with derivatives prudence

If you carry spot Bitcoin or blue-chip altcoins for the ETF-driven adoption cycle, consider using options or smaller futures hedges during headline-he vy periods instead of exiting core exposure. That can preserve longer-term theses while dampening drawdowns when macro noise spikes.

Track unlocks and governance threads.

For altcoins, weekly token unlocks and on-chain govern nc votes can be just as important as macro. Even modest emissions can tilt up ly-demand scales if order books are thin. Keep a separate watchlist for unlock dates from trusted dashboards and revisit position sizing around those windows.

Separate structural from cyclical

Structural forces—ETF inflows, protocol upgrades, institutional adoption—are trending supportive, as evidenced by early-Octo er flow data and continuing issuer interest. Cyclical forces—tariff threats, growth scares, leve ag washouts—can dominate for days or weeks. Let timeframe dictate reaction: traders respect the cycle; investors anchor to the structure.

Bottom Line

Bitcoin enters a critical week with macro winds swirling and al coin catalysts ready to spark dispersion. Trade-war tariff tensions continue to pulse through risk assets, influencing BTC’s path around the crucial $110K pivo. At the same time,e ETF headlines and product pipelines keep institutional capital in the conversation—even amid regulatory caution on leverage and a government shutdown that slows formal approvals.

For altcoins, watch the ETF decision chatter, token unlock calendars, and ecosystem updates across Ethe eu , Cardano, Solana, Polygon, and Arbitrum. In a week where narratives and numbers collide, disciplined risk management and a sharp event calendar are your best edge.

FAQs

Q Why do tariff headlines impact Bitcoin and crypto so quickly?

Tariff shocks ripple through the U.S. dollar, global growth expectations, and risk appetite—t e ame channels that influence crypto flows. When trade tensions escalate, investors often de-risk, which can pressure Bitcoin and lt oins in lockstep with equities and EM FX. Recent reports on disrupted U.S.–China trade and slower Chinese growth illustrate the macro sensitivity.

Q Are crypto ETFs still a maj r river after the early-October surge?

Yes. Early October saw record weekly inflows into crypto ETFs and a fresh wave of filin s, signaling durable institutional interest. Even with review delays during the shutdown and caution around leveraged products, the structural demand trend remains supportive for BTC and, eventually, for select altcoins as products broaden.

Q Which altcoin events should I watch most closely this week?

Focus on potential XRP ETF decision chatter, any issuer updates across altcoin filings, and project-level announcements from ecosystems such as Ethereum (post-Pectra adoption), Cardano (governance era rollouts), Polygon (2.0/ OL milestones), and Arbitrum (DAO programs). Token unlock schedules can also drive idiosyncratic volatility.

Q How should traders think about positioning aroun $ 10K BTC?

Treat $110K as a tactical pivot. Positive ETF headlines or calmer tariff rhetoric could see tests of the $118K–$122K zone; harsher trade noise risks revisits toward $105K–$108K supp rt highlighted in recent market commentary. Consider staggered entries, wider stops in volatile hours, and optionali y or hedging.

Q I’m a long-term investor. Should I change my plan be au e of this week’s headlines?

Probably not. If your thesis centers on institutional adoption, ETF access, and protocol u gr des, the structural story remains intact. Use headline-driven dips to optimize co t asis rather than to abandon the strategy. That said, maintain a cash buffer and avoid ev rage that forces selling into volatility. October’s flow data and pipeline developments support patience.

See More: Bitcoin Fragile Support and the Rapidly Shifting Altcoin Landscape