NFT Flywheel Coins Top Strategy Tokens by Market Cap

NFT Flywheel Coins by market cap. Learn how these crypto tokens create sustainable growth through innovative tokenomics.

NFT strategy flywheel coins, which utilize self-reinforcing mechanisms to create value for holders while expanding their market presence. NFT Flywheel Coins: These digital assets represent a new generation of blockchain projects that combine the uniqueness of NFTs with the liquidity and utility of traditional cryptocurrencies, NFT Flywheel Coins: establishing powerful economic flywheels that benefit all participants in their ecosystems.

Understanding the landscape of top NFT Flywheel Coins: NFT strategy flywheel coins by market cap requires examining how these projects structure their tokenomics, incentive mechanisms, and community engagement strategies. Unlike conventional cryptocurrencies that rely solely on speculation or simple utility, flywheel-based tokens create interconnected systems where increased adoption leads to enhanced value, NFT Flywheel Coins, which in turn drives further adoption. NFT Flywheel Coins: This virtuous cycle forms the foundation of sustainable growth in the rapidly evolving digital asset marketplace, NFT Flywheel Coins: making these projects particularly attractive for investors seeking long-term value appreciation rather than short-term speculation.

The concept of a flywheel strategy in the context of NFT-related tokens draws inspiration from traditional business models where initial momentum gradually builds upon itself, creating increasingly powerful effects over time. In the blockchain space, this translates to mechanisms where user participation, token utility, NFT creation, marketplace activity, and community governance work in harmony to strengthen the overall ecosystem. Projects that successfully implement these strategies often demonstrate remarkable resilience during market downturns and exceptional growth during bullish periods, making them standout performers in terms of market capitalization and investor confidence.

The NFT Strategy Flywheel Concept

The flywheel effect in business describes a situation where initial effort gradually builds momentum until the system operates with minimal additional input, generating continuous returns. When applied to NFT strategy tokens, this concept becomes particularly powerful because it combines multiple revenue streams and engagement mechanisms into a single, self-sustaining ecosystem. The fundamental principle involves creating interconnected systems where each component strengthens the others, resulting in exponential rather than linear growth patterns.

At its core, an NFT strategy flywheel operates through carefully designed tokenomics that incentivize specific behaviors within the ecosystem. When users purchase and hold the native token, they gain access to exclusive NFT drops, governance rights, staking rewards, or marketplace fee reductions. These benefits encourage long-term holding, which reduces circulating supply and creates upward pressure on token prices. As token values increase, the project gains visibility and attracts new participants, who bring additional capital and creativity to the ecosystem. This influx of new members increases NFT trading volume, generates marketplace fees, and creates demand for the native token, thereby completing and reinforcing the cycle.

The most successful flywheel mechanisms in the NFT space incorporate multiple feedback loops that operate simultaneously. For example, a project might combine staking rewards with NFT yield farming, where holders can stake their tokens to earn passive income while also receiving opportunities to mint exclusive NFTs. These NFTs might then provide additional utility within the ecosystem, such as enhanced voting power in governance decisions or access to premium features. Meanwhile, marketplace transactions generate fees that are redistributed to token holders or used to buy back tokens from the market, creating deflationary pressure that supports long-term value appreciation.

How Market Capitalization Reflects Flywheel Success

Market capitalization serves as a crucial indicator of a project’s overall health and the effectiveness of its flywheel strategy. Projects with higher market caps have typically demonstrated their ability to attract and retain significant capital, suggesting that their economic models resonate with investors and users. When evaluating NFT strategy flywheel coins, market cap provides insight into community trust, liquidity depth, and the project’s capacity to weather market volatility without collapsing under selling pressure.

The relationship between flywheel effectiveness and market capitalization is not merely coincidental. Projects that successfully implement self-reinforcing growth mechanisms naturally attract larger investment pools because investors recognize the sustainability of their business models. Unlike purely speculative tokens that experience boom-bust cycles, flywheel-based projects demonstrate more stable growth trajectories punctuated by periods of rapid expansion when network effects reach critical mass. This stability appeals to institutional investors and cautious retail participants who prioritize capital preservation alongside growth potential.

Examining the top projects by market capitalization reveals common characteristics that distinguish successful flywheel implementations from failed attempts. These projects typically feature robust developer ecosystems, active community governance, diversified revenue streams, and continuous innovation in their NFT offerings. They also demonstrate transparency in their tokenomics and maintain consistent communication with their communities, building trust that translates into sustained demand for their tokens. The market cap rankings essentially serve as a real-world validation mechanism, separating projects with genuine utility and sustainable economics from those relying on hype and speculation.

Leading NFT Marketplace Tokens and Their Flywheel Mechanisms

NFT marketplace tokens represent one of the most prominent categories within the NFT strategy flywheel landscape. These platforms facilitate the buying, selling, and trading of digital collectibles while their native tokens power various aspects of the ecosystem. The flywheel effect in marketplace tokens operates through transaction fees, staking mechanisms, and exclusive benefits that encourage both traders and collectors to accumulate and hold the platform’s native cryptocurrency.

Major marketplace tokens have established themselves through strategic positioning and continuous innovation. Their flywheel strategies typically involve redistributing a portion of trading fees to token holders, creating immediate value for long-term investors. As trading volume increases on the platform, fee generation rises proportionally, making token ownership more attractive and driving additional demand. This increased demand elevates token prices, which enhances the platform’s visibility and credibility, attracting more users and artists to list their NFT collections. The cycle intensifies as larger collections and higher-profile artists bring their audiences to the platform, exponentially increasing the potential trading volume.

The tokenomics design of leading marketplace platforms demonstrates a sophisticated understanding of incentive alignment. Many implement tiered membership systems where holding certain amounts of the native token unlocks reduced trading fees, early access to premium drops, or enhanced visibility for listed NFTs. These benefits create natural demand for the token beyond pure speculation, establishing fundamental value that supports price stability. Additionally, some platforms incorporate governance features where token holders vote on platform upgrades, fee structures, and strategic partnerships, giving the community genuine ownership and aligning long-term interests between the platform and its users.

Gaming and Metaverse NFT Tokens with Flywheel Economics

The gaming and metaverse sector has emerged as a powerful force in the NFT crypto ecosystem, with several projects achieving massive market capitalizations through innovative flywheel strategies. These projects combine play-to-earn mechanics, virtual real estate, digital asset ownership, and social interaction to create immersive ecosystems where the native token serves as both currency and governance mechanism. The flywheel effect in gaming tokens operates through player engagement, asset creation, in-game economies, and community building.

Gaming-focused flywheel tokens benefit from particularly strong network effects because each new player adds value to the ecosystem for existing participants. As player populations grow, virtual economies become more vibrant, in-game assets gain liquidity, and social features become more engaging. This increased engagement drives demand for the native token, which players need to purchase in-game items, acquire virtual land, or participate in special events. Higher token prices attract attention from both gamers and investors, bringing fresh capital into the ecosystem and enabling developers to expand features and content, which further enhances player retention and attraction.

The most successful gaming and metaverse projects demonstrate understanding that sustainable tokenomics require balancing token generation through gameplay rewards with token consumption through utility sinks. Projects that fail to manage this balance often experience hyperinflation, where excessive token supply crashes prices and destroys ecosystem value. Leading projects implement sophisticated economic models featuring crafting systems that consume tokens, marketplace fees, governance staking, and periodic token burns. These mechanisms ensure that as the player base grows, token demand increases proportionally or even exponentially, supporting long-term price appreciation while maintaining game balance and player satisfaction.

NFT Fractionalization and Liquidity Protocols: NFT Flywheel Coins

Fractionalization protocols represent an innovative category within the NFT strategy landscape, addressing one of the primary limitations of non-fungible tokens: illiquidity and high entry barriers. These platforms enable owners of valuable NFTs to divide their assets into multiple fungible tokens, allowing broader participation in high-value digital art and collectibles. The flywheel mechanism in fractionalization tokens operates through increased market accessibility, enhanced liquidity, and the creation of new financial primitives around NFT ownership.

The economic model behind fractionalization platforms creates multiple interconnected flywheels that reinforce each other. When users fractionalize their NFTs on a platform, they typically pay fees in the platform’s native token, creating immediate demand. The resulting fractional shares trade on secondary markets, generating additional transaction fees that benefit token holders. As more high-value NFTs become fractionalized, the platform gains reputation and attracts attention from collectors and investors seeking exposure to blue-chip digital assets without committing hundreds of thousands or millions of dollars. This attention increases trading volume across all fractionalized assets on the platform, multiplying fee generation and enhancing token holder rewards.

Leading fractionalization protocols have expanded beyond simple asset division to offer lending, borrowing, and yield generation opportunities built around fractionalized NFTs. These DeFi integration features create additional utility for their native tokens while deepening the flywheel effect. Token holders might stake their holdings to provide liquidity for NFT-backed loans, earning interest while supporting ecosystem functionality. They might also receive governance rights that determine which NFTs qualify for fractionalization, loan-to-value ratios, and platform fee structures. This governance participation increases token holder engagement and creates long-term commitment to the platform’s success, reducing selling pressure and supporting price stability.

Creator Economy Platforms and Their Token Strategies

Creator-focused platforms have emerged as significant players in the NFT token space, building flywheels around content creation, fan engagement, and community monetization. These projects recognize that sustainable NFT ecosystems require a constant influx of fresh, high-quality content that attracts collectors and drives marketplace activity. Their native tokens facilitate creator monetization, fan rewards, platform governance, and exclusive access to premium content, creating multi-faceted flywheel effects that benefit all participants.

The flywheel mechanism in creator economy tokens begins with attracting talented artists, musicians, writers, and other content creators to the platform. These platforms typically offer favorable revenue sharing compared to traditional Web2 alternatives, with creators retaining majority ownership of their work and earning directly from their audiences. As creators build followings on the platform, they bring their existing fan bases, who must acquire the platform’s native token to purchase NFTs, access exclusive content, or participate in creator communities. This demand drives token value appreciation, which increases the platform’s visibility and attracts additional creators seeking better monetization opportunities.

Advanced creator platforms implement loyalty and reward mechanisms that deepen community engagement and reinforce the flywheel effect. Fans might earn tokens through various activities like curating content, promoting creators, or participating in platform governance. These earned tokens can then be spent on exclusive NFT drops, premium content access, or even invested back into supporting favorite creators. Meanwhile, creators who achieve certain milestones receive bonus token allocations or reduced minting fees, incentivizing consistent content production and quality maintenance. This circular economy creates sustainable growth where increased creator success directly translates to increased fan engagement, which drives token demand and platform expansion.

Analyzing Tokenomics That Drive Sustainable Flywheels

Successful NFT strategy flywheel coins share common tokenomic features that distinguish them from projects destined for failure. Understanding these characteristics enables investors to identify legitimate long-term opportunities versus short-term speculation plays. The most critical element involves designing token distribution and utility mechanisms that align incentives across all stakeholder groups, including developers, early investors, community members, and new participants.

Sustainable tokenomics begin with a reasonable initial distribution that avoids excessive concentration in team or early investor wallets. Projects that allocate 70-80% of tokens to insiders create inherent selling pressure as these participants eventually liquidate positions, overwhelming any organic demand from the flywheel mechanism. Leading projects typically reserve 40-60% of tokens for community distribution through liquidity mining, airdrops, gameplay rewards, or creator incentives. This approach ensures that the majority of tokens rest in the hands of active ecosystem participants who have a genuine incentive to support long-term growth rather than seeking immediate exits.

The utility design of successful flywheel tokens incorporates multiple use cases that create consistent demand regardless of market conditions. Beyond speculative value, these tokens enable reduced transaction fees, exclusive NFT access, enhanced platform features, governance participation, and passive income through staking. Projects that rely solely on staking rewards often face challenges when those rewards come from token inflation rather than genuine revenue generation, creating a Ponzi-like structure that inevitably collapses. The most robust tokenomics generate real yield from platform activities like marketplace fees, subscription revenue, or in-game purchases, then distribute a portion of these earnings to token holders, creating sustainable value flow.

Risk Factors and Volatility in NFT Flywheel Investments

While NFT strategy flywheel coins offer compelling long-term growth potential, investors must understand the significant risks inherent in this emerging asset class. The cryptocurrency market generally exhibits high volatility, and NFT-focused tokens often experience even more dramatic price swings due to lower liquidity, sentiment-driven trading, and the cyclical nature of NFT market interest. Understanding these risks enables more informed investment decisions and appropriate portfolio allocation strategies.

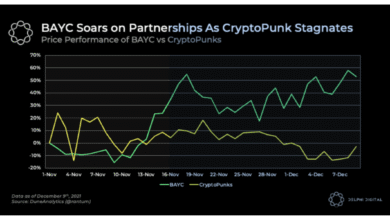

Market sentiment plays an outsized role in NFT token valuations, with hype cycles capable of driving prices to unsustainable levels, followed by devastating corrections. During bull markets, excitement around NFTs can push token prices far beyond reasonable valuations based on actual platform usage and revenue generation. Investors who purchase near cycle peaks often face extended periods of negative returns as prices normalize to levels supported by fundamental value. Additionally, the NFT market itself experiences boom-bust patterns, with trading volumes and new project launches surging during favorable conditions but contracting sharply when broader crypto markets decline or public interest shifts to other narratives.

Technical and execution risks represent another significant concern for NFT flywheel projects. Many platforms launch with ambitious roadmaps promising revolutionary features, seamless user experiences, and sophisticated economic models. However, blockchain development is complex, and numerous projects fail to deliver on their promises due to technical challenges, team inexperience, or insufficient funding. Smart contract vulnerabilities can lead to catastrophic hacks that destroy user trust and tank token values. Regulatory uncertainty adds another layer of risk, as governments worldwide continue developing frameworks for digital assets, with potential restrictions that could severely impact NFT platforms and their native tokens.

Evaluating Project Fundamentals Beyond Market Cap

While market capitalization provides useful preliminary information about NFT strategy tokens, sophisticated investors dig deeper into project fundamentals to assess true long-term potential. Several key metrics and qualitative factors separate genuinely promising projects from those riding temporary hype waves. Comprehensive evaluation requires examining technology, team expertise, community engagement, partnership networks, and competitive positioning within the broader blockchain ecosystem.

Technology assessment begins with evaluating the blockchain infrastructure supporting the NFT platform. Projects building on established, secure networks like Ethereum benefit from battle-tested security and extensive developer tooling, but may face higher transaction costs and scalability limitations. Those on newer, faster blockchains might offer better user experiences but carry risks associated with less proven technology and potentially smaller developer ecosystems. Examining whether the project has undergone professional smart contract audits, experienced security incidents, and how quickly issues were resolved provides insight into technical competency and commitment to user safety.

Team credentials and track record offer crucial signals about execution capability. Projects led by experienced blockchain developers and entrepreneurs with successful exits demonstrate a higher probability of navigating challenges and delivering on roadmaps. Anonymous teams are not automatically problematic in the crypto space, but they require extra scrutiny regarding deliverables and transparency. Community engagement metrics reveal whether the project has genuine user adoption or relies primarily on speculative interest. Active Discord servers, vibrant social media discussions, regular developer updates, and growing platform usage statistics all indicate healthy ecosystem development rather than artificial hype generation.

The Role of Community Governance in Flywheel Sustainability

Decentralized governance has emerged as a critical component of successful NFT flywheel strategies, enabling communities to guide project development and ensuring alignment between platform evolution and user needs. Token-based governance systems transform holders from passive investors into active stakeholders with genuine influence over protocol decisions, creating deeper engagement and long-term commitment that reinforces the flywheel effect.

Well-designed governance mechanisms strike a balance between accessibility and plutocracy prevention. Simple token-weighted voting systems often result in whales dominating decision-making, potentially prioritizing their interests over broader community benefit. Advanced governance models implement quadratic voting, time-locked voting power, or participation-based reputation systems that give voice to engaged community members regardless of token holdings. These sophisticated approaches encourage meaningful participation from diverse stakeholder groups, resulting in decisions that consider multiple perspectives and support long-term ecosystem health rather than short-term token price manipulation.

The scope of community governance varies significantly across NFT platforms, with some limiting decisions to relatively minor parameters while others enable fundamental protocol changes. Successful projects typically start with centralized development during early stages when rapid iteration and technical expertise are crucial, then gradually increase community control as the platform matures and token distribution broadens. Governance domains might include marketplace fee structures, new feature prioritization, treasury fund allocation, partnership approvals, and token emission schedules. Transparent governance processes with clear proposal mechanisms, discussion periods, and implementation timelines build trust and demonstrate respect for community input, strengthening long-term holder conviction.

Integration of DeFi Mechanisms in NFT Ecosystems

The convergence of decentralized finance and non-fungible tokens has created powerful synergies that enhance flywheel dynamics for leading projects. DeFi integration enables NFT holders to unlock liquidity from their assets without selling, provides yield opportunities for token holders, and creates sophisticated financial instruments around digital collectibles. These features expand addressable markets and add fundamental value that supports token price appreciation.

NFT-collateralized lending represents one of the most impactful DeFi integrations, allowing collectors to borrow against their digital assets while maintaining ownership and potential price appreciation exposure. Platforms offering this functionality typically require their native token for various aspects of the lending process, such as paying interest, accessing premium loan terms, or providing liquidity to lending pools. As NFT lending volume grows, demand for the platform token increases, driving price appreciation that attracts additional users and liquidity providers, thereby reinforcing the flywheel. These lending protocols must carefully manage risk through conservative loan-to-value ratios, reputable NFT collection whitelisting, and liquidation mechanisms that protect lenders.

Yield farming and liquidity provision opportunities create additional token utility while deepening flywheel effects. Token holders might provide liquidity for NFT-to-token trading pairs on decentralized exchanges, earning trading fees and bonus token emissions. They might stake tokens in various protocol mechanisms to secure the network, participate in governance, or underwrite platform activities, receiving rewards that create passive income streams. Some platforms implement revenue-sharing models where protocol earnings from marketplace fees, lending interest, or other activities flow directly to staked token holders, creating genuine yield not dependent on inflationary token emissions. These real yield mechanisms establish fundamental value floors that support prices during market downturns.

Future Trends Shaping NFT Strategy Token Landscapes

The NFT token ecosystem continues evolving rapidly, with several emerging trends poised to reshape competitive dynamics and create new opportunities for flywheel strategies. Understanding these trends enables investors to identify projects positioned for future growth and avoid those likely to be disrupted by technological advancement or shifting user preferences.

Cross-chain interoperability represents a major frontier for NFT platforms, with projects developing solutions that enable seamless asset transfers and user experiences across multiple blockchains. Platforms that successfully implement cross-chain functionality can access liquidity and user bases from diverse blockchain ecosystems, dramatically expanding their addressable markets. NFT Flywheel Coins: Their native tokens may serve as a universal currency across chains or provide governance for multi-chain protocols, creating demand from users across the entire crypto landscape rather than single blockchain communities. NFT Flywheel Coins: As blockchain fragmentation continues with new Layer 1 and Layer 2 networks launching regularly, interoperability solutions become increasingly valuable.

Artificial intelligence integration offers another transformative trend, with platforms incorporating AI-generated content, automated curation, NFT Flywheel Coins: predictive pricing, and personalized user experiences. Projects combining NFTs with AI might enable users to create unique digital art through text prompts, with the platform token required to access generation tools or mint creations. AI-powered recommendation engines could help collectors discover NFTs matching their preferences, NFT Flywheel Coins: with the platform earning fees on resulting transactions. These innovations differentiate platforms in an increasingly crowded market and create additional utility for native tokens, NFT Flywheel Coins: strengthening their flywheel mechanisms and supporting long-term value appreciation.

Conclusion

The landscape of top NFT strategy flywheel coins by market cap represents one of the most dynamic and innovative sectors within the broader cryptocurrency ecosystem. NFT Flywheel Coins: These projects demonstrate how thoughtfully designed tokenomics, NFT Flywheel Coins: combined with genuine utility and engaged communities, can create self-reinforcing growth mechanisms that generate sustainable value over extended periods. From marketplace platforms facilitating billions in trading volume to creator economy tools empowering digital artists, from gaming ecosystems hosting millions of players to fractionalization protocols democratizing access to valuable collectibles, NFT Flywheel Coins: the diversity of successful flywheel implementations showcases the versatility and potential of this approach.

Understanding the mechanics behind successful flywheels requires looking beyond simple metrics like market capitalization to examine the underlying economic models, community engagement strategies, technological foundations, NFT Flywheel Coins, and competitive positioning that separate temporary hype from lasting value creation. NFT Flywheel Coins: Projects that align incentives across all stakeholder groups, NFT Flywheel Coins: continuously innovate in response to user needs, maintain transparent governance, and generate real revenue that flows to token holders demonstrate the characteristics most likely to produce long-term success.

For investors navigating this space, NFT Flywheel Coins: thorough due diligence remains essential. While the flywheel concept offers compelling logic for sustainable growth, execution challenges, technical risks, regulatory uncertainty, NFT Flywheel Coins, and market volatility create significant hazards that can devastate unprepared portfolios. Diversification across multiple projects, position sizing appropriate to risk tolerance, NFT Flywheel Coinsand continuous monitoring of project developments and competitive dynamics provide sensible approaches to participating in this exciting asset class. As the NFT market matures and mainstream adoption increases, NFT Flywheel Coins: tokens powering the most effective flywheel strategies stand positioned to deliver substantial returns to patient, NFT Flywheel Coins: informed investors who recognize the transformative potential of digital ownership and decentralized creator economies.

FAQs

Q: What exactly is an NFT strategy flywheel coin, and how does it differ from regular cryptocurrencies?

An NFT strategy flywheel coin is a cryptocurrency token specifically designed to create self-reinforcing growth through interconnected mechanisms within an NFT ecosystem. NFT Flywheel Coins: Unlike regular cryptocurrencies that may serve as simple payment methods or stores of value, NFT Flywheel Coins: these tokens integrate with NFT platforms to provide utility like reduced marketplace fees, NFT Flywheel Coins: governance rights, NFT Flywheel Coins: staking rewards, and exclusive access to digital collectibles.

Q: How can I identify which NFT flywheel tokens have the strongest fundamentals?

Identifying strong NFT flywheel tokens requires examining multiple factors beyond market capitalization. NFT Flywheel Coins: Look for projects with transparent tokenomics that clearly explain how tokens are distributed, used, and how value flows back to holders. NFT Flywheel Coins: Evaluate whether the platform generates real revenue from activities like marketplace fees or subscriptions NFT Flywheel Coins rather than relying solely on new investment inflows.

Q: Are NFT strategy flywheel coins suitable for long-term investment or just short-term trading?

NFT strategy flywheel coins can serve both purposes depending on the project and investor strategy, NFT Flywheel Coins, but their design philosophy inherently favors long-term holding. NFT Flywheel Coins: The flywheel mechanism requires time to build momentum, NFT Flywheel Coins: with network effects and token utility becoming more powerful as ecosystems mature and user bases expand.

Q: What are the biggest risks associated with investing in NFT flywheel tokens?

Several significant risks accompany NFT Flywheel Coins: NFT flywheel token investments. Market sentiment volatility can cause dramatic price swings unrelated to fundamental value. NFT Flywheel Coins: with hype cycles pushing valuations to unsustainable levels, followed by severe corrections. NFT Flywheel Coins: Technical risks include smart contract vulnerabilities that could result in loss of funds, NFT Flywheel Coins: scalability limitations that degrade user experience, NFT Flywheel Coins: or execution failures where teams cannot deliver promised features.

Q: How do marketplace fees and revenue sharing contribute to the flywheel effect in these tokens?

Marketplace fees and revenue sharing form crucial components of sustainable flywheel mechanisms by creating direct connections NFT Flywheel Coins: between platform activity and token holder value. NFT Flywheel Coins: When NFT platforms charge fees on transactions and distribute a portion to token holders through staking rewards or buyback programs, NFT Flywheel Coins establish a genuine yield not dependent on inflating the token supply.