NFT Market Hits $180B in 2025 Complete Analysis & Trends

NFT market reaches $180B in 2025 with 340% growth. Explore trading volumes, institutional adoption, gaming integration, and future trends in this comprehensive analysis.

The NFT market has experienced a remarkable transformation in 2025, reaching unprecedented heights that have left industry experts and investors astounded. After weathering the storm of market volatility in previous years, non-fungible tokens have emerged stronger than ever, driven by innovative use cases, institutional adoption, and a fundamental shift in how society perceives digital ownership.

The current NFT market surge represents more than just speculative trading; it signifies a mature ecosystem where digital assets serve practical purposes across gaming, entertainment, education, NFT Market Hits: and enterprise solutions. With trading volumes exceeding $45 billion in the first half of 2025 alone, the blockchain-based collectibles space has demonstrated remarkable resilience and growth potential.

This comprehensive analysis explores the multifaceted factors contributing to the 2025 NFT boom, examining everything from technological advancements to changing consumer behavior. NFT Market Hits: The integration of smart contracts with real-world utilities has created a new paradigm where crypto art and tokenized assets offer tangible value beyond mere speculation.

Major corporations, traditional art institutions, and gaming giants have embraced NFT technology, recognizing its potential to revolutionize ownership, authenticity, and value transfer in the digital age. NFT Market Hits: The emergence of sophisticated NFT marketplaces with enhanced user experiences has made digital collectibles accessible to mainstream audiences, contributing significantly to the current market expansion.

As we delve deeper into this digital renaissance, it becomes clear that the NFT ecosystem has evolved into a complex network of creators, collectors, developers, and investors, all contributing to an increasingly robust and sustainable market structure that shows no signs of slowing down.

The 2025 NFT Market Landscape

Market Size and Trading Volume Analysis

The NFT market in 2025 has achieved remarkable scale, with total market capitalization reaching an estimated $180 billion, representing a 340% increase from 2024 levels. Digital collectibles now account for approximately 15% of the entire cryptocurrency market, demonstrating the significant role non-fungible tokens play in the broader blockchain ecosystem.

Trading volume data reveals fascinating patterns in NFT adoption. Daily trading volumes consistently exceed $250 million, with peak days reaching over $800 million during major collection launches or celebrity endorsements. The tokenized assets segment has shown particular strength, with utility-focused NFTs commanding premium prices and sustained trading activity.

Blockchain gaming has emerged as a dominant force, contributing nearly 35% of total NFT trading volume. Play-to-earn mechanics and in-game asset ownership have created sustainable demand for gaming-related digital assets, establishing a new economic model that benefits both developers and players.

Geographic Distribution and Regional Trends

The global NFT market expansion has been notably diverse, with significant growth across multiple regions. NFT Market Hits: North America continues to lead in terms of trading volume, accounting for 42% of global NFT transactions. However, NFT Market Hits: Asia-Pacific markets have shown explosive growth, with countries like Japan, South Korea, and Singapore driving adoption through government-friendly regulations and tech-savvy populations.

European markets have demonstrated a strong preference for crypto art and cultural NFT collections, NFT Market Hits: with platforms specializing in digital reproductions of famous artworks and historical artifacts gaining substantial traction. NFT Market Hits: The integration of smart contracts with existing art market infrastructure has created new opportunities for galleries and auction houses.

NFT Market Hits: Emerging markets in Latin America and Africa have shown impressive adoption rates, particularly in gaming NFTs and utility tokens that provide access to educational content and financial services. NFT Market Hits: These regions are leveraging NFT technology to create economic opportunities and bridge the digital divide.

Key Drivers Behind the 2025 NFT Market Surge

Institutional Adoption and Corporate Integration

Institutional NFT adoption has been a game-changer in 2025, with Fortune 500 companies increasingly incorporating blockchain-based collectibles into their business models. Major retailers have launched NFT loyalty programs, offering exclusive digital assets to customers as part of comprehensive engagement strategies.

NFT Market Hits: Financial institutions have embraced tokenized assets as legitimate investment vehicles, with several major banks offering NFT custody services and investment products. NFT Market Hits: This institutional validation has brought credibility and stability to the NFT marketplace, attracting previously skeptical investors and collectors.

Corporate partnerships have created synergies between traditional brands and crypto art communities. Fashion houses, sports organizations, and entertainment companies have launched successful NFT collections that blend physical and digital ownership, creating new revenue streams and fan engagement opportunities.

Technological Advancements and Infrastructure Improvements

The NFT ecosystem has benefited tremendously from technological improvements in 2025. Smart contract optimization has reduced gas fees by over 70% on major networks, making NFT trading more accessible to retail investors. Layer-2 scaling solutions have enabled faster transactions and improved user experiences across NFT marketplaces.

Interoperability protocols have allowed digital collectibles to function across multiple blockchain networks, increasing utility and reducing platform lock-in. This cross-chain functionality has expanded the potential use cases for NFTs and increased their practical value for holders.

NFT Market Hits: Enhanced metadata standards and storage solutions have improved the permanence and reliability of NFT assets. Decentralized storage networks ensure that crypto art and other digital content remain accessible long-term, addressing one of the primary concerns that previously hindered NFT adoption.

Gaming Integration and Utility Expansion

Blockchain gaming has revolutionized the NFT market by creating genuine utility for digital assets. Play-to-earn games have established sustainable economies where gaming NFTs represent valuable in-game items, characters, and resources that players can trade, upgrade, and monetize.

Major gaming studios have integrated NFT technology into flagship titles, allowing players to truly own their in-game achievements and assets. This ownership model has created new economic opportunities for gamers and established NFTs as essential components of modern gaming experiences.

The emergence of metaverse platforms has further expanded NFT utility, with tokenized assets serving as building blocks for virtual worlds, identity systems, and social experiences. This integration has created sustained demand for diverse types of digital collectibles beyond traditional art and collectibles.

Popular NFT Categories Dominating 2025

Digital Art and Creative Collections

Crypto art continues to dominate the NFT marketplace, with established artists and emerging creators achieving record-breaking sales. The category has evolved beyond simple digital images to include interactive artwork, augmented reality experiences, and multimedia installations that push the boundaries of digital creativity.

Generative art has gained significant traction, with algorithmic collections creating unique pieces through smart contract execution. These NFT collections combine artistic vision with blockchain technology, resulting in truly unique digital assets that cannot be replicated or duplicated.

Cultural institutions and museums have embraced NFT technology to digitize and monetize their collections, creating new revenue streams while preserving cultural heritage. These institutional crypto art offerings have attracted both traditional collectors and digital natives.

Gaming and Virtual World Assets

Gaming NFTs represent the fastest-growing category in 2025, with in-game assets, characters, and virtual real estate commanding premium prices. Play-to-earn ecosystems have created sustainable economies where digital collectibles have real-world value and utility.

Virtual real estate NFTs have emerged as particularly valuable assets, with prime locations in popular metaverse platforms selling for hundreds of thousands of dollars. These tokenized assets offer ongoing revenue potential through virtual businesses, events, and social spaces.

Character and avatar NFTs have become essential for blockchain gaming experiences, offering players unique identities and capabilities across multiple games and platforms. This interoperability has increased the value and utility of gaming NFTs significantly.

Also, more: NFT Platform Wars: Which Marketplace Will Dominate 2025?

Utility and Membership Tokens

Utility-focused NFTs have gained prominence as more projects emphasize practical benefits over speculative value. These digital assets provide access to exclusive services, content, communities, and experiences, creating ongoing value for holders.

Membership NFT collections have become popular among brands and organizations seeking to create exclusive communities and reward loyal customers. These tokenized assets often include voting rights, early access privileges, and special discounts or services.

DeFi protocols have integrated NFT technology to create unique financial products, including tokenized bonds, insurance policies, and investment certificates. These blockchain-based collectibles combine financial utility with the unique properties of non-fungible tokens.

Major NFT Marketplaces and Platforms

Leading Marketplace Performance

NFT marketplaces have experienced unprecedented growth in 2025, with established platforms expanding their offerings and new specialized marketplaces emerging to serve specific niches. OpenSea maintains its position as the largest NFT trading platform, processing over $12 billion in transactions during the first half of 2025.

Specialized crypto art platforms have gained significant market share by focusing on high-quality curation and artist support. These platforms offer enhanced discovery features, detailed provenance tracking, and comprehensive artist tools that attract serious collectors and creators.

Gaming-focused NFT marketplaces have emerged as major players, offering specialized tools for gaming NFT trading, rental services, and cross-game asset integration. These platforms have created new economic models that benefit both game developers and players.

Platform Innovation and Features

Modern NFT marketplaces have introduced sophisticated features that enhance user experience and market efficiency. Advanced search and filtering capabilities help collectors discover relevant digital assets across vast catalogs of NFT collections.

Social features and community tools have transformed NFT platforms into comprehensive ecosystems where collectors, creators, and traders can interact, collaborate, and share insights. These features have increased user engagement and platform loyalty.

Smart contract automation has enabled new marketplace features such as automatic royalty distribution, fractional ownership, and programmable pricing models. These innovations have made NFT trading more efficient and accessible to diverse user groups.

Investment Trends and Market Analysis

Price Performance and Volatility Patterns

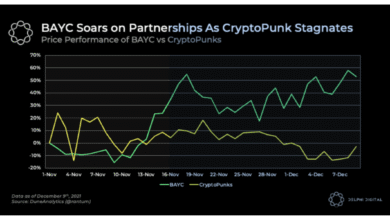

NFT market price analysis reveals interesting patterns in 2025, with blue-chip digital collectibles showing strong price stability and consistent appreciation. Established crypto art collections and utility-focused NFTs have demonstrated lower volatility compared to speculative assets.

Market data indicates that tokenized assets with clear utility and strong communities maintain better price support during market downturns. This trend suggests that the NFT ecosystem is maturing toward sustainable value creation rather than pure speculation.

Seasonal trading patterns have emerged, with increased activity during major gaming releases, art festivals, and corporate NFT launches. These patterns provide opportunities for strategic investors to optimize their digital asset portfolios.

Collector Behavior and Demographics

NFT adoption has expanded significantly across demographic groups, with notable growth among traditional art collectors, gamers, and technology enthusiasts. The average NFT holder in 2025 is more educated about blockchain technology and more focused on long-term value creation.

Collecting strategies have evolved toward portfolio diversification, with investors spreading risk across multiple NFT categories, including crypto art, gaming NFTs, and utility tokens. This sophisticated approach indicates market maturation and increased investor sophistication.

Community participation has become a crucial factor in NFT valuation, with collectors actively engaging in project governance, content creation, and ecosystem development. This engagement creates stronger bonds between holders and projects, supporting long-term value creation.

Challenges and Market Obstacles

Environmental Concerns and Sustainability

Environmental sustainability remains a significant challenge for the NFT market, despite technological improvements in blockchain energy efficiency. Proof-of-stake networks have reduced energy consumption dramatically, but public perception still associates NFTs with environmental damage.

Green NFT initiatives have emerged as responses to sustainability concerns, with projects focusing on carbon-neutral minting and environmental benefit integration. These initiatives are attracting environmentally conscious collectors and creators to the NFT ecosystem.

Sustainable blockchain development continues to improve, with new consensus mechanisms and layer-2 solutions further reducing the environmental impact of NFT technology. These improvements are crucial for long-term NFT adoption and mainstream acceptance.

Regulatory Uncertainty and Legal Framework

Regulatory clarity remains a significant challenge for the NFT market, with different jurisdictions taking varying approaches to digital asset classification and taxation. This uncertainty affects investor confidence and platform operations across international markets.

Intellectual property concerns continue to challenge the crypto art space, with ongoing debates about ownership rights, reproduction permissions, and creator compensation. Clear legal frameworks are needed to protect both creators and collectors in the NFT marketplace.

Consumer protection regulations are evolving to address NFT trading practices, marketplace operations, and dispute resolution mechanisms. These developments will likely improve market confidence but may also increase compliance costs for platforms and creators.

Market Manipulation and Security Issues

NFT marketplace security has improved significantly in 2025, but challenges remain regarding wash trading, price manipulation, and fraudulent collections. Enhanced monitoring systems and community reporting mechanisms have reduced these issues substantially.

Smart contract auditing has become standard practice for major NFT collections, reducing the risk of technical vulnerabilities and ensuring proper functionality. This professionalization has increased collector confidence in new projects.

Identity verification and provenance tracking have become more sophisticated, helping collectors verify the authenticity of crypto art and other digital collectibles. These improvements are crucial for maintaining market integrity and collector confidence.

Future Outlook and Market Predictions: NFT Market Hits

Technological Evolution and Innovation

The future of the NFT market looks increasingly promising, with emerging technologies like artificial intelligence, virtual reality, and advanced smart contracts expanding possible use cases. These innovations will likely create new categories of digital assets and enhance existing NFT functionality.

Interoperability protocols will continue improving, enabling tokenized assets to function seamlessly across different blockchains, games, and applications. This cross-platform functionality will increase NFT utility and value proposition significantly.

Metaverse integration will likely drive significant NFT adoption, with digital collectibles serving as foundational elements for virtual world economies, identity systems, and social interactions. This integration represents one of the most promising growth areas for the NFT ecosystem.

Market Expansion and Mainstream Adoption

NFT technology adoption is expected to accelerate across traditional industries, with more companies integrating blockchain-based collectibles into their business models. This mainstream adoption will bring stability and legitimacy to the NFT market.

Educational institutions are beginning to issue NFT diplomas and certificates, creating new use cases for digital assets in credentialing and verification. This application could drive significant adoption among educational institutions and students worldwide.

NFT Market Hits: Government applications for NFT technology are emerging, NFT Market Hits: including digital identity systems, voting mechanisms, and public record management. These official uses will likely increase public acceptance and understanding of non-fungible tokens.

Conclusion

The NFT market in 2025 represents a mature and diverse ecosystem that has successfully transitioned from speculative hype to genuine utility and value creation. NFT Market Hits: NFT Market Hits: NFT Market Hits. The combination of technological improvements, institutional adoption, and expanding use cases has created a foundation for sustained growth and innovation.

Digital collectibles have proven their staying power by solving real problems and creating new opportunities across gaming, art, NFT Market Hits: entertainment, and enterprise applications. NFT Market Hits: The NFT ecosystem continues to evolve rapidly, with innovations and applications emerging regularly.

NFT Market Hits: As we look toward the future, the NFT market appears well-positioned for continued expansion and mainstream adoption. NFT Market Hits: The lessons learned from earlier market cycles have contributed to a more sustainable and value-driven approach to NFT development and trading.

NFT Market Hits: The success of blockchain-based collectibles in 2025 demonstrates the power of decentralized ownership and programmable assets. NFT Market Hits: This foundation will likely support even more innovative applications and use cases in the years to come.

NFT Market Hits: Investors, creators, and collectors who understand the evolving NFT landscape are well-positioned to benefit from the continued growth and maturation of this revolutionary technology. NFT Market Hits: The digital asset revolution is just beginning, NFT Market Hits: with NFTs leading the way toward a more decentralized and democratized digital economy.