Alibaba Uses JPMorgan Blockchain for Digital Payments

Alibaba partners Blockchain for Digital Payments for tokenized dollar and euro payments, revolutionizing cross-border transactions.

Cross-border payments. According to recent reports from CNBC, Chinese e-commerce giant Alibaba has announced its intention to utilize JPMorgan Chase’s blockchain infrastructure for processing tokenized dollar and euro payments. This strategic partnership represents a significant milestone in the adoption of blockchain technology within traditional financial systems and signals a broader shift toward digital asset integration in global commerce.

As businesses increasingly seek faster, more efficient, and cost-effective payment solutions, the convergence of established financial institutions with technology-driven corporations is creating innovative pathways for international money transfers. Blockchain for Digital Payments: This collaboration between Alibaba and JPMorgan demonstrates how distributed ledger technology is moving beyond experimental phases into practical, real-world applications that address longstanding challenges in global trade and finance.

The Foundation: JPMorgan’s Blockchain Infrastructure

JPMorgan Chase, one of the world’s largest and most influential banking institutions, has been at the forefront of blockchain innovation within the traditional finance sector. The bank’s proprietary blockchain platform, known as JPM Coin, was initially launched as a digital token designed to facilitate instantaneous payment transfers between institutional clients. Unlike cryptocurrencies that operate independently of traditional banking systems, JPM Coin represents a stablecoin backed by fiat currency held in designated accounts at JPMorgan Chase.

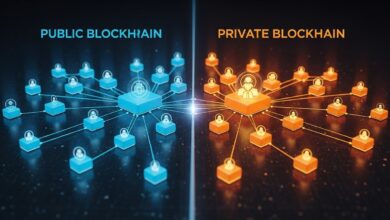

The infrastructure underlying this technology utilizes permissioned blockchain networks, which differ significantly from public blockchains like Bitcoin or Ethereum. In a permissioned system, only authorized participants can validate transactions and access the network, providing enhanced security, regulatory compliance, and operational control. This approach makes the technology particularly attractive to large corporations and financial institutions that require robust governance frameworks and adherence to international banking regulations.

JPMorgan’s blockchain solution has evolved considerably since its inception, expanding its capabilities to support multiple currencies and integrating sophisticated features for smart contracts and automated settlement processes. The platform’s ability to handle high transaction volumes while maintaining security and compliance standards has positioned it as a credible alternative to conventional payment rails, which often involve multiple intermediaries, extended settlement times, and substantial transaction fees.

Alibaba’s Strategic: Blockchain for Digital Payments

Alibaba Group, a multinational conglomerate specializing in e-commerce, retail, technology, and financial services, operates one of the world’s most extensive digital marketplaces. With millions of merchants and consumers conducting transactions across borders daily, the company faces constant challenges related to payment processing efficiency, currency conversion costs, and settlement delays. The decision to leverage JPMorgan’s blockchain infrastructure represents a calculated strategy to address these operational complexities while positioning the company at the cutting edge of financial technology innovation.

The implementation of tokenized payments offers Alibaba several distinct advantages over traditional payment methods. By converting dollars and euros into digital tokens that can be transferred instantaneously across blockchain networks, the company can significantly reduce the time required for cross-border transactions. Traditional international payments often take several days to complete due to the involvement of correspondent banks, clearing houses, and multiple verification stages. Blockchain-based payments, by contrast, can settle in near real-time, providing improved cash flow management and enhanced operational efficiency.

Furthermore, the adoption of blockchain technology aligns with Alibaba’s broader digital transformation initiatives. The company has consistently invested in emerging technologies, including artificial intelligence, cloud computing, and big data analytics, to maintain its competitive edge in the global marketplace. Integrating blockchain-based payment systems into its existing infrastructure represents a natural progression in this technological evolution and demonstrates the company’s commitment to exploring innovative solutions for complex business challenges.

The Mechanics of Tokenized Dollar and Euro Payments

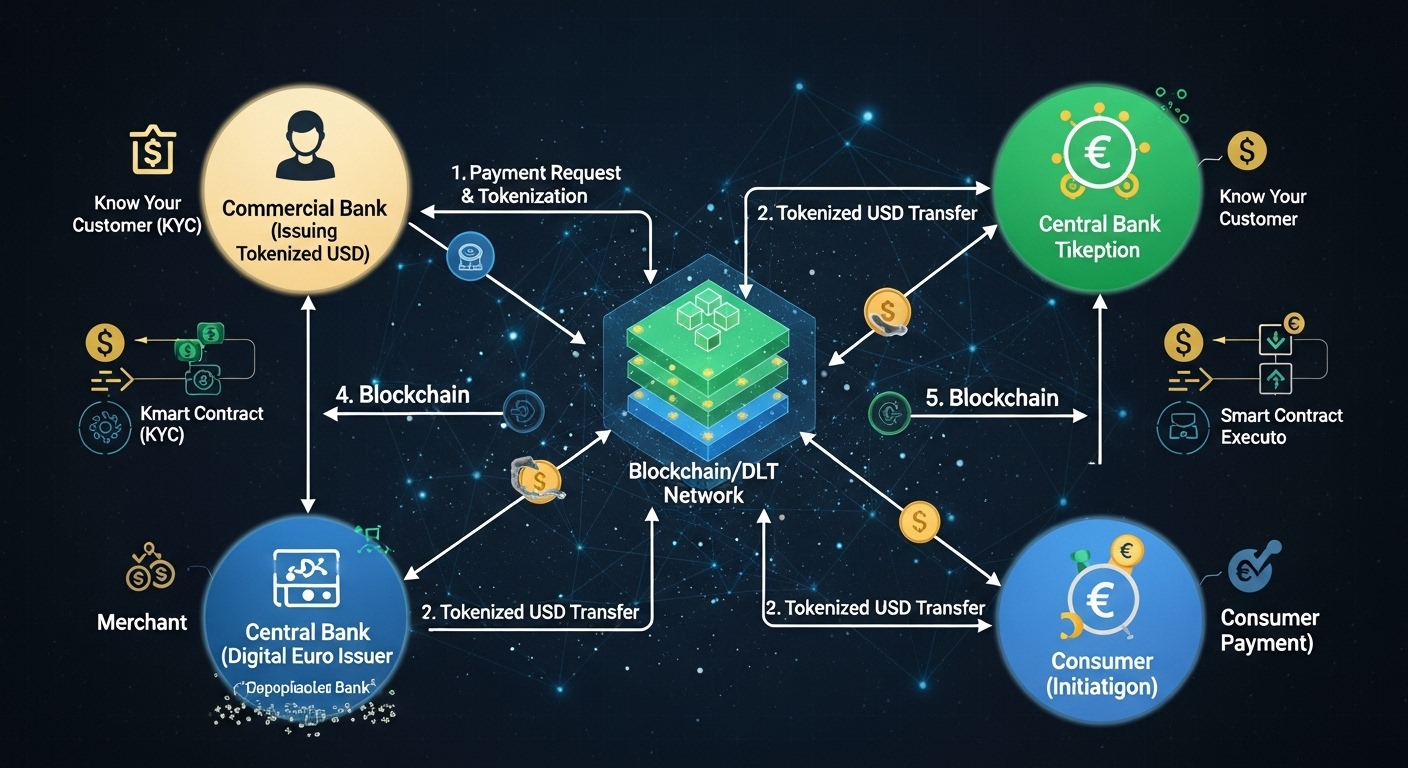

Tokenized payments represent a fundamental reimagining of how value is transferred in digital environments. In this system, traditional fiat currencies like the US dollar or euro are converted into digital tokens that exist on a blockchain network. Each token maintains a one-to-one correspondence with the underlying currency, ensuring price stability and regulatory compliance. When Alibaba conducts a transaction using JPMorgan’s blockchain, the payment is initiated by converting the required amount into digital tokens, which are then transferred to the recipient’s digital wallet within the blockchain ecosystem.

The process involves several sophisticated technological components working in concert. Smart contracts—self-executing programs stored on the blockchain—automatically verify transaction conditions, validate participant identities, and trigger payment execution when predetermined criteria are met. This automation eliminates much of the manual oversight traditionally required in international payments, reducing the potential for human error and accelerating transaction processing times.

Security considerations are paramount in any financial transaction system, and blockchain technology provides several layers of protection. The distributed nature of the ledger means that transaction records are replicated across multiple nodes in the network, making unauthorized alterations extremely difficult. Additionally, cryptographic techniques ensure that transaction data is encrypted and that only authorized parties can access sensitive information. For institutions like JPMorgan and corporations like Alibaba, these security features are essential for maintaining customer trust and meeting regulatory requirements.

Implications for Cross-Border Commerce and Trade

The collaboration between Alibaba and JPMorgan has far-reaching implications for the future of international commerce. Cross-border trade has historically been hampered by inefficiencies in payment systems, with businesses facing challenges related to currency fluctuations, high transaction costs, and lengthy settlement periods. By leveraging blockchain technology, companies can bypass many of these obstacles and create more streamlined, cost-effective payment channels.

For small and medium-sized enterprises (SMEs) that operate within Alibaba’s ecosystem, access to blockchain-based payment solutions could level the playing field in global markets. Traditional international payment methods often impose prohibitive costs on smaller businesses, making it difficult for them to compete with larger corporations that can negotiate favorable terms with financial institutions. Tokenized payments processed through blockchain networks typically involve lower transaction fees and reduced currency conversion costs, making international trade more accessible to businesses of all sizes.

The broader adoption of blockchain technology in payment systems also has implications for financial inclusion. In many developing economies, businesses and individuals lack access to reliable banking infrastructure, creating barriers to participation in global commerce. Blockchain-based payment systems can operate with minimal traditional banking intermediation, potentially opening new avenues for economic participation and growth in underserved regions.

Regulatory Landscape and Compliance Considerations

The integration of blockchain technology into mainstream financial operations raises important questions about regulatory compliance and oversight. Financial regulators worldwide are grappling with how to approach digital assets, blockchain networks, and tokenized payments within existing legal frameworks. The partnership between Alibaba and JPMorgan unfolds against this backdrop of evolving regulatory expectations and standards.

JPMorgan’s approach to blockchain implementation has consistently emphasized regulatory compliance and cooperation with financial authorities. The bank’s permissioned blockchain network includes built-in features for know-your-customer (KYC) verification, anti-money laundering (AML) monitoring, and transaction reporting that align with international banking regulations. This compliance-first approach makes the technology more palatable to regulatory bodies and reduces the legal risks associated with adopting innovative payment systems.

For Alibaba, operating across multiple jurisdictions with varying regulatory requirements presents complex compliance challenges. The company must navigate different regulatory frameworks in the United States, Europe, China, and numerous other markets where it conducts business. By partnering with an established financial institution like JPMorgan, Alibaba gains access to existing compliance infrastructure and regulatory expertise, potentially smoothing the path for blockchain adoption across its global operations.

Competitive Landscape and Industry Response

The announcement of this partnership has significant implications for the competitive dynamics within both the financial services and technology sectors. Other major banks and financial institutions are closely monitoring developments in blockchain payments and may accelerate their own initiatives in response to JPMorgan’s progress. Similarly, technology companies and e-commerce platforms are likely evaluating how blockchain-based payment systems could enhance their operational capabilities and provide competitive advantages.

Several financial institutions have already launched their own blockchain initiatives, including platforms for digital currency issuance, cross-border payment networks, and tokenization services. The competition among these various approaches will likely drive further innovation and refinement of blockchain technologies, ultimately benefiting end users through improved services, lower costs, and greater accessibility.

From Alibaba’s perspective, early adoption of advanced payment technologies provides an opportunity to differentiate its services and attract merchants and consumers seeking cutting-edge solutions. As the e-commerce landscape becomes increasingly competitive, technological innovation serves as a critical differentiator, and companies that successfully integrate emerging technologies into their operations can gain substantial market advantages.

Future Outlook and Technological Evolution

The collaboration between Alibaba and JPMorgan represents just one example of how blockchain technology is gradually permeating traditional business operations. As the technology matures and proves its value in real-world applications, adoption is likely to accelerate across various industries and use cases. The potential applications extend far beyond payments, encompassing supply chain management, identity verification, asset tokenization, and numerous other domains where secure, transparent, and efficient record-keeping is essential.

Looking forward, the evolution of digital payment systems will likely involve increasing integration between blockchain networks, traditional financial infrastructure, and emerging technologies like artificial intelligence and the Internet of Things. These convergent technologies could create entirely new business models and economic opportunities, fundamentally transforming how value is created, exchanged, and stored in digital economies.

For businesses operating in global markets, staying informed about these technological developments and understanding their potential implications is increasingly important. The partnership between Alibaba and JPMorgan provides a compelling case study of how established corporations and financial institutions can collaborate to leverage innovative technologies while managing risks and maintaining regulatory compliance.

Conclusion

The announcement that Alibaba will utilize JPMorgan’s blockchain infrastructure for tokenized dollar and euro payments marks a pivotal moment in the ongoing convergence of traditional finance and emerging technologies. This collaboration demonstrates how blockchain technology is moving beyond theoretical potential into practical applications that address real business challenges in cross-border payments and international commerce.

By leveraging JPMorgan’s robust and compliant blockchain platform, Alibaba gains access to faster, more efficient, and potentially more cost-effective payment processing capabilities. This partnership not only benefits the two organizations directly involved but also signals broader trends in how businesses and financial institutions are reimagining payment systems for the digital age.

As tokenized payments and blockchain-based financial services continue to evolve, their impact on global commerce, financial inclusion, and economic development will become increasingly apparent. The success or challenges encountered in this high-profile partnership will undoubtedly influence how other organizations approach blockchain adoption and shape the future trajectory of financial technology innovation.

For businesses, consumers, and financial institutions worldwide, this development serves as a reminder of the rapid pace of technological change and the importance of remaining adaptable in an increasingly digital economy. The journey toward widespread blockchain adoption in mainstream finance is still unfolding, but partnerships like this one between Alibaba and JPMorgan provide valuable insights into what that future might look like.

FAQs

Q: What are tokenized payments, and how do they differ from traditional digital payments?

Tokenized payments involve converting traditional fiat currency into digital tokens that exist on a blockchain network. Unlike conventional digital payments that process through traditional banking infrastructure, tokenized payments utilize Blockchain for Digital Payments: distributed ledger technology to enable near-instantaneous transfers.

Q: Why is Alibaba choosing JPMorgan’s blockchain over public blockchain networks?

JPMorgan’s blockchain platform offers a permissioned network with robust regulatory compliance features, institutional-grade security, and integration with traditional banking systems. Blockchain for Digital Payments: For a large corporation like Alibaba handling substantial transaction volumes across multiple jurisdictions, these factors are essential.

Q: Will this blockchain payment system be available to small businesses on Alibaba’s platform?

While initial implementation details have not been fully disclosed, blockchain-based payment systems typically offer advantages for businesses of all sizes, including reduced transaction costs and faster settlement times. As the technology matures and adoption expands, access to these payment capabilities.

Q: How does this development impact cryptocurrency adoption in mainstream commerce?

This partnership represents the adoption of blockchain technology rather than cryptocurrencies per se. The tokenized dollars and euros used in this system Blockchain for Digital Payments: maintain stable values tied to fiat currencies, avoiding the price volatility that has limited cryptocurrency adoption in commercial transactions.

Q: What security measures protect transactions on JPMorgan’s blockchain platform?

JPMorgan’s blockchain employs multiple security layers, Blockchain for Digital Payments: including cryptographic encryption, a distributed ledger architecture that replicates transaction records across multiple nodes, permissioned access controls, and continuous monitoring systems.