Bitcoin Crashes Below $100K Market Carnage Explained

Bitcoin Crashes Below $100K Market stocks collapse amid liquidity crisis. Driving the market turmoil and what investors should know now.

Bitcoin tumbled below the psychologically critical $100,000 threshold, sending shockwaves throughout the digital asset ecosystem. This dramatic downturn has not only affected cryptocurrency prices but has also eviscerated crypto-related stocks, leaving investors grappling with substantial losses. The current market carnage appears to be driven by a broader liquidity crunch that has hammered risk assets across multiple sectors, forcing traders to reassess their positions in what many are calling one of the most challenging periods for digital assets since the 2022 crypto winter.

The confluence of factors contributing to this perfect storm includes tightening monetary conditions, reduced market liquidity, and heightened regulatory scrutiny. Bitcoin Crashes Below $100K Market: As institutional investors pull back from riskier assets, the cryptocurrency market finds itself at a critical juncture where short-term volatility could determine the trajectory for months to come. Understanding the underlying mechanics of this downturn is essential for anyone with exposure to digital assets or considering entry points in this volatile landscape.

The Dramatic Fall: Bitcoin’s Descent Below $100K

Bitcoin’s journey to six figures was celebrated as a historic milestone that validated cryptocurrency as a legitimate asset class. However, the recent plunge below $100,000 has raised serious questions about market sustainability and the factors that drove the initial rally. The digital currency reached its peak amid euphoria surrounding potential regulatory clarity and institutional adoption, but those tailwinds have rapidly transformed into headwinds.

The velocity of the decline has caught many investors off guard. Within a matter of days, Bitcoin shed more than 15% of its value, erasing billions in market capitalization and triggering cascading liquidations across cryptocurrency exchanges. This rapid deterioration reflects not just profit-taking from early investors but also forced selling from leveraged positions that became untenable as volatility spiked.

Technical analysts point to the breakdown of critical support levels as a key catalyst for accelerated selling. Once Bitcoin breached the $100,000 psychological barrier, algorithmic trading systems and stop-loss orders activated en masse, creating a self-reinforcing downward spiral. The fear and greed index, which measures market sentiment, has plummeted into extreme fear territory, indicating that panic selling may have reached climax levels.

Crypto Stocks Face Devastating Losses: Bitcoin Crashes Below $100K Market

While Bitcoin’s decline has dominated headlines, publicly traded cryptocurrency stocks have experienced even more dramatic losses. Companies like Coinbase, MicroStrategy, Marathon Digital, and Riot Platforms have seen their share prices eviscerated as the correlation between crypto asset prices and mining stocks intensified. These stocks, which many investors view as proxies for crypto exposure within traditional portfolios, have amplified the losses experienced in the underlying digital assets.

MicroStrategy, the business intelligence company that transformed itself into a Bitcoin treasury vehicle, has been particularly hard hit. With the company holding over 150,000 Bitcoin on its balance sheet, the decline in Bitcoin’s price directly impacts the firm’s net asset value. Shareholders have watched helplessly as the stock tumbled more than 30% in a compressed timeframe, raising questions about the wisdom of corporate Bitcoin accumulation strategies during bull markets.

Mining companies face a different set of challenges. As Bitcoin’s price declines, mining profitability shrinks, especially for operations with higher energy costs or older, less efficient equipment. The hash rate—a measure of computational power securing the Bitcoin network—has remained elevated, meaning competition among miners is fierce even as revenues decline. This dynamic has forced some publicly traded miners to sell their Bitcoin reserves to cover operational expenses, adding additional selling pressure to the market.

The cryptocurrency exchange stocks have not been spared either. Coinbase and other trading platforms derive significant revenue from trading volumes and transaction fees, both of which typically contract during market downturns as retail investors retreat to the sidelines. Lower engagement translates directly to reduced earnings expectations, causing analysts to downgrade their price targets and further pressuring share prices.

The Liquidity Crunch Phenomenon

At the heart of the current market turmoil lies a fundamental liquidity crisis that extends far beyond cryptocurrency markets. Liquidity—the ease with which assets can be bought or sold without significantly impacting price—has evaporated across multiple risk asset classes as investors flee to safety. This contraction in available capital has hit cryptocurrencies particularly hard due to their classification as speculative, high-risk investments.

Several factors have contributed to the liquidity drought. Central banks worldwide, particularly the Federal Reserve, have maintained restrictive monetary policies designed to combat persistent inflation. Higher interest rates make borrowing more expensive and incentivize investors to park capital in risk-free Treasury securities rather than speculative assets. As money market funds offer yields exceeding 5%, the opportunity cost of holding volatile cryptocurrencies has increased substantially.

Additionally, the banking sector’s reduced appetite for crypto-related business has constricted the on-ramps and off-ramps between traditional finance and digital assets. Following several high-profile bank failures in 2023 that were partly attributed to crypto exposure, financial institutions have become exceedingly cautious about facilitating cryptocurrency transactions. This has created bottlenecks that make it more difficult for capital to flow into the space, even when investor appetite might otherwise support higher prices.

The liquidity situation has been exacerbated by deleveraging across the financial system. Hedge funds and proprietary trading firms that previously deployed substantial capital to crypto markets have pulled back, reducing the depth of order books on exchanges. Thinner order books mean that relatively modest selling pressure can generate outsized price impacts, creating the conditions for the rapid declines we’ve witnessed.

Risk Asset Correlation and Broader Market Dynamics

Cryptocurrency has long been touted as an uncorrelated asset that could provide portfolio diversification benefits. However, recent market action has demonstrated that during periods of genuine financial stress, crypto assets behave very much like other risk assets. The correlation between Bitcoin and technology stocks, particularly growth-oriented names in the NASDAQ composite, has increased markedly.

This correlation reflects the reality that cryptocurrency investment is dominated by the same cohort of investors who populate growth equity markets. When these investors face margin calls, redemptions, or simply reassess their risk tolerance, they tend to sell across the board. The result is synchronized selling that impacts equities and cryptocurrencies simultaneously, negating any diversification benefits investors might have expected.

The risk-off sentiment pervading global markets has been driven by multiple concerns. Geopolitical tensions, including conflicts in various regions and trade disputes between major economies, have increased uncertainty. Economic data suggesting potential recession risks have further dampened investor enthusiasm for speculative assets. In this environment, the narrative that cryptocurrency represents “digital gold” or a hedge against traditional financial system risks has been severely tested.

Furthermore, the anticipated approval and subsequent launch of spot Bitcoin ETFs, which many believed would usher in a new era of institutional adoption, has failed to provide the sustained upward price momentum that bulls expected. While ETF inflows were strong initially, they have since moderated, and during the recent downturn, some ETFs have experienced outflows as investors liquidate positions.

Regulatory Headwinds and Policy Uncertainty

Regulatory developments have cast an additional shadow over cryptocurrency markets. Government agencies worldwide continue to wrestle with how to oversee digital assets effectively without stifling innovation. In the United States, the Securities and Exchange Commission has maintained an aggressive enforcement posture, bringing actions against numerous crypto projects and exchanges for alleged securities law violations.

This regulatory uncertainty creates a chilling effect on institutional capital deployment. Many large financial institutions, pension funds, and endowments remain on the sidelines, waiting for clear regulatory frameworks before committing significant resources to the space. The longer this clarity remains elusive, the more pronounced the impact on market liquidity and price stability.

International regulatory coordination efforts have also gained momentum, with various jurisdictions implementing their own frameworks for crypto oversight. While some regions, like the European Union with its Markets in Crypto-Assets Regulation (MiCA), have sought to provide comprehensive guidelines, inconsistencies between jurisdictions create complexity for global operators. This patchwork regulatory landscape adds operational risk and compliance costs that ultimately impact market participants.

Tax treatment of cryptocurrency transactions remains another area of ongoing evolution. As governments seek to capture tax revenue from crypto gains, they’ve implemented increasingly sophisticated reporting requirements. These compliance obligations create friction for traders and investors, potentially reducing market participation and liquidity.

Market Psychology and Investor Sentiment

The psychological component of the current downturn cannot be underestimated. Cryptocurrency markets are notoriously sentiment-driven, with fear and greed oscillating wildly and often becoming self-fulfilling prophecies. The breakdown below $100,000 has triggered a crisis of confidence among retail investors who entered the market during the rally, many of whom are now sitting on substantial unrealized losses.

Social media platforms and crypto-focused forums have become echo chambers of negativity, with predictions of further declines dominating the discourse. This bearish sentiment can become self-reinforcing as potential buyers remain on the sidelines, waiting for capitulation and a definitive bottom. Without fresh capital entering the market, recovery becomes increasingly difficult.

Conversely, some veteran investors view the current situation as a classic shakeout—a necessary correction that eliminates weak hands and overleveraged positions, ultimately creating a healthier foundation for future growth. This perspective holds that the fundamental value proposition of blockchain technology and decentralized finance remains intact, and current prices represent attractive entry points for long-term accumulation.

The divergence in sentiment between short-term traders and long-term holders has created interesting dynamics in on-chain metrics. Data shows that long-term holders have largely refrained from selling despite the price decline, while newer entrants have been more prone to capitulation. This pattern is consistent with previous bear markets and suggests that a base of committed believers remains intact.

The Path Forward: Recovery Scenarios and Considerations

Looking ahead, several scenarios could play out for Bitcoin and the broader cryptocurrency ecosystem. The optimistic case involves a relatively quick stabilization as forced selling exhausts itself and bargain hunters emerge to establish a new price floor. This scenario would likely require some catalyst—perhaps positive regulatory developments, renewed institutional interest, or macroeconomic data suggesting central banks might pivot toward easier monetary policy.

A more pessimistic outlook envisions an extended consolidation period or further declines as the liquidity crunch persists and recession fears materialize. In this scenario, cryptocurrency could remain under pressure for quarters rather than weeks, testing the resolve of even committed long-term holders. Historical precedent from previous bear markets suggests that meaningful recoveries often take time and require the rebuilding of investor confidence.

The intermediate probability involves a grinding, volatile sideways market where neither bulls nor bears gain decisive control. This environment could persist until larger macroeconomic questions are resolved, particularly regarding inflation, interest rates, and global growth prospects. During such periods, trading volumes typically remain subdued, and price action becomes increasingly technical rather than fundamental.

Regardless of which scenario unfolds, certain realities remain constant. Cryptocurrency markets have consistently demonstrated resilience through multiple boom-and-bust cycles. The underlying technology continues to evolve, with developments in scaling solutions, regulatory compliance tools, and institutional infrastructure proceeding even during price downturns. These foundational improvements may not manifest in immediate price appreciation but could support sustainable growth in future cycles.

Conclusion

The dramatic plunge of Bitcoin below $100,000 and the subsequent devastation of crypto-related stocks represent more than just another episode of volatility in notoriously turbulent markets. It reflects a fundamental liquidity crisis impacting risk assets broadly, driven by restrictive monetary policy, reduced institutional participation, and heightened regulatory uncertainty. While the immediate outlook remains challenging, with technical indicators and sentiment metrics suggesting further volatility ahead, the long-term trajectory of cryptocurrency adoption and blockchain innovation continues to trend upward.

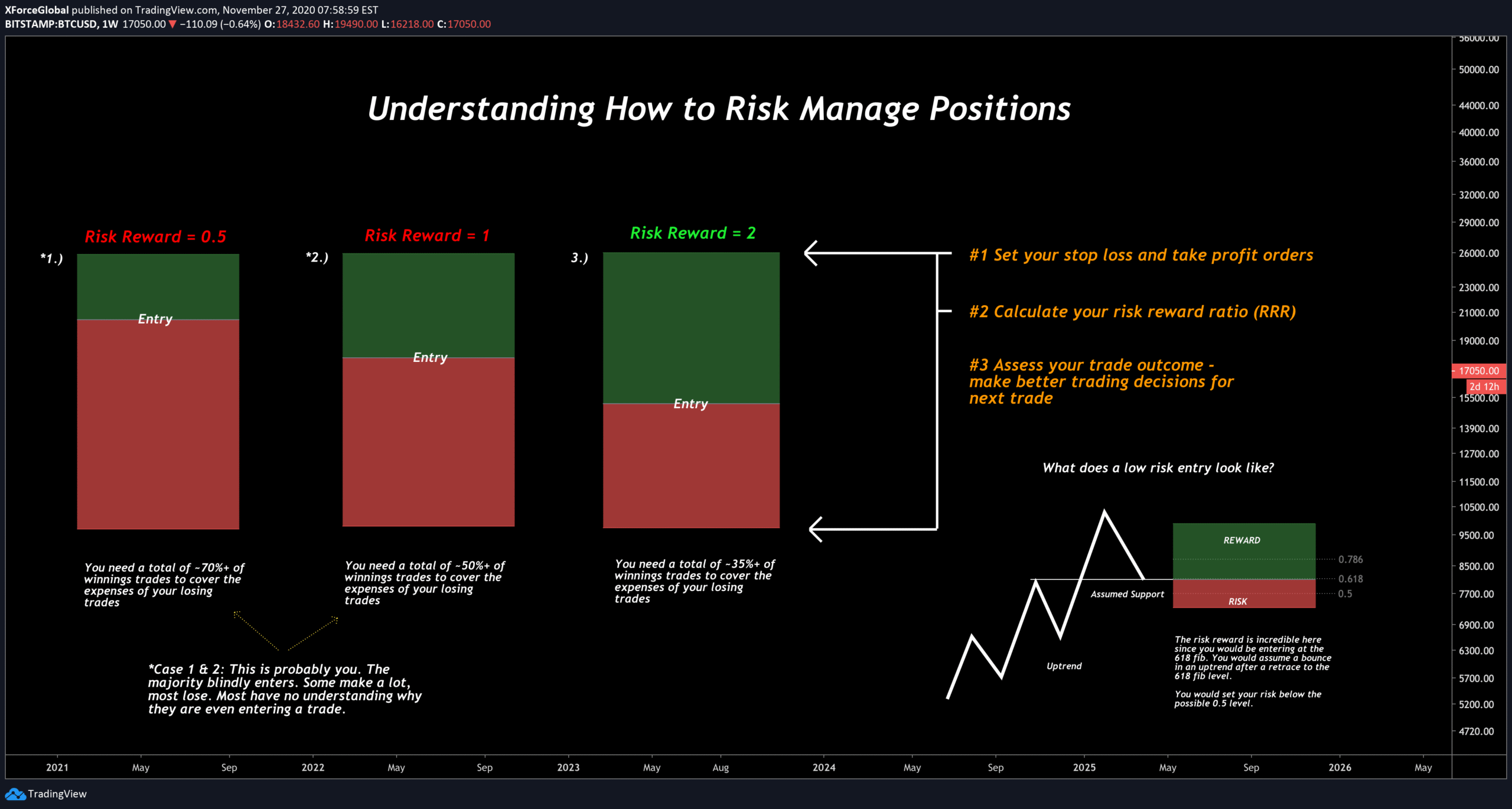

Investors navigating this environment must exercise caution, employ appropriate risk management strategies, and avoid the temptation to make emotionally driven decisions during peak fear. The current downturn, while painful for those with exposure, may ultimately prove to be another chapter in the ongoing maturation of digital asset markets. As liquidity conditions eventually normalize and regulatory frameworks crystallize, the cryptocurrency sector will likely emerge with stronger infrastructure, more sophisticated participants, and renewed potential for growth.

The key lesson from this episode is that cryptocurrency remains a highly volatile, speculative asset class that requires careful consideration within diversified portfolios. Those who approach the market with realistic expectations, appropriate time horizons, and disciplined risk management are best positioned to weather the inevitable storms and potentially benefit from future upswings.

FAQs

Q: What caused Bitcoin to fall below $100,000?

Bitcoin’s decline below $100,000 resulted from a combination of factors including a broader liquidity crunch affecting risk assets, forced liquidations from overleveraged positions, and weakening investor sentiment. Restrictive monetary policy from central banks has reduced available capital for speculative investments, while technical breakdowns of key support levels triggered algorithmic selling.

Q: How long might the crypto bear market last?

The duration of bear markets in cryptocurrency is difficult to predict with precision, but historical patterns suggest they can persist for several months to over a year. Previous cycles have shown that recovery often requires the exhaustion of forced selling.

Q: Should investors buy Bitcoin during this dip?

Whether to buy during a decline depends entirely on individual risk tolerance, investment time horizon, and overall portfolio construction. Some investors view significant drawdowns as accumulation opportunities, employing dollar-cost averaging strategies to build positions gradually.

Q: How are crypto stocks different from owning actual cryptocurrency?

Crypto stocks represent equity ownership in companies involved in the cryptocurrency ecosystem—such as miners, exchanges, or companies holding Bitcoin on their balance sheets. These stocks offer exposure to crypto price movements through traditional brokerage accounts but come with additional company-specific risks.

Q: What signs should investors watch for a market recovery?

Key indicators of potential recovery include stabilizing price action with higher lows establishing a base, increasing trading volumes suggesting renewed participation, improvement in sentiment indicators moving out of extreme fear territory, and positive on-chain metrics such as reduced exchange inflows.