Digitap TAP Visa partnership marks a pivotal moment in the adoption of blockchain technology, demonstrating how innovative crypto projects can secure major corporate collaborations while prioritizing user privacy. This strategic alliance has sparked significant market interest, particularly as the partnership emphasizes no-KYC (Know Your Customer) privacy features that appeal to privacy-conscious cryptocurrency users.

While established tokens like Chainlink (LINK) maintain steady support levels around $23, emerging projects like Digitap (TAP) are experiencing explosive growth driven by real-world utility and corporate partnerships. The Digitap TAP Visa partnership showcases the potential for blockchain projects to bridge the gap between decentralized finance and mainstream payment processing, creating new opportunities for crypto adoption across traditional commerce platforms.

The Digitap TAP Visa Partnership Revolution

What Makes the Digitap TAP Visa Partnership Unique

The Digitap TAP Visa partnership stands out in the crowded cryptocurrency space due to its focus on privacy-first payment solutions. Unlike traditional crypto payment processors that require extensive identity verification, Digitap’s collaboration with Visa emphasizes user anonymity while maintaining compliance with regulatory frameworks. This innovative approach addresses growing concerns about financial privacy in an increasingly surveilled digital economy.

Digitap’s partnership with Visa introduces several groundbreaking features that distinguish it from conventional cryptocurrency payment solutions. The platform enables users to conduct transactions without revealing personal information, utilizing advanced cryptographic protocols to ensure transaction validity while preserving user anonymity. This no-KYC approach resonates with cryptocurrency enthusiasts who value financial privacy as a fundamental right.

Technical Infrastructure Behind the Partnership

The technical foundation of the Digitap TAP Visa partnership relies on sophisticated blockchain architecture that seamlessly integrates with existing Visa payment networks. Digitap’s development team has created a bridge protocol that translates blockchain transactions into formats compatible with traditional payment processors, enabling merchants to accept cryptocurrency payments without modifying their existing point-of-sale systems.

Advanced smart contract functionality powers the Digitap ecosystem, automatically handling currency conversions, fee calculations, and privacy protection measures. These smart contracts operate transparently on the blockchain while maintaining user anonymity through zero-knowledge proof implementations. The partnership with Visa provides the necessary infrastructure to scale these privacy-focused payment solutions to millions of merchants worldwide.

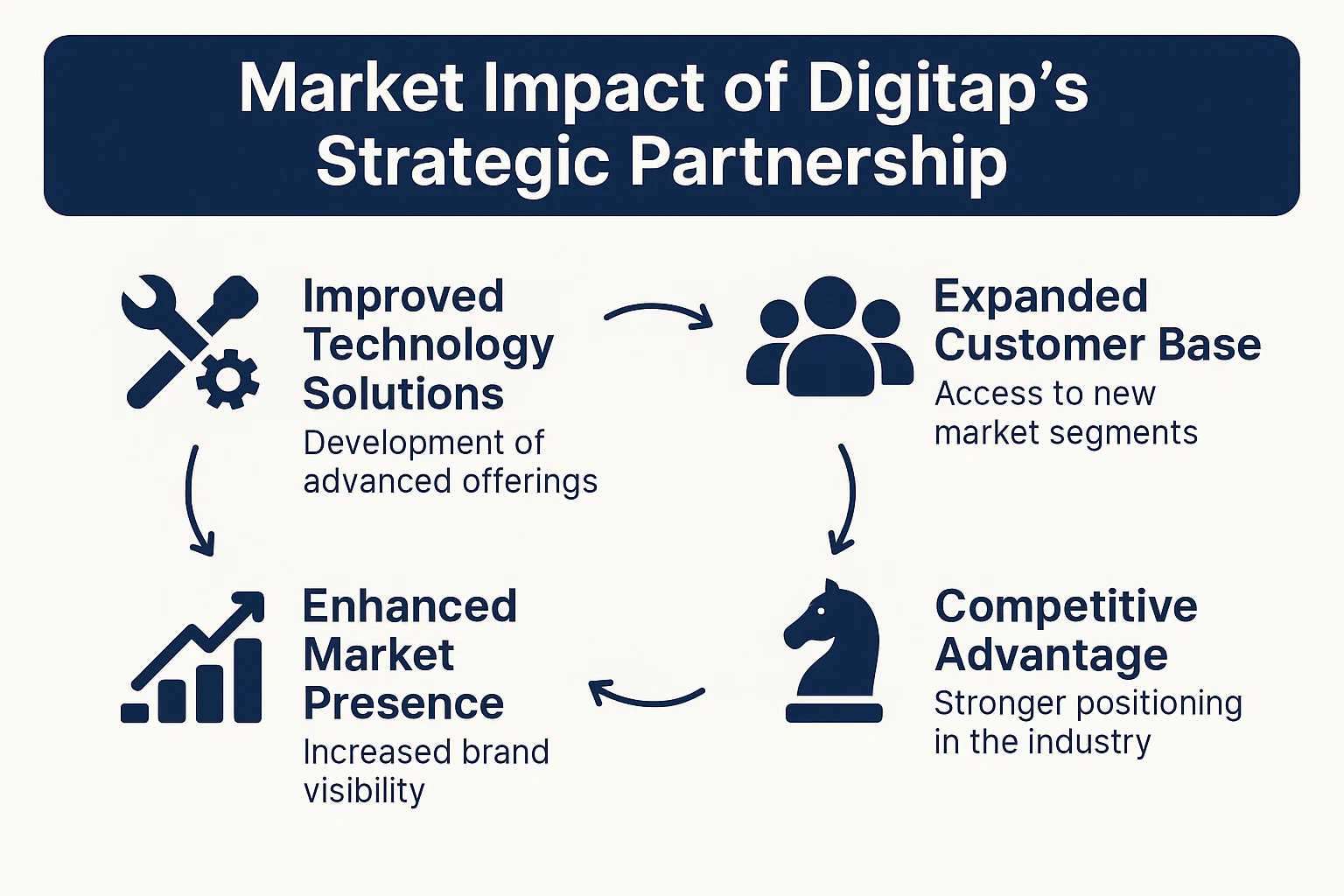

Market Impact of Digitap’s Strategic Partnership

Token Performance and Growth Metrics

Following the announcement of the Digitap TAP Visa partnership, the TAP token has experienced remarkable growth that significantly outpaces many established cryptocurrencies. Market analysis reveals that strategic partnerships with major financial institutions create substantial value propositions for blockchain projects, particularly when these partnerships address real-world payment challenges.

Trading volume for TAP tokens has increased exponentially since the announcement of the Visa partnership, indicating strong investor confidence in Digitap’s long-term viability. The token’s price trajectory illustrates how corporate partnerships can drive cryptocurrency adoption beyond speculative trading into practical, utility-based applications. This growth pattern contrasts sharply with that of more established tokens, which rely primarily on network effects and ecosystem development to appreciate in value.

Comparative Analysis with Chainlink LINK Performance

While Digitap TAP surges on news of its Visa partnership, Chainlink (LINK) maintains its position around $23, reflecting the different market dynamics that affect established versus emerging cryptocurrency projects. Chainlink’s price stability demonstrates the token’s maturity and established market position, with LINK serving as crucial infrastructure for decentralized finance applications across multiple blockchain networks.

Chainlink’s $23 support level represents strong technical resistance that has held through various market conditions, indicating sustained demand for oracle services in the decentralized finance ecosystem. However, the explosive growth of projects like Digitap illustrates how strategic corporate partnerships can create rapid value appreciation that exceeds the gradual growth typically seen in infrastructure tokens, such as LINK.

Privacy and No-KYC Features in Modern Cryptocurrency

The Growing Demand for Financial Privacy

The emphasis on no-KYC features in the Digitap TAP Visa partnership reflects broader trends toward financial privacy in the cryptocurrency space. As governments worldwide implement increasingly stringent surveillance measures on financial transactions, privacy-focused cryptocurrency solutions gain appeal among users seeking to maintain anonymity in their financial activities.

No-KYC cryptocurrency payments address legitimate privacy concerns while challenging traditional assumptions about transaction monitoring and compliance. Digitap’s approach demonstrates that privacy and regulatory compliance can be mutually compatible, utilizing advanced cryptographic techniques to satisfy both user privacy preferences and institutional security requirements.

Regulatory Considerations and Compliance

The success of the Digitap TAP Visa partnership depends partly on navigating complex regulatory landscapes that govern cryptocurrency payments and privacy protection. Digitap’s compliance framework incorporates privacy-by-design principles, ensuring adherence to anti-money laundering and counter-terrorism financing regulations that affect major payment processors, such as Visa.

Regulatory compliance in no-KYC systems necessitates innovative approaches that strike a balance between user privacy and institutional risk management. Digitap’s partnership with Visa suggests that major financial institutions recognize the viability of privacy-focused payment solutions when implemented with appropriate safeguards and compliance mechanisms.

Corporate Partnerships Driving Cryptocurrency Adoption

Strategic Importance of Traditional Finance Integration

The Digitap TAP Visa partnership exemplifies how cryptocurrency projects can achieve mainstream adoption through strategic alliances with established financial institutions. These partnerships provide cryptocurrency projects with access to extensive merchant networks, payment infrastructure, and regulatory expertise that would be difficult to develop independently.

Corporate partnerships in blockchain create mutual benefits that extend beyond simple technology integration. Traditional financial institutions gain access to innovative blockchain solutions, while cryptocurrency projects receive validation, distribution channels, and operational expertise necessary for large-scale deployment. The Digitap-Visa collaboration demonstrates this symbiotic relationship in action.

Impact on Merchant Adoption and User Experience

Through the Digitap TAP Visa partnership, merchants can accept cryptocurrency payments without significant changes to their existing payment processing systems. This seamless integration removes traditional barriers to cryptocurrency adoption in retail environments, potentially accelerating the transition toward digital asset payments in everyday commerce.

User experience improvements resulting from the partnership include faster transaction processing, reduced fees, and enhanced privacy protection compared to traditional payment methods. These benefits create compelling value propositions for both merchants and consumers, driving organic adoption growth that extends beyond speculative investment interest.

Also, More: The Best Crypto Investment Strategies for 2025

Technical Analysis and Future Price Projections

Market Sentiment and Technical Indicators

A current market analysis of the Digitap TAP Visa partnership’s impact reveals strong bullish sentiment, supported by increasing trading volumes and positive technical indicators. The token’s price action exhibits classic patterns associated with partnership announcements, characterized by an initial surge in activity followed by consolidation phases that establish new support levels.

Technical analysis of the TAP token suggests potential for continued growth as the Visa partnership implementation progresses through various development phases. Key resistance levels and support zones indicate healthy price discovery mechanisms that balance speculative interest with fundamental value creation from the partnership’s practical applications.

Long-term Growth Potential and Market Positioning

The strategic nature of the Digitap TAP Visa partnership positions the project for sustained growth as cryptocurrency payment adoption expands across traditional commerce sectors. Market projections based on partnership implementation timelines suggest significant upside potential as merchant integration accelerates and user adoption increases.

Digitap’s long-term market positioning depends on the successful execution of its Visa partnership and the continued development of privacy-focused payment solutions. The project’s emphasis on no-KYC functionality creates differentiation that could establish Digitap as a leading privacy coin with practical utility applications.

Investment Implications and Risk Assessment

Portfolio Diversification Strategies

The emergence of projects like Digitap, facilitated through strategic partnerships, illustrates the importance of diversification in cryptocurrency portfolios. While established tokens like Chainlink LINK maintain $23 support, newer projects with corporate partnerships can provide portfolio growth opportunities that complement stable infrastructure investments.

Investment strategies that incorporate partnership-driven tokens should consider both the growth potential and risk factors associated with newer blockchain projects. The Digitap TAP Visa partnership represents high-reward potential balanced against execution risks typical of emerging cryptocurrency ventures.

Risk Factors and Mitigation Strategies

Despite the promising outlook for the Digitap TAP Visa partnership, investors should consider various risk factors that could impact token performance and the partnership’s success. Regulatory changes, technical implementation challenges, and market volatility represent significant considerations for investment decision-making.

Risk mitigation approaches include diversifying exposure across multiple partnership-driven projects, carefully monitoring development milestones, and staying aware of regulatory developments that could impact privacy-focused cryptocurrency solutions. The balance between growth potential and risk management remains crucial for successful cryptocurrency investing.

Broader Implications for the Cryptocurrency Industry

Setting Precedents for Future Partnerships

The success of the Digitap TAP Visa partnership could establish important precedents for how traditional financial institutions approach cryptocurrency integration while respecting user privacy preferences. This partnership model may influence other major payment processors to explore similar collaborations with privacy-focused blockchain projects.

Industry-wide implications include potential acceleration of cryptocurrency adoption in mainstream commerce, increased legitimacy for privacy-focused tokens, and demonstration of viable business models that balance innovation with regulatory compliance. The Digitap-Visa collaboration represents a significant step toward broader cryptocurrency integration in traditional financial systems.

Evolution of Privacy-Focused Cryptocurrency Solutions

The emphasis on no-KYC features in the Digitap TAP Visa partnership reflects the evolving expectations of users for financial privacy in digital transactions. This trend suggests growing market demand for cryptocurrency solutions that prioritize user anonymity while maintaining practical utility for everyday transactions.

Advancements in privacy technology, driven by partnerships like Digitap-Visa, could accelerate the development of more sophisticated anonymity protocols, zero-knowledge proof implementations, and privacy-preserving smart contract functionality across the broader cryptocurrency ecosystem.

Competitive Landscape and Market Positioning

Comparison with Other Privacy Coins

The Digitap TAP Visa partnership distinguishes the project from other privacy-focused cryptocurrencies by emphasizing practical payment applications over pure anonymity features. This approach creates a unique market positioning that combines privacy protection with mainstream utility applications.

Competitive advantages of Digitap’s partnership approach include access to established payment infrastructure, merchant networks, and regulatory compliance frameworks that many privacy coins lack. The collaboration with Visa provides legitimacy and practical utility that could drive adoption beyond privacy-focused user segments.

Market Share and Growth Opportunities

Current market positioning of the Digitap TAP Visa partnership suggests significant growth opportunities in the expanding privacy-focused payment sector. As awareness of financial surveillance increases, demand for privacy-protecting payment solutions is expected to grow across both cryptocurrency and traditional finance sectors.

Growth trajectory analysis indicates that the successful execution of the Visa partnership could position Digitap as a leading provider of privacy-focused payment solutions, potentially capturing market share from both traditional payment processors and existing cryptocurrency projects.

Conclusion

The Digitap TAP Visa partnership represents a transformative development in cryptocurrency adoption, demonstrating how innovative blockchain projects can secure major corporate collaborations while prioritizing user privacy. This strategic alliance showcases the potential for privacy-focused cryptocurrency solutions to gain mainstream acceptance through partnerships with established financial institutions.

While Chainlink LINK maintains its $23 support level through continued utility in decentralized finance applications, the explosive growth of Digitap illustrates how strategic corporate partnerships can create rapid value appreciation in emerging cryptocurrency projects. The success of the Digitap TAP Visa partnership could establish important precedents for future collaborations between traditional finance and privacy-focused blockchain solutions.