Public vs Private Blockchain Choose the Right Network

Discover the key Public vs Private Blockchain. Learn 5 critical factors to select the perfect blockchain for your business needs.

As businesses increasingly explore blockchain technology, one fundamental question emerges: Should you build on a public or private blockchain? Public vs Private Blockchain: This decision shapes everything from security protocols to operational costs, and making the wrong choice can have lasting consequences for your project’s success.

Understanding the distinction between public and private blockchain networks isn’t just about technical specifications. It’s about aligning technology with your business objectives, regulatory requirements, and operational constraints. While public blockchains like Bitcoin and Ethereum offer transparency and decentralization, private blockchains provide controlled access and enhanced privacy. Each architecture serves different purposes, and the optimal choice depends on your specific use case and organizational needs.

This comprehensive guide explores the top five factors that should influence your decision when choosing between public and private blockchain solutions. Whether you’re a startup founder evaluating blockchain adoption, an enterprise architect designing distributed systems, or a developer selecting the right platform, understanding these critical factors will help you make an informed decision that supports your long-term goals.

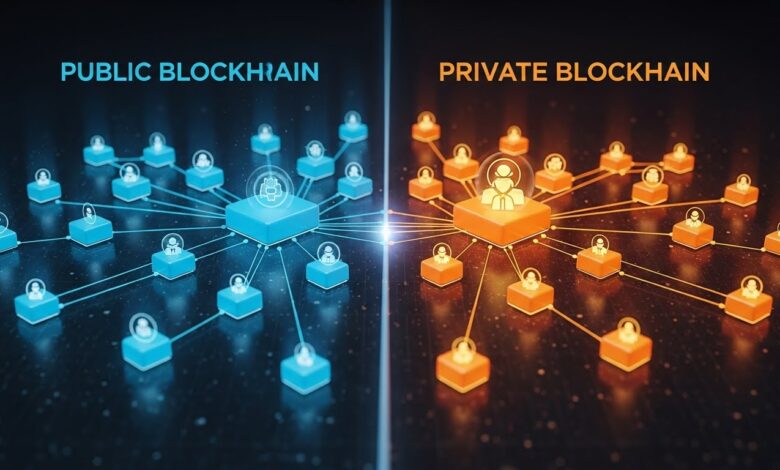

The Fundamental Differences: Public vs Private Blockchain

Before diving into the selection criteria, it’s essential to grasp what distinguishes these two blockchain architectures. A public blockchain operates as a permissionless network where anyone can join, validate transactions, and access the complete transaction history. These networks prioritize decentralization and transparency, with no single entity controlling the system. Bitcoin, Ethereum, and Cardano exemplify this model, where consensus mechanisms like Proof of Work or Proof of Stake ensure network security through distributed validation.

Conversely, a private blockchain functions as a permissioned network with restricted access. Organizations control who can participate, validate transactions, and view data. These networks sacrifice some degree of decentralization for improved performance, privacy, and governance control. Hyperledger Fabric and R3 Corda represent popular private blockchain frameworks designed specifically for enterprise applications.

The hybrid approach, known as consortium or federated blockchains, combines elements of both models. These networks allow multiple organizations to share control while maintaining restricted access, making them suitable for industry-specific collaborations where trust exists among known participants.

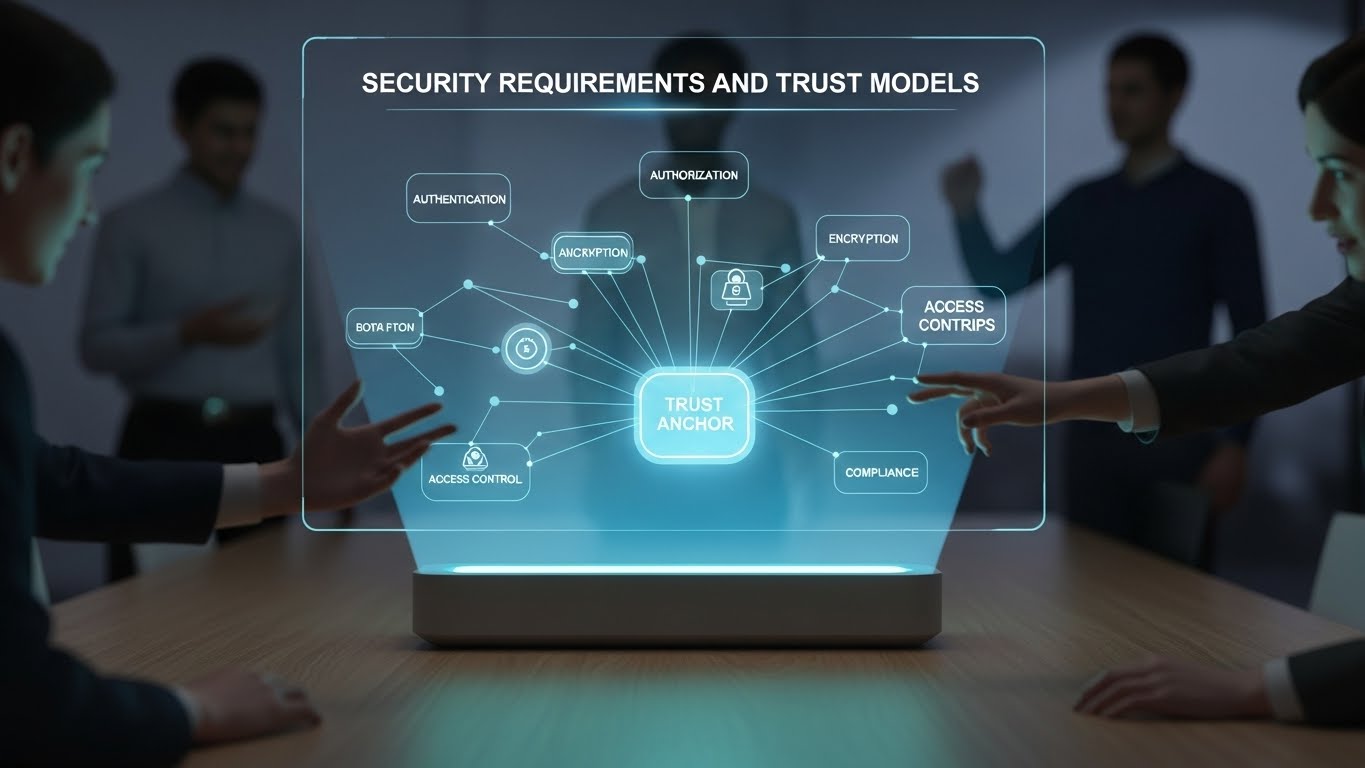

Security Requirements and Trust Models

Security architecture represents perhaps the most critical factor when evaluating public vs private blockchain options. The security model you require directly correlates with your trust assumptions and threat landscape. Public blockchains derive security from their massive, distributed validator networks. With thousands or millions of nodes participating in consensus, attacking or compromising the network becomes economically impractical. This security through decentralization makes public chains exceptionally resilient against tampering and censorship.

However, this security comes with tradeoffs. Public blockchains expose all transaction data to every network participant, making them unsuitable for applications requiring confidentiality. While encryption and zero-knowledge proofs can enhance privacy, the fundamental transparency of public networks remains a core characteristic. For organizations handling sensitive financial data, proprietary business logic, or personally identifiable information, this transparency poses significant challenges.

Private blockchains flip this security model. Rather than relying on mass decentralization, they leverage traditional access controls and cryptographic permissions. Organizations can implement role-based access control, ensuring only authorized participants can read, write, or validate transactions. This controlled environment reduces certain attack vectors while introducing others. Since fewer validators secure the network, the potential for collusion or internal threats increases. Organizations must trust the validators they authorize, making governance and validator selection critical security considerations.

The trust model extends beyond technical security to encompass legal and operational dimensions. Public blockchains operate as trustless systems, meaning participants don’t need to trust each other or any central authority. Smart contracts execute automatically based on predetermined conditions, eliminating counterparty risk. Private blockchains, conversely, operate within a known trust boundary where participants have legal relationships and contractual obligations. This known-entity model enables dispute resolution mechanisms and regulatory compliance frameworks that public chains struggle to accommodate.

Performance Metrics and Scalability Needs

Transaction throughput and latency requirements significantly influence the public vs private blockchain decision. Public blockchains face inherent scalability challenges due to their consensus mechanisms and global distribution. Bitcoin processes roughly seven transactions per second, while Ethereum handles approximately fifteen to thirty. These limitations stem from the computational overhead of achieving consensus across thousands of nodes and the blockchain trilemma, which posits that networks can only optimize two of three characteristics: decentralization, security, and scalability.

Private blockchain networks consistently outperform their public counterparts in transaction speed and throughput. With fewer validators and permissioned access, these networks can achieve thousands of transactions per second with sub-second finality. Hyperledger Fabric, for instance, can process over three thousand transactions per second in optimized configurations. This performance advantage makes private blockchains attractive for high-frequency applications like supply chain tracking, interbank settlements, and real-time asset transfers.

The scalability equation extends beyond raw transaction speed to encompass storage requirements and network bandwidth. Public blockchains require every full node to store the complete transaction history, creating significant storage burdens. The Ethereum blockchain has grown to hundreds of gigabytes, while Bitcoin approaches similar sizes. This storage requirement limits who can practically operate nodes, potentially centralizing networks over time despite their permissionless design.

Private networks offer flexible data management approaches. Organizations can implement pruning strategies, archive historical data off-chain, or distribute data selectively among participants. This flexibility enables sustainable growth without imposing unreasonable infrastructure requirements on participants. Additionally, private blockchains can upgrade their protocols more easily, implementing performance improvements without coordinating across a global, anonymous participant base.

Layer-two solutions and sharding technologies aim to address public blockchain scalability, but these approaches introduce complexity and remain under development. Organizations requiring immediate, predictable performance typically find private blockchains more suitable, while those prioritizing decentralization and willing to accept current limitations may prefer public networks.

Regulatory Compliance and Data Privacy

Regulatory requirements increasingly shape blockchain architecture decisions, particularly for organizations in heavily regulated industries like finance, healthcare, and government services. The public vs private blockchain choice has profound implications for regulatory compliance, data sovereignty, and privacy protection. Regulatory frameworks like GDPR in Europe, HIPAA in United States healthcare, and various financial regulations impose specific requirements on data handling, storage, and deletion.

Public blockchains present unique compliance challenges. Their immutable nature conflicts with GDPR’s “right to be forgotten,” which requires organizations to delete personal data upon request. Once data is written to a public blockchain, it becomes practically impossible to remove, creating potential regulatory violations. While techniques like storing only data hashes on-chain and maintaining actual data off-chain can mitigate this issue, they introduce complexity and partially defeat blockchain’s purpose as a single source of truth.

Additionally, public blockchains’ transparent nature exposes transaction patterns and metadata that privacy regulations aim to protect. Even when transaction contents are encrypted, metadata analysis can reveal sensitive information about participants’ activities, relationships, and behaviors. For organizations handling protected health information or financial data subject to confidentiality requirements, this transparency poses significant compliance risks.

Private blockchain networks provide granular control over data access and visibility, simplifying compliance with privacy regulations. Organizations can implement encryption at rest and in transit, restrict data access to authorized parties, and maintain audit trails demonstrating compliance with data protection requirements. The known-participant model enables identity verification and know-your-customer procedures required in financial services while maintaining transaction efficiency.

Data sovereignty considerations further complicate public blockchain adoption. Many jurisdictions require that citizen data remain within national borders or specific geographic regions. Public blockchains’ global distribution inherently conflicts with these requirements, as nodes worldwide store copies of all blockchain data. Private blockchains allow organizations to deploy infrastructure in compliant jurisdictions, ensuring data residency requirements are met.

However, private blockchains introduce their own compliance considerations. Organizations become data controllers under various regulations, assuming liability for data breaches, unauthorized access, and processing violations. This responsibility requires implementing comprehensive security controls, incident response procedures, and compliance monitoring systems. The regulatory burden shifts from decentralized protocols to centralized organizations, requiring significant compliance resources.

Cost Structure and Operational Expenses

The economic implications of blockchain selection extend well beyond initial development costs to encompass ongoing operational expenses, scaling costs, and opportunity costs. Understanding the complete cost structure of public vs private blockchain implementations helps organizations budget appropriately and assess long-term sustainability. These costs vary dramatically between blockchain types and significantly impact total cost of ownership.

Public blockchain operations incur transaction fees paid to validators for processing and confirming transactions. These gas fees fluctuate based on network congestion, sometimes becoming prohibitively expensive during peak usage periods. Ethereum gas fees have exceeded hundreds of dollars per transaction during high-demand periods, making many applications economically unviable. While layer-two solutions and alternative blockchains offer lower fees, organizations lose control over these costs and remain vulnerable to fee volatility.

Infrastructure costs for public blockchain applications primarily involve running full nodes for reliability and privacy, developing and maintaining smart contracts, and integrating with existing systems. Organizations avoid the capital expenditure of deploying blockchain infrastructure but accept ongoing operational expenses determined by network usage. This model suits applications with variable transaction volumes where predictable costs matter less than avoiding infrastructure investment.

Private blockchain implementations require substantial upfront investment in infrastructure, including servers, networking equipment, security systems, and backup solutions. Organizations must deploy and maintain validator nodes, implement high-availability architecture, and ensure disaster recovery capabilities. These infrastructure costs can range from tens of thousands to millions of dollars depending on scale, redundancy requirements, and performance specifications.

However, private blockchains offer predictable operational costs. Organizations control their infrastructure and can optimize costs through cloud services, managed blockchain solutions, or hybrid approaches. Transaction fees become internal accounting considerations rather than external expenses, providing budget certainty and eliminating fee volatility. For high-transaction-volume applications, private blockchains often prove more cost-effective over time despite higher initial investment.

Development costs differ significantly between approaches. Public blockchains offer mature tooling, extensive documentation, and large developer communities, reducing development time and expertise requirements. Private blockchain frameworks often require specialized knowledge and offer less community support, increasing development costs. However, private networks’ flexibility allows custom implementations optimized for specific use cases, potentially reducing long-term maintenance costs.

Governance Models and Control Requirements

Governance mechanisms determine how blockchain networks evolve, how disputes are resolved, and who controls critical decisions. The governance structure profoundly impacts an organization’s ability to adapt the network to changing requirements, implement improvements, and resolve conflicts. Understanding governance implications helps organizations assess whether public vs private blockchain models align with their control requirements and decision-making processes.

Public blockchains implement decentralized governance where protocol changes require community consensus. This democratic approach prevents any single entity from controlling the network but makes implementing changes slow and contentious. Bitcoin’s block size debate and Ethereum’s transition to Proof of Stake demonstrate how public blockchain governance can involve years of discussion and sometimes result in network splits. Organizations building on public blockchains must accept this limited control and adapt to protocol changes they may not support.

The immutability of public blockchain governance extends to smart contract upgrades and bug fixes. Once deployed, smart contracts cannot be modified, requiring complex upgrade patterns and potentially introducing new vulnerabilities. This rigidity provides certainty that code will execute as written but limits organizations’ ability to respond to discovered issues or changing requirements. The DAO hack on Ethereum highlighted these governance challenges when the community debated whether to hard fork the blockchain to reverse the hack’s effects.

Private blockchains offer centralized or consortium-based governance models where authorized participants control network evolution. Organizations can implement governance frameworks aligned with their existing decision-making processes, from hierarchical corporate structures to democratic consortium models. This control enables rapid protocol upgrades, emergency responses to security issues, and customization to specific business requirements.

Governance flexibility in private networks extends to smart contract management. Organizations can implement upgradeable contracts, emergency pause mechanisms, and administrative controls that would be impossible or unacceptable in public blockchains. This flexibility supports agile development and rapid iteration while introducing risks of centralized control abuse. Implementing appropriate checks and balances becomes crucial to prevent governance authority misuse.

The governance model also determines dispute resolution mechanisms. Public blockchains offer limited recourse when disputes arise, relying on code execution and community consensus. Private networks can implement traditional dispute resolution through contractual agreements, arbitration clauses, and legal frameworks. This legal backing provides certainty for business applications but reintroduces intermediaries that blockchain technology aims to eliminate.

Conclusion

Choosing between public and private blockchain networks represents a strategic decision with lasting implications for your project’s success, scalability, and sustainability. The five factors explored—security requirements, performance needs, regulatory compliance, cost structure, and governance models—provide a comprehensive framework for evaluating which blockchain architecture best serves your specific use case.

Public blockchains excel in scenarios requiring maximum decentralization, transparency, and censorship resistance. They’re ideal for applications serving global user bases, requiring trustless interactions, or building on established networks with extensive developer ecosystems. Despite scalability limitations and regulatory challenges, public chains provide unmatched security through mass decentralization and eliminate single points of failure.

Private blockchains shine in enterprise environments where performance, privacy, and regulatory compliance take precedence over maximum decentralization. They suit organizations requiring high transaction throughput, confidential data handling, and flexible governance structures. The controlled environment enables compliance with industry regulations while maintaining blockchain’s core benefits of immutability and distributed verification.

The decision isn’t always binary. Hybrid approaches, consortium models, and emerging technologies blur the lines between public and private blockchains. Many organizations implement multi-chain strategies, using public blockchains for certain functions while maintaining private networks for sensitive operations. As blockchain technology matures, interoperability solutions enable these hybrid architectures, allowing organizations to leverage both models’ strengths.

Ultimately, the right choice depends on your specific requirements, constraints, and strategic objectives. Carefully evaluate your security posture, performance requirements, regulatory obligations, budget constraints, and governance needs. Consider both immediate requirements and long-term scalability as your application grows. By thoroughly analyzing these factors and understanding the tradeoffs inherent in each approach, you can confidently select the blockchain network that positions your project for success.

FAQs

Q: Can I migrate from a private blockchain to a public blockchain later?

Migration between blockchain types is technically possible but presents significant challenges. The process requires reimplementing smart contracts, restructuring data models, and often redesigning governance mechanisms. Organizations typically maintain separate implementations rather than migrating, though interoperability bridges can connect private and public networks. Planning for potential migration from the outset by designing modular architectures can ease future transitions if needed.

Q: Do private blockchains provide the same security as public blockchains?

Private and public blockchains offer different security models rather than superior or inferior security. Public blockchains provide security through mass decentralization and economic incentives, making attacks economically impractical. Private blockchains rely on access controls and trusted validators, offering protection against external threats while requiring trust in authorized participants. Neither approach is inherently more secure—appropriateness depends on your threat model and trust assumptions.

Q: How do transaction costs compare between public and private blockchains?

Public blockchains charge transaction fees (gas fees) that fluctuate based on network congestion, potentially becoming expensive during peak periods. Private blockchains eliminate per-transaction fees but require infrastructure investment and operational expenses. For low-volume applications, public blockchains may prove more economical. High-volume applications typically find private blockchains more cost-effective over time, as per-transaction costs approach zero after infrastructure investment.

Q: Can private blockchains interact with public blockchains?

Yes, various interoperability solutions enable communication between private and public blockchains. Cross-chain bridges, wrapped tokens, and interoperability protocols allow asset transfers and data sharing between networks. Organizations increasingly implement hybrid architectures leveraging public blockchains for certain functions while maintaining private networks for sensitive operations. These integrations require careful security consideration to prevent vulnerabilities at connection points.

Q: Which industries benefit most from private blockchains?

Highly regulated industries like finance, healthcare, supply chain management, and government services typically benefit most from private blockchains due to compliance requirements and privacy needs. Financial institutions use private blockchains for interbank settlements and trade finance. Healthcare organizations implement private networks for medical record sharing while maintaining HIPAA compliance. Supply chains leverage private blockchains for tracking goods among known partners while protecting proprietary business information.