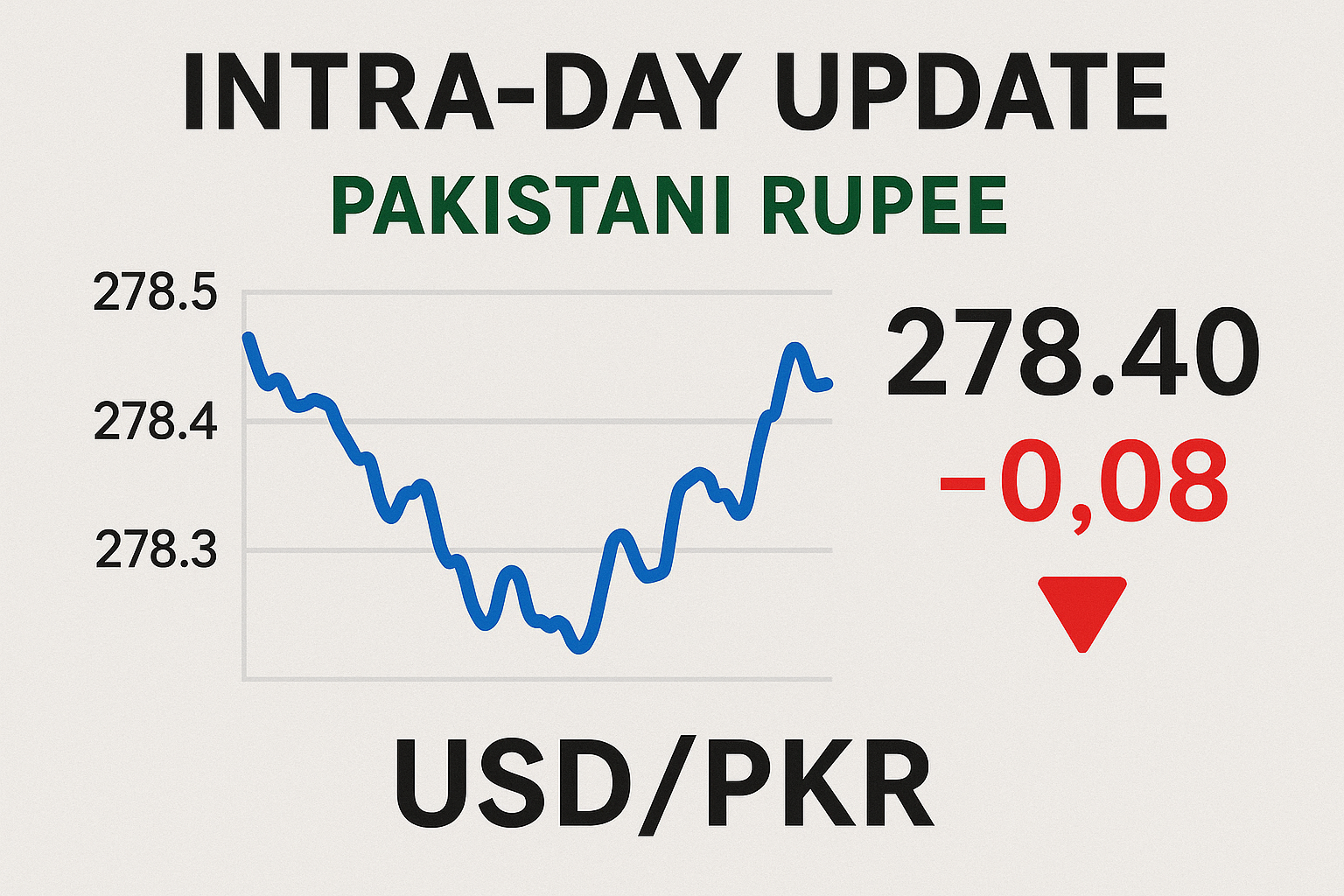

Intra-Day Update Pakistani Rupee Extends Gains Against the US Dollar

Intra-day update: Pakistani rupee firms in interbank and open market as sentiment steadies; key drivers, data, and outlook for USD to PKR today.

The Pakistani rupee continued to firm in mid-day trade, reflecting improved sentiment in both the interbank and open market as dollar demand moderated and global risk cues steadied. Fresh readings show the USD to PKR rate hovering in the low 281–282 range on the interbank counter—near Friday–Monday closes—with the open market quoting slightly higher as is typical due to dealer spreads. As of September 23–24, 2025, widely tracked dashboards that mirror State Bank of Pakistan (SBP) figures put the interbank dollar rate near PKR 281.85, while open-market quotes sat just a rupee or so above that handle.

While Pakistan-specific flows dominate the rupee-dollar narrative, global cross-currents also matter. Oil prices remain range-bound after a second day of gains, a supportive backdrop for Pakistan’s import bill, while Asian FX has been broadly mixed. Brent edged up modestly in today’s session, helping frame expectations for Pakistan’s external account in the weeks ahead.

Below we break down the key moving parts—from interbank dynamics and open market dollar rate behavior to macro drivers, technical levels, and what to watch into the close.

Key Takeaways at a Glance

-

Interbank firmness: The rupee is holding the USD/PKR line around 281–282, reflecting balanced trade flows and cautious demand from importers.

-

Open market premium: Dealers continue to quote the open market dollar rate a touch above the interbank rate, consistent with historical spreads and cash demand.

-

Macro cross-winds: Slightly firmer oil and a steady global dollar index keep moves contained; no outsized shocks in Asia FX during the session.

-

Historical context: The USD to PKR pair has primarily traded within a broad 278–293 band in 2025, with the current level positioned near the year’s average

Where the USD/PKR Prints Today

On the interbank counter, commonly referenced screens that track SBP-aligned settlements showed USD to PKR at around 281.85 late Monday and into Tuesday, indicating a slight rupee improvement compared to prior sessions. Because intraday prints can vary from bank to bank, market participants typically focus on the daily SBP-aligned close to anchor expectations. As of September 23, 2025, HamariWeb’s interbank dashboard (citing SBP) displayed 281.85, broadly in line with the recent range.

For context, the USD/PKR history for 2025 shows that the pair peaked near 293.33 in March and troughed around 278.48 in January, leaving the current zone just a shade weaker than the annual average (i.e., a slightly stronger rupee versus the peak). This historical lens is useful when evaluating whether today’s firmness will persist or wane.

What this means: A print in the 281–282 band suggests the rupee is improving against the US dollar on a mark-to-market basis versus the spring highs, even if the near-term baseline remains range-bound.

Open Market Check: Cash Premiums Stay Modest

The open market dollar rate typically trades at a slight premium to interbank due to cash handling, dealer margins, and retail demand. Fresh quotes on widely used rate portals showed the open market USD rate near PKR 282.3–282.5, roughly one rupee above the interbank rate. Intraday adjustments can occur quickly depending on customer flows and the availability of notes.

While third-party portals are indicative (not official), they map closely to SBP’s end-of-day ECAP summaries for closing cash rates. Traders often check both the real-time retail dashboards and the SBP/ECAP closing files for validation, especially when volatility picks up.

Bottom line: The rupee’s intra-day improvement is also visible in retail pricing, with cash spreads remaining contained.

Why the Rupee’s Firming Today

1) Softer Importer Demand and Balanced Trade Flows

With month-end LC settlements paced and commodity purchases staggered, importer dollar demand appears manageable. When importers step back—even temporarily—the rupee tends to stabilize or improve against the US dollar, especially if exporters are willing to convert proceeds.

2) Oil Still Range-Bound

Brent’s incremental uptick today kept prices well within the middle range of 2025, a relative positive compared to spikes that strain Pakistan’s import bill. Elevated but contained oil often correlates with PKR stability as long as financing pipelines (e.g., multilateral disbursements or Eurobond interest) are predictable.

3) Asia FX Mixed; No New Dollar Shock

Broader Asia-FX tone today did not deliver a fresh dollar shock. While the Indian rupee has been under pressure near record lows—a reminder of regional sensitivity to US policy—the immediate spillover into USD/PKR has been limited during today’s session. Traders nonetheless watch the Asia tape for sentiment cues.

Technical Picture: Levels That Matter

-

Immediate support (USD/PKR): 281.5–282.0 (recent interbank prints). A sustained break below this pocket would underline rupee strength.

-

Near-term resistance: 283.5–284.5 (recent tops seen on retail screens and prior interbank spikes). Failure to pierce this area intraday typically signals PKR resilience.

-

2025 range markers: 278.5 (year-to-date low) and 293.3 (YTD high). These anchors frame the broader macro range for positioning.

Translation for businesses and travelers: If you’re budgeting for imports, remittances, or travel, today’s rupee vs dollar levels are favorable relative to the March peak; locking in needs on dips can reduce exposure to upside USD/PKR risk.

Macro Context: Where We Are in the 2025 Cycle

Inflation, Policy, and Real Rates

With policy settings tight across much of 2024–25, PKR stability has benefited from real-rate support and contained domestic demand. While SBP’s live mark-to-market page updates daily, analysts typically pair it with broader market context—such as policy rate corridors and liquidity windows—to infer how comfortable authorities are with currency movements.

External Balances and Flows

Pakistan’s current account remains sensitive to energy prices, which continue to be a central driver. When Brent steadies, import bills become more predictable, easing spot dollar demand. Inflows via remittances and multilateral support help smooth volatility, especially around quarter-end. Today’s tape—steady oil and neutral risk tone—sits in the rupee’s favor.

Interbank vs Open Market: Why the Rates Differ

The interbank rate is shaped by bank-to-bank trades, corporate flows, and settlement conventions aligned with the SBP. The open market dollar rate reflects retail cash conditions, including the availability of physical notes, dealer inventory, and tourist demand. On calmer days like today, the spread is tight (≈ PKR 1.0–1.2). During stress, that gap can widen sharply as cash becomes scarce or demand spikes. Today’s narrow spread underscores a rupee market that’s orderly and improving against the US dollar intraday.

What Could Move USD/PKR Next?

-

Oil headline risk: Any fresh supply shock or inventory surprise can nudge Pakistan’s import bill higher, lifting USD/PKR. Conversely, softer oil is PKR-positive.

-

Quarter-end demand: Corporations settling payables can temporarily push up dollar demand—watch the book around closing windows.

-

Global dollar swings: US data or Fed-speak can reprice the DXY, spilling over into Asia FX and USD/PKR even without local catalysts.

-

SBP signals: Liquidity operations and communication shape expectations for volatility bands, often anchoring rupee-dollar ranges.

Practical Guidance for Businesses, Traders, and Individuals

-

Importers: If your exposures are short-dated, consider laddering purchases on intraday dips toward 281.5–282.0.

-

Exporters: Opportunistic conversions above 282.5–283.0 can diversify cash flows without over-hedging.

-

Travelers/Students: For cash needs, compare bank TT rates with open market dollar rate quotes; minor timing differences can save a few paisas per dollar.

-

SMEs: Utilize forward cover for predictable invoices; even bare hedges can reduce outcome uncertainty if the USD/PKR whipsaws near month-end.

Data Sources You Can Track Intraday

-

Interbank (indicative) & SBP-aligned dashboards: HamariWeb’s interbank board frequently mirrors the day’s official settlement tone.

-

Open market snapshots: Retail portals that aggregate dealer quotes offer a live view of cash premiums.

-

Official references: SBP’s mark-to-market and ECAP pages publish authoritative daily tables (typically end-of-day).

-

Macro backdrop: Energy market headlines (e.g., Brent updates) offer immediate context for external-account sensitivity.

Conclusion

Today’s intra-day update shows the rupee improving against the US dollar, with USD to PKR steadying around the 281–282 zone on the interbank market and a modest premium in the open market. The move is not explosive—nor does it need to be. With oil contained and Asia FX free of fresh shocks, the market is giving PKR room to breathe. For now, the path of least resistance is sideways to firmer, provided importer demand remains measured and global risk remains benign. Keep an eye on oil, quarter-end flows, and SBP communication for the next impulse.

FAQs

Q: What is the difference between the interbank USD/PKR and the open market dollar rate?

The interbank rate is where banks and large institutions transact electronically; it serves as the anchor for official settlements and SBP reporting. The open market dollar rate is typically the retail (cash) rate and usually carries a slight premium due to physical-note handling and dealer margins.

Q: Is the rupee actually stronger today, or just less weak?

Both can be true. Intraday, the rupee improved against the US dollar as the USD to PKR quote dipped into the low 281s. In the broader 2025 context, it still trades in the mid-range—stronger than March’s peak but near the annual average.

Q: Why do portals sometimes show slightly different USD/PKR numbers?

Timing, sources, and whether the quote is interbank (TT clean) or open market (cash) are all critical considerations. Official end-of-day closes come via SBP tables; live dashboards are indicative.

Q: How does oil affect the rupee?

Pakistan is a net energy importer. Higher Brent prices typically increase the dollar value of oil, adding pressure to the USD/PKR exchange rate. Range-bound or softer oil eases that pressure.

Q: What are the key levels to watch this week?

Support sits around 281.5–282.0; resistance near 283.5–284.5. A break below support favors further rupee firmness; a push above resistance warns of renewed USD strength.

See More: Solana Price Rallies Polymarket Poll Hits ATH Complete Guide