Ethereum Surges Past $3,200 Bulls Eye Further Gains

Ethereum Surges Past momentum builds. Discover what's driving ETH's rally and where prices could head next in this market analysis.

Ethereum emerging as one of the standout performers among major digital assets. After months of consolidation and bearish sentiment that tested the resolve of long-term holders, ETH has surged above the psychologically significant $3,200 level, igniting renewed optimism across the trading community. This breakthrough represents more than just a numerical milestone—it signals a potential shift in market dynamics that could pave the way for an extended bullish run.

The second-largest cryptocurrency by market capitalization has demonstrated impressive strength as buying pressure intensifies across spot and derivatives markets. Ethereum Surges Past: Traders and investors are now closely monitoring key technical levels and fundamental catalysts that could propel Ethereum’s price toward even higher targets. Understanding the forces behind this rally and the potential trajectory ahead has become crucial for anyone involved in the digital asset ecosystem.

This comprehensive analysis explores the factors contributing to Ethereum’s recent price surge, examines critical technical indicators that traders are watching, and evaluates the broader market conditions that could support continued upward momentum. Whether you’re a seasoned cryptocurrency trader or a newcomer trying to understand the landscape, this detailed examination will provide valuable insights into where Ethereum might be headed next.

Ethereum’s Recent Price Action: Ethereum Surges Past

The journey to $3,200 has been anything but straightforward for Ethereum. Throughout the past several months, the cryptocurrency faced substantial headwinds, including regulatory uncertainty, macroeconomic pressures, and shifting investor sentiment. However, the recent breakthrough above this resistance level demonstrates that bulls have regained control of the market narrative.

Ethereum’s price movement over the past few weeks has been characterized by steadily increasing volume and consistently higher lows—classic indicators of accumulation and growing bullish conviction. The breakout above $3,200 came with substantial trading volume, suggesting genuine buyer interest rather than a temporary spike driven by speculative excess. This volume confirmation is particularly important because it indicates that the move has strong foundational support.

Market participants have observed that each pullback has been met with aggressive buying, preventing significant downside movement and creating a solid floor for prices. This pattern of resilient support combined with periodic upward bursts, has created an ascending channel that technical analysts view favorably. The ability of Ethereum to hold gains and build upon them rather than experiencing sharp reversals has bolstered confidence among traders who had grown cautious during previous volatile periods.

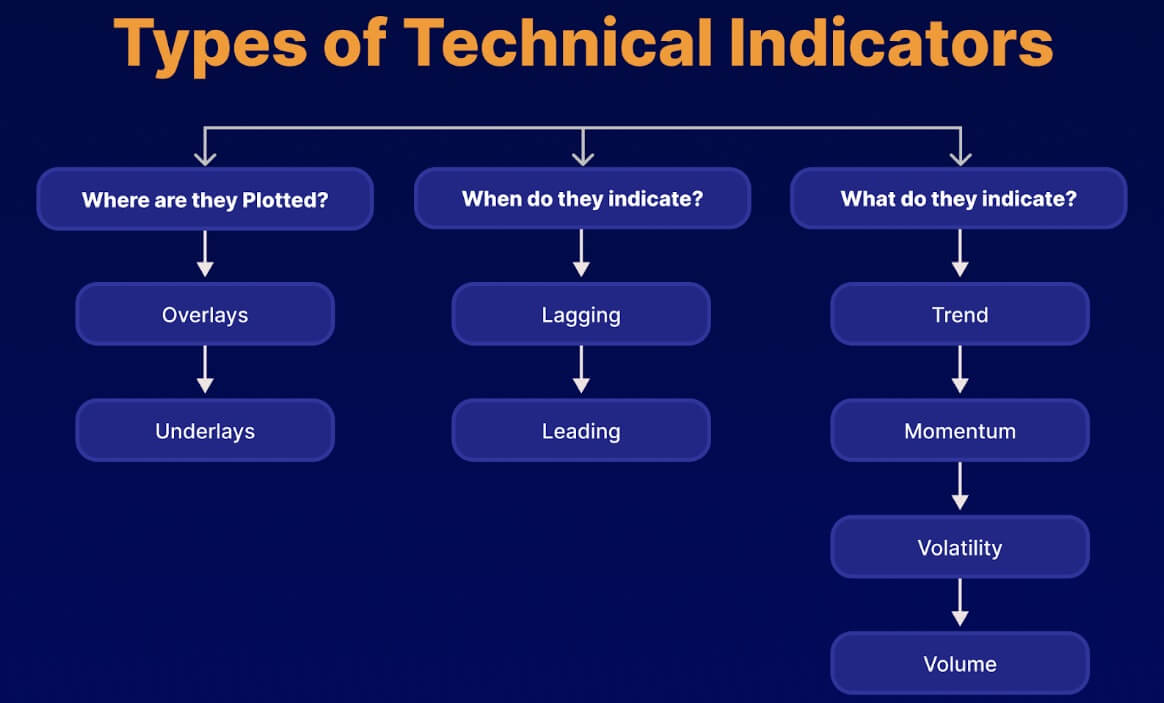

Technical Indicators Point to Continued Strength

From a technical analysis perspective, several key indicators are flashing bullish signals for Ethereum. The Relative Strength Index (RSI), which measures momentum and helps identify overbought or oversold conditions, has moved into positive territory without reaching extreme levels that would suggest an imminent correction. This balanced positioning indicates there’s still room for upward movement before the asset becomes technically overextended.

The Moving Average Convergence Divergence (MACD) has recently posted a bullish crossover on multiple timeframes, reinforcing the positive momentum narrative. When the MACD line crosses above the signal line, it typically indicates that bullish momentum is accelerating—a pattern that has historically preceded sustained rallies in Ethereum’s price history. Traders who rely on this indicator have taken notice and adjusted their positions accordingly.

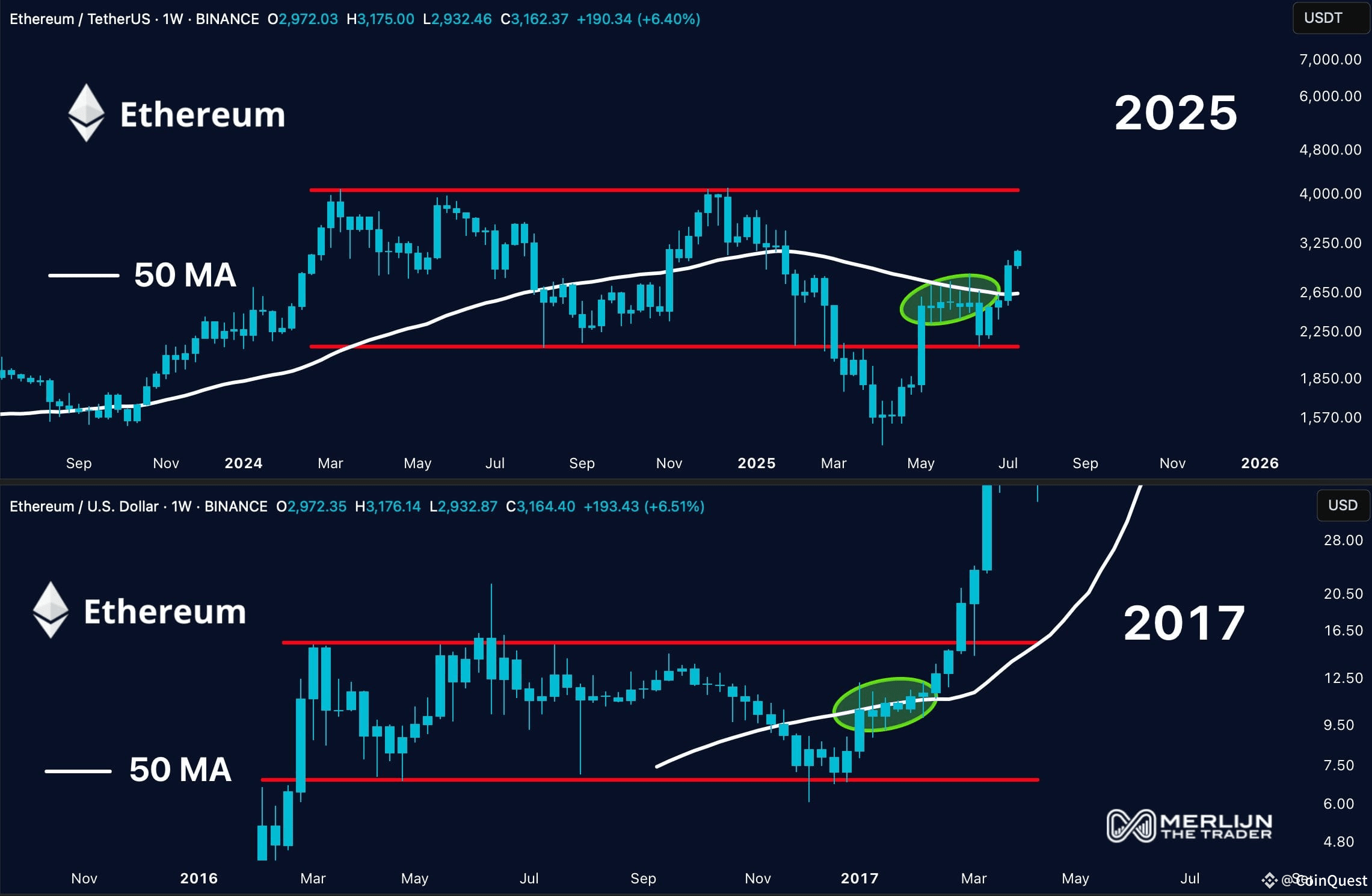

Additionally, ETH has successfully reclaimed several important moving averages that previously acted as resistance. The 50-day and 100-day moving averages now serve as potential support levels, creating a technical foundation that could cushion any short-term pullbacks. The fact that price action is unfolding above these key averages rather than below them represents a significant shift in market structure that favors continuation to the upside.

Fundamental Catalysts Driving Ethereum Higher

Beyond technical factors, several fundamental developments have contributed to Ethereum’s renewed strength. The Ethereum network continues to evolve with ongoing upgrades and improvements that enhance its functionality, security, and scalability. These technological advancements make the platform more attractive for developers building decentralized applications and enterprises exploring blockchain solutions.

The growth of decentralized finance (DeFi) protocols and non-fungible token (NFT) platforms built on Ethereum has sustained demand for ETH as both a utility token and store of value. Transaction activity on the network has remained robust, generating consistent fee revenue and demonstrating real-world usage beyond mere speculation. This organic demand provides a strong fundamental underpinning for price appreciation.

Institutional interest in Ethereum has also intensified, with major financial institutions and corporations increasingly recognizing the blockchain’s potential for smart contract execution and tokenization of traditional assets. The introduction of Ethereum exchange-traded products in various jurisdictions has provided new pathways for institutional capital to flow into the ecosystem, creating additional buying pressure that supports higher prices.

Market Sentiment and Trading Psychology

The shift in market sentiment surrounding Ethereum has been palpable. After an extended period of fear and uncertainty that characterized much of the broader cryptocurrency market downturn, traders are now exhibiting greater willingness to establish long positions and hold through minor volatility. This psychological shift cannot be understated—markets are ultimately driven by human emotion and collective decision-making.

Social media sentiment analysis and on-chain metrics reveal growing optimism among retail and institutional participants alike. Discussion forums and trading communities have noted increased engagement around Ethereum, with conversations focusing less on survival and more on growth potential. This transition from defensive to offensive positioning often precedes sustained rallies as more capital enters the market.

The fear and greed index, which measures overall market sentiment in the cryptocurrency space, has moved into more neutral to slightly greedy territory—a zone that historically supports continued price appreciation without indicating dangerous euphoria. When this index reaches extreme greed levels, corrections typically follow, but current readings suggest the market remains in a healthy phase of the cycle.

Resistance Levels and Price Targets Ahead

With Ethereum surging above $3,200, traders are now setting their sights on the next significant resistance levels that could either halt the advance or be conquered in a continuation pattern. The first major hurdle appears around the $3,400-$3,500 zone, where previous price action created a cluster of resistance that may attract profit-taking.

Should ETH successfully clear this mid-range resistance with conviction, the psychological $4,000 level becomes the next logical target. Breaking through four thousand dollars would represent not just a numerical milestone but also a reclamation of territory lost during previous market downturns. Many analysts believe that reaching this level could trigger additional momentum as it would validate the bull case and potentially attract fresh capital from sidelined investors.

Looking further ahead, some optimistic projections suggest that if current momentum continues and is supported by favorable market conditions, Ethereum could challenge its previous all-time highs established during the last major bull cycle. However, reaching these elevated levels would require sustained buying pressure, favorable macroeconomic conditions, and continued fundamental strength across the ecosystem.

Risks and Potential Headwinds

While the outlook for Ethereum appears increasingly positive, prudent traders recognize that risks remain. The cryptocurrency market is notoriously volatile, and sudden reversals can occur with little warning. Regulatory developments, particularly in major markets like the United States and European Union, could introduce uncertainty that dampens enthusiasm and triggers selling pressure.

Macroeconomic factors including interest rate policies, inflation data, and broader financial market stability continue to exert influence on risk assets like cryptocurrencies. Should traditional markets experience significant stress or if central banks adopt more hawkish monetary policies, capital could flow out of speculative assets including Ethereum, potentially interrupting the current rally.

Technical resistance levels, while discussed as targets, also represent zones where significant selling could emerge. Traders who purchased at higher prices during previous cycles may use rallies as opportunities to exit positions, creating supply that must be absorbed for prices to continue advancing. Additionally, profit-taking by short-term traders after substantial gains can create temporary corrections that test the resolve of newer market participants.

Comparing Ethereum to Broader Cryptocurrency Market Trends

Ethereum’s performance has notably outpaced many other cryptocurrencies during this recent surge, demonstrating relative strength that traders view favorably. While Bitcoin has also posted gains, Ethereum’s percentage increase has been more substantial, suggesting that capital is rotating specifically into ETH rather than rising uniformly across all digital assets.

This outperformance can be attributed to Ethereum’s unique position within the cryptocurrency ecosystem. Unlike Bitcoin, which functions primarily as digital gold and a store of value, Ethereum serves as the foundation for a vast array of decentralized applications, smart contracts, and innovative blockchain solutions. This utility-driven value proposition attracts different types of investors and creates multiple demand drivers.

The altcoin market more broadly has benefited from Ethereum’s strength, as improved sentiment toward the second-largest cryptocurrency often spills over into smaller-cap projects. However, Ethereum has maintained its leadership position, suggesting that investors are prioritizing quality and established platforms over speculative smaller projects—a dynamic that often characterizes mature phases of bull markets.

Strategic Considerations for Traders and Investors

For those considering positions in Ethereum at current levels, several strategic approaches merit consideration. Dollar-cost averaging, which involves making regular purchases regardless of price, can help mitigate the risk of poorly timed entries while building exposure over time. This strategy proves particularly valuable in volatile markets where predicting short-term movements remains challenging.

Active traders might focus on identifying pullbacks to key support levels as entry opportunities rather than chasing prices during vertical rallies. Waiting for consolidation periods where ETH digests recent gains can provide more favorable risk-reward ratios compared to buying at immediate resistance levels. Setting clear profit targets and stop-loss levels helps manage risk and prevents emotional decision-making during periods of heightened volatility.

Long-term investors with conviction in Ethereum’s fundamental value proposition may view current prices as attractive regardless of short-term fluctuations. The continuous development of the network, growing adoption of decentralized applications, and increasing institutional recognition suggest that Ethereum could continue appreciating over extended timeframes, making strategic accumulation during relatively early phases of adoption potentially rewarding.

Conclusion

Ethereum’s surge above $3,200 represents a significant milestone in the cryptocurrency’s ongoing price discovery process. The convergence of positive technical indicators, improving fundamental developments, and shifting market sentiment has created conditions favorable for continued upward momentum. While risks and potential headwinds remain, the overall picture suggests that bulls have gained control and are positioning for a stronger extension of the current rally.

As traders and investors navigate this evolving landscape, maintaining disciplined risk management and staying informed about both technical and fundamental factors will prove essential. The breakthrough above $3,200 may well be remembered as a pivotal moment that marked the beginning of Ethereum’s next major advance, but only time will reveal whether current optimism translates into sustained price appreciation.

For now, the cryptocurrency community watches with anticipation as Ethereum continues its upward journey, testing resistance levels and building the foundation for what many hope will be an extended bull market. Whether you’re actively trading or holding for the long term, understanding the dynamics driving this surge provides valuable context for making informed decisions in the exciting and sometimes unpredictable world of digital assets.

FAQs

Q: What caused Ethereum to surge above $3,200?

Ethereum’s surge above $3,200 resulted from a combination of factors, including improving technical indicators, increased institutional interest, growing adoption of DeFi and NFT platforms built on the network, and overall positive sentiment shift in the cryptocurrency market. Strong buying volume and consistent demand created momentum that pushed prices through this resistance level.

Q: Is it too late to buy Ethereum at current prices?

Whether current prices represent a good entry point depends on individual investment goals and risk tolerance. While Ethereum has already made significant gains, many analysts believe further upside potential exists based on technical targets and fundamental growth. Dollar-cost averaging and waiting for pullbacks to support levels are strategies that can help manage entry risk for new investors.

Q: What are the next major resistance levels for Ethereum?

Following the break above $3,200, the next significant resistance zones appear around $3,400-$3,500, followed by the psychologically important $4,000 level. Beyond that, previous all-time highs become relevant targets if bullish momentum continues. Each of these levels may require consolidation and volume confirmation before being decisively broken.

Q: How does Ethereum compare to Bitcoin in the current market?

Ethereum has demonstrated relative strength compared to Bitcoin during this rally, with higher percentage gains and more aggressive momentum. While Bitcoin remains the largest cryptocurrency and market leader, Ethereum’s utility-driven value proposition and role as the foundation for decentralized applications has attracted specific investor interest that differentiates its performance.

Q: What risks should traders be aware of when trading Ethereum?

Key risks include potential regulatory developments that could impact cryptocurrency markets, macroeconomic factors such as interest rate changes and broader financial market instability, technical resistance levels where selling pressure may emerge, and the inherent volatility of cryptocurrency markets that can produce sudden reversals. Maintaining appropriate risk management through position sizing and stop-losses helps mitigate these concerns.