Web 3.0 Blockchain Market Revenue Forecast to 2034

Explore the Web 3.0 blockchain market revenue report with growth drivers, trends, challenges, and a detailed forecast outlook through 2034.

The digital economy is undergoing a fundamental transformation, and at the center of this shift lies Web 3.0 powered by blockchain technology. Unlike earlier versions of the web that focused on static information or centralized platforms, Web 3.0 emphasizes decentralization, user ownership, transparency, and trustless interactions. As organizations, developers, and governments explore new digital frameworks, interest in the Web 3.0blockchain market revenue forecast to 2034 has grown rapidly.

Web 3.0 blockchain technology is no longer limited to cryptocurrencies or experimental decentralized applications. It is becoming the backbone of decentralized finance, non-fungible tokens, digital identity systems, metaverse platforms, and next-generation data economies. As adoption accelerates, investors and enterprises are increasingly focused on revenue potential, market size, and long-term growth forecasts.

This article provides a comprehensive and forward-looking analysis of the Web 3.0 blockchain market, examining current revenue trends, growth drivers, technological advancements, regional dynamics, and a detailed revenue forecast to 2034. By understanding how this market is evolving, stakeholders can better position themselves in a rapidly decentralizing digital world.

Web 3.0 and blockchain integration

The evolution from Web 2.0 to Web 3.0

Web 3.0 represents a shift away from centralized control toward decentralized digital ecosystems. In Web 2.0, data ownership largely resides with platforms, while users generate value without full control over their digital assets. Web 3.0 changes this model by leveraging blockchain technology to enable peer-to-peer interactions, smart contracts, and tokenized economies.

Blockchain acts as the foundational layer for Web 3.0 by providing distributed ledgers that ensure transparency, immutability, and security. This integration is what allows decentralized applications to function without relying on centralized authorities. As a result, the Web 3.0 blockchain market revenue is directly linked to the broader adoption of decentralized technologies.

Why blockchain is critical to Web 3.0 growth

Blockchain enables trustless systems where transactions and data exchanges occur securely without intermediaries. This capability is essential for Web 3.0 applications such as decentralized finance platforms, decentralized autonomous organizations, and digital asset marketplaces.

As enterprises and consumers increasingly value data sovereignty and privacy, blockchain-powered Web 3.0 solutions are gaining momentum. This growing demand forms the basis for strong long-term revenue growth in the market.

Current state of the Web 3.0 blockchain market

Market revenue landscape today

The Web 3.0 blockchain market has experienced significant revenue growth over the past few years. Early adoption in finance and digital assets has expanded into gaming, content creation, healthcare, and supply chain management. This diversification has broadened revenue streams and reduced dependence on a single sector.

Venture capital investment and institutional participation have further accelerated market expansion. Despite market volatility in crypto-related assets, underlying blockchain infrastructure and Web 3.0 Blockchain Market platforms continue to attract funding, reinforcing confidence in long-term growth.

Key contributors to present-day revenue

Revenue in the Web 3.0 blockchain market is driven by transaction fees, platform services, infrastructure solutions, token economies, and enterprise blockchain deployments. Decentralized applications generate value through user engagement, while infrastructure providers earn revenue by supporting network operations and development tools.

The convergence of blockchain with cloud computing, artificial intelligence, and Internet of Things technologies is also expanding monetization opportunities, strengthening the overall revenue base.

Major drivers shaping market growth to 2034

Decentralized finance and digital assets

Decentralized finance remains one of the strongest growth drivers in the Web 3.0 blockchain market revenue forecast to 2034. DeFi platforms offer lending, borrowing, trading, and yield generation without traditional financial intermediaries. This model attracts users seeking transparency and financial inclusion.

As regulatory clarity improves and institutional adoption increases, DeFi is expected to contribute significantly to market revenue over the next decade. Tokenization of real-world assets further expands the scope of blockchain-based financial products.

Expansion of NFTs and the creator economy

Non-fungible tokens have redefined digital ownership and monetization. Artists, musicians, gamers, and content creators are leveraging NFTs to directly engage audiences and generate revenue. Beyond digital art, NFTs are being adopted in real estate, intellectual property, and entertainment.

This evolution strengthens the Web 3.0 Blockchain by empowering creators and reducing platform dependency. As use cases mature, NFT-related revenue is projected to remain a key component of market growth.

Technological advancements influencing revenue growth

Scalability and interoperability solutions

Scalability has historically been a challenge for blockchain networks. However, advancements such as layer-two solutions, sidechains, and cross-chain protocols are improving transaction speeds and reducing costs. These innovations enhance user experience and make Web 3.0 applications more viable for mass adoption.

Interoperability allows different blockchain networks to communicate seamlessly, expanding the reach of decentralized applications. This connectivity is essential for unlocking new revenue opportunities across ecosystems.

Smart contracts and automation

Smart contracts automate processes and enforce agreements without manual intervention. Their adoption across industries reduces operational costs and increases efficiency. From automated insurance claims to decentralized supply chain management, smart contracts are becoming a cornerstone of Web 3.0 revenue generation.

As smart contract platforms mature, enterprises are more likely to integrate them into core operations, driving sustained market growth.

Regional analysis of the Web 3.0 blockchain market

North America and Europe

North America remains a leading region in Web 3.0 blockchain Market innovation due to strong investment activity, technological infrastructure, and supportive startup ecosystems. Europe follows closely, with a focus on regulatory frameworks and enterprise blockchain applications.

Both regions contribute significantly to global market revenue, particularly in finance, digital identity, and enterprise solutions.

Asia-Pacific and emerging markets

The Asia-Pacific region is experiencing rapid growth driven by high digital adoption, fintech innovation, and government-backed blockchain initiatives. Countries in this region are embracing Web 3.0 for payments, gaming, and digital governance.

Emerging markets also present substantial opportunities as Web 3.0 solutions address challenges related to financial inclusion and data access. These regions are expected to play an increasingly important role in revenue forecast to 2034.

Challenges impacting market revenue

Regulatory uncertainty and compliance

Regulatory uncertainty remains a challenge for the Web 3.0 blockchain market. Governments worldwide are still developing frameworks for digital assets, decentralized platforms, and data governance. Unclear regulations can slow adoption and impact revenue growth.

However, clearer guidelines may ultimately strengthen the market by increasing trust and encouraging institutional participation.

Security and user education

Security risks such as smart contract vulnerabilities and cyberattacks pose threats to market stability. Additionally, user education remains a barrier, as Web 3.0 platforms can be complex for non-technical users.

Addressing these challenges through better design, audits, and education will be critical for sustaining long-term revenue growth.

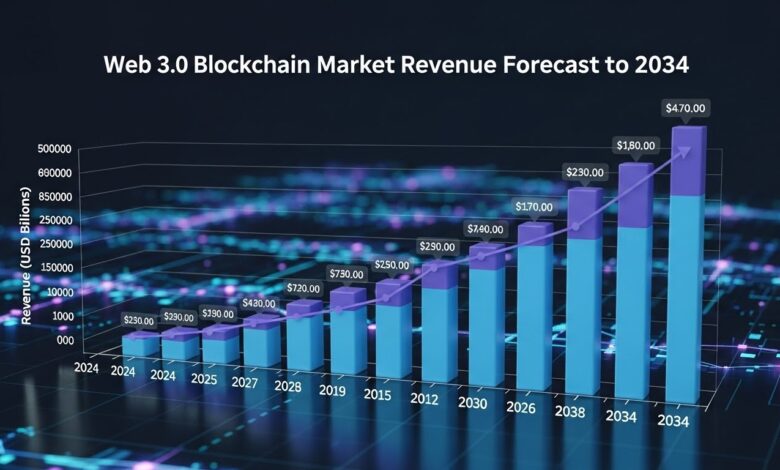

Web 3.0 blockchain market revenue forecast to 2034

Long-term growth outlook

The Web 3.0 blockchain market revenue forecast to 2034 indicates strong compound annual growth driven by expanding use cases and technological maturity. As decentralized technologies integrate into mainstream applications, revenue is expected to grow steadily across multiple sectors.

Enterprise adoption, government use cases, and consumer-facing platforms will collectively shape the market’s trajectory. Increased scalability and regulatory clarity are likely to further accelerate growth.

Market maturity and sustainability

By 2034, the Web 3.0 blockchain market is expected to transition from rapid experimentation to sustainable growth. Revenue models will become more refined, focusing on long-term value creation rather than speculative activity.

This maturation will position Web 3.0 as a foundational layer of the digital economy, supporting innovation across industries.

Conclusion

The Web 3.0 blockchain market revenue forecast to 2034 highlights a technology landscape that is rapidly evolving and increasingly influential. From decentralized finance and digital assets to enterprise solutions and creator economies, Web 3.0 is reshaping how value is created and exchanged online.

While challenges related to regulation, security, and scalability remain, ongoing technological advancements and growing adoption signal a strong long-term outlook. As businesses, developers, and governments continue to embrace decentralization, the Web 3.0 blockchain market is poised for sustained revenue forecast to 2034 and beyond.

Understanding these trends is essential for stakeholders seeking to navigate and capitalize on the future of the decentralized digital economy.

Frequently Asked Questions

Q. What is driving growth in the Web 3.0 blockchain market?

Growth is driven by decentralized finance, NFTs, enterprise adoption, smart contracts, and increasing demand for data ownership and transparency.

Q. How does Web 3.0 differ from earlier web models?

Web 3.0 emphasizes decentralization, user ownership, and blockchain-based trust, unlike centralized Web 2.0 platforms.

Q. What role does blockchain play in Web 3.0 revenue generation?

Blockchain provides the infrastructure for decentralized applications, enabling secure transactions, automation, and new monetization models.

Q. Which regions are leading Web 3.0 blockchain adoption?

North America, Europe, and Asia-Pacific are leading adoption, with emerging markets showing strong growth potential.

Q. What is the long-term outlook for the Web 3.0 blockchain market?

The market is expected to experience sustained growth through 2034 as technology matures and adoption expands across industries.